If Lending Isn’t The Answer, Does The Question Change For Fintech In India?

For a sector whose success is so closely tied to the steady flow of economic activity, what happens when the world stops spinning? What does the next leg of financial inclusion look like in India?

This post was originally published on Medium in June 2020

“For every subtle and complicated question, there is a perfectly simple and straightforward answer, which is wrong.” ― David Graeber, Debt: The First 5,000 Years

Ok yes, the title is shameless clickbait, because digitising our MSMEs and infusing them with quick working capital may well be our best bet to getting the Indian economy up and running again. But regardless of how and when we truly get back to business, and whether you’re a small business, a fintech start-up, a lender or an investor, over the past couple of months the ground has undeniably shifted.

In all likelihood both the ‘fin’ and the ‘tech’ will need an upgraded set of tools to navigate this new terrain. However, the good news is that the public digital infrastructure (India Stack, Account Aggregators) that we have been building for over a decade, and a new modus operandi (Cash Flow Lending, Loan Service Providers) are ready to shepherd in the next era of India’s fintech story.

[1] Everyone’s a lender

If you count yourself as part of the fintech industry in India (and even if you don’t) there’s a decent chance you’ve had to reckon with the ‘L’ word at some point in the past 12–24 months. Whether you operate a payment gateway or provide software tools, whether you are a marketplace or a manufacturer, you’ve probably had a discussion around how to incorporate credit into your current product or offerings.

You might have had an exploratory call with a lending partner to provide them with leads or to collaborate at a deeper level of product integration. You’ve likely thought about how lending to your customers or partners might boost your revenue prospects even if credit lies outside your immediate area of expertise. Your business development lead has probably spent some time trying to understand the different types of financial products you could potentially offer — term loans, lines of credit or invoice discounting?

Or maybe you’ve built a better replacement for components in the traditional lending value chain, and you have your sights set on disruption.

In each of these pursuits you would be no different than hundreds of other enterprises who in the recent past have all assumed different roles in the grand march towards financial inclusion in India.

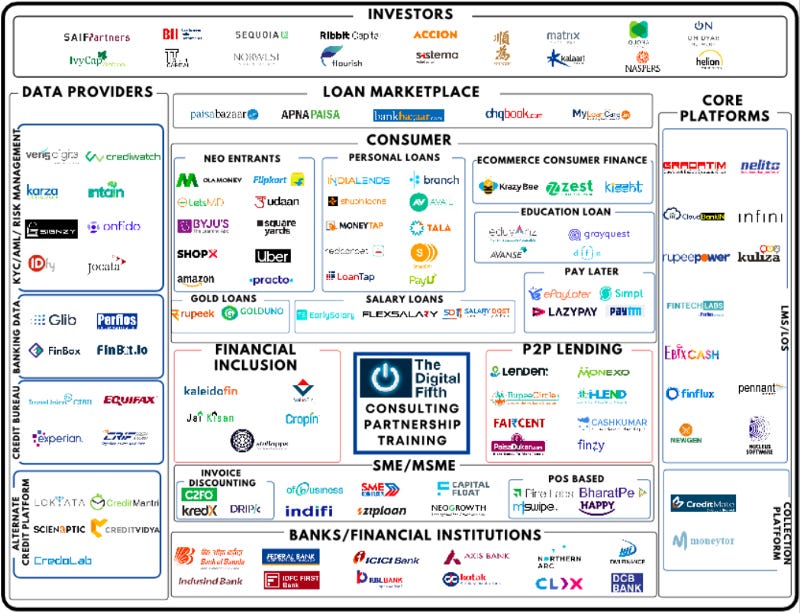

Image source: The Digital Fifth

The intention of this piece is not to suggest that any of this activity will or should end overnight, but to pose an open question about whether a post-coronavirus economic landscape in India can support the same scale of ambition with regards to our fintech objectives, and particularly to explore if Lending-as-a-Narrative will evolve or take a backseat in the coming months.

[2] Who cares about credit?

Even if you have no interest in the explosion of digital lending in India, chances are you’ve noticed the steady invasion of credit into your daily life.

Choosing to ‘Pay Later’ for your dinner on Swiggy while checking out?

Using the convenience of Ola Money instead of paying for every ride?

Getting an instant line of credit when booking your flight on Make My Trip?

