Winter Has Passed: What To Watch In Crypto, Part 1

As told by 8 of India's leading web3 founders and builders

Greetings, friends, and a good day to you all 👋

The coins are at it again, so we’re back with a two-parter featuring contributions from the best and brightest across India’s crypto ecosystem. Batten down the hatches, because it looks cloudy with a chance of learning today.

But first, a warm welcome to the 802 new subscribers who’ve joined the Tigerfeathers tribe since our last article. You’ve just unlocked an invite to Rahul’s wedding (happening sometime in the next year btw!). So congrats to you all, Rahul included 🍾

Before we dive in to today’s piece, a little interlude.

As our regular readers will know, over the past year we’ve begun to work with different sponsors as presenting partners for several of our pieces. We’re grateful that some of our favourite companies and funds have deemed our logo worthy of standing next to theirs. As we continue to build Tigerfeathers into something of a time capsule for 21st century India, we hope to partner with other companies that want to etch their names into this electric chapter of Indian history.

We do this for a couple of reasons: for one, it helps us generate revenue - we’ve been told this is a good thing (and a way to make Tigerfeathers a sustainable long term endeavour). Secondly, it lets us spotlight cool and interesting companies (both in India and abroad) without committing ourselves to a million-page dedicated feature. We hope you can appreciate this. If you’re interested in exploring a future Tigerfeathers sponsorship, get in touch with us on Twitter, or by replying to this email.

So, that brings us to today’s shout out, which is…Rocket Health.

Now while this isn’t a paid feature, I should disclose that I am an investor in this company. But what exactly is Rocket Health and why am I writing about them in an article about crypto?

In a nutshell, Rocket Health is a platform that caters to the mental health needs of our generation. It was started by the brother and sister duo of Abhineet Kumar and Dr. Ritika Sinha, who have made it their mission to cancel stigma and help people seeking therapy. I’m writing about them here because I believe there is a clear link between their mission and the psychology of investing.

I’ve faced anxiety and depression through the years, and therapy has helped me tremendously in my life. Having said that, I still struggle occasionally, and investing can sometimes be a catalyst for my mental struggles. I’ve spent many sleepless nights beating myself up for making poor calls, undersizing positions when I make great calls, and generally feeling like I’m fumbling the bag in some way or another (narrator voice: he was not fumbling the bag, this is just a classic and common case of anxiety).

This is not a unique situation. Many people can probably relate to this - and not just crypto investors too. Everyone has to deal with feelings of regret or self-doubt in life, but it doesn’t need to be a millstone that weighs you down. And you don’t need to suffer it in solitary silence.

Speaking with a trained therapist can help you understand your feelings and a build a toolkit for dealing with negative thoughts and emotions, whatever they may be caused by. It can teach you to be kinder to yourself and focus your energies on what actually matters to you. In short, it can help you become a happier and more empathic person.

Rocket Health makes it easy for someone to take their first steps towards therapy. Through a secure questionnaire on their website, they help people unpack the issues they are struggling with. Based on this initial assessment, they recommend a shortlist of trained practitioners who can help the user. The user is then able to schedule a private virtual appointment with the practitioner of their choice, making the act of seeking therapy both convenient and discrete.

Rocket Health works with over 70 professionally trained and certified therapists, and they’ve conducted over 75,000 sessions in the past couple of years. They are able to offer services ranging from psychotherapy and psychiatry all the way through to couple’s counseling, de-addiction, and sex therapy. If, like me and many millions of others, you have found yourself occasionally unable to operate at your full capacity due to mental and emotional blockers, check out Rocket Health! It’s easy to get started and you never know what might happen - the right therapist can be life-changing for you or a loved one.

Right, let’s get to today’s piece.

Ladies and gentlemen, the crypto winter of 2022 and 2023 has finally thawed. The bear market has been vanquished and all manner of animal spirits have once again been unleashed upon the world’s most unhinged financial market. And this time, the grown ups don’t seem to be calling the police on the party.

