The $4bn Indian Unicorn You (Probably) Don't Know But You NEED To Hear About

How A Small Team From Ahmedabad Is Changing A $1.75trn Ecosystem

$4bn? Like four billion US dollars backed by the Federal Reserve of the United States of America? And you’re saying we probably haven’t even heard of this company?

Yes, yes indeed.

Thats pretty crazy…

It gets a lot crazier. This story involves Elon Musk, Kanye West, and one of the most inspirational founder journeys I’ve heard in my life. But it also requires a little bit of knowledge about blockchains for proper context, so readers should be aware that the story takes a while to come together. But once it does come together, I promise it’ll be worth it 😄

Go on…

OK, for starters, it probably seems insane to many of our readers who follow Indian tech that a $4bn company was created under their noses without so much as a sniff from YourStory or Entrackr.

That would be a totally reasonable point of view, but the subject of this post is not actually a company, but rather a cryptocurrency protocol called Polygon (formerly known as Matic Network, but not so formerly that I won’t still refer to them as Matic in this post).

At the time of writing, the fully diluted market cap of this project is $4bn dollars, which makes it one of the most valuable technology projects to ever come out of the subcontinent period. I apologize in advance to the pedants who will correctly argue that cryptocurrency market capitalizations are ephemeral, often dubious, and incongruous with company valuations. I also apologize to the kind and humble folks from Matic who would doubtless cringe and squirm when reading my hyperbolic headline. I’m sorry guys, but everything I’ve written so far is a fact, and sometimes a little bit of clickbait goes a long way in terms of spreading a worthy message :)

So… tell us about Matic!

Definitely - but before diving in, I’d like to just take a moment to thank our readers and outline my motivations for this piece. More than 30,000 people read our last post about the incredible technology innovation known as India Stack, and many of you continue subscribing to this newsletter in spite of our… erratic publishing schedule. For all of this support, you have my deep gratitude. I hope you enjoy this post and our subsequent write-ups.

Speaking of subsequent write-ups, I will be talking more and more about blockchains in the coming months. This is a topic that I care about, and one that I want you to care about too. Some of you might know this, but I’ve been extremely fascinated by Bitcoin and blockchains for almost 8 years now. In fact, in 2016, I co-founded one of the first blockchain companies in India. This company, known as Elemential Labs, initially built bespoke blockchain-based copies of existing fintech systems such as KYC registries, trade finance platforms, and proxy voting systems for the corporate governance of listed companies. As we churned out these solutions for clients like the National Stock Exchange and various private banks, my cofounders and I realized that we had actually discovered a common problem in blockchain development: configuring, deploying, and orchestrating a private blockchain network.

In simple terms, the problem was that if you wished to build a private blockchain with only known and trusted participants (as opposed to a public blockchain like Bitcoin or Ethereum, which anybody can join), you needed to go through a variety of steps to set up that blockchain.

Most of these steps are repetitive and menial tasks such as procuring the actual computers which will run the blockchain program (called ‘nodes’), installing the relevant software dependencies on those machines, editing their configuration so that they can talk to one another, and a variety of other jobs which take up quite a lot of a software developer’s bandwidth. My cofounders and I were repeating these tasks each time we built a new blockchain application for a client, and we eventually realized that we could automate a lot of this work through custom scripts and tooling.

After building these tools to scratch our own itch, we realized we could offer the same convenience to other blockchain developers around the world. On the back of this idea, Elemential raised some money from a number of investors including Lightspeed India, Matrix Partners India, and a US-based crypto behemoth known as Digital Currency Group.

Despite the backing and support of these investors, it turned out the team had differing viewpoints on how to move forward, and I left the company in 2018 to launch Prophetic Ventures. But here’s the point of all this - I’ve been enamoured by this technology for a long time. I’ve already seen a couple of cycles in crypto, and although I took a hiatus from this field to also explore new subjects, my interest in this industry has never been higher than today. I want to educate myself on some of the exciting new developments that have taken place over the last couple of years, and I’d like to use this medium as a way to share my learnings with readers!

Matic is the ideal project to begin with because their local origin story makes them a fascinating subject of study for our largely Indian reader base. But over and above that, I would also go as far as to say that the Matic story is one of the most inspiring startup stories I have heard in my life.

In our startup ecosystem, we often lionize groundbreaking local companies, but I would bet that outside of the crypto community, few people would have even heard of this cutting edge project. Now, just a few days after the the MATIC cryptocurrency was listed on Coinbase (a huge sign of validation for any crypto project), is a great time to shine a spotlight on this protocol and introduce Matic to new audiences!

😤 Cool story, bro, but nobody cares about your background or motivations for writing this piece! Tell us the epic story!

Ok, I’ll begin with my favourite part - the human side. Matic initially had three cofounders: Jaynti Kanani, Sandeep Nailwal, and Anurag Arjun. Later on, Serbian programmer and entrepreneur Mihailo Bjelic also joined the team as a cofounder. Having said that, the principal inventor of the Matic protocol is Jaynti, also known as JD, and it is his tale that we will cover in this post, with respect and apologies to the other cofounders!

JD was born and brought up in Ahmedabad as the son of a worker from one of the city’s many diamond kaarkhanas or factories. Growing up, circumstances weren’t the easiest for JD - his two sisters didn’t attend school past the 10th grade due to financial difficulties.

