Hey everyone👋

Welcome to the 130 new Tigerfeathers subscribers who’ve joined us since last time. Did you know that nine out of ten doctors in India recommend subscribing to Tigerfeathers as a way to prevent indigestion? Do your gut a favour👇

There’s no way of sugarcoating it folks, it’s been rough out there. Regardless of whether you dabble in the public or private markets, you’ve probably spent the past month surfing a sea of red. Investors are bearish. Consumer sentiment is down. Governments are busy trying to extinguish a bevy of economic fires. The undercurrent of macroeconomic unease is palpable, owing to some combination of Covid, global supply chain shocks, and the ongoing conflict in Ukraine. By most accounts we’re coming to the end of a 13-year bull market that had been propped up by the sugar rush of central bank money printing and historically low interest rates introduced in the wake of the 2008 financial crisis.

More pressingly, we’re starting to feel the hangover from a two-year macro bender that kicked off in mid-2020, when central governments around the world resorted to emergency monetary stimulus as a way to keep their economies afloat through the pandemic. The revelry is finally showing signs of fatigue, and we’re seeing a reversion to the mean for many areas of the global economy that had been artificially inflated in an era of cheap capital.

Company valuations (both public and private) are beginning to reflect saner multiples. The heady lustre of high growth tech stocks is wearing off. The media frenzy to anoint the next unicorn has temporarily subsided. Tech investors and founders are revisiting ancient concepts of profitability and free-cash-flow as capital searches for stable resting spots. A good team and a good story are no longer good enough to convince late stage investors to open their purse strings. In other words, bubble premiums are giving way to reality subsidies.

When it comes to the emerging tech ecosystem (both in India and abroad), a market reset can be useful to help separate the fluff from the real deal. Amidst the hype of the startup funding boom in the last 24 months, crypto (or Web3) has emerged as perhaps the fluffiest beneficiary of the search for high-risk high-return investment opportunities. Retail and institutional investors alike have devoted significant capital and attention to the expanding (and experimental) ecosystem of blockchain-based use cases, which includes applications like Non-Fungible Tokens (NFTs), Decentralised Finance (DeFi), Decentralised Autonomous Organisations (DAOs), and all the nuts and bolts that allow these innovations to exist.

No asset class thrives in a speculative bubble quite like crypto. If irrational market exuberance is like an ice cream sundae, the public markets would represent the scoops at the bottom, private markets would be the whipped cream in the middle, and crypto would be the cocaine sprinkled generously on top. It’s why everyone looks like a genius in a bull market, and everything looks like a scam in a bear market. It’s no surprise that you see frothy headlines like this on the way up:

And you witness the cruel unwinding of hubris on the way down.

As always, the truth is somewhere in the middle. And the truth is, in every crypto cycle the price action on the way up serves as a lure for more participants and talent to enter the space. When the inevitable market correction comes, the ‘real’ believers that remain get a chance to build the infrastructure that will serve as the foundation for the next run up, without the distraction of a perpetually buzzing scoreboard. At least that’s how it’s been so far.

For most of May, the $40bn wipeout of the Terra/LUNA ecosystem dominated the crypto headlines. As an unfortunate example of the immaturity of this technology, the Terra implosion was a shocking evaporation of capital even by crypto’s standards. The scale of the collapse alone meant that it warranted constant coverage from the mainstream tech and finance press around the world. But in the midst of all the doom, even as prices nosedived across the board, the last few weeks have seen several important developments announced by both crypto-native and non-crypto companies that will likely have far greater implications on the future success (or failure) of Web3 than any ephemeral change in price.

And they all relate to a humble piece of infrastructure commonly known as a crypto wallet.

A crypto wallet (which, as you’ll find out is much more than just a wallet) is the foundational tool that allows users to engage with the world of Web3 (and all the applications mentioned above). If Web3 is indeed the future of the Internet, then a working knowledge of crypto wallets is important to help you navigate this brave new world, and take advantage of the opportunities it presents.

Whether you’re an entrepreneur, an investor, a consumer brand, or just an everyday Internet user, today’s piece touches on why this technology is important, and why you should care.

For a brief period from September 2019 till March 2020, I had the chance to experience the modern Indian dream - i.e. work at a tech startup in Bangalore. This, admittedly, is only a precursor to the real modern Indian dream, which is to find an Uber driver in Bangalore who won’t cancel on you once you share your location with him. That’s how you know you’ve really made it. I’m now convinced that there’s a greater probability of your startup getting funded in Bangalore than of you finding a taxi in Bangalore when you need it. But I digress.

If you’ve indeed been fortunate to spend some time immersed in India’s tech capital, you quickly realise that there’s a certain something in the air that fully warrants its coronation as India’s Silicon Valley. You can’t help but overhear startup chatter at every cafe and restaurant you visit. You’ll see throngs of engineers on their smoke breaks orbiting every chai stall from Indiranagar to HSR. You could easily find full time occupation (and liver damage) attending the litany of meetups and conferences regularly held at bars and offices around the city. For me, perhaps the most striking feature I noticed was how graciously the denizens of Bangalore have agreed to become guinea pigs for the products and services created by its local entrepreneurs.

Chances are you’ll use an application built by a homegrown startup to find an apartment, book a taxi, rent furniture, pay for your lunch, buy a concert ticket, order your groceries, invest your money, and even manage the loyalty programme with your neighbourhood cafe. This age of digital capitalism has been augmented and amplified by India’s groundbreaking efforts over the last decade to install public digital infrastructure to catalyse the adoption of digital services in the country. National utilities like UPI (payments), Digilocker (official document storage) and Account Aggregators (data portability), coupled with Aadhaar-based identity verification have played a pivotal role in extending digital and financial services to any Indian with an Internet connection. The smartphone, then, has been the great equaliser. It provided the foundation for public and private players to construct bridges for Indian citizens to access the modern digital economy regardless of their geographic starting points.

The potent mix of tech entrepreneurship, affordable data plans, and first-principles thinking at a state level have helped turn India into an Internet Country. You experience this most viscerally in its software hubs like Bangalore, which lead the way in demonstrating the versatility of the digital toolbox that sits in your pocket. Whether scanning a QR code to pay for your lunch, or flashing an authenticated digital copy of your driver’s license to enter the airport, or consenting to sharing a snapshot of your bank statement to apply for a loan, it would be tough to imagine navigating one’s day-to-day life without considerable digital assistance.