Along with folks like Mr. Kotak - India’s most illustrious banker - regulators and financial institutions are also ready to discuss Bitcoin’s place in the global financial order. The narrative that Bitcoin can be ‘digital gold’ for the 21st century has been parroted on national TV in the United States by the likes of Larry Fink, CEO of BlackRock, the world’s largest asset manager.

Fink has also gone on to say that the Ethereum blockchain can serve as the bedrock of the financial system of tomorrow. And it’s not just talk - Fink and Blackrock went and launched a full fledged investment fund on Ethereum just a few weeks ago. The world has taken notice - just last week, a prominent VC touted Ethereum as one of the “greatest ideas hiding in plain sight” at the prestigious Sohn investor conference.

What I’m trying to say here is that the window of acceptability is shifting. A lot of moonshot crypto ideas are gaining traction even with serious financial kingmakers. Governments are begrudgingly enacting policies that allow more and more people to buy the big orange coin. The genie is coming farther out of the bottle, and the crypto prices are shifting to reflect this optimism.

This means that coverage is coming. Lots of media coverage. In all likelihood, your newsfeeds may soon come to be haunted by lots of low-quality crypto articles. Hooray.

But just because crypto was out of the global news cycle for a little while doesn’t mean that the industry was lying in stasis. On the contrary, there has been incredible progress made over the past two years as serious teams and dedicated builders buckled down to get shit done away from the distracting glare of the seasonal hype circus. And what’s more - a LOT of the moving and shaking in global crypto is now being driven by Indian founders. So whether you’re a casual crypto observer or a devoted degen, you’re probably going to want a primer on what’s going on - and we’ve got you covered.

In this edition of Tigerfeathers, we seek to bring you up to speed on some of this progress. To help with this, we asked 16 of the most talented Indian web3 builders and founders to grace us with their responses to one simple question: “what are you watching in crypto right now?”.

The reason we selected builders for this task is because they typically look at things from a long-term perspective. They assess possibilities and commit themselves to an idea they believe in. In other words, they have skin in the game. And not just the financial kind - we’re talking about significant mental, emotional, and professional investment.

And that means something to us, because the objective here is learning. We are not interested in collecting tips or recommendations for tokens or coins to punt on. Instead, we want to expand our knowledge, upgrade our mental models, and build new synaptic connections in our brains. Speaking with committed subject matter experts who are building a vision of the future is a sure-shot way to do that. If as a result of this learning, you feel the sapling of an investing idea in your mind, then that’s fine, but just be aware that our goal is solely education, and none of what you are about to read is financial advice.

Yeah yeah, we get it. Just spill the alph- er, I mean education.

Sigh…

Alright, but first let’s talk about what to expect.

We asked the 16 builders to answer the question: “what are you watching in crypto right now”. We didn’t give them a word limit, structure, or focus area. The only restriction we gave them was to not talk about their own company.

But in order to give you context about who they are and spotlight the work they do, we have written a blurb about each of the contributors. Alongside that, we have pasted the responses they sent back to us.

Be warned that some of these responses are quite technical or abstract, but we have tried our best to provide explainers where appropriate (the italics and pictures/captions are from us, the rest is from contributors). In the first segment of this piece, we will bring you 8 ideas from our contributors, and then in the following week we will release the second set.

If you’re new to crypto, consider spending far too much some time exploring our older primers on how Bitcoin works, the Metaverse, and Web3.

With all that said, let’s dive in!

1. Krishna Hegde, BrownRice Capital: Real world asset tokenization

Krishna is building BrownRice Capital, a crypto wealth platform designed to help Indian institutions and ultra high net-worth individuals (UHNIs) gain access to this burgeoning asset class.

Although many wealthy Indians are curious to explore crypto as an asset class, there are major stumbling blocks - transparency, trust, and education. The legal status of crypto in India has always been a murky topic. So too has the tax status, reporting standard, and banking pathway. When you factor in the additional complexity of choosing coins and managing custody risks, it is easy to see why investor interest has seldom evolved into investor implementation.

But BrownRice Capital is aiming to change that. They want to give UHNIs the service, support, and comfort that they need in order to actually take the plunge and begin accumulating those coins. They help you understand the risks, design a portfolio, deploy your rupees, hold your coins, and do your taxes. And they do this while maintaining industry leading compliance standards.