Nonetheless, the family was able to send JD to an engineering college in the small nearby town of Nadiad. It was something of a coincidence that JD ended up in the computer science program there - he didn’t get good enough grades to get into the college’s more popular electrical engineering program - but I think everybody can agree now that it was an extremely happy coincidence :)

It was only while he was studying computer science at Dharmsinh Desai Institute in Nadiad that JD was actually exposed to programming for the first time. In fact, JD didn’t even have his own computer till the third year of college, when an aunt of his gifted him a laptop. Prior to that, JD had to use the shoddy school computers or borrow a machine from his friends just to complete his assignments and get some hands on experience working with code.

After graduating from college in 2011, JD joined Pune-based IT services company Persistent Systems. It was here, through a mentor, that JD was first introduced to Hacker News, Y Combinator, and global startup culture. Having discovered this exciting new world, JD threw himself into learning about tech and startups. He moved on from Persistent in 2014 and joined an edtech startup called Function Space - at the time, the company was helmed by Sumit Maniar, who would later go on to found the gold-loan trailblazer Rupeek.

As a natural result of immersing himself in all things entrepreneurial, JD soon got the itch to start up himself. However, his first venture - a Twitter analytics tool - failed to take off, and JD applied to Housing.com shortly thereafter.

While working at Housing as a frontend developer, JD befriended the firm’s head of data science, who pulled him into the company’s data science team. It was during this phase of his career, around 2015, that JD first heard about crypto. The story behind this is quite amusing. As an avid Game of Thrones fan, JD wanted to build a side project that people could use to wager on plot developments in the show.

“Which character will die next on GoT? Bet correctly and win money!” - this was the premise of JD’s app, but he ran into issues when building payment functionality that could serve a global user base. While trying to find solutions to these issues, JD discovered crypto, and quickly fell down the rabbithole, as so many of us do.

From thereon out, JD kept reading and absorbing things about the burgeoning world of cryptocurrencies. After making some money during the bull run of 2017, JD finally left Housing.com in October 2017 to branch out on his own once more. In 2018, JD completed the first proof-of-concept for the system that would eventually become the Matic network. Along the way, he met Anurag and Sandeep; together, along with the rest of the Matic team, the 3 of them have gone on to create one of the most valuable and important crypto projects out there.

I’m sure that if you told JD or the people around him growing up that he would one day build a network worth tens of thousands of crores of Indian rupees, you would get some funny looks. And thats exactly what is so inspiring to me about this story. JD’s career shows that it doesn’t matter who you are, where you come from, or how much money you have - anybody can change the world only through curiosity, determination, and the willingness to take risks.

JD certainly took many risks throughout the course of his life - you could even argue that the very act of going to college was a risk for his family. Nonetheless, all of those risks paid off in one of the most unlikely and spectacular ways possible. Although JD and his siblings might have grown up without access to computers and higher education, something tells me the same won’t be true for the next generation of the family 😁

Woah… You’re right, that is an epic story. Respect to JD and his cofounders! So what the hell is Matic and how does it work?

I promise we’ll get there in a second, but first lets check out the topics we will cover:

What is Ethereum and why is everybody trying to fix it?

What do Matic and Ethereum have to do with each other?

What does it mean that Matic is worth $4bn?

If you feel like you don’t totally understand how cryptocurrencies actually work, I strongly recommend reading this article I wrote in September of last year. I explain the actual mechanism that powers Bitcoin and provides inspiration to hundreds of other projects. Readers who complete that post will have an extremely solid foundational understanding of cryptocurrency architecture, security properties, and overall capabilities. The following post about Matic will make a lot more sense if you know these things, but I will try and keep this article at a high enough level that newcomers can follow along.

Anyway, to begin understanding Matic, we need to first understand Ethereum. To understand Ethereum, let’s compare it with Bitcoin. The entire point behind Bitcoin is the creation of a decentralized ledger which keeps track of one thing - Bitcoin transactions. The ledger is decentralized because each computer running the Bitcoin program keeps its own internal copy of the ledger. There is no central or ‘master’ copy anywhere - when an interested party needs to check something in the ledger, they can just look up the internal copy stored in their own computer. The benefit of this architecture is that no single party can alter, censor, or throttle the ledger, but the downside is that the entire system becomes unreliable and completely useless if the various ledger copies are even slightly out of sync. Luckily, Bitcoin uses a clever combination of cryptography and economic incentive games to help create one consistent version of the ledger across nodes. This innovation was a breakthrough for accounting, computer science, and economics, but as mentioned previously, the Bitcoin ledger tracks one thing only - Bitcoin transactions.

The people behind Ethereum decided to take this concept up a notch. They basically said “what would happen if we took Bitcoin’s concept of a decentralized ledger but allowed people to add other data to this shared ledger, in addition to merely Bitcoin transactions?”

What do you mean “other data”?

The Ethereum protocol allows users to write custom code into the decentralized ledger in the form of “smart contracts”. Once this code is deployed to the ledger, everybody else can see it and interact with it. Entire applications can be built which have no central server, no single database, and which are open-source from the get-go.