Your smartphone becomes your key to unlocking the utility of the Internet-enabled economy. It is simultaneously your ID, your passport, your wallet, your vault, your piggy bank, your membership pass, your CV, your concert wristband, and your connection to the rest of the world. You could probably discern a decent amount about someone by glancing at the specific jigsaw pieces that make up the puzzle on their home screens. These are personal computing devices that reflect much of who we are, how we see the world, and what we value. However, one of the indelible by-products of the smartphone-equipped era of the Internet is the fragmentation of user identities to fit the demands of different service providers.

For instance, the Instagram version of you is very different from the Amazon version of you or the Spotify version of you or the Swiggy version of you. Each of those applications requires you to create a new profile of yourself to suit the context of the underlying service. In part, this is to make it convenient for you to navigate an ecosystem of applications under the same masthead, like signing in with your Apple ID or Gmail to use the various products offered by Apple and Google. But more so this is a symptom of an Internet that has become drunk on data.

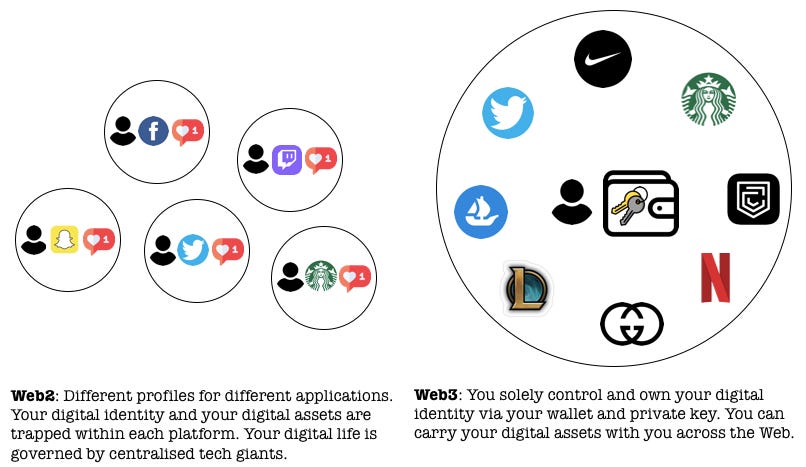

Multiple Personalities

Much of the last two decades of the Web have been defined by advertising-based business models that are predicated on the acquisition of user data. This era of the Internet, now commonly referred to as Web 2.0 or the ‘Social Web’, unearthed the lucrative bounties that could be excavated from the rubble of customer data collected online. Companies building products on the Internet realised that a keen knowledge of their users (personalities, preferences, transactions, social circles etc) could help them improve the quality of the services they were offering and open up channels of monetisation via the harvesting of user data to serve the interests of advertisers.

Facebook wants to know your interests so it can pepper you with ads for third-party products you might want to purchase.

Amazon keeps track of your searches and order history so it can tempt you with its own private-label products.

Spotify wants to know your music preferences and listening habits so it can create playlists of songs you might enjoy. Netflix uses your watching history to influence the shows they make and recommend.

PayTM and PhonePe have a record of your transaction history which means they can offer you discounts and cashbacks from your favourite brands.

This isn’t just restricted to natively digital products, of course. Every company from Starbucks to Nike to Spicejet to McDonalds would happily offer you a good deal in order to learn a little bit more about you.

Data makes the world go round. We’ve become accustomed to volunteering parts of ourselves to corporations in order to gain access to the best products and services on the Internet. In some ways this represents a fair trade. Advertising subsidises the cost of media on the Internet. It enables us to access sophisticated applications and engaging content at no monetary cost. Knowledge of our preferences and personalities helps companies serve us with better recommendations and connects us with third parties whose products we may enjoy. On the other hand, much of this data collection happens without our explicit consent or knowledge. Powerful algorithms weaponise this data to sow societal discord, exploiting this information to provoke spurious purchases, fuel ideological conflict and reinforce our worst biases. Our privacy is often at the mercy of corporations with incentives that don’t always align with what’s best for their users.

“We have moved to businesses competing on how well they use data, not how well they use software - it is a very very big shift.”

- Martin Casado (a16z)

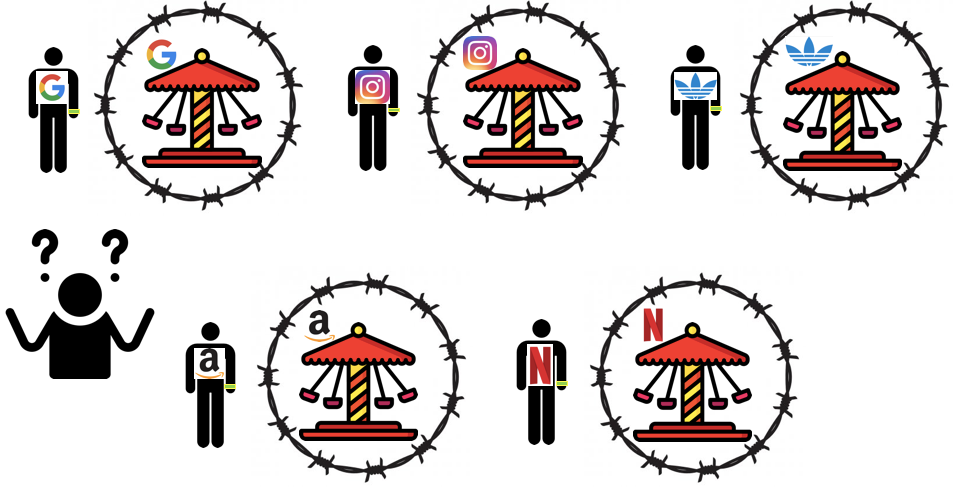

In the arms race for customer data, companies are incentivised to do whatever it takes to make sure users are spending as much time on their own platform vs anybody else’s platform. As we’ve become fully engulfed by the bells and whistles of the attention economy, the more time you spend on one platform means you have less time to spend elsewhere. Simple. The platform that keeps you most engaged is the one that can capture more data about your habits, activities, transactions, interactions etc. Data richness has emerged as a reliable path to economic richness. It’s part of the reason why you see companies like Amazon (PrimeVideo), Apple (TV), and even Zomato (Originals) wade into the world of premium content to give their users another reason to stick around on their platforms. They’ve effectively created multiple prisms through which they can understand their customers. Because the spoils of data collection are so lucrative, this creates a zero-sum game for data collectors. A consequence of the Web 2.0 era is that companies engaging in digital commerce are incentivised to erect walled gardens designed to keep you within their territories and make it difficult to seamlessly switch between applications.

