This essay originally appeared as a guest post in the 51st edition of Fintech Inside.

If you were using the Internet in 2021, at some point you probably received a little nudge that your software was ready for upgrade. You might have noticed it by the increasing number of brands announcing they were entering the Metaverse. Or by the increasing number of your friends who became overnight authorities on Solana, Matic and Dogecoin. Maybe it was the seemingly ridiculous sums of money being spent on virtual real estate. Maybe it was the hordes of NFT influencers invading your Instagram feed or the incessant advertisements from crypto exchanges that interrupted your cricket viewing.

Maybe it was the monkey pics.

Yeah, it was probably the monkey pics.

The ‘upgrade’ I’m referring to, of course, is Web3. It was undoubtedly the biggest, frothiest (and possibly the most contentious) tech story to emerge in 2021. That’s because the tech itself wasn’t really new. But the packaging certainly was. Web3 is in many ways a branding makeover for all the philosophical underpinnings and technical promise of blockchains and crypto assets. It is shorthand for the next iteration of the Internet, one which offers the potential (and not the guarantee) of a more egalitarian future for Internet users. If you haven’t been keeping score, the ‘3’ in Web3 signifies the third major chapter of the Internet story, which aims to improve upon the achievements in the first two while correcting the missteps we’ve made along the way.

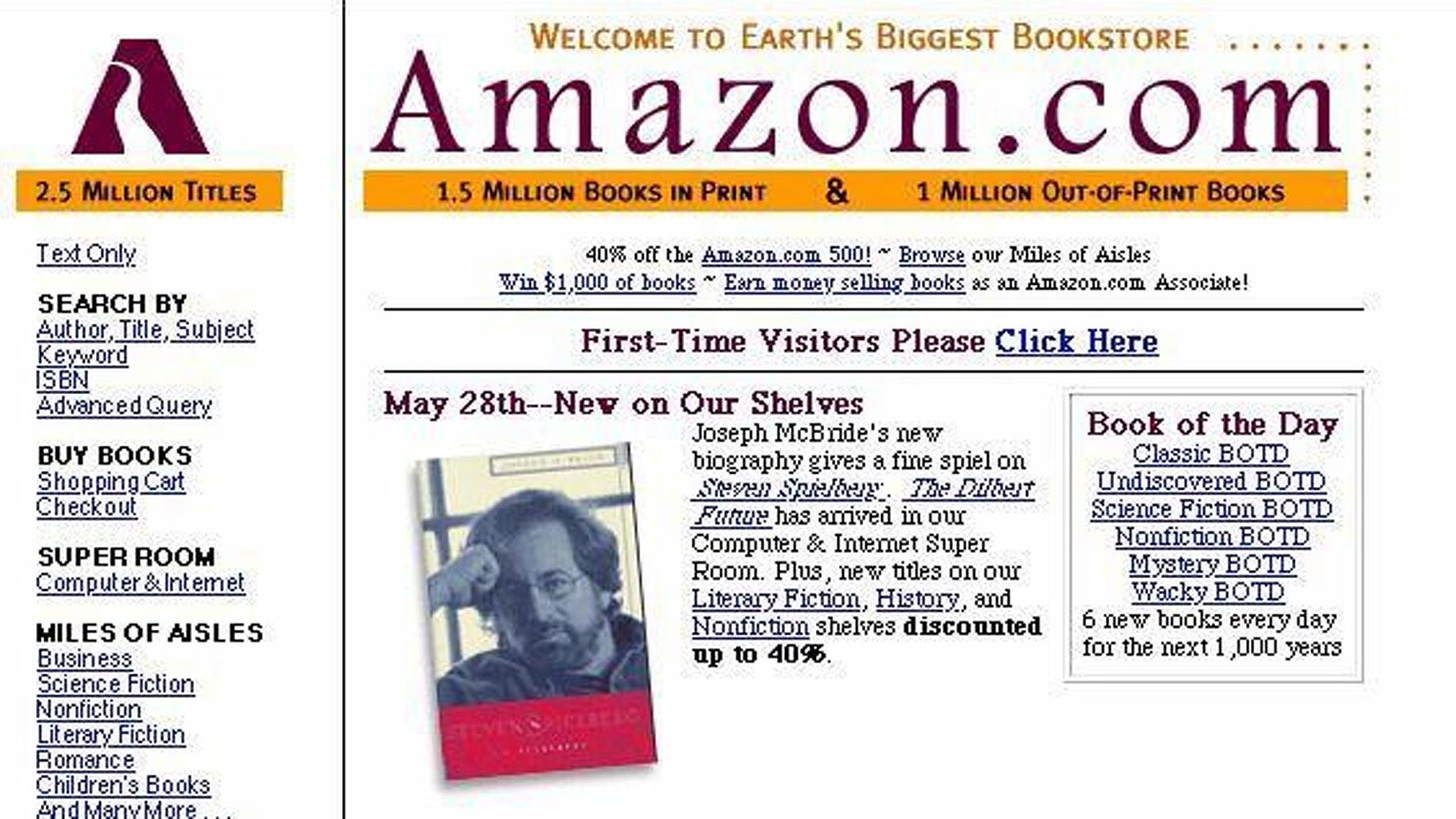

.Com

For the uninitiated, Web1 was the first epoch of the Internet that unfolded over most of the 1990s. It was characterised by the invention and proliferation of common standards and protocols that helped lay the interoperable foundations of the global information system we know as the World Wide Web today. These protocols were collectively governed by independent non-profit organisations made up of early Internet pioneers, which kept the nascent Web free from corporate capture or monopolisation. This era of the Internet wasn’t optimised for the average Internet user. You had to be somewhat technically literate to manoeuvre your way around this terrain because it consisted largely of crude building blocks as opposed to the slick user-friendly applications we’re accustomed to today. This meant that early web pages were made up of static media, leading to one-way relationships where average Internet users were limited to reading or consuming content instead of contributing it themselves.