It is not an accident that lending has slowly ingrained itself into the non-financial products and services we use on a day-to-day basis. Credit has always been an invisible tool that has lubricated our economic and social lives, in many cases without even drawing attention to the fact that we have entered a new financial relationship with another person or entity.

Think about this — if you’ve ever offered to pay your newspaper vendor at the end of the month, you should be thankful for the interest free loan that you’ve been generously given along with your daily crossword.

Or if you currently work for a company all year round but only get paid on the last day of every month, you effectively grant your employer 30 days-worth of free credit for using your services. Maybe you’re getting a raw deal?

As we expand our digital footprints and spend more of our waking hours online, we increase the number of interfaces through which we can avail of financial services. The demand for credit in India from both consumers and MSMEs presents an addressable opportunity of USD > 1 trillion by 2023. It is no surprise that investors and entrepreneurs alike have scrambled to fill this lucrative gap over the past half-decade. Even if you weren’t in the lending business, you had to be in the lending business.

While retail loans can enable a vegetable vendor to buy the phone she needs, or give a gig worker early access to his income, when we talk about India’s economic ascent the real transformative opportunity at hand is one which depends on the ability of the FS sector to guide debt capital into the hands of our micro, small and medium enterprises.

[3] The MSME story in India

It is an open secret that India’s economic heart beats in the chest of its MSMEs. Pick any yardstick you like and you would plainly see the importance and contribution of this group to our economic prosperity:

MSMEs contributed up to 38% of GDP in 2018 to the tune of $1.1 Tn.

The total number of working MSMEs is over 65 million

The MSME sector was poised to be a $866-billion industry by 2020

There are currently over 9.2 million MSMEs registered under GST

MSME share of total Indian exports has touched 45% in recent years

Total MSME employment exceeds 124 million individuals

While remarkable, MSME contribution to India’s GDP is about 23% lower than that of China and 10% lower than that of the USA, largely due to a lack of access to formal credit.

Despite being a seemingly colourless acronym, the individual businesses that make up this faceless economic segment are the ones you use and interact with every day.

The restaurant you order lunch from? The local stationary manufacturer? The boutique HR strategy consultancy? The bookshop on the corner? The millennial-friendly ad agency that does your Instagram marketing? The salon you visit to get your nails done?

Each one of the above would count as an ‘MSME’, and is part of an incredibly vibrant group of entrepreneurs, professionals, managers, executives, workers and every other role that’s trying to find a home for themselves in capitalist India and make a better life for themselves, their families and their country.

It is clear that any significant step forward we take as a country will be led by our MSME base and the enabling environment that both the public and private sectors choose to build around it. We are at a pivotal point in our economic history where the twin forces of digitisation and formalisation are empowering Indian businesses to skip ahead into the future. Whether it is the adoption of GST or the proliferation of India Stack or the one-two punch of cheaper data and smartphones, there has never before been a time in India’s history where such a fertile ground has been presented to the entrepreneurs of our country to take their ambitions to the next level.

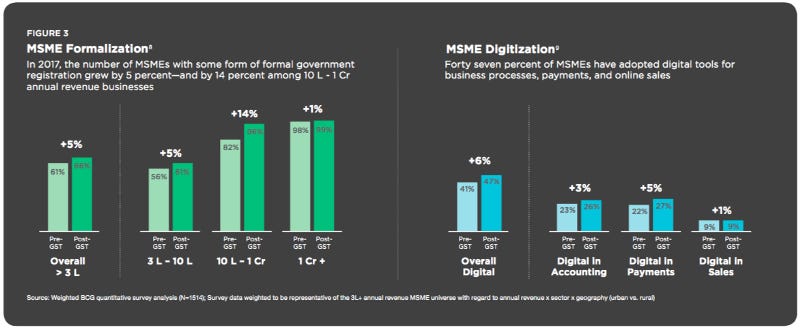

Source: Omidyar Network and BCG

In recent times India’s brightest tech minds have scrambled to create software products to capture the attention of this market, providing everything from logistics services, QR codes, expense management tools, neobanks and everything in between to reduce the time and costs expended by business owners to make decisions.

The most potent catalyst to the MSME story in India, however, is financial services and in particular the opening up of formal credit facilities to a sector that has been chronically underserved in the past. It is not a stretch to suggest that India’s MSME journey has not yet gotten out of second gear due to the inability of traditional lenders to adapt to the needs of a new customer profile — one that needs credit in a timely manner at the right cost of capital and tailored to their individual requirements. The proliferation of digital lending on the back of e-KYC, e-NACH and other innovations over the past half-decade is only a taste of what the fintech revolution in India promises to bring.