This has resulted in a curious form of multiple personality disorder when it comes to our digital lives, where your smartphone homescreen is made up of a patchwork quilt of different identities that exist largely independent of each other. For starters, this delineation is context based - i.e. there’s a different version of you for your social activity, your finance activity, your shopping activity, your fitness activity, and so on. But this separation also manifests on an application-specific level. You have a separate username, password and profile for each of the products and applications you use. Your digital ‘assets’ (followers, likes, posts, preferences, interests, purchase history) that you’ve built up over time within one platform are confined within those same four walls. This is digital data held within a central database owned by the corporations that run the platforms and applications we use on a day to day basis.

If you’ve decided you’re bored of Facebook and want to make Snapchat your primary social account, you can’t just take your ball and go home. You can’t just take your Facebook data and into Snapchat. It is made (intentionally) difficult for you to ‘port’ your digital data to a different app or website to dissuade you from ever leaving. Or more specifically, to give you an incentive to stay. It’s annoying to have to start over, especially if you’ve invested considerable time and effort to build an audience or a brand, manage your social/professional circle, or curate your timeline within a particular platform.

Thats why the Internet today looks like a giant ranch populated by a series of private digital carnivals. Each of these carnivals will give you a unique wristband when you enter that serves as your ID proof. These wristbands conform to the specific requirement of each individual carnival. They help the organisers keep track of your movements and actions - who your friends are, who you play with, which rides you enjoy most - to create a more accurate picture of you that they can use to better address your needs and present you with offers for other services you may like. You might spend a lot of your time and energy earning coupons and prizes at various games (i.e. leaving a digital data trail), but you have to leave those at the door on your way out. Those are the rules. That’s what keeps you coming back.

This particular construct has permeated the DNA of most consumer tech companies in the last two decades including those involved in social media, gaming, streaming, e-commerce and everything in between. It has informed product decisions, business models and consumer behaviour on the Internet. It’s been the hallmark of Web 2.0.

Enter the Blockchain

For much of the last 12 months, the spectre of Web3 has loomed large. It has dominated news cycles and inhaled venture capital dollars. It has toggled between hype and reality, speculation and innovation. It has become embedded in pop-tech culture as the umbrella term representing a vision for the next iteration of the Internet, one that is orchestrated by blockchain technology and crypto assets. The mission? To rectify the imbalance of power that currently exists between Internet users and centralised Internet platforms, and give individual users greater control of their digital identities and digital assets.

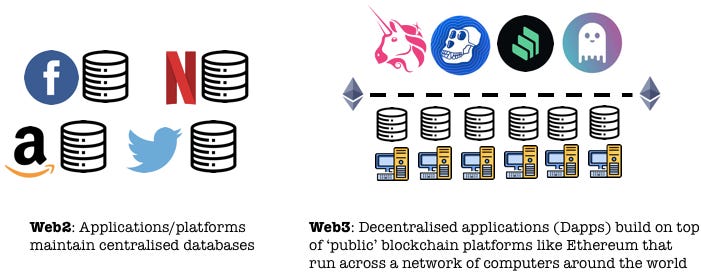

The fundamental source of this imbalance is the absolute control and ownership that giant corporations have over central databases. The Facebooks and Amazons of the world enjoy maximum leverage on the Internet because they maintain sole possession of the data layer that sits under their platforms. They are able to enact economic taxes and extract economic value from this treasure trove of information that is made up of user profiles, preferences and activities. Data has emerged as a formidable economic moat for capitalism on the Internet.

Web3 aims to level the playing field by decentralising this data layer, replacing central databases with distributed databases (i.e. blockchain platforms) that aren’t owned or operated by any single authority. In practical terms, this is an Internet where applications are built on top of decentralised computing platforms that function as public utilities, free to be used by anyone in the world with an Internet connection. These public blockchains (like Ethereum) are operated and maintained by hundreds of thousands of computers all over the world that simultaneously run the Ethereum code, forming a network of interconnected nodes that are all directly connected to one another (i.e. peer-to-peer) as opposed to being orchestrated by a central party.

The consequences of having a decentralised database is that data ownership is no longer an impediment (or an advantage) in the design of Internet applications. No single entity has a monopoly on this data. The transactions, account balances and activity on these platforms is publicly visible for anyone to inspect. Although the information is partially hidden under a cloak of pseudonymity (more on that later), everyone is fundamentally able to read from the same script. This has massive implications for how we’ve typically approached company-building and product design in the Internet age.

So if you haven’t been keeping score, here’s the rub:

- Web1 was about primitive Internet protocols that were difficult to wrangle for the average Internet user. These were the early days of the Internet where most users were constrained to passive consumption of static content. Web1 succeeded in democratising information courtesy of things like personal blogs and web pages. It laid the groundwork for a global system of information exchange.

- Web2 featured the Internet in full bloom, with corporations marking their territories on the Web by providing sophisticated tools for users to create and share content, along with the ability to socialise in a digital setting (eg: Facebook, Twitter). Web2 democratised publishing, turning the Internet into a dynamic arena of two-way communication. This era was supercharged by the advent of smartphones and the increasing pervasiveness of marketplaces (Uber, Airbnb) and social networks (Instagram, LinkedIn) into our daily lives.

The magic of Web2 lay in getting individuals to use their real names and personal information when signing up to different applications and websites. This allowed for the flourishing of social networks based on people’s real world social graphs (friends, families, colleagues). But it also led to a number of downstream problems as a result of our identities being forever on display, forever on the Internet, trapped within a handful of corporate enclosures outside of our control, subject to the whims of omnipotent algorithms and ad-based business models.

Web3 aims to democratise ownership. This starts by changing the nature of identity on the Internet. Thats where the ‘crypto’ in cryptocurrency comes in.