This changed with Web2, or what would come to be known as the ‘Social’ web. This era is responsible for the coronation of tech giants like Apple, Facebook, Twitter, Amazon and Google who would erect empires on the previously unconquered land of the Web, eventually replacing the open decentralised protocols with their own fortified walled gardens. The Internet was suddenly filled with dynamic web pages that invited users to like, tag, comment and share their thoughts with the world. The Web2 superpowers helped to expand the utility of the Internet beyond the domain of geeks, and in turn were rewarded with mammoth valuations and an outsized influence on our society. Their ascent was supercharged by the arrival of the smartphone, meaning that for the first time ever we carried the Internet around with us wherever we went.

The success of Big Tech was ultimately down to one thing – these companies are really, really good at what they do. It is no surprise then, that in the last 15 years Internet companies have become a fixture in our daily lives. They’ve given us the ability to shop online, to date online, to share ideas online, to find work online, to make and meet friends online. This chapter of the Web helped to evaporate geographical barriers between people and helped to digitise our social and economic lives. And in exchange for (often free) access to these sophisticated digital services, we volunteered the control of our personal data and online identities to a handful of omnipotent tech executives. We submitted to the algorithms.

These platforms trained us to surrender more and more of ourselves to unlock access to supposedly better services. For example, the more of your real-world identity you upload to Facebook, the more it will fill your newsfeed with products and content it thinks you might like. The more you shop on Amazon, the better your ‘recommended items’ list will be. The more you interact with political content on Twitter, the deeper you will be ushered into an ideological echo chamber. We have grown accustomed to trading privacy for convenience when it comes to our online activities. This means we are now at the mercy of algorithms that use every trick in the book to keep us engaged and occupied in order to harvest our data to serve the interests of advertisers.

And that’s where things have gotten weird.

Legendary entrepreneur and VC Marc Andreessen frequently laments what he calls ‘The Internet’s Original Sin’. As the founder of Netscape, where he built the first commercially successful web browser (called Mosaic) in 1994, Andreessen often talks about how the lack of a native payments protocol for the Internet is what’s led us to the advertising-plagued mess we find ourselves in today. In the early days of Mosaic, the Netscape team wanted to integrate a provision for payments directly into the browser. The idea was that if you could incorporate a native payment functionality into the browsing experience, you could conceive of a more sustainable (and diverse) model for commerce on the Internet, one where users could directly pay for the information, content, goods and services that they liked.

“This is the way the real world works – you know something is valuable because someone is willing to pay for it.”