If I sound excited, it’s because I am. I have personally spoken with several leading industrialists and seen firsthand their desire to invest in this asset class. The one thing that has held them back is the experience. They want white-glove service from seasoned finance professionals who are taking risk, compliance, and reporting very seriously. I believe BrownRice and Krishna are doing just that.

BrownRice Capital recently completed a fundraise from Castle Island Ventures, Hash3, Future Perfect Ventures, Force Ventures, Coinbase Ventures, Coinswitch, Balaji Srinivasan, and Kunal Shah.

India's financial markets are making big strides in efficiency. The National Stock Exchange is already the global leader in derivatives trading, and it's even settling trades within a day, with plans for even faster settlement in the future.

Imagine a big leap forward for financial markets, similar to how mobile phones changed communication. That's the promise of Real World Asset (RWA) tokenization. This means converting ownership of real things, like stocks, bonds, or even real estate, into digital tokens on a special system called a blockchain.

Just like securitization (where big loans were transformed into easier-to-manage packages), a good legal framework can help turn assets into tokens. India's experience with digital payments shows how digital tools can boost growth, and RWA tokenization could have an even bigger impact.

Here's how RWA tokenization can benefit the Indian market:

Easier Investing & More Choices: Investments that are usually difficult to buy and sell in small amounts, like real estate or private company shares, can be broken down into smaller tokens. This makes them more accessible to a wider range of people, who can now invest their savings in a broader variety of assets.

Faster & Cheaper Transactions: Smart contracts, which are like automated agreements on the blockchain, can streamline and automate transactions involving tokenized assets. This reduces complexity, lowers costs, and makes the whole investment process more transparent.