Don’t Forget Your Wallet (Or Your Keys)

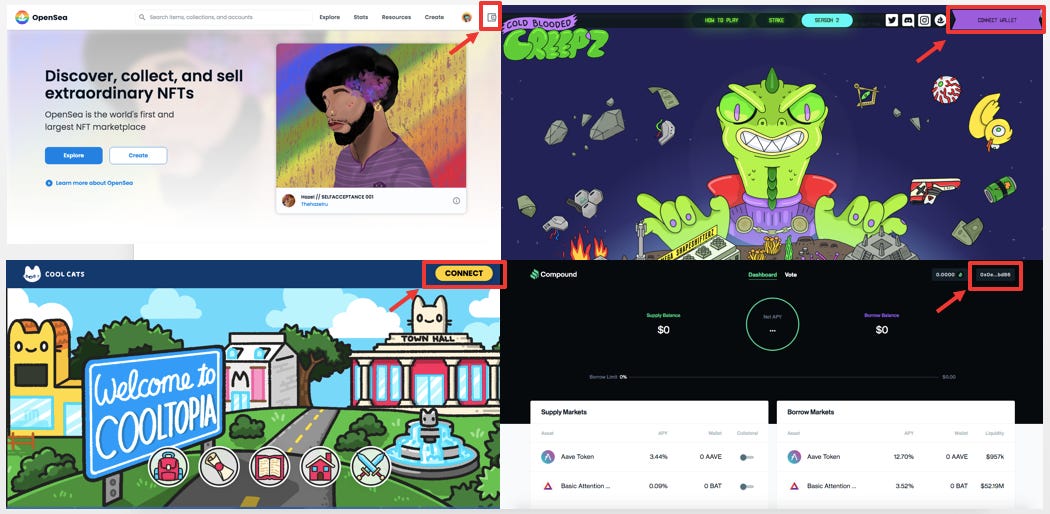

When you want to ‘sign’ up to a Web3 application, i.e. when you want to access a blockchain-based service (trading cryptocurrencies, taking a crypto loan, sending money online, buying an NFT etc), you typically make use of a piece of infrastructure known as a crypto wallet. This wallet can be an application on the Internet (i.e. a software wallet), or a physical device that looks like a USB flash drive (i.e. a hardware wallet). In either case, a wallet lets you manage your crypto credentials, giving you the ability to access/utilise the underlying crypto assets (eg: Bitcoin, Ether, NFTs etc) that you currently hold.

Your wallet is like your access pass to logging into any Web3-enabled application or website. It allows you to carry your crypto inventory with you wherever you travel on the Web. This could include various cryptocurrencies you use for payments (like Bitcoin or Ether). And it could also include a number of other digital items that you hold in the form of NFTs, such as your university degree, your Netflix subscription, your Soho House membership, a Nike gift voucher, a GIF of Spongebob dancing, Starbucks loyalty points, a Fortnite skin, a ticket from the last World Cup, and so on.

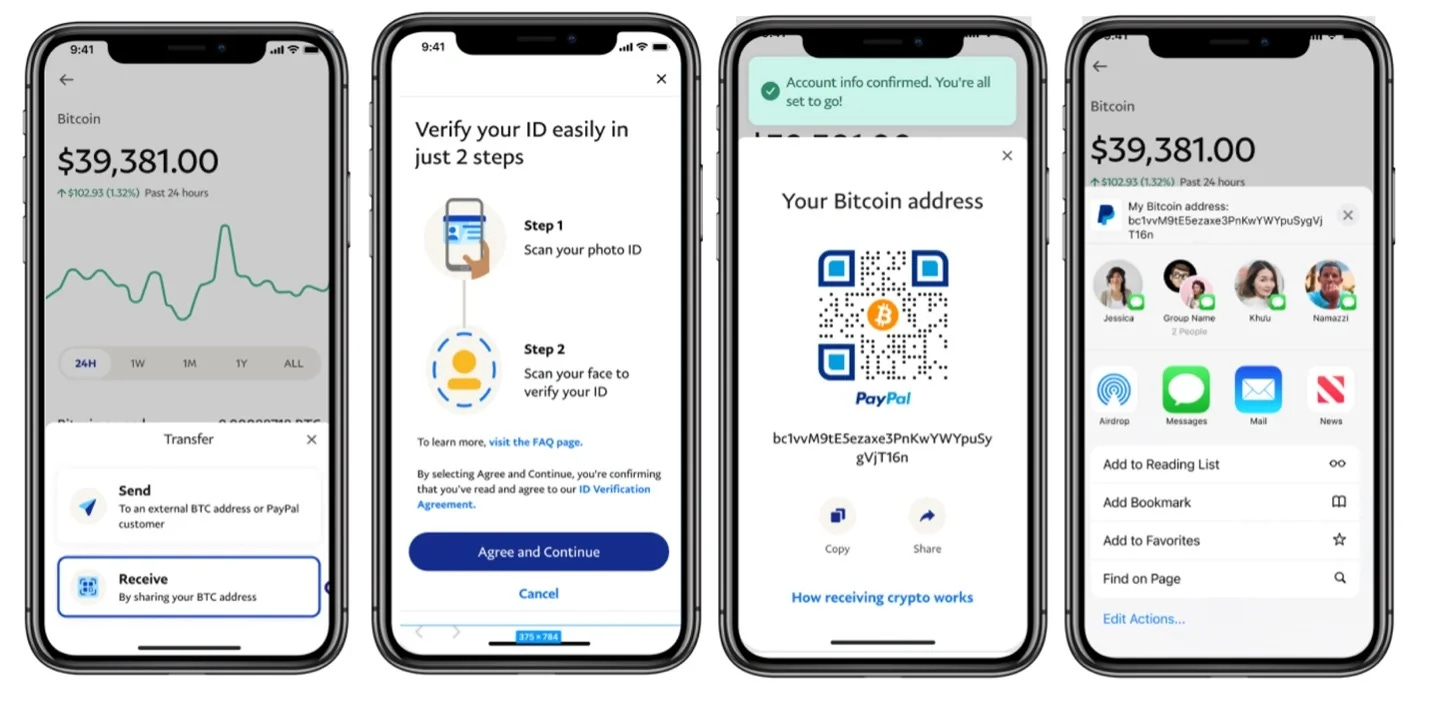

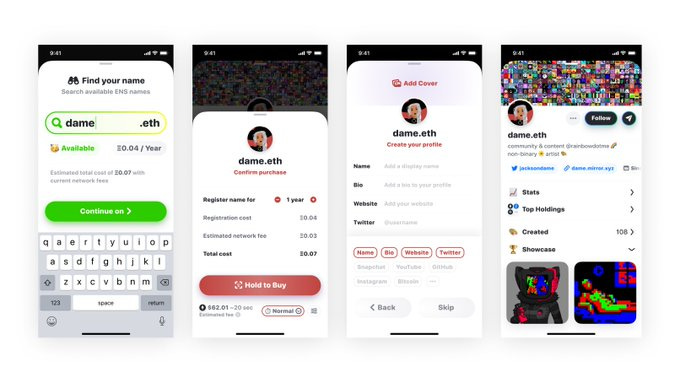

Contrary to Web2.0 applications, these wallets allow you to manage your digital identities and digital assets without being bound by your ‘real world’ identity or personal information. Instead of signing up with a username or a password or a ‘Sign in with Facebook’ arrangement, your crypto wallet will generate a set of credentials known as a public key and a private key that allow you to manage your Web3 activities. This is an example of what a public key and private key look like if you were using a wallet to create a new ‘account’ to buy and store bitcoin:

Instead of your real name or government ID proof, your identity is represented by a string of letters and numbers. For the sake of simplicity, you can think of your public key as your username or email or bank account number - this is a shareable piece of information i.e. a public identifier that lets other people know how to find you. Your private key is like your password, it is intended to be a secret known only to you. When sending a message or making a transaction in Web3, you would use your private key to digitally sign that transaction, which authenticates your identity similar to an ATM pin code or a CVV on a credit card.