As part of their launch campaign marketing in 2015, the Ethereum Foundation likened the project to a “World Computer”. Just like how the Bitcoin program helps maintain a single ledger of Bitcoin transactions, the Ethereum program maintains a single ledger which acts like computer database containing all sorts of things.

Here is a small list of the kind of things people use Ethereum for:

To keep track of account balances and transactions for the program’s native cryptocurrency token called ether (ETH), and hundreds of other cryptocurrencies subsequently launched by users leveraging the possibilities of smart contracts

To transfer or view the ownership and provenance of a digital asset such as a land record, virtual trading card, or artwork (more on this ‘non-fungible token’ or NFT use case later)

I once created an Ethereum program for fun called ‘Taco Flavour Of The Day’… It was pretty simple, anybody could read the program to see the flavour of the day. If you payed a small fee you could change the flavour to whatever you wanted. Yes, I really did that, and yes, I really like tacos 😅

People also write financial programs onto Ethereum which facilitate things like peer-to-peer insurance or credit. Here is how the insurance piece works for example:

Akbar invests 10 ether into a smart contract as an insurance provider

Bob pays 1 ether to the smart contract in order to purchase flight insurance

The contract is designed in such a way that Bob’s flight details are automatically fetched from some pre-determined source such as Jet Airways or a flight tracking website (known in blockchain terminology as an ‘oracle’)

The contract has stipulations such as “if the flight is on time, automatically give Bob’s 1 ether to Akbar and allow Akbar to withdraw his 10 ether”, “If the flight is >1 hour late, give 5 ether to Bob”, “If the flight is >6 hours late, give 10 ether to Bob” etc. The whole thing can be designed to work programmatically, without the need for human intervention or manual claims adjudication (which can be good or bad depending on the use case)

The cool thing about Ethereum is that anybody can come up with an idea and launch this idea into the World Computer as a set of smart contracts. On the other end, anybody can read and interact with those contracts once they are deployed. All these programs are transparent, open, and freely accessible, so the whole world is always on the same page about the state of any application or transaction.

This functionality has given rise to a massive industry called ‘decentralized finance’ or DeFi for short (pronounced like dee-fai). This is honestly one of the most interesting phenomenon in recent financial history, so I’d like to spend a couple of minutes talking about some of the key trends here.

Decentralized Lending

The concept is pretty simple - its basically like a loan against shares. Lets say I have some ether and I need liquidity, but I don’t want to sell my ether because I anticipate the price will go up in the future. In the world of DeFi, you can borrow against your crypto by using a smart contract.

The borrower deposits his collateral (ether) into a contract which functions like an automated escrow account. Against this collateral (lets say some ether worth 100 dollars), the borrower is able to withdraw some money (say 50 dollars) denominated in another currency - usually some stablecoins, which are tokens pegged to currencies like USD. The loan amount is always smaller than the value of the collateral, so that if the borrower defaults or the price of the collateral falls to close to 50 dollars, the smart contract can liquidate the collateral and automatically return the lender’s deposit plus accrued interest.

On the other hand, if the borrower is able to service the interest and repay the loan on time, they are able to withdraw their locked collateral and enjoy any capital appreciation on that asset.

This use case is hugely popular - here are some headline numbers taken from an incredibly useful and sexy website called Dune Analytics:

There are currently around $23bn worth of assets deposited in lending protocols on Ethereum, up from $1bn only 12 months ago

$600mn was the net borrowing (fresh borrowing minus payback) in the last 7 days, which works out to $31bn on an annualized basis

The most popular lending protocols on Ethereum are Aave, Compound, and MakerDAO

There are currently $9bn worth of loans outstanding across these protocols, up from ~$150m exactly a year ago

There are between 1000-1400 unique borrowers per day

The interest per year (IPY) generated by DeFi lending fluctuates depending on the ratio of outstanding loans vs closed loans. Currently the figure stands at $650m. A few days ago on March 11th, 2021 it stood at $850m. One year ago on March 17th, 2020, it was $5m.

The interest rates can fluctuate between 0-50% depending on factors like collateral type (more volatile assets are riskier) and amount borrowed

Whichever way you look at it, these numbers are impressive for any financial market. When you consider the fact that these financial products are working (mostly) smoothly in a completely trustless, automated, and decentralized manner, it becomes pretty mind blowing.

At this point I want to give a shout out to another awesome Indian crypto project called Vauld. Amongst other things, this company offers Indian users a chance to borrow or lend using their crypto - they currently handle $73m in AUM and have raised $2mn from various investors including Coinbase Ventures and Pantera Capital. Disclosure: I am also a lucky investor ✌️

Decentralized Exchanges

For the uninitiated, there are thousands of different cryptocurrencies. Most of them are worthless, but there are also many wonderfully fascinating projects out there which each have their own token. Many of these tokens were actually launched on and reside in the Ethereum blockchain, including lending tokens such as Aave, Compound, and others.

The reasons that these protocols require their own currencies can differ, but they usually have to do with securing the system by aligning users’ monetary incentives with the smooth and successful functioning of the system.

Anyway, the point is that since there are many different cryptocurrencies, there is massive demand for trading platforms that enable the swapping and exchange of tokens. In contrast to centralized exchanges which function kind of like traditional stock exchanges, there are also decentralized exchanges or DEXs which exist as contracts on platforms like Ethereum.

