The Business of Diagnostics and the Opportunity for Indian Startups

The pathology industry is large, fragmented, and ready for transformation

Photo by Karolina Grabowska from Pexels

README: So.. I’m pretty surprised to be finding myself writing an article about the diagnostics industry, but it is 2020 so I guess it makes sense. I recently became interested in this space after meeting a fascinating startup working in lab-tech. From the outside, the whole business of pathology seemed ripe for disruption, so I wanted to understand more about it. In that process, I learned quite a lot about an exciting corner of our medical landscape, and I thought I would share those learnings with our readers in this week’s edition of Tigerfeathers!

So, what is this article going to be about?

Lab-tech, mate. Labrador technology. The secret behind why those goofy mutts are so darn loveable.

No, of course not. I’m talking about the business of diagnostics. Specifically, I am talking about the field of pathology, and the way that new technology companies and startups are trying to change this $4bn industry in India.

Upon finishing this article, readers will know the following;

The requirements and economics of running pathology labs

The path lab market landscape in India

Trends to watch out for in this space

Some of the new startups and products making waves in lab-tech

Sweet, so I guess you should explain what pathology is before you do anything else

Yes - the word pathology is derived from the Greek root ‘pathos’, which means suffering. So pathology is the study of suffering, especially the kind brought on by diseases.

In modern parlance, pathology refers to the business of studying an individual’s health through the careful examination of their body tissue, blood, excreta, and the like. So all your blood tests and urine tests come into this category.

Besides pathology, the other main branch of diagnostics is radiology, which is the study of medical images such as X-rays, CAT scans, and so on. In this article, I am only going to talk about the pathology industry in India and the ways in which tech can improve and alter the landscape.

Thanks for the etymology, Aristotle. So what do pathology labs actually do?

They collect samples of human tissue or fluid from a patient, analyze these samples in specialized machines or medical instruments, and report the results back to the patient. To illustrate the end-to-end flow, here are the various steps in the life of a medical sample:

The sample is collected by a professional known as a phlebotomist. In India, phlebotomists need to complete a short certification from an accredited institution or university. Phlebotomists typically earn Rs. 10,000-15,000 per month, and many labs make their staff undergo extra training to make sure they can draw blood from patients in the safest and most painless way possible. And I guess some labs don’t do this extra training because I have had some dodgy phlebotomists down the years 🙄

Anyway, the phlebotomists usually collect the patients’ samples at a collection center, which is kind of like a warehouse to gather and properly store the samples in the right temperatures and conditions to prevent them from getting spoiled.

From the collection center, the sample makes its way to a processing center. This is the place where the sample goes into the medical instrument for analysis. At this point, the samples are handled by technicians. Unlike phlebotomists, technicians need a full fledged 2-year degree called a Diploma in Medical Laboratory Technology (DMLT). Many phlebotomists also have this degree, but for technicians it is a necessity whereas it is not usually enforced for sample collectors.

Regardless, the technician is responsible for preparing the samples and loading them into a medical instrument. These instruments are made by international manufacturers like Roche, Siemens, or Trivitron (Indian company). The job of the instrument is to use special chemicals called reagents to examine the sample for signs of a particular biomarker. In a Complete Blood Count (CBC) test for example, the machine will try to count the number of different cellular bodies (white blood cell, red blood cell etc.) present in the sample. Most commonly, these machines use the reagents to dye the target biomarker and then utilize laser light reflections to quantify the presence of that biomarker.

After the machine is done with its job, it spits the results of the test out into a computer through a wired connection. At this point, a pathologist (3 year undergraduate course) double checks and signs off on the data, before the lab’s computer system formats these results and shares them with the patient. This is the life cycle of a medical sample.

A Siemens immunoassay analyzer system, found in many labs (but not Theranos’ labs)

Ok, so what was new or surprising about this?

Here are the things I learned about this industry that surprised me the most:

The industry is super commoditized: Contrary to my expectations, I found out that there is virtually no technology differentiation between labs. They all rely on pretty much the same machines to do the analysis. If you collect somebody’s blood, load it into the machine, and press the button, your test is exactly the same as everybody else’s (assuming you handle the sample and machine correctly).

The industry is extremely fragmented: About 50% of this industry’s revenues in India come from stand-alone labs and small-scale operators. Another 15-20% come from hospital-based labs, while only 30-35% come from large organized lab chains. In terms of number of labs, the unorganized sector makes up more than 90% of the approximately 100,000 labs operational in India.