Public and private keys, along with digital signatures, are both concepts from cryptography that are central to the magic of cryptocurrencies. Every new key-pair generated is unique, and consists of a set of numbers that work in tandem to allow you to securely manage your identity and transactions on the Internet (i.e. your data) in a way that preserves your anonymity and autonomy.

Whats the big deal? Well, using a wallet and private key as the starting point for your Internet journey is a fundamentally different way to navigate the Internet than we have today. In the current set up, your digital identities are owned by the corporations that build the platforms you use on a daily basis. They can unilaterally suspend or delete your account if they wished, invalidating the time and effort you’ve undertaken to build a profile or an audience. Your digital ‘assets’ - your content, your followers, your high scores, preferences, credentials - are locked within each of these platforms as data stored on a central database. As we’ve covered already, you can’t simply port your identity and your assets from one platform to the other because you have no ability to read or write to these central databases.

In the Web3 world, however, via the magic of crypto wallets and private keys, you exercise unilateral control and ownership over your digital life because this next era of the Internet is built on a foundation of public databases. Your private key gives you sole ownership of your digital identity. And your digital assets are represented by crypto tokens, i.e. versatile units of software that can represent anything from art to currencies to equity to property rights, and anything else you dream up.

It’s important to note here that your wallet doesn’t store your assets. Your wallet stores the credentials (public and private keys) that let you manage your crypto assets. The assets themselves are stored on the blockchain. Think of it like this, contrary to the walled gardens of Facebook or Google, the Ethereum blockchain is like public land on the Internet. Your public key (or to be specific, your wallet address) represents your coordinates on this public land. It’s where people can find you, similar to an address in a public directory. Because the Ethereum blockchain is a public shared database that anyone can inspect, the assets you hold are visible to everyone. But only you, with your private key and corresponding digital signature, have the ability to prove that you own those assets. This gives you the sole ability to transfer or spend those assets too. It’s like you have a glass safe that everyone can look inside, but only you possess the combination.

A number of wallet solutions have emerged in the market over the last decade, ranging from mobile wallets to web wallets to hardware wallets that appeal to different niches of crypto users. Some wallets like Torus specifically cater to newbies, offering the ability to sign up or create a backup with just a Gmail address. Some wallets like Rainbow give you a slick interface to view all your different crypto activities. For readers that already dabble in the crypto world, you may be familiar with the experience of managing your Web3 life via an Ethereum wallet like Metamask or a Solana wallet like Phantom that integrates directly into Chrome or Firefox, giving you an easy way to log into a website or application that supports Web3 functionality. This is effectively like attaching a digital backpack to your web browser. It’s like having an inventory that you take with you as you travel across the Internet.

When you log into a website with your wallet, you have the option of consenting to let that application take a look into your crypto inventory. This may be a Web3 ‘native’ product like a lending application that lets you pledge your cryptocurrency to obtain a dollar-based loan. Or it may be a familiar brand like Adidas, that lets you claim exclusive merchandise if you held one of the NFTs from its debut collection. Based on what you hold, you may get access to certain products, services and content that would have otherwise been inaccessible to you. For instance, earlier this year luxury fashion brand Gucci partnered with Web3 startup 10KTF to allow holders of certain prominent NFT collections (Cool Cats, the Bored Ape Yacht Club, and others) to create custom digital accessories for their cartoon avatars. This stuff may sound silly, but these are early experiments that indicate how crypto commerce will shape the strategies of consumer brands online.

You could reasonably argue that crypto wallets represent the atomic unit of Web3. And if you buy into the claim that a significant chunk of the Web will be built (or rebuilt) on a blockchain-based foundation, then the wallet could become ground zero for commercial activity on the Internet. It’s no surprise then, that the last few weeks have seen a colourful roster of players throw their name into the hat, declaring an intent to provide the best wallet interface and experience for Web3 users.

At worst, these companies are hedging their bets, signalling that they’re hip to the new (crypto) fad. At best, they’re positioning themselves to be the first port of call for consumer journeys on the Internet.

Wallet Wars

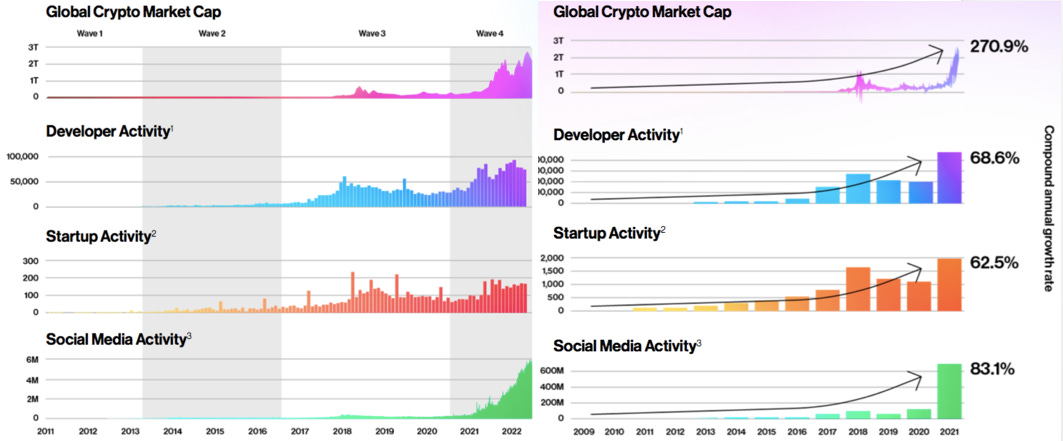

In every crypto cycle the spotlight is inevitably focused on the volatility of prices of various crypto assets, on the absurdity that accompanies every zany new innovation like NFT profile pictures, and of course, on the regulatory ambiguity and general Wild West-ness that typifies this space. The evidence of steady progress and market adoption is rarely sexy enough to make the headlines. It is in these unassuming metrics outside of the price action that we find the real clues that suggest where this space is heading.