These systems employ clever mathematical and economic models to provide security, liquidity, and good UX to customers. Because of their permissionless and non-custodial nature (meaning you don’t need to give your assets over to a centralized actor who could theoretically abuse that custody), DEXs are popular amongst the crypto community, with the Ethereum ecosystem boasting many of the largest DEXs around.

Here are some headline numbers, once again courtesy of Dune Analytics:

There was $1.61bn of trading volume on Ethereum-based DEXs in the last 24 hours. This is up about 150x in the past year. For comparison, the Indian NSE does around $37bn in daily consolidated volumes, the largest centralized crypto exchange Binance does $82bn and the Nasdaq does consolidated volumes of around $230bn.

The largest DEXs are Uniswap (with 50% market share and investments by a16z and other top VCs), Sushiswap, and projects like Curve, Balancer, Bancor, and Kyber Network

There are around 200K unique addresses trading on Ethereum-based DEXs every week

Over 1.2 million unique addresses have transacted with DEXs since Ethereum launched

OK, at this point we need to intervene and ask where you are going with all of this? You were explaining ‘what kind of data’ exists on Ethereum, and then we got sucked into a DeFi rabbithole?

Sorry, DeFi is just so interesting that I felt like I had to talk about it a little bit. In fact I would like to digress a little further just to say a sentence or two about NFTs and blockchain based games.

Lots of people are building video games and artworks on Ethereum. One popular project is called Decentraland. In this project, users bid to purchase unique plots of virtual land. The landowners are then entitled to build any applications they want on their land - some of the most common applications are shooting games, casinos, and art galleries.

Users can access this virtual world through a web browser or VR headset. The rules of the virtual world are set in the blockchain, so the code behind the gambling games can be inspected to ensure it is provably fair. Land owners can set whatever rules they want on their own land, so they could charge visitors a fee to enter their building or play a game.

In the video below, an enthusiast shows viewers around a new virtual arcade built in Decentraland by Japanese gaming company Atari.

In tandem with the concept of buying and building on virtual land, the idea of owning and trading digital art is also growing in popularity - recently, a work of art boasting an Ethereum-based ownership token was sold to two Indian crypto entrepreneurs for $69m in a Christie’s auction, making it the 3rd most expensive work of art ever sold by a living artist! The artwork itself is available online - it can be seen for free by anybody, just the same way that the Mona Lisa could also be seen for free or even printed on art paper and stuck on a canvas in someone’s home. The point of having the work’s token on a blockchain is that you can prove that you are indeed the owner of the work. You can easily transfer the ownership of that work to others, or write a custom smart contract that allows you to borrow against the work, sell fractional ownership of the work, or basically do anything you could think of.

In addition to this greater degree of flexibility and control over the actual possession of the work, the striking thing about art that exists on a blockchain is that instead of deriving legitimacy from a paper certificate issued by an auction house, the work proves its provenance directly from an artist who creates and digitally signs the work on a decentralized ledger.

In many ways, this is an important moment in the history of how we think about art and art ownership. In that sense, one can appreciate why these pioneering digital art ownership tokens are being bought for such high prices - can you imagine how much art collectors would pay to own Marcel Duchamp’s famous urinal today? Probably hundreds of millions, and we wouldn’t even balk despite the fact that a urinal is literally a device meant to take the piss. Go figure.

(PS: if you don’t know about Duchamp’s urinal, click here to find out how it changed the perception of art forever.)

You’re getting carried away again - what does this have to do with Ethereum and Matic?

Everything that we’ve discussed so far is happening on Ethereum. All of these DeFi, art, and gaming use cases occur inside the World Computer. But there is a problem - the World Computer has some limitations: transaction throughput, transaction speed, and transaction cost.

You see, any transaction made on Ethereum - be it an ether payment, smart contract deployment, creation of an artwork, or an update to the taco flavour of the day - must necessarily be replicated on all the nodes running the Ethereum program. This is the only way that the various internal copies of the decentralized ledger will remain in sync. But this opens up the possibility for abuse - somebody could write a program which takes up gigabytes of memory or creates an infinite loop, causing computers running it to crash.

To get around this problem, Ethereum introduced the concept of gas. Just like in the logistics industry, the gas costs rise higher as the amount of work increases. If you want to move a truck from point A to nearby point B, you pay for only a small amount of gas. But if you want to move the truck far away, the petrol/gas costs will be much higher.

The idea is the same in Ethereum - the more storage and memory a transaction requires, the more a user has to pay in order to make that transaction reflect on the ledger. So building and using complex decentralized apps can become very expensive.

Along with the gas related issues, there are also transaction bottlenecks in Ethereum. The system was designed in such a way that it can only process 12-20 transactions per second. For a hugely popular system like Ethereum, this results in a large queue of pending transactions. Furthermore, transactions take around 13 seconds to be processed and written into the ledger, with different users bidding higher and higher fees to make sure that their transactions are next in line to be processed.

Consequently, all the millions of DeFi, NFT and general Ethereum users need to wait in line for their turn before their transaction is confirmed on the ledger. However, as we just saw, there is a way to jump the queue - paying a higher transaction fee. At the time of writing, the average transaction fee on the Ethereum blockchain is around $20. In the past, the average fee has gone as high as $45. This is really expensive just to change the flavour of a taco or take a ride on a virtual roller coaster.