There is negligible regulation: This one really shocked me, considering the oftentimes absurd regulatory requirements to do just about anything in this country. There are literally no requirements to start a lab. You don’t need a license from NABL (less than 1% of labs have this accreditation). You don’t even need to register yourself as a medical facility. All you need in India is a pathologist to sign off on the lab reports you produce and you are good to go. If you have enough money to rent an office and hire a pathologist, you can start a pathology lab. Given these low entry-barriers, it is unsurprising we have so many independent outfits in this space.

Pathology instruments are leased: In a neat trick, the manufacturers of lab instruments actually lease out their machines to labs instead of selling them. This has a few benefits: firstly, the manufacturer can use the low up-front cost of the lease to entice more customers. Secondly, the manufacturer can extract a commitment from the customer to purchase reagents and other consumables made by that same manufacturer (these reagents are the real money spinners here, just like how ink was the real money spinner for the Xerox machines that the Xerox company would lease out). Lastly, since the assets are leased, the manufacturers can show the depreciation of the machines on their own books and claim the sweet tax benefits as a result! This arrangement is often also palatable for customers, who are happy to trade the upfront capex in favour of pay-as-you-go pricing.

Most tests are ‘sickness tests’: There are two kinds of tests: sickness tests and wellness tests. Sickness tests are tests prescribed by a doctor in order to confirm the presence of some particular pathogen or disease (eg. tuberculosis test, HIV test). These kinds of tests make up ~90-93% of all the tests done in India. Wellness tests, on the other hand, are done in order to monitor a patient’s chronic condition or overall health. Diabetics, for instance, will do regular blood tests to check on the state of their condition. General purpose health checkups such as vitamin tests also fall into this category. Although wellness tests in India only make up 7-10% of the overall testing volumes, that number is as high as 60% in Western countries. This makes sense to me - as testing becomes better, cheaper, and we become more health conscious, why wouldn’t people want more data about their bodies? This is probably going to be a big growth driver for the industry.

Most sample collection doesn’t happen at home: As somebody who has only ever given blood samples at home, I was surprised to learn that ~90% of samples are obtained in collection centers. Since the real analysis only happens at processing centers, a costly collection center kind of seems like a gratuitous expense lying between the patient and the medical instrument. This could be a big opportunity for business model innovation. I heard about a company called Droplet that used to specialize in running Pre-Analytical Centers (PACs). These are basically like checkpoints at which samples are stabilized to ensure they don’t get spoiled. Droplet effectively offered a logistics service to labs by aggregating samples at their PACs before dropping them off at the relevant processing center. Although Droplet had no instruments or even phlebotomists on its books, this company was eventually acquired for $2mn (according to Traxcn) by healthtech giant 1mg, who presumably use this logistics capability to power sample collection+transport services for their users and lab partners.

Ok, I guess that is kind of surprising. So who are these organized and unorganized players you speak of and what makes their businesses tick?

On the unorganized side, many of the entrepreneurs running pathology labs are people who have some medical/pathology background or DLMT diplomas. They are people who understood the economics of the business and invested in the processing centers, phlebotomists, and machines needed to serve local demand. While I originally thought that this breed of lab must be dying out, one lab-tech CEO told me that the numbers of solo labs is actually growing fast. Unorganized labs usually enjoy gross margins of 30-45%