Unfortunately, the internet was still a strange commodity at the time. The money men didn’t know what to make of it. The banks, the credit card companies and other payment processors were all reluctant to jump headfirst into this brave new world (i.e. to work with Netscape), which suffocated the early potential for commerce on the Internet. Amazon had also been experimenting with its own native payment solution but it wasn’t till PayPal came along in 1999 that users could really transact online without the stress of having to share their credit card details with strangers on the Internet.

The failure to convince the banks to get on board meant that the Internet always contained a placeholder for a native payments protocol (it is also why we’ve had to navigate through a mess of clunky incompatible banking portals, card numbers and payment gateways to make an online payment for so many years until modern fintech solutions finally came along). Worse, it meant that advertising would become the default business model for Internet companies because it was the only monetisation route that didn’t require users to volunteer any sensitive financial data over the Web. It resulted in a whole host of downstream problems (“80%” of which could have been avoided) like user data mining, algorithmic manipulation, privacy violation, third-party ad networks, and a general misalignment of incentives between online platforms and their users.

For all the amazing ways the Social Web has transformed our lives in the last decade, it has left us reeling from the mess of advertising-dependent business models. Today Big Tech holds all the cards. Users have no control or ownership over their online identities i.e. Facebook, Youtube and Twitter could arbitrarily delete your account or boot you off their platforms if they determine you’ve violated some rule that you didn’t even know existed. Businesses on these platforms are at the mercy of algorithms that dictate how much user traffic is directed towards them, and how much revenue they can subsequently make. Users and entrepreneurs have very little say when it comes to the governance of the platforms that they invest so much time, money and effort in. The hallmark of the social web is user generated content, which has earned the tech companies untold riches with no compensation for the actual users that drive traffic on these social feeds. The need to draw eyeballs has made it paramount for tech companies to manipulate users and consolidate user data within individual silos, making it hard (or impossible) for users to seamless port their data, their history, their identities and their assets between platforms. The ills of Web2 boil down to an inability of users to view, edit and contribute to the databases that are centrally managed by corporate behemoths.

That’s where Web3 comes in.

.BTC

As we’ve learned, many of the problems associated with Web2 are really collateral damage resulting from the lack of a native solution for transferring money over the Internet. This is no longer a problem waiting to be solved. In October 2008, in the wake of the financial crisis, a person (or group) by the name of Satoshi Nakamoto would lay the blueprint for a native monetary system for the Internet, one that would allow people to send and receive money online without going through any central intermediary. This system, of course, was Bitcoin. Three months later Satoshi would release the open source code for the Bitcoin software which anyone in the world could inspect and download. Users that downloaded the software could join a network of computers all running the Bitcoin code, creating a peer-to-peer system for transferring money online that relied on the use of its own native currency - bitcoin. By creating a decentralised system (without intermediaries) specifically for the digital world, the process of sending money over the internet could theoretically resemble the process of sending an email – instant and virtually free. Just bits of data moving through cyberspace.

There were several reasons why this was such an important breakthrough. First, Satoshi essentially figured out a way for parties that didn’t know or trust each other to come to a consensus about the state of a database. The legacy financial system is based on the supremacy of financial middlemen like commercial banks, payment networks, clearing houses etc who each maintain central systems of record (i.e. central ledgers) to keep track of customer balances and transactions. These institutions traditionally fulfil the role of trusted intermediaries, helping transacting entities overcome counter-party risk and ensuring that the terms of any transaction are duly fulfilled. They earn a healthy fee for performing this service. In comparison, Satoshi proposed the use of a system of distributed ledgers, where each node on the network would maintain a record of transactions and account balances instead of some central authority. The genius of Satoshi’s design was in the enshrining of cryptography and game theory as the central pillars of the system. This meant that each participant on the network was incentivised to act in the best interest of the system i.e. each node was incentivised to maintain an accurate synchronous copy of the ledger. The information itself was secured by cryptography (the art of encoding and decoding information), making it easy to verify whether two disparate ledger copies were the same.