This is why Ethereum is currently breaking - the high costs, slow processing time, and low transaction throughput make it completely untenable for many use cases.

OK finally you tell us why Ethereum is broken and everybody is trying to fix it. Took you long enough. So how does this relate to Matic then?

The idea for Matic was borne from the need to improve Ethereum’s cost and scalability issues. In 2018, the team at Matic began modifying and innovating upon some existing concepts in the cryptocurrency world to create a “layer-2” or L2 solution on top of Ethereum.

In contrast to the first layer, which is the Ethereum blockchain itself, Matic provides a second layer of scaffolding that helps improve transaction costs and throughput. In order to understand how this is possible, consider the two main components of the Matic system:

A set of Matic smart contracts residing on the Ethereum blockchain (the ‘main chain’)

The Matic sidechain, which is a totally separate blockchain!

The first part should be fairly simple to grasp given what we now know about smart contracts on Ethereum. There are a number of contracts deployed on the main chain which relate to the Matic system. We’ll cover these in more detail in a moment, but lets quickly understand a bit about the Matic sidechain.

The second main component of the Matic system is the Matic sidechain. This is essentially a completely new blockchain built by the folks at Matic. In contrast to Ethereum, this blockchain was optimized for certain parameters like transaction speed and transaction throughput. Transactions on the Matic chain get cleared after 1-2 seconds, as against 15-20 seconds on Ethereum. There is also scope for more transactions to be processed parallelly on Matic, reducing the fee pressure relative to Ethereum. There are still transaction fees on Matic, but these fees range between $0.00004-$0.00012 and are paid in MATIC tokens, which is the native cryptocurrency of the Matic chain.

Just like Ethereum and Bitcoin, the Matic blockchain achieves its security and consistency across copies of its decentralized ledger thanks to a game-theoretical mining process. Essentially, people are incentivized to run computers which constantly process Matic transactions and maintain a provably honest internal copy of the ledger. In Matic, these people are known as validators, and their incentive for running these computers is that they can earn newly minted Matic tokens as long as they prove they are maintaining a correctly ordered ledger of all processed transactions. In order to participate in this process, validators need to ‘stake’ some of their MATIC tokens. These tokens effectively get locked up in a special contract. If it comes to light that a certain validator is trying to promote a spurious version of the ledger, the protocol allows honest bystanders to punish this bad behaviour by “slashing”or snatching the liar’s staked MATIC by providing a mathematical proof which invalidates the spurious ledger promoted by the liar. This is the incentive structure that propels people to maintain their own independant honest copies of the Matic ledger.

This is the principle behind “proof-of-stake” cryptocurrency mining, which is a less energy-intensive process than the computationally heavy “proof-of-work” consensus mechanisms utilized by chains like Bitcoin and Ethereum.

OK but how do these two components of Matic improve the transaction throughput on Ethereum?

Matic offloads the computational burden of Ethereum transactions to the Matic sidechain. This is how it works:

First, lets say a user wishes to make a bunch of quick and low-cost transactions in the Decentraland casino using ether

This user can’t make these transactions on the main Ethereum chain due to high fees, gas costs, and slow processing times

The user takes the money they wish to spend - lets assume 100 ETH - and sends it to a special smart contract on the Ethereum main chain known as the Matic Deposit Manager

The Deposit Manager is basically like a vault which keeps a pool of assets inside under lock and key. Once the user has sent the 100 ETH to the Deposit Manager, the user no longer has access to that ETH on the Ethereum Main Chain

This transaction, which takes places on the Ethereum main chain, is subject to the same high fees and slow times as all other Ethereum transactions - but not to worry, it gets better from here

After the user makes the transfer to the Deposit Manager, the Matic side chain, which is constantly scanning the Ethereum ledger to keep track of transactions involving the Deposit Manager contract, sees this 100 ETH transfer and credits 100 ETH to a new account on the Matic chain

The Matic chain is built as a sort of mirror of Ethereum, so the user can use the same wallet on Matic that they use on Ethereum. So it is this mirrored account on the Matic chain that gets credited the 100 ETH once the deposit transaction goes through on the main chain

Now that the user has 100 ETH in the Matic chain, they can go about doing as many transactions as they wish. They can send money to the Decentraland casino’s Matic wallet and rejoice as the transaction goes through quickly and cheaply

Whenever the user wishes to move their funds back on to the Ethereum main chain, they can send those tokens to a special ‘burn address’ on Matic. This is basically equivalent to publicly destroying those funds. In our example, assume that the user spent 20 ETH unsuccessfully gambling in the Decentraland casino, and they sent the remaining 80 ETH to the burn address.

After burning the tokens on the Matic chain, the user must then send a mathematical proof of this burn back to the Deposit Manager contract on the main chain. The Deposit Manager is able to calculate whether the burn really did take place on the side chain, and upon successful calculation, the user receives the 80 ETH back in their ETH wallet.

This is a super simplified version of events which omits a number of details, but this is the essence of the system. Matic basically provides a parallel transaction processing layer with low fees and quicker confirmation times. Assets can be moved back and forth between the parallel layer and the Ethereum main chain using a kind of bridge created by the Deposit Manager.