[4] The Credit Gap

A 2018 IFC report on ‘Financing India’s MSMEs’, claimed that the overall debt demand of India’s MSMEs stands at a massive INR 69.3 trillion, out of which 84% is financed through informal or unregulated channels. Traditional banks and Non Banking Financial Companies (NBFCs) still only account for 16% of the total demand.

Most estimates would peg the MSME digital lending landscape in India as having the potential to grow 10 to 15 times larger by 2023, to $80–100 billion — which would rival that of the entire global microfinance industry. Small businesses in India are eager to grow, and at last count we had more than 9500 official lenders and 330 lending start ups.

Because of the ‘way we do business in India’, MSMEs tend to get paid late by their customers (particularly larger enterprises), and tend not to receive the same courtesy from their suppliers. This is partially the result of a quixotic and poorly enforced MSME Act, and the fact that smaller players don’t want to risk their long term relationships with enterprise buyers. This results in a perennial squeeze for business owners who have to constantly make sure they have enough liquid capital to finance their day-to-day operations.

So why is there a gap between the lenders and borrowers? Surely banks and NBFCs should be rushing in to service this urgent need for working capital from India’s ambitious MSMEs?

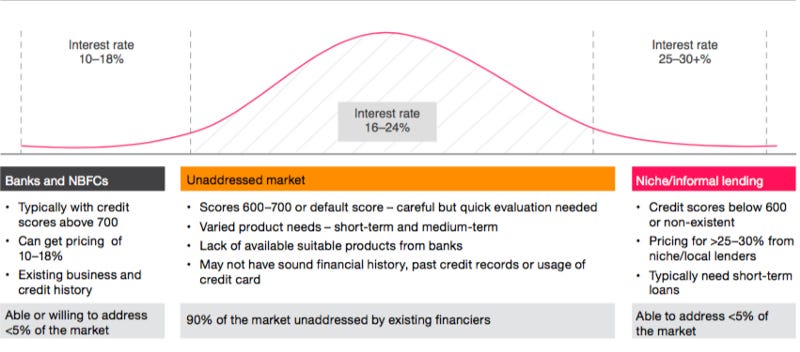

The reason for this ‘Missing Middle’ group in our financial services landscape is a result of three broad factors:

Banks that have the cheapest cost of capital (from customer deposits) prefer lending directly to larger enterprises with proportional credit requirements which provides an immediate boost to the size of their loan books. It is an easier and cheaper task than having to expend the cost of acquiring and servicing of millions of individual MSME customers who have far smaller ‘ticket-size’ requirements.

NBFCs tasked with rotating the capital they receive from banks and other investors have to charge a higher rate of interest to compensate for higher cost of capital they have to bear. Additionally MSMEs typically don’t have the kind of fixed assets on their books that can be used as collateral to avail of loans, which means that their lenders tend to charge a higher rate of interest. This eats into the already relatively slimmer operating margins of small businesses.

Excessive documentation and stringent Know-Your-Customer requirements by traditional banks leads to lengthy processing times for loans, that MSMEs with urgent working capital requirements cannot afford to spare. This is paired with the fact that a large number of MSMEs don’t have a credit history and don’t maintain a consolidated record of their financial data such as tax filings, P&L and invoices, making for riskier and less-than-ideal customers.

So you have microfinance companies and moneylenders catering to ‘micro’ businesses. You have banks catering to large companies. And the vast majority of India’s businesses are left up the creek without a paddle.

Source: PwC

All this is not to say that this market remains completely unserved. There are a number of well respected ‘start ups’ like Capital Float, Lendingkart and others that have established themselves over the past decade as pioneers of digital lending in India, using innovative methods to find these customers in neglected sectors and onboard them cheaply, utilizing the digital tools at their disposal to disburse business loans in a matter of days and hours instead of the bloated turnaround-times of old school lenders.

In the relative stability of a post financial crisis world, and with the scope for FS innovation offered by public infrastructure like India Stack, lending start-ups have been able to experiment with new bespoke products and credit assessment models, using a mix of traditional data (bank statements, income tax returns etc) and alternative data (POS transactions, psychographic profiling) to create richer pictures of their customers and service them more efficiently than was previously possible.