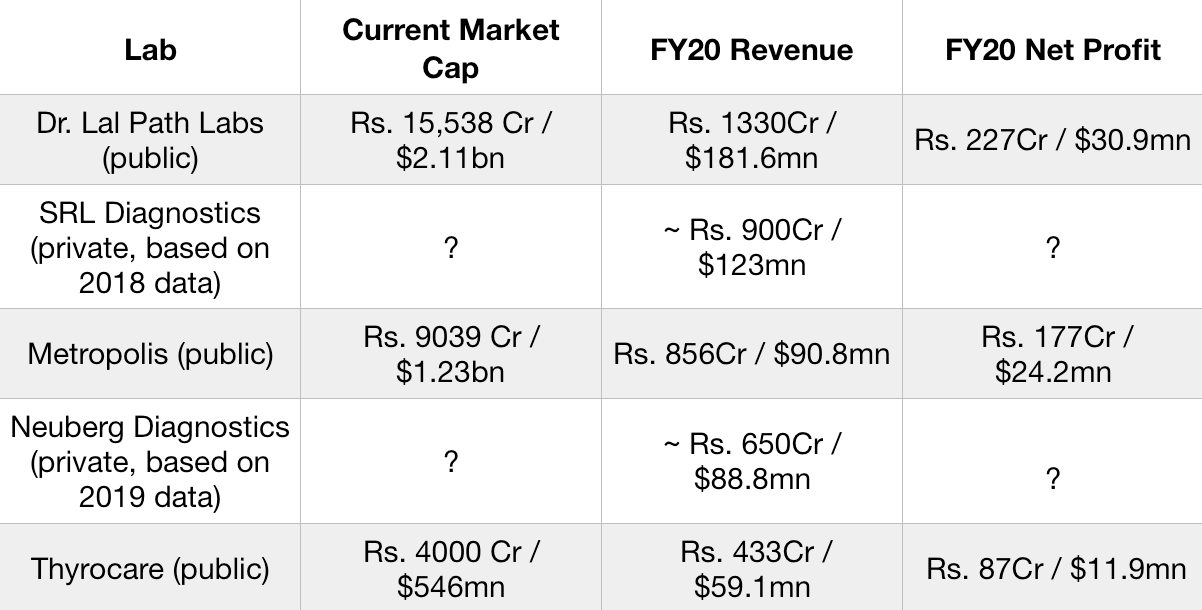

On the organized side, there are 5 main players. In descending order of revenue they are: Dr. Lal Path Labs, SRL Diagnostics, Metropolis Healthcare, Neuberg Diagnostics, and Thyrocare. These businesses usually enjoy economies of scale and gross margins of 40-60%.

You can really tell that Dr. Lal Path Labs was founded in 1949 (sorry, Dr. Lal)

We will soon study the numbers these players generate, but first it is worth understanding the key strategy in this business. The name of the game in diagnostics is volumes. If you have a higher volume of tests, your cost per test comes down dramatically. This is because your main costs are rent (for collection centers and processing centers), manpower, and other overheads. While the reagents can cost up to 40% of the cost of a test, the other elements make up the majority of the unit cost.

All in all, if you have a greater number of tests, you can amortize your rent and HR expenses across these tests and maximize your returns. Rent in particular is a big fixed cost in the pathology business. Since such a high proportion of sample collections happens in collection centers, it has been important to acquire real estate that is optimized for footfalls. This is why some people describe pathology as a clandestine real estate game, echoing the oft-quoted line about how “Starbucks is a real estate business masquerading as a cafe chain”.

And just like Starbucks, path labs also rely heavily upon franchising models to scale up their businesses. In the case of path labs, the franchisee just needs to set up and staff a collection center. After the relatively simple task of collecting and storing the samples, the franchisee only needs to get the samples to the nearest processing center run by the parent lab for analysis and reporting. There is normally no need for the franchisee to operate or possess any medical instruments. For their seemingly menial task, franchisees are able to charge up to 30%-50% commissions from the parent lab chain! This number is so high because the franchisee eats the main costs of setting up and staffing collection centers. Franchisees also kick back some commission as referrals to doctors who prescribe their tests. While this margin seems really high, it makes sense if you look at it from the parent lab’s perspective; this model frees them from the operational headache of establishing centers, hiring staff, and marketing their services. In fact, even for e-pharmacies and teleconsultation apps like mFine, PharmEasy, 1mg, and Practo, the deepest profit pools come from diagnostics services. The app basically acts like a franchisee by generating demand and facilitating sample collections/transport to the parent lab. The only difference is that these apps don’t have physical collection centers like more traditional franchisees do.

In addition to franchising, another powerful growth engine for pathology labs in India is M&A, the funds for which typically come from private equity shops. This makes complete sense - given the fragmented market landscape, there is lots of scope to ‘roll-up’ small players and consolidate them into a single brand which can enjoy economies of scale and centralized back office functions like compliance, procurement, finance, and tech. I was not at all surprised to read that KKR, Carlyle, and Warburg Pincus all owned stakes in Metropolis. High margins, fragmented market landscape, and commoditized product offerings - this is straight out of the PE roll-up handbook. The subscribe button below is straight out of the “necessary self-promotion” handbook.

OK we get the point, now lets look at some numbers and get to the tech and startup stuff

The data for the publicly listed companies came from moneycontrol.com, while the data for Neuberg and SRL came from The Ken. All of these companies have their own interesting stories, but we won’t be covering them here.

In terms of growth rate, the public companies in the table have all enjoyed an average top line growth of ~12-18% YoY over the past 4 years (excluding one year in 2016-17 when Thyrocare’s revenue jumped by 26% up from 240Cr to 304Cr). Having said that, all three companies reported relatively weak growth in FY19-20. I am not sure why this happened, but in the year ending March ‘20, each of the three companies saw their top lines grow by around 30-50% less than the previous year. Metropolis saw growth slow from 18.3% to 12.48%, Dr. Lal went from 13.9% to 10.55%, and Thyrocare went from 12.9% to 7.7%.