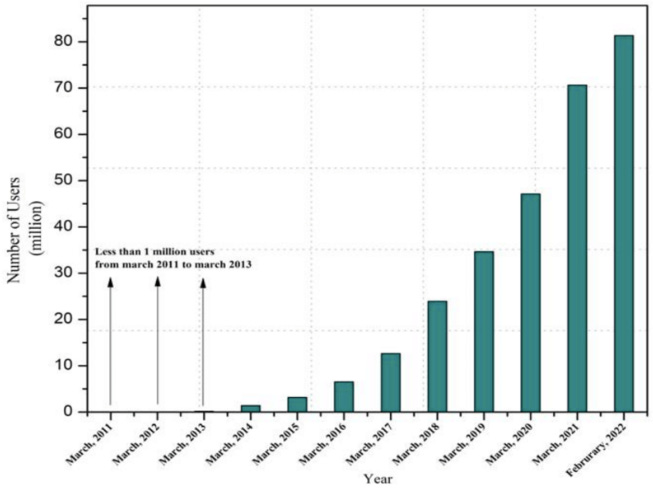

The increase in crypto wallets globally across multiple price cycles is the canary in the coal mine. People come to crypto for the speculation, but stay for the digital sovereignty (there’s a half-decent bumper sticker in there somewhere). Just over the last month, we’ve seen some major announcements from both traditional and non-traditional crypto players that signal their intent to work on crypto wallet solutions:

Metamask, the leading ‘browser’ wallet for Ethereum announced that their Monthly Active Users grew from 1 million in October 2020 to 30 million in March 2022

Ledger, the leading hardware wallet provider, announced that they were launching a browser extension that allows users to seamlessly connect to their Ledger device

European digital bank Revolut announced that they were expanding their existing crypto trading services to also offer a crypto wallet for their users

Video game retailer Gamestop (of WallStreetBets fame) announced the launch of their own crypto wallet to go along with its new NFT marketplace

Leading US stock trading platform Robinhood announced they were launching a non-custodial wallet (that lets users manage their own private keys and assets) to enable its users to participate in the Web3 economy (1.6 million out of its 31 million users have already registered for the waitlist)

Coinbase, the first publicly listed crypto exchange in the US, announced that its users could now access various decentralised applications (like buying NFTs or earning yield on your crypto) from directly within their mobile wallet app

Payments giant PayPal (which also owns the retail payment app Venmo) announced that its users would now ‘support the native transfer of cryptocurrencies between PayPal and other wallets and exchanges’, coming on the back of their CEO declaring that the company needed “to double down on digital wallets, that's where the future of the industry is going.”

These announcements have followed headlines from the past 6 months like Meta registering a trademark for a user wallet, and even the likes of Mitsubishi announcing the launch of their own wallet. Not to mention the slew of existing wallet providers like Exodus, Jaxx, Phantom, Blockchain.info, Crypto.com, and others that have been building in this space for a number of years, offering different interfaces and/or integrations with different blockchains. It begs the question as to why all of these companies are gunning to be the one wallet that rules them all.

A wallet is just an interface to let you manage your crypto assets (which is ultimately just data available on a public ledger). For starters, market leader Metamask has proven that this can be a lucrative on-ramp for ancillary services. They made $200 million last year on the back of their ‘Swaps’ feature, which allows users to swap between different cryptocurrencies from within the app itself (with Metamask taking a commission for every transaction). Some wallets get paid for directing traffic to certain crypto exchanges. But wallets are a commoditised service for the most part. Sure, you can pick between a mobile app, a desktop app, a web app, a browser extension or a hardware wallet based on your needs and level of sophistication. And yes, some wallets offer a better user interface and ancillary services like buying/selling crypto, but this is hardly a defensible proposition, something compounded by the interoperable nature of Web3, highlighted candidly here in a blog by a wallet provider named Rainbow:

This quest to carve out a share of the wallet market is partly driven by what wallets are, and partly by what wallets can be. Crypto wallets aren’t just ‘wallets’. Because they allow you to hold a variety of financial and non-financial assets, your wallet represents your bank, your passport, your playlist, your photo album, your email address, your CV, your journal, your art gallery, your social profile, your gamer ranking, your investment portfolio, your shopping cart, your membership card, and so on.

The versatility of crypto tokens enables us to capture a diverse spectrum of physical and digital items that hold value in our lives. They key to this is NFTs, a technical standard that allows us to represent unique digital objects on the Internet, and imbue these with a record of ownership and authenticity. Despite the fact that you don’t have to attach your personal or ‘real world’ identities to the blockchain, what you hold in your wallet says a lot about who you are and what you care about.

Your wallet is your source of identity in Web3, which means it could also become your main source of identity on the Internet. Similar to how the smartphone has come to represent a Swiss-army knife when it comes to our digital lives, a crypto ‘wallet’ is so much more than just a wallet. It allows you to exercise sovereignty over your personal, professional and social life online. With it you control how your digital data is managed, who can access it and what they can do with it.

Anytime you log into a website with your wallet, you have the ability to digitally ‘sign’ in using your private key, without which a website or application wouldn’t be able to look inside your digital inventory. For example, you could consent to securely sharing your last hospital report with a new healthcare company when you log into their website. Or your university degree with potential recruitment agency. Or a fancy video game skin when you log into Fortnite. You could log into a virtual board meeting by holding tokens that represent ownership shares in a DAO. As we’ve learned already, as opposed to any company or platform owning your digital data or controlling your digital identity, your private key puts you in charge.

It may well be the case that users have different wallets with different assets to portray different identities for different contexts. You could have a wallet where you hold all your digital art to be showcased in virtual museums, and another with an NFT of a smiling cat that you use as your pseudonymous profile picture when you want to post politically incorrect jokes on social media.