The cynical view to this happy-go-lucky lending-driven growth of fintech in India has been that newfangled models of sourcing, assessment, underwriting and collections may find success in times of economic prosperity, but what happens when things get ugly? Does the brave new world have the stomach to withstand an economic earthquake?

[5] Enter Covid-19

The impact of the virus and the ensuing two-month (at last count) lockdown in India have been felt across every sector and household. Almost overnight it would seem that our lenders are sitting in a precarious position. Regardless of what type of lender or which segment they are catering to there’s really been nowhere to hide.

For a lender who caters to individuals and daily wage workers (a relatively surer bet in normal times), you suddenly don’t know how many of your customers have faced unemployment due to the shutting down of our cities, or how many individuals have been forced to migrate back to their hometowns to find refuge from economic calamity.

If you lend to businesses, how could your underwriting models account for the fact that there’s been no income for two months, and that underlying market conditions are drastically different from what they were before or will be in the future?

For a lender providing trade finance, entire supply chains and international trade routes have been disrupted overnight. How do you create an accurate map of your portfolio when the pieces are moving every day?

There’s no guarantee of when household demand returns. There’s no certainty about when you can send out your sales or collections agents en masse to find new customers or to collect repayments. There’s no way to know what an individual’s financial priorities will be for themselves or their businesses. The metrics that have been successfully used to evaluate the credit worthiness of a potential customer may now be outdated.

It’s tough. The Finance Ministry and the RBI for their part have doubled down on the fact that monetary intervention rather than the fiscal route is our ticket out of this crisis. That is, instead of choosing to put money directly in the hands of consumers and businesses by slashing taxes or increasing spending, they have chosen to make credit cheaper for lenders to redistribute, and provided customers with a 6-month moratorium from paying their EMIs. Unfortunately, this has been met with the economic equivalent of a shrug emoji. Adding to this is the fact that NBFCs haven’t been given a moratorium of their own, meaning that they still have to repay their debts to banks at a time where their customers aren’t paying them back.

So where do we stand?

- The RBI and other official bodies have directly and indirectly tried to infuse banks with liquidity in order to encourage them to ramp up lending to consumers, businesses as well as NBFCs.

- The six-month moratorium on loans may provide an immediate measure of relief for borrowers but it could just be kicking the NPA can down the road.

- Lenders who already have to deal with large unknowns on their existing portfolios are reluctant to ‘go in blind’ and extend loans to new customers.

- MSMEs ‘need’ working capital to restart their operations but don’t want to be saddled with more liabilities that weigh down their businesses in the midst of an uncertain economic climate.

- The government is keen to push lending to MSMEs as a way to revive the economy, but no one really wants to lend in the current set-up and no one really wants to borrow either.

The Credit Gap is going nowhere. If anything it has gotten even wider over the past couple of months as businesses have had to pay their fixed costs often without any revenue coming in. In my opinion, digital lending isn’t going anywhere either. Our FS industry may well be forced several years into the future because of the virus. We’re entering another fascinating point in our fintech evolution, and many of the pieces for this future are already in place.

[6] What next?

“The information you have is not the information you want. The information you want is not the information you need. The information you need is not the information you can obtain. The information you can obtain costs more than you want to pay”

― Peter L. Bernstein, Against The Gods: The Remarkable Story of Risk

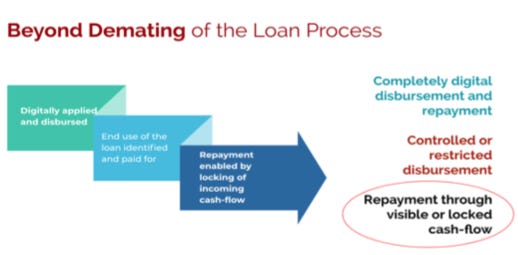

The game has changed for the lending business, as it has for most businesses. It is no longer a balance sheet focused operation but one which needs a richer picture of incoming and outgoing cash flows. The lenders that have relied on traditional documents and physical processes to understand and evaluate their customers will need to recalibrate their models to consider the realities of a new world.

Just like we’ve had to take more of our social and economic lives online through the lockdown period, businesses have been thrust into the digital age, and with an increasing digital footprint comes an entirely new class of information to fill the current data vacuum.

Filling the data vacuum

How do you assess a new SME customer’s ability to repay a loan in the face of so many unknowns about their financial stability, their supply chains, and the wider market for their goods and services? Our over-dependence on credit scores and credit bureaus will likely need readjustment. What ratios or metrics can we introduce that can augment the traditional way of evaluating a business?