The last thing I will say before we move on to the lab-tech players is that due to Covid, the June ‘20 quarterly revenue for Metropolis, Thyrocare, and Dr. Lal fell by 30%, 46%, and 20.6% respectively compared to the same quarter’s results in 2019. Surprisingly, the fall in YoY quarterly revenues was accompanied by a fall in net profits of 88%, 85%, and 52%. This just illustrates the importance of scale and operational efficiency to the bottom line of these businesses.

Ok I didn’t know this was going to be a financial accounting class, what about the cool lab-tech startups you were talking about?

👆Is it weird that the writer me is getting annoyed with the sarcastic narrator me?

Anyhow, I am excited to finally talk about some of the companies I came across that are innovating in this space. Without further ado, let’s jump in to 4 companies, beginning with LiveHealth.

LiveHealth

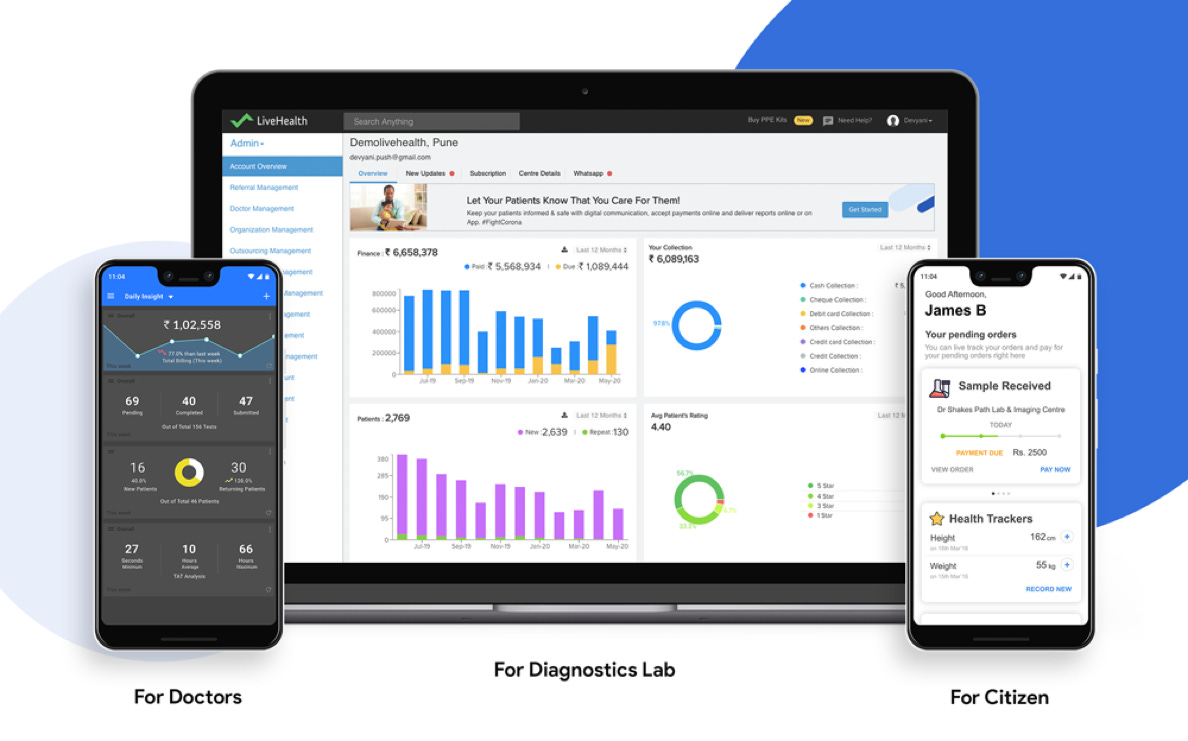

LiveHealth is a Lab Information Management System company (LIMS or LIS). They make software that helps pathology labs manage their resources and handle the day to day operations.

Here are some non-pathology things that labs need to do to run smoothly:

Manage customers appointments and bookings

Handle HR and payroll

Order reagents, consumables, and general supply chain and inventory management

Reconcile bookings and receivables

Collect customer payments

Report results to customers and store customer data safely and correctly

And here are some core-pathology related things that labs need to do:

Optimise the utilization of their medical instruments

Ensure that the correct test is performed on the correct sample

Decode, interpret, and map the results of tests to the right patients

Calibrate and ensure QC for the medical instruments

LiveHealth helps their customers do most of these things on a SaaS model. They have over 1000 different labs using their product, across 30 countries.

Many of their customers switched over to them from legacy software providers. To my surprise, I discovered that there was a vibrant historical Indian LIMS industry. Companies like Birla Medisoft used to make and sell LIMS software to customers on a license basis. In many cases labs even bought bespoke LIMS created by local system integrators or dev shops.