Thus, nodes on the network essentially perform the role of decentralised auditors (‘miners’), helping to maintain the integrity of the ledger without the need for any governing entity. In exchange, they are rewarded in the form of the network’s native digital currency – bitcoin – which is issued on a pre-defined schedule. The currency itself has a fixed supply of 21 million which means that as more people use the network i.e. as the demand for the currency increases, the artificial scarcity (fixed supply) is designed to foster a positive price appreciation. This in turn incentivises more participants to join the network and to continue to maintain the accuracy of the ledger which in turn maintains the viability of the bitcoin as legitimate medium of exchange, unit of account and store of value. Magic.

Bitcoin unearthed a number of important technological developments and seminal ideas that would go on to form the backbone of the next Internet era (Web3):

The concept of cryptocurrencies (or crypto assets or crypto tokens), units of software that can carry value over the Internet, which are created via code instead of being issued by central banks

Using a peer-to-peer system of distributed ledgers secured by cryptography as a decentralised accounting system for digital assets. This system is called a blockchain (because transactions are recorded in batches or ‘blocks’). A blockchain is essentially a way for parties that don’t trust each other to agree on the contents of a database or the state of a network or just a set of facts. The integrity and accuracy of the ledger is maintained by the consensus of network participants.

Bitcoin introduced the idea of provable digital scarcity. The Internet had reduced the marginal cost of replicating and sharing content down to zero. This makes it difficult to verify the authenticity of any single file or unit of media (eg: you could make infinite copies of a meme to share with your friends over email without anyone knowing which was the original file). However, because of bitcoin’s 21 million hard cap (that is enshrined in the bitcoin code) and the use of a blockchain to track the provenance and history of every token in the bitcoin network, you could now create natively digital assets that could hold value on the Internet because you had a way to validate its scarcity.

A blockchain effectively allows you to verify the authenticity and scarcity of a digital file. If provable digital scarcity can enable digital assets to hold and appreciate in value, then there is now merit in digital ownership. Bitcoin uses cryptographic techniques to secure identities and transactions on the network. Your identity on the network is pseudonymously represented (i.e. a unique string of letters and numbers) and yours alone to manage, thanks to a cryptographically generated public key (i.e. your Bitcoin username) and private key (i.e. your Bitcoin password). No organisation can seize your assets or censor your transactions unless they have your private key. This means that you finally have a way to exercise autonomy and control over your identity on the internet outside of the reaches of any social media company or online administrator. Your keys, your coins, your identity.

The concept of decentralised governance. Anyone on the Internet can download the Bitcoin software. You don’t need anyone’s permission to join the Bitcoin network. There are over 100 million wallets currently on the Bitcoin network, out of which an overwhelming number of people have no idea who else is on the network. And yet they are able to coordinate harmoniously despite the absence of personal familiarity because they can supplant their trust in people with a trust in code i.e. each participant agrees to abide by the rules of the game. Bitcoin is the first example of trust-less, permission-less finance – anyone in the world with an internet connection can use the bitcoin network to send and receive money, safe in the knowledge that everyone else in the network is financially incentivised to behave in the best interests of the system.

And finally, the concept of programmable money - the idea that you could prescribe the rules of a monetary system and embed those into its source code (eg: Bitcoin’s 21 million limit, the reward schedule, the process of making transactions etc). This code executes on the satisfaction of pre-defined conditions without the need for lawyers or accountants or any other type of intermediary. These self-executing ‘contracts’ embedded in code are known as smart contracts. They are a way to create decentralised applications where the ‘rules of the game’ are programmed into the network, which means that the system will keep working as intended as long as the prescribed terms of the contract are met.

Depending on who you ask, Web3 is either an abstraction, an application, a contortion or an outright manipulation of the concepts described above. In the years since 2009, Bitcoin has attracted the attention of technologists, idealists, opportunists and ideologues from around the world who believe in the merits of a financial system that exists outside of state control, one which anyone with an Internet connection is free to join and participate, one that restores monetary sovereignty back to individuals instead of institutions. ‘Decentralisation’ has emerged as a seductive proposition and a persuasive rallying cry for builders and users, a cause that is relatively easy to support but harder to faithfully implement (not for want of trying).

Therein lies Bitcoin’s most important contribution of all – it has given us ideas worth fighting for. This genie does not return to the lamp.

.eth

The ideas put forth by Satoshi have since been experimented on and expanded further. Entrepreneurs and engineers have attempted to apply the same concepts to use cases besides ‘money’, in the process launching an entire ‘crypto’ industry that now boasts an undeniable intellectual and financial gravity.