But what happens if the Matic blockchain becomes clogged like Ethereum and the transactions become slow and expensive?

Good question! If the Matic sidechain becomes stressed due to high fees and overflowing transactions, the same architecture can be used to build a bridge from the Ethereum main net to a second, third, or thousandth Matic sidechain. This is just one way in which this problem could be tackled.

For the time being however, the Matic sidechain has plenty of room to grow before it hits any barriers.

Thats pretty cool! How has the market responded to this project?

The market loves Matic! It is the most popular L2 solution in the market for Ethereum, or any blockchain for that matter. Almost every major blockchain team is building integrations with Matic, and most of the key Ethereum-based projects have found a great home on the Matic blockchain.

In fact, even Elon Musk, Kanye West, and Jack Dorsey used Matic recently!

Wait, what? Are you serious?

Yes. Thats because Matic powers a project called Cent, which is a platform for digital identity. People like Dorsey and Musk have been using Cent to sell NFTs of their tweets - basically the idea is that you can buy something akin to an autographed tweet or piece of content which comes from the content creator himself.

Dorsey’s first tweet, which is also the very first tweet ever sent on Twitter, is currently being sold to the highest bidder on Cent. The current bid stands at $2.5m, and Dorsey has promised to donate all proceeds to charity.

In a similar vein, Musk and Kanye have also created NFTs out of their own tweets on Cent. Since Matic powers the whole Cent platform, all of those celebrities have used Matic!

I don’t know whether to be impressed by Matic or horrified that people are buying and selling Tweets…

Well, I think its possible to be horrified, impressed, and intrigued all at the same time!

Chris Dixon, one of the leading minds in Andreessen Horowitz’ crypto team, has an awesome quote where he says that “the next big thing will start out looking like a toy”. It will initially seem trifling, trivial, and completely useless, but soon thereafter the real power of the technology will shine through.

We’ve seen the same phenomenon play out with the Internet - most of the early applications were questionable ideas like Pets.com. In fact, it was those kinds of shallow but hyped up ideas that fuelled the dotcom bubble. But once the dust settled on the wreckage of that investment frenzy, transformational companies like Uber, Airbnb, and Facebook emerged to provide real and long-lasting value.

Similarly, most of the use cases and projects in crypto today will be worthless in the near future. Many of them are frankly outlandish or laughable. But sometimes even the laughable ideas can turn into awe-inspiring ones in short order. And thats something that is highly likely to happen with NFTs, for example.

If you say so, man… This whole industry is bonkers. But lets get back to Matic - what else should we know?

The industry is completely bonkers, but its also so much fun.

To pick up where we left off with Matic, the platform powers many more use cases than only selling autographed NFT tweets. Matic also powers a popular DEX called QuickSwap, which is a clone of the Uniswap exchange on Ethereum.

Furthermore, Matic is the scaling solution of choice for many other Ethereum-based projects that strive to offer lower fees and better UX including:

Decentraland, the leading blockchain based virtual world video game

OpenSea, the Amazon of NFTs which recently picked up a $23m Series A round led by Andreessen Horowitz

Aavegotchi, a popular video game that somehow weirdly marries together NFTs, DeFi, and the old Tamagotchi game that many readers would probably remember

PolyMarket, a prediction market wherein users can bet on the outcomes of certain events (eg. US election, covid second wave)

The list of partners and use cases keeps increasing, and Matic will soon also extend support to other popular layer 1 blockchains in addition to Ethereum.