This software, much of which is written in languages like Visual Basic and COBOL, was hosted on-premise at the lab. Predictably, cloud-based solutions like LiveHealth are quickly coming in to modernize the space and grab market share.

There are a couple of things I like about this type of business:

Being the first ones to get the data: When the Siemens/Roche/Trivitron machine is done with the analysis, it outputs data to a computer. From there, the data is uploaded to the LiveHealth server. In many cases, LiveHealth configures or provides this intermediary computer itself. This means they are very deep in a lab’s core pathology workflows. As a SaaS company, its encouraging when you are deeply entrenched in your customers’s business. It is also great when you are the first ones to get the data. There is a ton of stuff you can do with the data should the agreement with the lab permit it. Because you have this centralized view of data across thousands of labs, you can do epidemiological trend mapping, district level biomarker monitoring, and a lot more. It is even conceivable to open an ‘app-store’ of sorts wherein developers could compete to offer solutions to labs and patients. Some examples could be AI diagnosis/second opinion services, data sharing with insurers/drug makers, and more.

Use scale to unlock efficiency: When you have thousands of partners, you can begin to offer supply chain solutions like managed procurement at much cheaper rates. After all, ordering reagents for a thousand labs will get you a bigger discount than ordering them for one lab. Furthermore, owing to the system’s view of a lab’s inventory and cash flows, LiveHealth is also in a great position to offer financing to its customers (fintech everywhere, baby).

LiveHealth is a 7 year old company which last raised a seed round from Nexus VP in 2018. I will be watching them closely because it stands to reason that somebody comes and consolidates LIMS market share amongst the 90,000 independent labs in India (and indeed the other ones all around the world).

The main Indian competitor for LiveHealth is Attune Technologies, but Attune appears to have many different product verticals besides their LIMS offering (stuff like hospital and clinic information systems etc).

Screenshots of the various LiveHealth user interfaces. The doctor and citizen apps allow those stakeholders to keep track of test results, monitor trends, and book tests. The main attraction, however, is the dashboard for diagnostic labs.

Neodocs

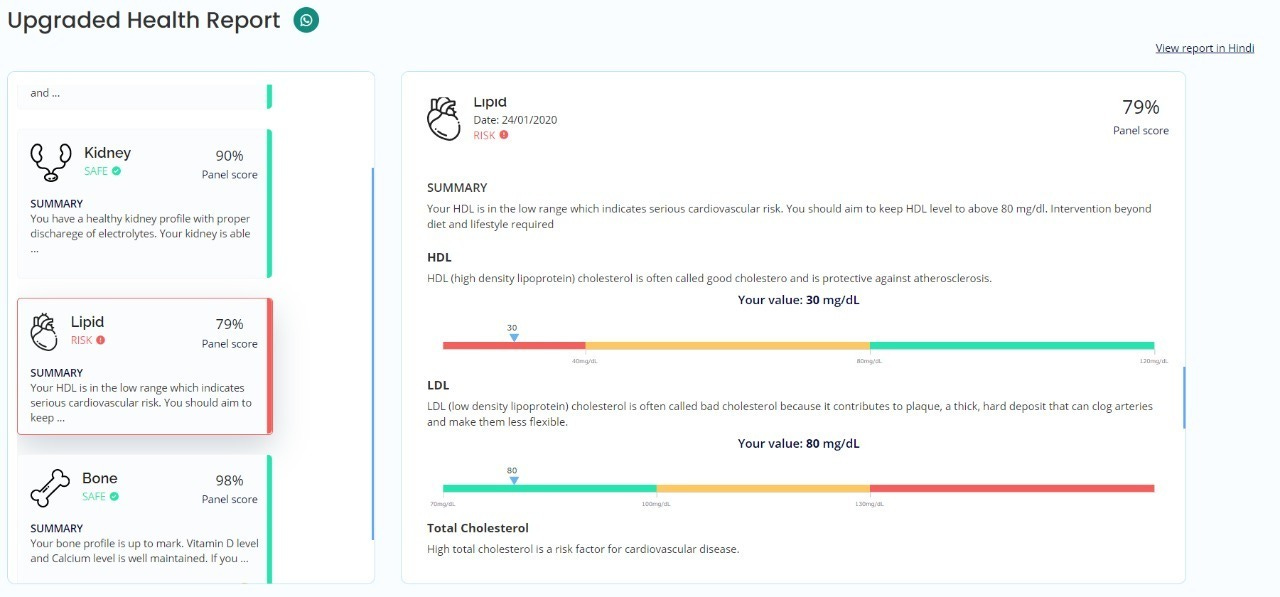

Neodocs is a pre-seed stage startup working on “smart reports”. This means that they make pathology reports more useful and digestible for patients.