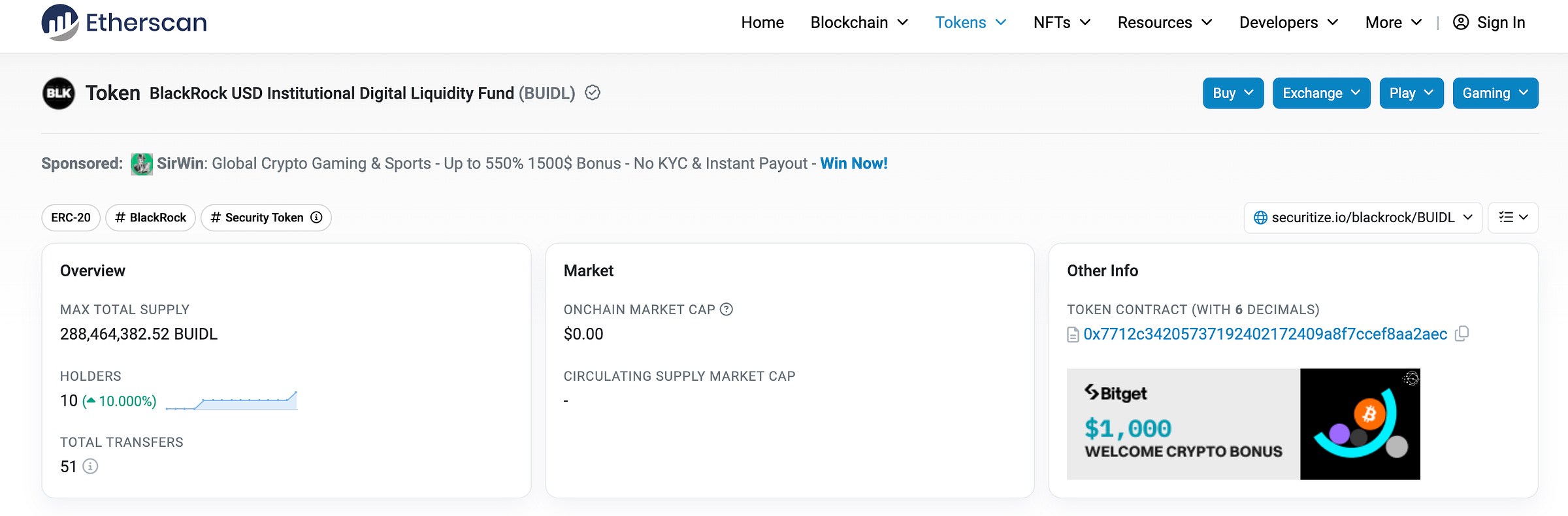

The world is already moving quickly in this direction. BlackRock announced its first tokenised fund on Ethereum in late March 2024 - BlackRock US dollar Institutional Digital Liquidity fund, dubbed BUIDL. BUIDL will invest in US Treasury bills, cash, and repurchase agreements and offers a stable value of $1 per token. Yields will be paid out daily to investors. In under 10 days, it has drawn $275 million of assets. BlackRock’s CEO Larry Fink has said that the future of finance is the full digitisation of assets like stocks and bonds. Hamilton Lane & Franklin Templeton are other US firms that have introduced tokenized funds. With RWA tokenization, tech-savvy Indians can easily invest their savings in the parts of the economy they want to support.