In the last decade we’ve seen:

the creation of general-purpose blockchain platforms like Ethereum (and others) that allow anyone to spin up their own decentralised applications with their own native tokens. These tokens are versatile instruments that can represent ownership, governance rights, property rights, future revenue and anything else that developers can dream up, potentially replacing websites as the atomic units of the Internet.

the proliferation of ‘token offerings’ as a way to raise money for crypto projects where anyone in the world with an internet connection has the right to invest in the next big tech idea. Particularly significant is the ability for Internet users to have equity in the platforms they use and support from an early stage, instead of typically waiting to pick up scraps in a future IPO (as was the case with Web2)

the popularisation of a new token standard to represent unique digital assets known as Non-Fungible Tokens (NFTs). In comparison with bitcoin and other monetary systems where each unit of a currency is interchangeable with any other, an NFT is a way to prove the authenticity, ownership and provenance of unique digital goods. An NFT is a blockchain-based record of ownership for any kind of digital file (an image, video, meme, game item, document etc) that contributed to a renaissance of digital creativity over the course of 2021.

the flourishing of an entire ecosystem for Decentralised Finance (DeFi), where each of the components of the traditional financial system are being replicated for the internet via smart contracts built on blockchain-based platforms. This means, again, that anyone with an internet connection can trustless-ly and permissionless-ly invest, borrow or lend their money to strangers on the Internet without any documentation or discrimination, safe in the knowledge that the smart contract will guarantee that the terms of any proposed agreement will be duly met as specified, and users are incentivised to be on their best behaviour.

the arrival of Decentralised Autonomous Organisations (DAOs) as a new way of coordinating people and resources over the Internet. Particularly in the last year, we’ve seen people all over the world come together (bound by contracts written in code, not paper) to pool and manage resources towards a specific goal like tackling climate change, supporting creators, or buying the Constitution of the United States. There is merit in suggesting that DAOs could be a logical evolution of the joint stock company for the Internet.

When people today say ‘Web3’ they typically mean the ecosystem that encompasses the components mentioned above. Web3 broadly refers to the idea of a reimagined Internet, one that continues to provide the sophisticated services offered in Web2 while returning to the decentralised, interoperable foundations of Web1 through the use of blockchain-based technologies and crypto protocols. It is a vision of the Internet where the balance of power is restored to individual users who have complete privacy, ownership and control over their digital identities and their digital property (i.e. NFTs and other crypto assets) via the sole control of their private keys. It is “an internet owned by the builders and users, orchestrated with tokens”.

“Web3 is the world in which the code is open source instead of closed source, the users own their data instead of being the data, and the users and the contributors govern the network and own the network instead of a small number of shareholders owning the network”

– Naval Ravikant

However, the irony is that for a technology based on the distributed consensus of strangers on the Internet, no one can actually agree on the definition of Web3. The public discourse has become stained by the tribalism from both proponents and opponents of crypto who argue on the linguistic boundaries of Web3 as well as its technological promises. Strangely enough, this is one of the quirks of having Web2 social platforms where we can debate the merits and shortcomings of Web3 all day. It is being constantly defined and redefined, litigated and castigated, all in real time.

Bitcoin maximalists like Jack Dorsey suggest that crypto projects that have significant VC ownership on their ‘cap tables’ should be disqualified on grounds that they aren’t really free from centralised influence. To him there is no Web3, only Bitcoin.

Cryptographers like Moxie Marlinspike (Former CEO – Signal) have offered thoughtful critiques on the technical underpinnings of Web3, pointing out that there are elements of Web3 infrastructure that still have centralised components, and others that insufficiently incorporate cryptography into their security practices.

While ‘Web3’ as a convenient label has helped to soften the narrative blow that typically accompanies any discourse around ‘crypto’, there are still many issues that need to be addressed specifically around the scaling and accessibility of these technologies beyond crypto-literate and crypto-wealthy audiences before they can deliver on their lofty ambitions and justify often gaudy market valuations. This, unfortunately, will always be the nature of the game. As a 24/7 liquid trading market with constant price discovery, crypto can often a resemble a global casino where people are gambling on instruments that have no actual use. It is easy for outside observers to compare the token value of a project and the actual impact of that project and come away with the opinion that something stinks. That is understandable. That’s why there are still regulatory questions to be answered across the globe. But I’m hopeful that the strides made over the last 12 months have helped to validate the work and commitment of Web3 proponents who believe in a fundamentally better future for creators and consumers on the Internet.