All of you have probably seen a pathology report - it is pretty hard to tell what the report is saying and whether the results are good or bad. Many doctors don’t do much to help alleviate a patient’s worries about this either; I have heard doctors say things like “Don’t worry about that” or “it’s nothing major”. While one can sort of understand why doctors might be tired of explaining the same thing a hundred times to clueless patients, the impatience of doctors and the confusing nature of these reports is a source of opportunity for innovators like Neodocs.

Overall, there is a ton of cool stuff which can be done to a pathology report to make it more user-friendly and actionable. This is especially true when you consider that 100% of pathology reports in India are printed in English! In some villages, patients cannot even find translators to help them demystify the foreign scrawl they see on the paper.

For a startup, this seems like a really powerful use case. Neodocs approaches this opportunity through a dual B2B and B2C approach. On the one hand, they partner with independent labs to provide a smart-report feature to all the brand’s customers. This increases user satisfaction and recall and differentiates the standalone lab from its peers.

On the other hand, Neodocs has a customer-facing Whatsapp bot. Anybody can send their lab reports to the bot, which will process the data through OCR/parsing and generate a smart report link in return. The smart report can come in different languages, and its purpose is to explain a patient’s biomarker values in simple terms. It tells patients how they compare with the wider population and suggests some ways to improve their health through lifestyle or diet changes.

What I like about this business is the fact that there is a very strong impulse to act when a patient sees their test results. If your report indicates you should consult a dietitian or buy a supplement, that action can be just one click away. I also think that building proprietary ML models for medical report translation and health benchmarking for Indians can be a good way to generate valuable IP.

One growth driver for this business will be the rise of wellness-focused tests. Many people today report the results of their wellness tests to a nutritionist or wellness coach. The prognosis from these reports is usually some dietary change or vitamin prescription. If Neodocs wanted, they could probably replace the expensive nutritionists gaining popularity today with their own customized virtual nutritionist. One concern, though, is on the medical side - what happens if you give a patient some incorrect or misleading information? Particularly when it comes to a sensitive diagnosis? The best way out of this is probably to steer clear of sickness reports as far as possible and to tie up with doctors to help build the most responsible models for analyzing wellness reports.

Besides Neodocs, I came across two other companies that focus on smart reports: NirogGyan and Healthvectors. In addition to these three, more companies do offer smart reports, but not as the main offering.