How about what percentage of their goods can be sold without in-person interaction? Or whether they have digital payments facilities integrated? Do they have an online store?

Is their staff set up to work remotely? Can the business even function remotely?

Do they have a high exposure to certain international supply chain partners?

Are they selling ‘essential’ goods and services?

Are they using any digital tool for invoicing or inventory management that can give you a snapshot of their economic health?

The point is, that just like every analyst forecast for 2020, current lending risk models need to be significantly revised. The ‘Before’ and ‘After’ picture for every sector will look radically different, but the pillars of success for a post-covid enterprise provide us with a guideline for how to tweak these frameworks. Lenders must follow the digital trails left by MSMEs to predict what their futures look like.

Innovation in lockdown

There are a few crucial questions that lenders have to answer:

1) How to detect how many borrowers in your current portfolio will default after the 6-month moratorium on loans comes to an end?

2) How to know which sectors will come out better or worse after this and how does it affect your ability to grant new loans?

3) How to make sure sourcing, onboarding, disbursals and collections can take place in a digitised capacity?

3) How do you adapt your products and operations for a post-Covid world, and what innovations can you leverage?

On the operational side of things, banks and NBFCs have already begun accelerating their digital transformation journeys, regardless of their strategic attitudes towards digitisation before the virus.

The NPCI announced on 26 May that Aadhar based authentication services for e-signatures would be relaunched from 1 June overturning the suspension of eSign back in 2018, making it easier to remotely onboard new users for financial services.

Paisa Bazaar (the largest lending marketplace in the country) has provided their lending partners with an entire ‘PB Stack’ including facilities for e-mandate, e-signature, e-income validation to help their lending partners fast-track customer onboarding.

Well respected NBFCs like Aye Finance who have built successful lending models around having a physical feet-on-street presence have found that 90% of their loan repayments in April and May have come through digitally via Automated Clearing House (ACH).

Fintech startup Klub has launched a new product called ‘Revenue Based Financing’ or RBF that seeks to dynamically adjust the amount an MSME would have to repay every month based on how much revenue the business actually brought in.

Nasper’s backed payment gateway, PayU, has provided SMEs with a host of new initiatives such as a free website with a built-in payment channel, and a dynamic loan facility in partnership with Indifi. Kunal Shah’s Cred has launched a product called Cred STASH to make an instant line of credit available to customers.

Even traditional FS heavyweights like Bajaj Allianz have been able to onboard over 3 lakh customers just through Whatsapp using e-KYC.

Our fintech companies have wasted no time in understanding the trajectory of the economy and tweaking their operating models to continue being successful, and not just operational over the coming months. But we are on the cusp of a generational change when it comes to financial services in India and the steps to that future have already been laid out.

[7] A new playground

“What demonetization was to payments in India, coronavirus will be for financial services” — Sameer Nigam (CEO, PhonePe)

One of the lesser stated truisms in pop-tech culture is Amara’s Law, coined by Stanford professor Roy Amara in the 1960s which states that ‘we tend to overestimate the impact of new technology in the short run and underestimate it in the long run’.

It is not a stretch to say that India has been busy building for this moment. The unique part about our current situation is that the tools for another fintech revolution are already in place. The public digital infrastructure that fuelled the first leg of India’s fintech boom is ready for its next upgrade.

India Stack

When I was a consultant in KPMG’s Global Financial Services team in London back in 2016, I was astounded by the number of people I encountered who were looking to India as an example of how to create financial products at a national scale.

India Stack is one of the coolest things to come out of the country and it is an innovation we should be immensely proud of. For the uninitiated, India Stack is a set of digital tools that any entrepreneur or institution in the country is free to use to build new products, originally with the intention of widening the net of financial inclusion in India.

This ‘Stack’ is made up of a set of components that seek to provide digital services to Indians that is ‘presence-less, paperless, cashless’ and based around user consent. Today this set of utilities forms a key part of the connective tissue that glues together much of our fintech infrastructure. In a country that grapples with inequality every day, we have made strides over the last decade to create a platform that can support the needs of every digital Indian.