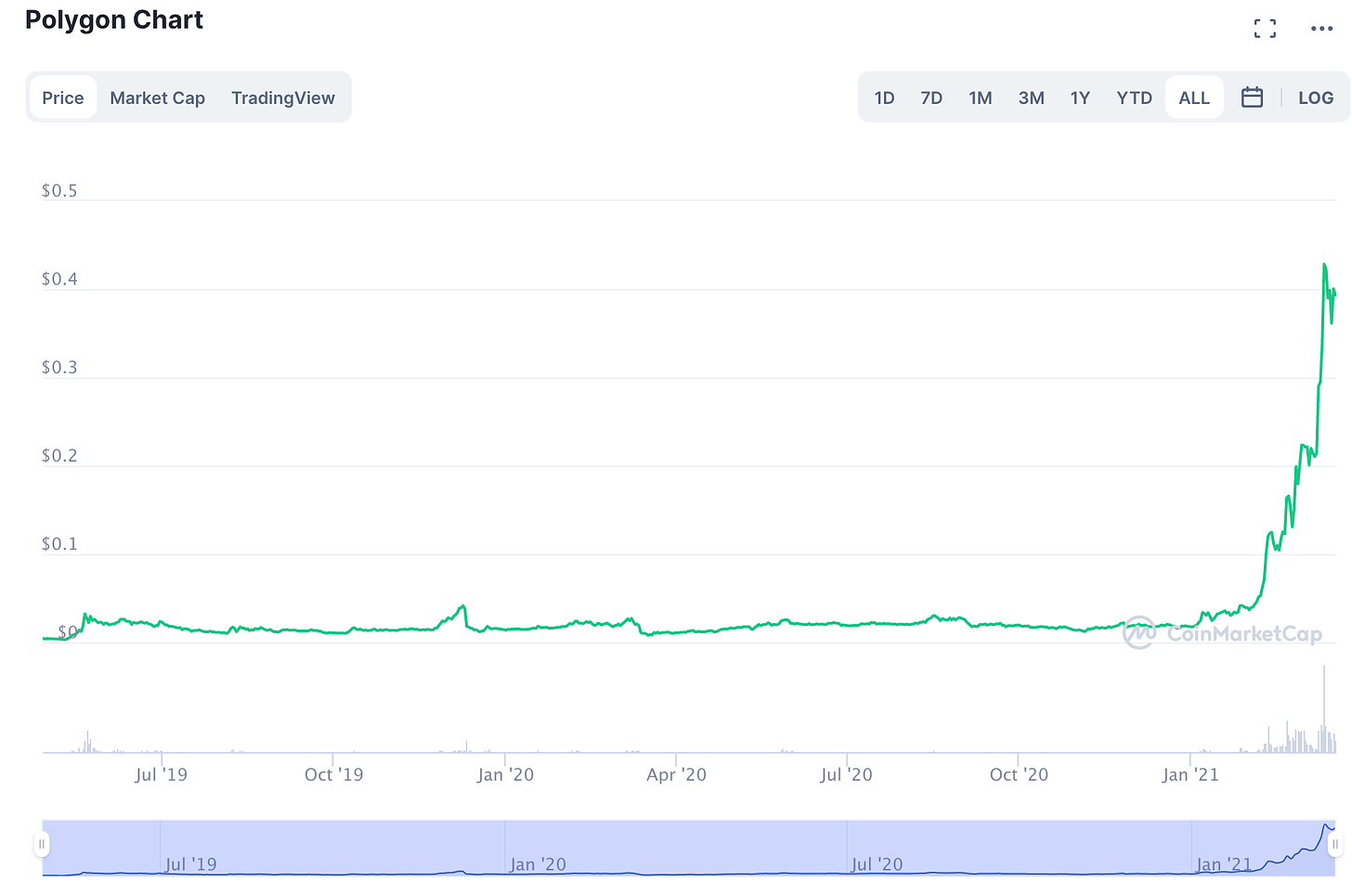

As it stands, users have deposited around $400m worth of token into the Matic Deposit Manager. This is down from a recent peak of $600m, but the crazy thing is that the project first hit an all-time high of $100m only on Feb 12th! This explosion in TVL - “total value locked”, a common term used to describe the amount of assets locked up in a given smart contract or crypto system - came with an accompanying explosion in Matic’s market cap, with the MATIC token rising almost 20x in price since January 2021

Hold up - why does a MATIC cryptocurrency exist in the first place? What is the value of this token?

As we saw earlier, Matic actually runs its own proof-of-stake blockchain. Any blockchain requires some incentive for people to secure the network and ensure the honest and fair maintenance of the collective ledger.

On a public network like Matic or Bitcoin, everybody can be anonymous. There is no obligation for anyone to maintain an honest copy of the ledger, especially if doing so requires spending some resources like server time or computing hardware. Thats why blockchains offer a monetary reward to miners (in proof-of-work systems) or validators (in proof-of-stake systems) who secure the network by verifying transactions and maintaining a mathematically provable internal record of all these transactions in sequence.

The idea is that because the correct state of the ledger is always mathematically verifiable, no bad actor will be able to get away with fudging numbers. There will always be ample ‘honest’ nodes with their own copies of the ledger who will disregard the fraud and continue building an honest ledger safe in the assumption that all other rational and profit-seeking folks would converge on a common, provably true version of events.

In the case of Matic, validators are rewarded with MATIC tokens that are created by the protocol to keep the incentive structure in check. Over time, the supply of these new MATIC tokens keeps falling till no new tokens are created by the protocol. This is similar to the scarcity-creating inflation dynamic in Bitcoin and most other cryptocurrencies. However, in order to earn these newly minted MATIC tokens, validators need to ‘stake’ their MATIC tokens. The more MATIC you stake, the more MATIC you stand to earn as a block reward. This sounds great, but validators who intentionally or inadvertently mess up their accounting of the ledger can have their MATIC deposits slashed if they aren’t careful.

So thats one use case for the MATIC token - you need to stake the token in order to get your chance to produce blocks on the blockchain and earn the accompanying MATIC rewards. The other use case is fees - anybody wishing to transact on the Matic chain must pay fees in MATIC in order for validators to pick up their transactions and include them in blocks on the ledger. Effectively, you need to buy and spend MATIC tokens in order to use the Matic blockchain. In the future, the MATIC token will also be used as a governance mechanism - so basically the people who own MATIC can ‘vote’ in proportion with their holding to conduct certain actions on the network such as apportioning community funds or deploying software updates.

If the users with the largest MATIC holdings also earn the most MATIC and have the most votes, doesn’t that lead to consolidation and centralization of power?

Good question - this is a common issue in proof-of-stake systems, but you also have a similar dynamic in proof-of-work (in which the people who have the most money to buy powerful mining hardware are the ones who make the most money). I guess if you take a step back, the same thing also happens in real life - the people with the most money can keep becoming richer faster than the rest of us because they have access to the best investment opportunities and advice.