A smart report from Neodocs

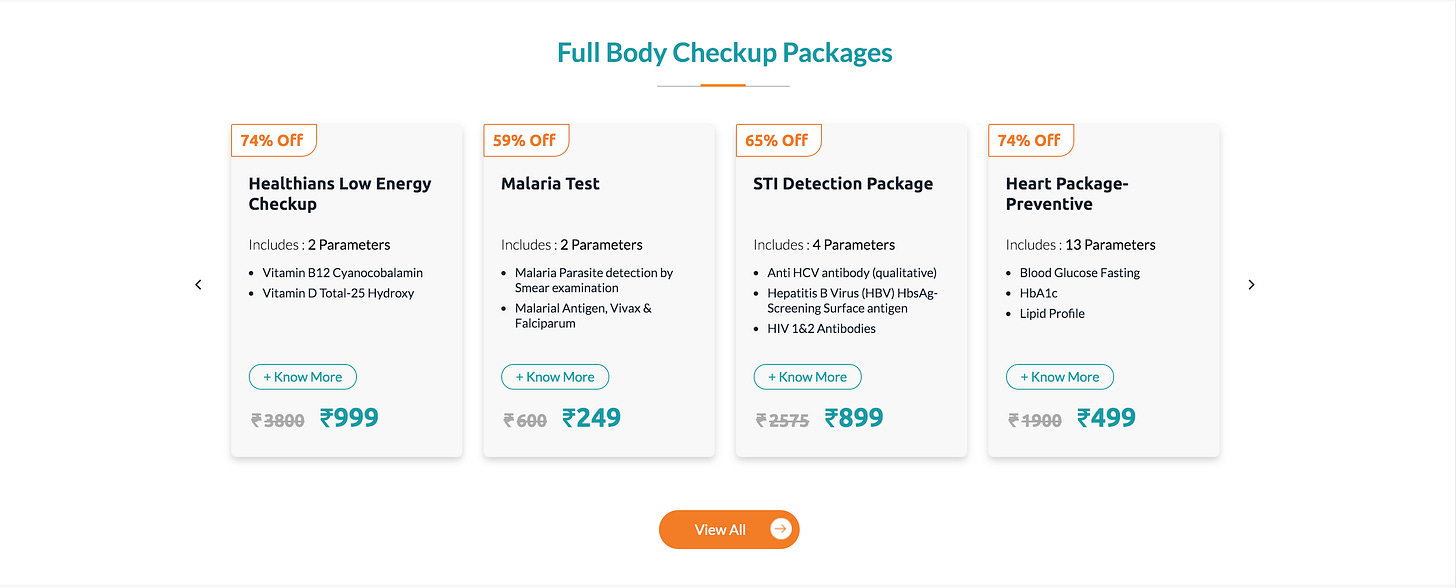

Healthians

One such company that offers smart reports as a feature is Delhi-based Healthians. This is a Series C stage company that already has several PE and VC backers like Beenext, Kotak Private Equity, and Yuvraj Singh’s YouWeCan Ventures.

Unlike the companies from the previous section, Healthians’ focus is not smart reports but instead on-demand B2C diagnostics services. Consumers in 45 cities can visit the Healthians website/app and book themselves a variety of diagnostics services. The kicker for consumers is that Healthians is able to charge up to 30% less than its competition while also providing a 100% accuracy guarantee. This means that if a doctor expresses doubt in the accuracy of a Healthians report, the company will issue a full refund.

There are two things to unpack about the Healthians model. The first is the pricing arbitrage. Healthians is able to offer lower prices primarily because they cut out the middlemen. In the case of pathology labs, the middlemen are the franchisees (who take up to 30-50% commission from processing labs).

If you remember the earlier section on franchisees, you would know that the job of the franchisee is to generate demand and facilitate collections for the lab. This is exactly what Healthians does. They use their digital presence to acquire customers and then service those customers with a fleet of phlebotomists who make home visits to collect samples. Healthians only supports home visits, and they claim to employ India’s largest fleet of phlebotomists.

In the early days of the company, Healthians used to approach lab partners with a promise of savings (lower commissions payouts) and guaranteed revenues. Recently, however, the company has realized that approaching instrument manufacturers is a better way to scale.

As we learned earlier, manufacturers like Siemens or Roche usually lease out medical instruments to path labs. Many of these lease agreements stipulate that the lab has to pay the manufacturer for each test performed; they also require the labs to guarantee a certain quantum of reagent purchases per month. When a lab is operating at low capacity, the labs struggles but the instrument manufacturer suffers as well. The lab ostensibly also runs losses due to the low capacity utilization, making the guaranteed reagent purchases prohibitive for the lab owner.

Rather than take back the machine, it would be in Roche/Siemens’ best interest to ensure that machine utilization goes up and the lab restarts business. Here is where Healthians comes in. By striking a partnership with the manufacturer and their struggling lessor labs, Healthians is able to acquire lab capacity and equipment in a way that works for all parties. The manufacturer gets to earn from their machine usage and reagents sales (now funded by Healthians), the lab owner is able to cease his expenses and generate income by renting out his facility to Healthians, and Healthians is able to acquire lab capacity for cheap. This is how they are able to beat competitors on price.

In order to fulfill their 100% accuracy guarantee, Healthians uses their newfound control over their labs to bring in their own lab staff and protocols. In the world of pathology testing, there are two phases to a test: pre-analytical and post-analytical. The pre-analytical component refers to the life of the sample after collection before it goes into the machine. If it is not stored properly or is exposed to too much heat or sunlight, the sample gets spoiled. These kind of pre-analytical gaffes contribute to an estimated 70% of inaccurate reports. On the other side are post-analytical processes such as machine calibration, quality control, and correct sample-patient mapping. Because Healthians manages the end to end testing workflow from collection to testing, they are able to mitigate both pre-analytical and post-analytical errors. They have GPS trackers and temperature sensors that tell patients exactly where and how their sample is traveling. Programmatic beat planning and route optimisation probably also helps reduce the time the sample is in transit. This takes care of the pre-analytical side of things. At the lab’s end, Healthians installs their middleware between the medical instruments and the LIMS. This helps them ensure the post-analytical side is running smoothly too.

From my brief interaction with the Healthian’s founder, I was impressed. He clearly knows his industry very well and the scaling strategy makes a lot of sense. I am sure his business faced a chicken-and-egg problem early on when he didn’t have the demand side figured out from customers, but now things seem to be going well as Healthians claims to enjoy a 100Cr top line.

Some of the tests and pricing offered by Healthians

Orange Health

From the little bit I was able to understand online, Orange Health is kind of similar to Healthians except for one big difference.