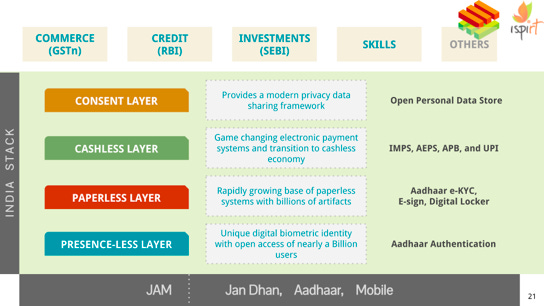

Image source: iSpirt

If you’ve used any payment app like Google Pay or PhonePe, you know how easy it is to make mobile payments to anyone regardless of where they’re located or what bank they’re using. That’s because they’ve been built on this ‘Cashless’ layer called UPI (Unified Payments Interface) which functions as the invisible rails underneath our entire mobile payments system. Or if you’ve ever used your Digi Locker app to verify your identity at the airport, you’re using the ‘Paperless’ layer of India Stack, that seeks to let you store and retrieve authenticated official documents like your drivers license or Aadhaar card.

Even as a safety net in times of economic crisis, just like UPI helped us adapt to a post-demonetisation world, the AePS or Aadhar-enabled payment system has enabled the government to disburse aid to millions of individuals across their country directly through their mobiles due to the disruption caused by coronavirus. It is no small feat to execute a national scale digital project that has given financial access to every Indian with a mobile.

India Stack has already brought in so much of the Indian population into the formal financial system by providing them with a digital identity and the ability to interact with their money or make payments directly from their phones. Much of the fintech boom in India has been the result of the bottom three layers of this platform allowing for cheaper ways of onboarding, authenticating and serving customers digitally.

However, we stand on the cusp of entering a new digital age in India with the launch of the ‘Consent layer’ of the stack, which is the final piece of the puzzle.

Data Empowerment and Protection Architecture (DEPA)

The biggest clues about the trajectory of fintech and lending in India can be found in the seminal U.K. Sinha RBI Report on MSMEs from June 2019, and the landmark Personal Data Protection Bill that was tabled in parliament in December 2019 and is waiting to be formally enacted.

The past few years have seen the global conversation around data ownership and privacy change in a significant way. Private citizens are now conscious of the fact that tech companies are exploiting user data without our consent, with no apparent concern for who can mine our data, for what purpose or for how long. Globally, seminal pieces of legislation like the GDPR in the EU or the California Consumer Privacy Bill have sought to give back users control of their data and allow them to decide how it should be governed.

India has always been a ‘data-rich’ nation, but this data is stored in different silos across banks, telcos, consumer tech co’s, social media providers and other entities we use, with no framework in place to aggregate or share this information. An individual must manually collect and distribute this data to avail of services (eg: loans) which is a time consuming and costly process. There has been no mechanism in place to let you securely share your data with different entities. Till now.

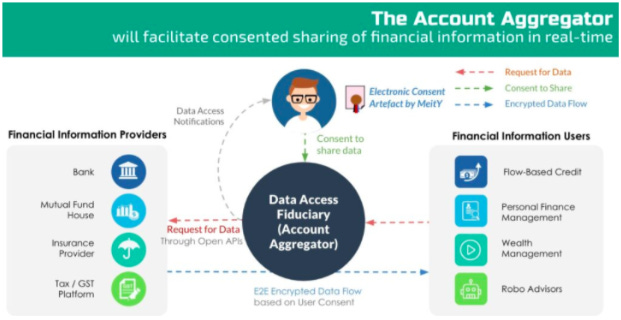

In 2016, the RBI approved a new class of NBFCs called ‘Account Aggregators’ (AAs) whose role is to act as ‘consent managers’ in the financial services industry. In effect these are intermediaries who provide an interface to facilitate the ‘easy sharing and consumption of data from various entities with user consent’.

Image source: iSpirt

What this means in practice is — if you’re a business owner, it will soon be possible with just a few clicks on an AA app to give your bank the go-ahead to securely share your account balance with a prospective lender. The AA performs the role of facilitator, simply retrieving and transferring your data from the provider of your information to the prospective user. The lender can then make a decision on whether to grant you a loan on the back of that information, practically in real time. The interoperability and ease that UPI unlocked for payments will similarly be replicated when it comes to enabling consumers to manage and exploit their own data for personal benefit across a range of participating institutions.

This soon-to-be launched Data Empowerment and Protection Architecture (DEPA) is India’s attempt to create an open data economy, where access to data is commoditized to the point where the time and cost of retrieving consented user data should no longer be a hindrance in building sustainable financial products.