2. Prithvir Jhaveri, Loch: Stablecoins

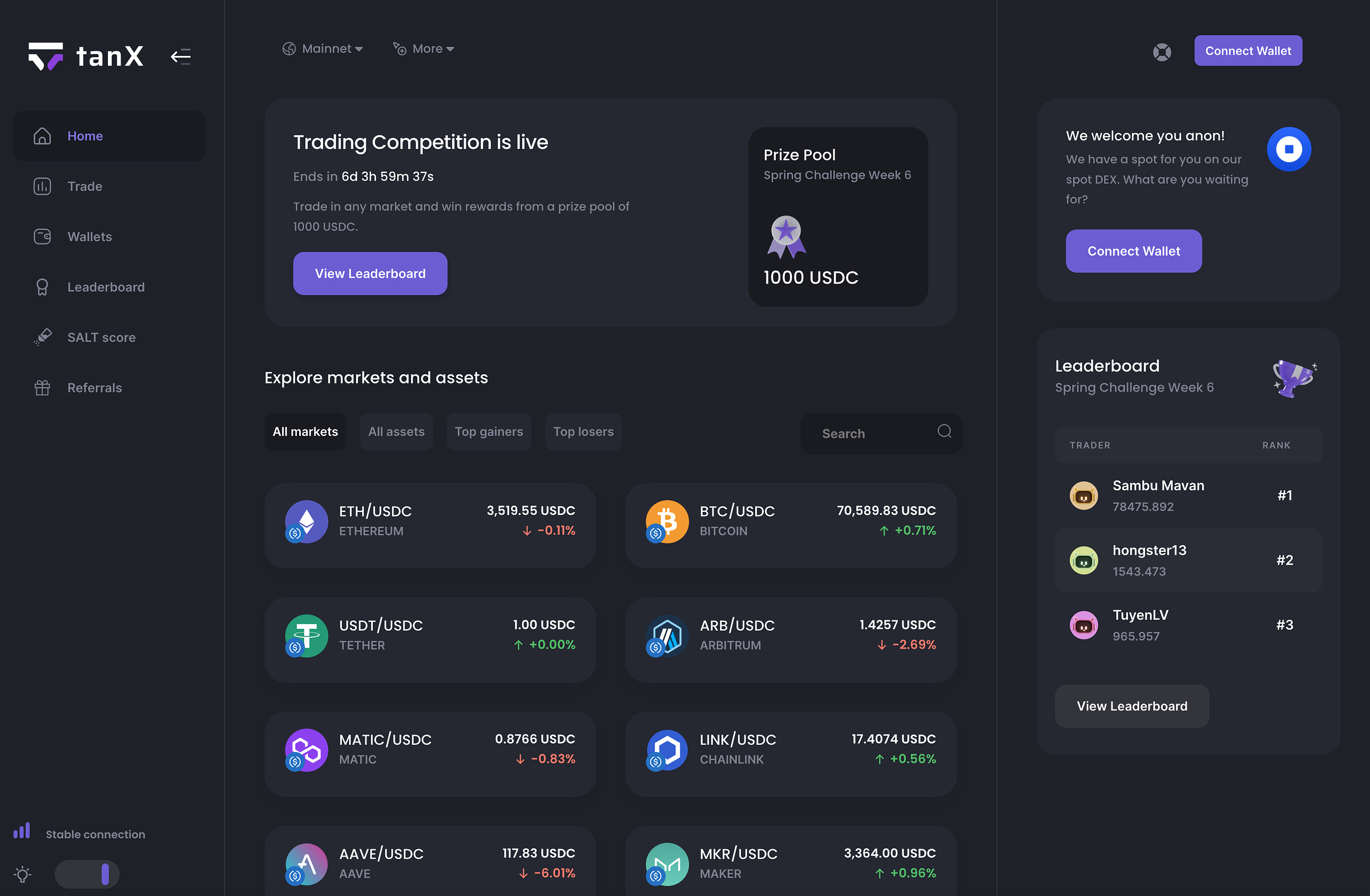

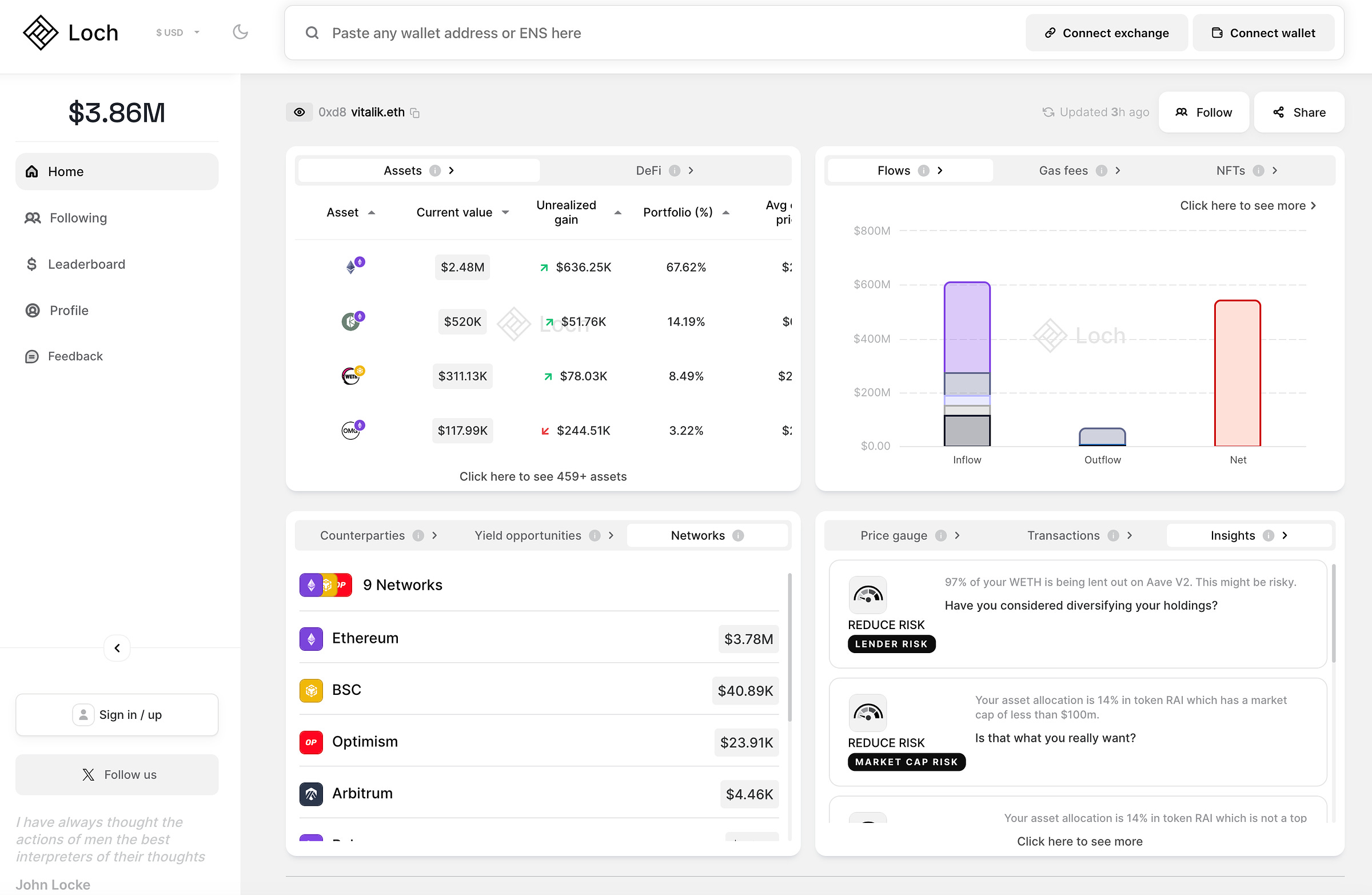

PJ is building loch.one, an AI-powered blockchain reader, aggregator, and search engine. In the cluttered and confusing world of blockchain accounts, Loch helps investors cut through the noise.

What is the value of my portfolio across multiple public chains? What does my PnL look like? What are my current DeFi positions and where can I get the most yield on my idle assets? Loch helps investors get all these insights.

What’s more, Loch’s powerful tool can also be used to follow, analyze, and copy-trade anyone on the blockchain in seconds. If you want to start earning like the smart money earns, it’s probably a good idea to start doing as the smart money does. Loch is your first step to achieving that.

Stablecoin volumes and MAUs have grown despite the bear market. In six years, the annual volume settled with stablecoins has eclipsed PayPal ($100b) and global remittances ($1t). Soon, it will surpass VISA ($10t), ACH ($15t), and Fedwire ($100t). Stablecoins offer a step-function improvement in the cost and speed of money movement. Product-market fit is evident.

However, this is not the most interesting thing about stablecoins. Stablecoin issuers now hold over $108.8b in US treasuries, collectively ranking them as the 20th largest holder, just behind Germany. On the current trajectory, stablecoins are on track to: (1) become one of the top 10 largest holders of US debt within 10 years, and (2) be deemed 'systemically important' to global financial systems.

Perfunctory arguments may conclude that the US government could try to block stablecoin issuers from buying US treasuries. We believe they won't. Stablecoins help absorb debt and export the dollar to the world. Remember, there’s $30t in outstanding debt and there will be over $1t spent on servicing interest payments yearly. Stablecoin issuers need Uncle Sam, and vice versa. The relationship is symbiotic.

Tether is the largest issuer of stablecoins. The foundation generated more profit than Goldman Sachs and BlackRock, exceeding $5 billion last year. While the underlying business is insanely capital efficient (greater than $100m in revenue per employee), the financial products offered are not. To guarantee depositors, each stablecoin is backed and collateralized 1 to 1 using cash and cash equivalents. This approach is undoubtedly safer than an under-collateralized approach. But unfortunately, it suffers from two problems: inefficient use of capital and a lack of censorship resistance.