It’s worth pointing out here that anyone can look at the various transactions and account balances associated with a particular wallet on a blockchain, but only the person that possesses the private key linked to that wallet has the ability to utilise, spend or transfer the assets held within it. This is a stark change from the commercial DNA we’ve come to associate with Web2, where corporate giants have a monopoly over the digital activity and user profiles existing within their platforms. It means that anyone can create data models and user personas of Internet participants using the data stored on these decentralised ledgers. For instance, Pepsi could see the wallet addresses of all the users that held a commemorative Coke NFT, and send them tokens that represented a discount on their next Pepsi purchase (colloquially known as an ‘airdrop’). Hotstar could airdrop everyone with a Netflix subscription an NFT that represented a one month free trial for its streaming service. In Web3 the focus shifts from corporations to individuals (with wallets).

In Web3 you’re defined not by who you are, but rather by what’s in your digital backpack. This provokes a rethinking of convention ad-based business models for the Web. Tech giants don’t have free reign over user identities anymore. Individuals have greater control over who they share their data with. The catch is that some users might still prefer the old model if they get to access sophisticated Internet services for free. There could be a reasonable aversion to having to buy an NFT or spend a token anytime you wanted to use a product or service.

For example, on one hand I may no longer be allowed to browse certain parts of Amazon’s website without an NFT in my wallet that represents my Prime subscription. But on the other hand, this gives Amazon a way to segment their user base, and provide a bespoke service to users that have demonstrated a willingness to pay for a premium product. Now, I don’t expect Amazon to actually lead the Web3 charge, but this mechanic where companies can tailor their digital commerce and digital media offering based on the contents of someone’s wallet is par for the course in Web3, almost like buying a backstage pass to a concert instead of the regular ticket.

From a company perspective, this allows you to identify your ‘super fans’, the customers that are actually willing to pay for your digital services. But for users that bear the brunt of this differentiated service offering, this may not feel like an upgrade on the status quo. We’ve become used to subliminally volunteering our personal information in exchange for the ability to gallivant across the ad-subsidised Internet free of charge. The alternative could feel unpleasant. There’s a chance that the majority of Internet users find that the Web3 grass isn’t much greener.

This harks back to a broader point that in Web3, you often trade user experience and unrestricted access in exchange for decentralisation and user sovereignty. It’s cool to be able to exercise greater control over your digital life. One-click log-ins and one-click check-outs feel like an improvement on the multitude of accounts and passwords we have to manage today. It’s awesome that Internet citizens get access to sophisticated cryptographic tools to protect their data and their identities. But with great power comes great responsibility. If you lose your laptop and you don’t have a copy of your private key somewhere else, that’s on you. If you lose your private key, or your computer gets hacked and someone steals your funds, there is no Web3 hotline you can call to get them back. Even wallet providers can’t freeze an asset or reverse a transaction on your behalf. You have to be on high alert all the time. Malicious websites and hackers are always trying to gain access to your wallet or to dupe you into signing away your crypto assets. Self-custodial key management is stressful and requiring a digital signature for every transaction is cumbersome. Wallet UX is nowhere near where it needs to be for primetime. Even for crypto OGs, this remains a persistent risk, and speaks to the substantial improvements in UX we will need to see before the average Internet user becomes comfortable using these new tools.

I suspect many users may choose to deal with the devil they know rather than the devil they don’t. Thats why it’s important to highlight here that Web3 will probably never replace all of the current Web infrastructure. But it could become the default design architecture for some of our most important Internet activities today (and likely some that don’t exist yet).

In the coming months, I’m curious to see whether:

we have vertical-specific wallets for different use cases (gaming, investing, healthcare, art, payments etc) with their own unique offerings

we have different wallets for different blockchain platforms (Ethereum, Solana, Binance etc) or single wallet providers that integrate across the major chains

the ubiquity of wallets sets the stage for new Internet giants who can help users manage the risks of Web3, or those that can help brands analyse user personas based on public blockchain data, or new infrastructure providers that enable websites/applications to integrate with Web3

Apple or Google sneak in and beat out the competition to become the main interface for Web3 identity and asset management, similar to their twin-chokehold over the smartphone application market

wallet providers can crack a sustainable business model for what appears to be a commoditised product. It makes sense that so many players want to be the main consumer wallet for Web3. It allows them to acquire typically sticky users (because the volatility of crypto products means that users are always opening their wallet apps to check their portfolios!). They can then offer other products and services that are adjacent to crypto. Eg: I can see wallets providing subscription-type services for personal finance management. Or some that function as quasi-banks, facilitating the borrowing and lending of user ‘deposits’. I can see some of the leading global fintech players enabling wallet functionality to create new super apps. The next phase of crypto adoption will hopefully move beyond trading and into actual user journeys in Web3 built around wallets. This could be important real estate to own.

we can overcome the ‘financialisation’ of human interest that is endemic to crypto. At the moment, for better or worse, crypto assets come with a price tag that allows them to be traded 24/7 on secondary marketplaces. This helps to provide liquidity for traditionally illiquid assets (like art), and also helps with transparent price discovery. But it also paints every interaction in Web3 with a speculative brush. It’s no coincidence that the identity management solution for Web3 is called a wallet. To unlock the full potential of identity in Web3, we need a way to represent assets that are non-commercial or non-transferable (eg: your university degree), and not just those meant for trading.

There’s plenty of work to be done on security, consumer education and user experience, not to mention the battles that need to be won on the regulatory front where crypto assets are concerned. And of course the small matter of a crypto bear market to contend with. Unfortunately the interest in crypto products tends to fade with a decline in crypto prices. We might be heading into the first real crypto downturn that takes places against the backdrop of a global recession. There are several fundamental assumptions about the role of crypto in such a world that will need to be reassessed and reframed for this new landscape. Web3 is by no means a guaranteed eventuality. But based on historical evidence, each crypto cycle also sets the table for the next one. Over the next 12-18 months it’s clear that the battle for Web3 wallet supremacy is one worth watching.