But coming back to blockchains, users can actually participate in governance and consensus no matter how big or small their holdings are. The long tail of smallholders usually provides a bulwark against the tiny group of large whales who own a lot of a given asset. The smallholders can also band together to unite their voices. This need not be limited only to super-technical users. In Matic, and many other blockchains, there is usually an easy way for non-technical users to ‘delegate’ their holdings to savvy validators. These validators help stake the users’ funds in return for some commission.

Currently, the staking rewards on Matic are around 12.5% a year, so you can earn 12.5% on your MATIC tokens every year by delegating them to a validator (minus some commission and assuming you don’t get slashed!). This ‘interest rate’ automatically goes up or down depending on how much of the total MATIC in circulation is locked in staking. Currently, that amount is 31% of the total circulating supply. If the amount of MATIC staked increases, the interest rate will go down, helping to keep the total inflation in check.

Sounds pretty cool, but what makes it worth $4bn?

Well, its worth $4bn on a fully diluted basis. The amount of MATIC tokens in circulation are worth only $2bn as it stands - the rest will be released over a long term period as block rewards for validators. What makes this all the more impressive is that the Matic team has only raised a little more than $5m over its lifetime, with the initial token offering taking place at a price of $0.00263 (150x lower than today), which is something out of a VC investor’s dreams.

As for the question on value - its difficult to say how much anything is really worth. This is true for many kinds of assets. Some of them are completely nebulous, like artworks, while others can have some measure of calculable baseline value - like bonds, or to a lesser extent, equities. Things like gold and Bitcoin are much harder to put a figure to, and younger cryptocurrencies like Matic derive their value largely from Bitcoin’s momentum.

At the moment, Matic is the most popular L2 solution for the most popular smart contract platform (Ethereum), so it clearly has some value. It is used more widely than many other currencies which have much higher market caps, but it is still a small fraction of Ethereum’s $200bn market cap or Bitcoin’s $1.1trn market cap. At the current price, Matic is the 54th most valuable project in crypto by market cap, so it definitely has some more headroom to grow versus other less-used and more-hyped tokens (please don’t take this as investment advice).

Speaking of other projects, it is worth pointing out that Matic does have competition. There are a number of other teams working to solve Ethereum’s scalability issues, including Starkware and Loopring, which are both privacy-focused scaling solutions that help users make transactions in a verifiable yet totally clandestine way. As I write this, Loopring has a fully diluted market cap of $800m for its LRC token. Starkware just raised a $75m Series B led by some of the smartest investors in the business. According to many commentators, including the creator of Ethereum, projects like Starkware, Loopring, and Matic have a critical role to play in scaling the Ethereum network, so this is definitely a space to watch out for.

OK mate, you’ve been rambling for a while and we’re now in desperate need of digesting the dense ball of information you’ve just spat out, so care to wrap this up?

I’m extremely grateful to JD and the rest of the Matic team for allowing me to tell their story. And to you, the patient reader, for making it all the way to the end of this post.

In my view, there are a few interesting lessons from this story. The first lesson is to always be curious and to believe in yourself: just follow the intellectual threads tugging at the corners of your mind, it will always hold you in good stead. You will certainly learn things, probably meet similarly motivated people, and possibly even build something life-changing with them! This is especially true in the cryptocurrency industry, which is by definition a global industry with no barriers to entry. Any kid from a small corner of the world can come up with an idea, deploy it to this global computer system, and see it achieve rapid adoption. I hope that Matic’s success inspires many of the young talented engineers we have in India to dream big and dive into this fascinating field of study.

The second takeaway is that it always pays off to contribute to the public commons. Life and entrepreneurship shouldn’t be a zero-sum game in which all growth must come at someone else’s expense. JD and the Matic engineers first made their name by building and launching one of the most popular free developer tools in the Ethereum ecosystem. Lots of pivotal connections and ideas ensued from that first act of building something for the public good. It doesn’t matter if you are crafting content, design assets, or software projects - give back to the community and you will be rewarded!

The last point I would like to make is that while the cryptocurrency industry does have its share of charlatans and unanswered questions, it also attracts some of the most talented minds and produces some of the most groundbreaking ideas of our times. Furthermore, this community is made up of many people who just wish to improve the society we all live in. The best example of this is Sandeep Nailwal, the cofounder of Matic. Dismayed by the suffering he saw around him, Sandeep started the Crypto India Covid Relief Fund in an attempt to help fight back against the pandemic ravaging India. As of the time of writing, Sandeep has raised hundreds of millions of dollars for this cause. Please do educate yourself about this industry and support Sandeep’s noble initiative! And with that appeal, I thank you for reading and hope to see you back on this site soon 🙏

Read this for a cool opportunity: An incredible Indian startup is looking for talent! If you want to join a category-defining company reshaping the Indian fintech ecosystem, please reach out to me on Twitter!

Read this for shameless self-promotion: Since you made it all the way here, why not subscribe? Or read one of our other articles about topics like Clubhouse, diagnostic tech opportunities, or the D2C movement in India?

Brilliant as always. Your depth of research is fantastic.

Fantastic read! Thanks for writing!