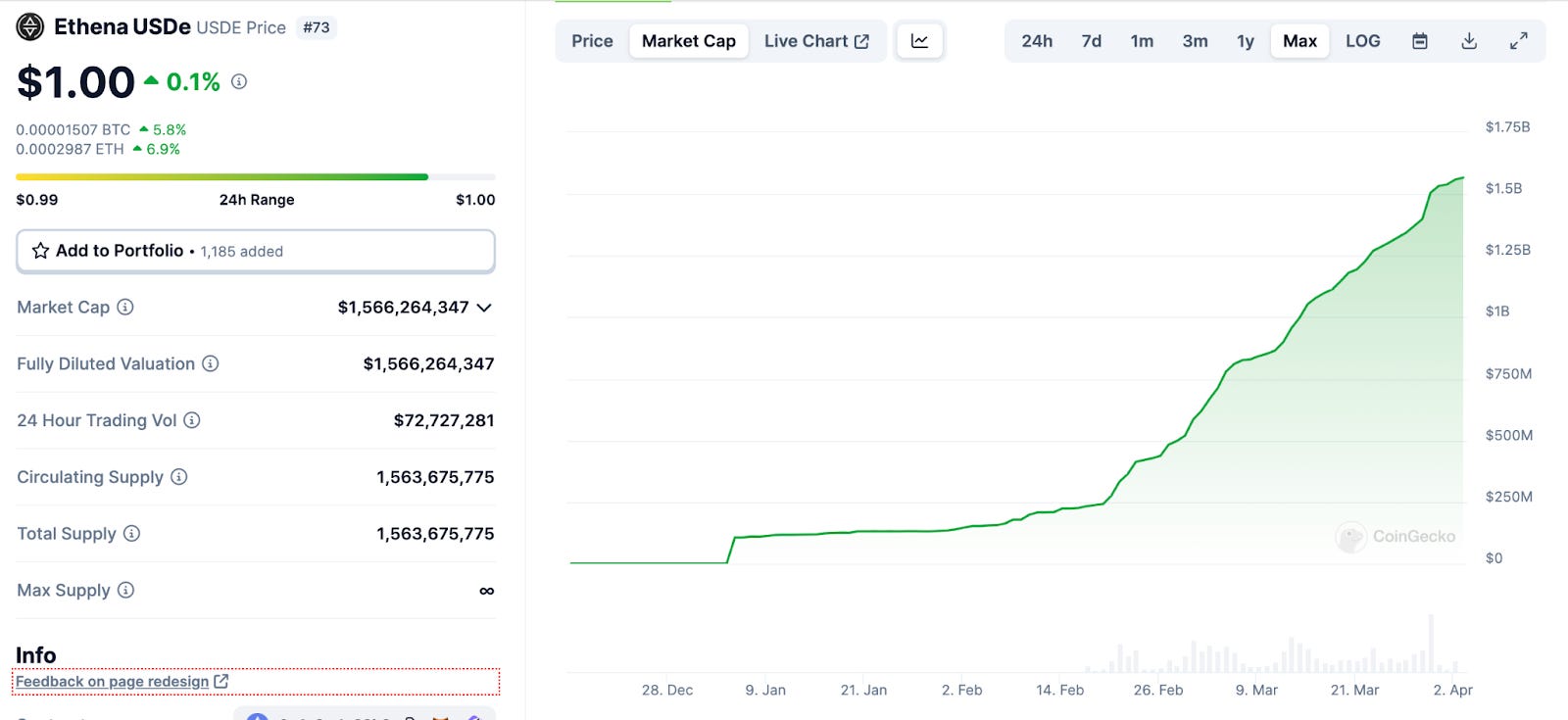

This brings me to an exciting new product - Ethena. Ethena is attempting to build a synthetic dollar-pegged instrument without USD as collateral. USDe is collateralized with crypto assets and maintains its peg using corresponding short future positions. It’s 100% permissionless and censorship-resistant. Now, of course this is much riskier than USDC and USDT. We all remember what happened with Luna, Basis Cash, and various others who have tried this before. But it’s a fascinating experiment nonetheless. The project is backed by some of the biggest names in crypto like Arthur Hayes, Dragonfly, and Binance Labs.

It has already gained $1.5b in market cap 3 months post-launch. We expect it to become a top 3 stablecoin in the next few months.

3. Joel John, Decentralised.co: Web3 social networks

Joel is building Decentralised, one of the finest Web3 publications on the Internet. Every week, they put up topical, funny, and insightful pieces about the blockchain industry. Exhibit A - this incredibly GOATed deep dive on the Solana ecosystem from January 2024.

It’s also worth pointing out that Decentralised isn’t merely another online publication - they also operate like a pseudo venture fund with stakes in dozens of Web3 projects and companies. However, unlike typical VC funds, they don’t have any external investors. All the investments they make are funded through their own revenues, proprietary capital, or in lieu of advisory services.

In other words, they don’t just commentate from the sidelines - they actually put their money where their mouth is. That’s one of the reasons why their counsel and involvement is sought by Web3 startups from around the world.