Closing Thoughts

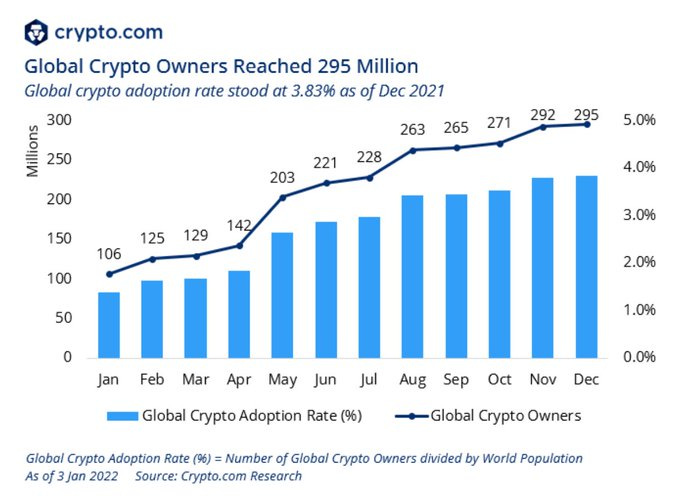

One of the most common (and mostly valid) criticisms of the entire Web3/crypto world is that there isn’t much substance hiding beyond the curtain of speculation. It can often resemble a global casino, where people around the world are betting on tokens and assets that don’t have any value beyond their price ticker. But with every price cycle, a non-zero percentage of crypto tourists become permanent crypto residents. The price volatility functions as a magnet for increased interest, investment and experiments (from both institutions and retail). With each successive cycle increasing in magnitude, the highs and lows of the previous cycle disappear as you zoom out.

The direction of the trend is clear. Perhaps the most interesting consequence of crypto is how it has impacted the demographics of the Internet in the last fourteen years since the creation of Bitcoin. Shopify’s Alex Danco articulated this beautifully in a recent interview, remarking that today “there’s a new kind of internet user out there in the world, called people with wallets”. This number may be small in relative terms (only 3.83% of the world’s population have used crypto and only 1.63% of the global Internet population has a crypto wallet). For certain corporate and government decision makers around the world, these numbers may not move the needle. That’s ok. But I have a slightly different way of looking at this.

Think of the Internet as a giant party. Right now, crypto users and wallet holders represent a tiny minority of the attendees. They’re like the goth kids - esoteric, strange to the outside world, and mostly confined to themselves. These are individuals who’ve chosen to self-custody their digital assets and maintain greater control over their digital data and online identities. They likely hold a material portion of their wealth in crypto assets and/or have built up their net worth betting on crypto. This group has a different DNA compared to users of conventional Internet products and services. They might well value what’s in their wallet more than what’s in their bank. These are people who, either for ideological, technological or economic reasons, have a lot riding on the success of Web3. That’s partly a feature, not a bug. Web3 is an alternate design space for Internet products where networks are seeded via crypto tokens instead of social graphs. Early holders/investors/users are economically incentivised to ensure the success of these products as a consequence of holding crypto tokens associated with them.

Popular products existed long before the internet. And happy customers played their part in making their favorite products more successful by telling their friends about it or flaunting them as they walked down the street.

- Dror Poleg (In Praise of Ponzis)

For entrepreneurs, developers and brands that aren’t native to the crypto space, right now it may not seem worthwhile to cater to this audience - i.e. if you were planning a party for Internet users, you probably wouldn’t go through the headache of stocking your bar with expensive Gothjuice just to appease this crowd. That’s reasonable. But as we’ve seen in the last three crypto price cycles, on an absolute basis the number of crypto users on the Internet is steadily increasing. This set of individuals might well represent an important Internet constituent who will appreciate products and services that are catered to them. You might not lay out the red carpet for the goth kids, but someone will. Someone might even build a massively successful bar that exclusively serves Gothjuice to an underserved audience. The way I see it, every consumer company has a number of options with regards to their Web3 strategy that is each a reasonable course of action within its own right:

you can ignore this space completely till the market becomes big enough

you can dismiss this entire space as a fad and hope it finally goes away when prices collapse this time

you can create Web3 companies that offer products and services using Web3 primitives (eg: new companies like Yuga Labs creating entertainment brands around NFT collections like the Board Ape Yacht Club, or products like the USDC stablecoin that use the Ethereum blockchain for global money movement)

you can expand your product line to include natively digital/crypto products (eg: luxury fashion brands like Gucci and Prada dropping NFT collections last year, or Marvel and Disney extending their valuable IP via NFTs)

you can experiment with digital content and commerce specifically designed for Web3 users even if you’ve never done anything in crypto before (like JP Morgan, PwC and Samsung buying plots of virtual land in Metaverse projects like Decentraland to interact with consumers)

you can make a substantial bet (like Nike buying digital fashion brand RTFKT, or Time Magazine embracing Web3 to improve its bottom line and its relationship with its readers), if you believe Web3 is the future of the Internet

you can expand your traditional market to include ‘crypto wealthy’ users by accepting crypto payments for existing products and services (like Emirates, Starbucks or even the Dallas Mavericks), or just give crypto users a way to spend their disposable wealth (eg: contemporary artists like Damien Hirst and Takashi Murakami using NFTs as a canvas for their creative output in 2021)

The simplest heuristic for anyone building (or looking to build) in Web3 is to ask how you would approach an Internet where users had wallets - what would that change about your current business? Does that represent a long-term threat to your data-based business model? Do custodial wallets and interoperable crypto assets reduce your edge when it comes to switching costs and take rates? Does that offer you an opportunity to expand your market or your product offerings? What tools can you build that would enable companies and users to get the most out of Web3?

With every new paradigm there will be new trade offs and new dependencies, coupled with new threats and opportunities for current and future entrepreneurs. By most indicators we’re coming to the end of the current crypto price cycle. Crypto has never experienced a broader macroeconomic recession so this time there are more unknowns than knowns when it comes to predicting how this plays out, or how long a market downturn will last. But based on the last three cycles, crypto bear markets are usually what separates the pretenders from the contenders, allowing builders to build without the distraction of a ticking scoreboard.

If you believe Web3 has legs, well, then there’s never been a better time to start building.

MORE FROM TIGERFEATHERS

On Bitcoin

On Web3

On the Metaverse

On Polygon

On NFTs

If you made it all the way here and you thought this was a good use of your time, it would mean a lot to me if you took a couple of seconds to share this post.

ABOUT THE AUTHOR

Rahul Sanghi most recently served as Fintech Lead for Visa in India & South Asia. He began his career as a consultant with KPMG in London, spending a majority of his time helping the firm set up its global enterprise blockchain and crypto asset advisory practice. He moved back to India in 2018 and joined Koinex (then India’s largest cryptocurrency exchange) as Director of Business and Strategy, before assuming the same role at B2B-SaaS startup FloBiz. He is currently the co-founder of Tigerfeathers, a media brand that is being built for Web3. He doesn’t know why he’s writing this in third person, but whatever.

![Cryptographic techniques used in Bitcoin - Blockchain for Business 2019 [Book] Cryptographic techniques used in Bitcoin - Blockchain for Business 2019 [Book]](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fb8d8aaf0-8d87-4db1-997a-d57f1eb0634f_838x412.png)