This is now an open invite to the entrepreneurs of the country to decide on how best to use and analyze this information to unlock new digital services for Indian citizens. Aside from collections, successful lending is a function of a lender’s cost of capital and cost of customer acquisition. In the world of AAs, a user will now be able to share his financial history (bank balance, GST invoices etc) with a lender through an AA app to instantly avail of offers for loans. Ideally this should result in lenders passing on the reduced cost of operations to the end customer. It should also allow users to leverage this ease of data sharing into a number of competing offers from multiple banks and NBFCs.

With regards to what the FS sector could look like in 3–6 months with the DEPA framework in place:

- lenders will be able to pull a wider net of prospective customers into the formalized system because new-to-lending customers (who previously could not provide the documentation or data to get loans) will now have the ability to seamlessly share officially verified data that can be used for underwriting.

- The blind spot that banks and NBFCs find themselves with regards to the economic health of a business post the virus and the lockdown, can be filled with newer sources of data provided via user consent (eg: AWS infrastructure spend data from Amazon? Or accounting data from Tally? Or inventory data from SAP?). It should be noted that at the moment both the ‘providers’ and ‘users’ of data within the Account Aggregator framework have to be regulated financial institutions. But we’re moving towards a data democracy where the above examples may well be par for the course.

We are entering the age of Open Banking, which should free our valuable financial data from the exclusive provinces of banks and other legacy institutions and provide an impetus to fintech startups, marketplaces, and entrepreneurs to ‘sachet-ize’ current FS value chains.

Loan Service Providers

With a view to further reduce the credit gap and recognise the development of the fintech lending ecosystem, the UK Sinha MSME Report has proposed a new class of intermediaries called Loan Service Providers (LSP) to occupy a novel role in India’s lending ecosystem.

As lightly regulated middlemen, LSPs would function as agents of borrowers (like RIAs in the mutual fund industry). The idea is to acknowledge the fact that the access points to the formal financial system extend far beyond just the reach of banks and NBFCs. We have seen platforms like Swiggy and Make My Trip, marketplaces like Udaan, and tech providers like BharatPe, among others, start to play an important role in aggregating users, finding customers, and capturing useful data on individuals and MSMEs in India.

As illustrated earlier in this piece, all of these companies that exist outside of the regulated FS ecosystem have all waded into the lending world through different models of partnerships with traditional credit providers, with the following goals:

- To supplement their core business models

- To capitalise on the transaction data they are capturing (eg: Swiggy knowing how many orders a restaurant receives)

- To solve working capital issues for their customers or partners (eg: Amazon providing their sellers with loans)

- To provide lending solutions at key touch-points in the transactional chain (eg: Udaan offering retailers a line of credit that can be utilized while buying goods on the Udaan app)

While most of this activity has arisen organically in the last few years, each of these companies could be empowered to play an even stronger role to foster financial inclusion in India by formally assuming the position of Loan Service Providers.

As LSPs each of these companies (and hopefully several new ones) would be structured to act in the best interest of their users. At a basic level they can assist their customers to select the right credit option, effectively helping new-to-credit customers navigate the world of policy documents, hidden costs, repayment schedules etc.

However at a deeper level this opens the door to every tech company in India becoming a quasi-fintech provider, where entire lending models can be built for the ecosystems conceived around a Big Basket or an Ola. Imagine if Swiggy created an underwriting model based around how many repeat orders a restaurant gets or how many employees they have, or if repayment of a monthly EMI could be done by deducting a certain amount of each invoice? The cost of acquiring these customers would be negligible because they’ve already been through a verification process to be onboarded to the Swiggy platform. And the servicing of these customers can be done by Swiggy’s account managers who liaise with their restaurant partners on a daily basis. For a lender, you drastically reduce the costs and effort involved in finding and catering to new MSME customers.

Source: UK Sinha Report on MSMEs (2019)

To illustrate the potential of this, Archit Gupta who is the CEO of ClearTax (the largest providers of tax filing software for individuals and SMEs in India), said recently that MSMEs on their platform want the company to leverage the bank and GST data they already capture to provide them with working capital. As a trusted brand, they are in a position to connect their verified users with a marketplace of lenders to satisfy the credit demands of MSMEs on the platform. And they will undoubtedly be the first of many to go down this path.

In order to supercharge these efforts, UK Sinha Report recommends the creation of a Digital Public Infrastructure just like India Stack ‘for processing the loan application, disbursement and chasing repayments’. These new lending bridges would seek to add the same ease to lending that India Stack has provided to other areas of the FS ecosystem. Companies will have the ability to ‘plug in’ lending capabilities into their core businesses, and also to connect to a market of ready lenders instead of spending time trying to set up partnerships and integrations with individual lenders.