To start with the similarities, Orange Health also works with local lab partners for processing samples. These labs presumably get a rebrand of some kind, and gain a new means of lead generation. Sort of like the Oyo-ization of small pathology labs. On the collections side, Orange’s website makes reference to ‘eMedics’, so they probably also have their own team of phlebotomists like Healthians does.

The big difference in the case of Orange Health is that they build up the demand side of the business through a doctor network. Because 90-93% of diagnostic tests are prescribed to sick patients by doctors, this seems like an obvious distribution channel.

For doctors, one benefit is that they can monitor their patients’ reports directly on an Orange Health app. This app can also be used to converse with patients and keep track of a particular care context or medical history. From the website, it seems like the app also helps doctors collect consultation fees and commissions for prescribing Orange Health tests to patients. A natural evolution of this app would likely be appointment bookings and teleconsultations, with a promise to the doctors not to market other caregivers to the patients they bring onto the app (so that they keep their patients to themselves without worrying that the platform will encourage the patient to try a new doctor).

My apprehension about this model is downloading a separate app to communicate with my doctor or book diagnostic tests. Doing it via WhatsApp would be far more appealing for me as a consumer. Having said that, I am sure doctors feel the exact opposite way as they are sick of giving their personal numbers to patients.

There isn’t much publically available information about this company but it appears to be a pre-seed stage business backed by Y Combinator and Pioneer Fund (thanks, Crunchbase). Whatever may be the case, the business seems ambitious and purposeful and the design on the website is beautiful, so I’m sure we will hear about them in the news sooner rather than later. Yes, I correlate website design with success.

The beautiful Orange Health website

Conclusion

There really isn’t a particular guiding message I’d like to end with, so I guess I’ll just run a quick recap of the things we covered:

Diagnostic pathology in India is a $4bn industry that is highly fragmented. The organized lab chains make up only 30% of the industry revenues, and 10% of the total number of labs.

Diagnostics is a commoditized business but it also has high gross margins of 30-60%. The main cost centers are marketing, rent, and staffing.

Clever logistics and sample collection can drive a lot of efficiency in diagnostics. Presently, 90% of samples are collected in dedicated centers, but this will change going forward as the logistics of home-collection becomes more refined.

90-93% of diagnostic tests are prescribed to patients by doctors to see if they are sick or suffering from a particular disease. Only 7-10% of tests in India are for general checkups, wellness studies, or chronic condition monitoring. In Western countries, 60% of diagnostics tests are wellness tests. It is highly likely that wellness tests will be a major growth engine for the Indian lab industry going forward.

The startups operating in this space mainly fall into two main categories: software-focused and ops-focused. Software-focused companies do things like provide SaaS tools to labs or use AI to interpret and diagnose lab reports. Ops focused companies optimize the logistics and operations of collection centers, PACs, and processing centers.

Trivitron is an example of an Indian medical instrument manufacturer - hopefully we produce many more local hardware companies that can design medical instruments and export them around the world.

An unmentioned factor in the growth of lab-tech will be the introduction of India’s National Health Stack (NHS). This project consists of various pieces of public digital infrastructure that are intended to elevate public health standards through the use of technology. The first piece of this stack to come to market is the Personal Health Record (PHR) or National Health ID system. In a nutshell, the PHR system allows individuals to discover, link, and share their health data through standardized interfaces. This system - which prioritizes user consent and data privacy - will allow all the various lab, health tech, and hospital systems to communicate in a common language.

The ramifications of this new system are manifold and thrilling; folks interested in learning more about this should definitely check out this blog post and sign up for Healthathon 2020, an event designed to generate awareness, engagement, and innovation on top of the PHR system.

In conclusion, I really enjoyed learning about this new industry. There are many lessons to take from this sector that might be applicable to other sectors in India or indeed within foreign countries too. I hope you had as much fun reading this as I did writing it!

If you liked this article, do subscribe to this weekly newsletter and come back for our future posts!

While we are talking about posts, let me just run through some other stuff we have written recently:

A guide to the new credit coordination framework that everybody in Indian fintech is talking about

Rahul’s cleverly titled piece on Substack and the future of media/publishing

Read and share for good karma (and good lab test results going forward) 🙏

Acknowledgements

I’d like to thank Deepak Sahni of Healthians, Abhimanyu Bhosale of LiveHealth, and the Neodocs team for sharing their stories with me and teaching me about the fascinating world of diagnostic pathology. Best of luck to all our daring Indian lab-tech entrepreneurs!

Very nicely summarised article and provides an indepth understanding of a laboratory, laboratory business and the new avenues created by some of he start up companies. Congratulations. Good Job!

World of Information, Very Informative... Thanks a Bunch 👍