Closing Thoughts

“Information that we assume to be public, we publish. Information that we assume to be agreed, we place on a consensus-ledger. Information that we assume to be private, we keep secret and never reveal.”

- Gavin Wood

I first went down the bitcoin rabbit hole in 2015, and came out sufficiently radicalised. I’ve since tempered my own opinions on the necessity for absolute decentralisation to achieve all of crypto’s grand objectives. We don’t need to overthrow every central figurehead or intermediary to unlock a better future for the internet (or internet users). Not every feature of Web2 is bad, nor every outcome of Web3 noble. Not every technological problem requires a blockchain solution. Not all advertising models are evil. Not every facet of humanity needs to be financialised and tradable. Not every aspect of centralisation is toxic, nor every outcome of decentralisation desirable. I do believe, however, that we need to even the stakes. We need to safeguard the ultimate sovereignty of the individual, restoring control over personal data and identity back to people, and giving global citizens equal access (and not the obligation) to use open digital and financial infrastructure that could enrich their lives.

If you find yourself in the privileged segment of the world that has access to all the benefits of a functional economic and social system (and government), some of these objectives probably don’t move the needle for you. But the virtues of decentralisation often reveal themselves only in times of need.

You don’t need inflation-resistant money unless you live in a country where monetary mismanagement has resulted in a hyperinflationary currency that isn’t worth the paper its printed on.

You won’t understand the benefits of owning your online identity and assets till Facebook blocks your account for making a supposedly controversial political statement.

You won’t see the need to have a say in the governance of platforms you use, till they suddenly change the rules of the algorithm that determine how much money you make every month.

You might not see how the ability to create and market scarce digital goods will transform the fortunes of global artists who’ve typically had to rely on the benevolence and endorsement of traditional gatekeepers to get their work in front of an audience of potential patrons.

You won’t see the necessity for decentralised finance to protect and grow your wealth, till interest rates in your country fall to a point where you’re actually losing money by holding your savings in a bank.

You don’t understand why seizure-resistant and censorship-resistant money are important, till your bank account has been frozen by a national government gone rogue.

Decentralisation can often sound like a vapid rallying cry, but it is an option that everyone on the Internet deserves to have. Web3 is not about removing centralised platforms from the Internet, it is about reducing their absolute control over our digital lives. Its not about cutting VCs and bankers out of the system, its about letting everyone else in. Its not about installing a global scoreboard to watch prices go up in perpetuity, its about designing systems with incentives that drive the right outcomes. Interoperable crypto protocols and cryptographically secure private keys mean that we can now own our identities and take them with us across the Internet, with complete control over who can access our data. Web3 is about reducing rent seeking and switching costs, shifting the balance of power from corporations and platforms to individual users. Web3 is the ownership layer of the internet disguised as the value layer.

Based on where you’re sitting, we’re either at the start of a new Internet era or right in the middle of it. There is plenty of work to be done on security, scaling, UX and consumer education to ensure that all citizens of the Internet have fair access to this new frontier. With great power comes great responsibility accountability. Web3 might mean different things to different people (and it might not be the first choice for everyone). But its worth remembering that we are moving from the age of the institution to the age of the individual. Crypto is enabling the autonomy and sovereignty of the individual at a global level by empowering the users and builders of the Internet to have a say in where it goes next. It is on us to ensure that we build in the right direction.

ABOUT THE AUTHOR

Rahul Sanghi most recently served as Fintech Lead for Visa in India & South Asia. He began his career as a consultant with KPMG in London, spending a majority of his time helping the firm set up its global enterprise blockchain and crypto asset advisory practice. He moved back to India in 2018 and joined Koinex (then India’s largest cryptocurrency exchange) as Director of Business and Strategy, before assuming the same role at B2B-SaaS startup FloBiz. He is currently the co-founder of Tigerfeathers, a media brand that is being built for Web3.