If ‘all roads lead to lending’ has seemed to be the dominant narrative in India’s tech circles in recent times, then that road is about to get much wider, and we’ve only just scratched the surface of digital financial inclusion in India.

[6] Conclusion

It is hardly original to herald a new age of *insert thing here*. But the virus has provided us with a neat way to split the world into a before and after. In India it hasn’t been uncommon to see headlines outlining the difficulties that the fintech sector has faced over the past couple of months. Right from the lack of physical access to customers; to a six-month moratorium on loan repayments; to a radically altered market that has shifted in their economic health and financial priorities, our lively fintech sector and the multitude of lenders has taken its share of bumps and bruises.

Our MSME Credit Gap threatens to go unfilled, as banks and NBFCs lick their wounds and search for a way to sustainably continue to disburse new loans, underwrite new customers and do their best to manage their portfolios.

However in this difficult situation we turn to our public digital infrastructure for a way forward — a set of innovations that has sought to provide financial inclusion to every Indian over the past decade. Adding to the JAM trinity and the existing pillars of India Stack comes India’s first push to being a data democracy with the DEPA framework. New policy and tech-driven initiatives like Loan Service Providers and Cash Flow Lending will push lenders to philosophically change the question they ask prospective MSMEs from ‘what can you offer me?’ to ‘what can you tell me about the future performance of your business?’

There will undoubtedly be consolidation amongst banks and NBFCs over the coming months as lenders seek to fortify their balance sheets against economic collapse. There might be a drying up of capital in the short term from traditional lenders. However to illustrate the faith in our fintech start ups, just in the last month nine lending companies announced that they had raised a total of $60 million with $117 million coming into the fintech sector as a whole.

We have seen innovations in the last month from the likes of Capital Float who announced a new line-of-credit product with Amazon. LazyPay announced a new facility for individuals to check their credit scores. Whatsapp revealed that it has its sights set on lending in India. Setu and Yap, both building API infrastructure for banks and fintechs, announced successful fundraises. Even outside the lending world, the Bombay Stock Exchange announced that it would start e-KYC to onboard mutual fund investors.

Lenders in India must now balance Capital and Liquidity on one hand while doubling down on the scale, reach and efficiency offered by other tech platforms and solutions. These new solutions must tie together ‘experience, economics, and technology’ as outlined in the original vision for India Stack. Our country has led the charge when it comes to building scalable digital infrastructure and there is no doubt that the world is watching how we leverage these utilities to guide our citizens and businesses out of these tricky times.

References & Further Reading

UK Sinha Report on MSMEs (June 2019)

https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=47331#:~:text=Press%20Releases,-(209%20kb)&text=The%20Reserve%20Bank%20of%20India,sustainability%20of%20the%20MSME%20sector.

Credit Disrupted — Digital MSME Lending in India (Omidyar Network and BCG)

https://www.omidyar.com/sites/default/files/18-11-29_Report_Credit_Disrupted_Digital_FINAL.pdf

Sahamati — Collective of the Account Aggregator Ecosystem

https://sahamati.org.in/

Aaryaman Vir’s primer on DEPA

https://blog.usejournal.com/this-can-be-as-big-as-upi-understanding-the-big-new-thing-in-india-76465995997f

India Stack: The Bedrock of Digital India

https://medium.com/wharton-fintech/the-bedrock-of-a-digital-india-3e96240b3718

NASSCOM Fintech Lending Report

https://www.nasscom.in/knowledge-center/publications/fintech-lending-unlocking-untapped-potential#:~:text=The%20report%20also%20highlights%20new,untapped%20potential%20of%20the%20industry.

Digital Lending and the changing landscape of financial inclusion (PwC)

https://www.pwc.in/assets/pdfs/consulting/financial-services/fintech/publications/a-wider-circle-digital-lending-and-the-changing-landscape-of-financial-inclusion.pdf

Financing India’s MSMEs (IFC)

https://www.intellecap.com/wp-content/uploads/2019/04/Financing-Indias-MSMEs-Estimation-of-Debt-Requireme-nt-of-MSMEs-in_India.pdf

The Tigerfeathers! piece on India Stack

https://tigerfeathers.substack.com/p/the-internet-country