The figures back it up - Decentralised.co has more than 22,000 subscribers, including the founders and executives of the world’s top venture funds and Web3 companies. There’s value for money, and then there’s a Decentralised.co subscription. Seriously, get on it.

Blockchains produce an incredible amount of data. Historically, on Ethereum and Bitcoin, these were pseudonymous wallets sending money. You knew how much money was going around, but very little on who was behind it or what happened to the capital after it was transferred. In 2020, Nansen and Arkham Intelligence gradually began making visual overlays that helped track the flow of money. Algorithms would help categorise the nature of a wallet doing a particular transaction. Labels like “Smart money” or “Large Dex Trader” would be the earliest representations of pseudonymous identities that were sourced from a wallet’s transactional history.

In 2024, there are emergent social graphs with a wallet linked to them. So if you use Farcaster or Lens Protocol - you tend to get rich data-sets about a wallet’s on-chain interactions and social graph. This data, is now open and free for anyone to parse through and draw insights from. The Web2 equivalent of this would be downloading your friend’s list - and getting a record of every bank transaction your friends have done. In open-protocols, you can do this for every wallet that is active on the protocol. Think of getting a CSV export of all transactions done by all users of Facebook.

It is dystopian and there are implications of privacy, but there is a new explosion of rich on-chain data sets linked to social graphs on Web3 native protocols. Very few tools exist to transfer value (as offers, early access NFTs, or just tokens) to these users. Products that are able to translate the data coming from these on-chain graphs and their transactional history to actionable insights will soon find themselves in a very sweet spot. For scale, Nansen helped visualise DeFi transactions and saw itself go from $10 million to $750 million valuation in a single cycle. The products that do the same for Web3 social networks, are not here yet. If data is the new oil, we have found new fields. The mechanisms of rigging machines that can work on this data, are currently unknown but worthy of exploration.

Disclosure: Joel is an investor in Nansen and several Web3 social networks.

4. Aniket Jindal, Biconomy: Telegram bots

Aniket is building Biconomy, a platform devoted to making web3 more accessible and user-friendly for all.

As much as folks in the industry like to rave about cryptos’ benefits, it is actually a very complicated technology for newcomers to pick up. Blockchains can be unforgiving, unpredictable, and largely prohibitive for casual or non-technical users.

Most people don’t want to have to deal with concepts like key management, gas-provisioning, and data signing. Biconomy helps developers take care of these issues on behalf of their end users. Whether you want to enable biometric login, social sign-in or account retrieval, gasless payment experiences, smart transaction scheduling, or session-key based signing, Biconomy has you covered.

Their suite of tools is available via SDK and can be deployed across all EVM chains. Biconomy has helped set up millions of smart accounts, and their technology powers the vast majority of transactions taking place on the Avalanche C-Chain and Polygon PoS chain today.

Biconomy is funded by Mechanism Capital, Binance Ventures, Eden Block, Coinbase Ventures, True Ventures, NFX, Bain Capital Ventures, CoinFund, DACM, Fenbushi Capital, Woodstock Capital, Outlier Ventures, Morningstar Ventures, and others.

An emerging trend in the crypto trading landscape that has garnered significant attention from both seasoned crypto enthusiasts and newcomers alike is the advent of Telegram bots. These innovative bots streamline the user experience by facilitating automated DEX trading directly through the Telegram platform, particularly catering to mobile users. Offering an array of features such as sniper buying, copy trading, DEX limit orders, privacy enhancements, and measures against Miner Extractable Value (MEV) extraction, Telegram bots present a novel approach to interacting with smart contracts.

The appeal of Telegram bots extends beyond mere convenience; they represent a fresh paradigm in engaging with smart contracts, emphasizing the bypassing of traditional on-chain interactions while prioritizing mobile accessibility. While still in their nascent stages, the realm of trading bots continues to evolve, with considerable room for innovation. Notably, trading terminals, which are immensely popular among CEX users, are poised to complement Telegram bots, providing a seamless trading experience across both desktop and mobile platforms. Already, Unibot's trading terminal, Unibot X, has gone live, with BananaGun set to launch a similar offering soon. This convergence suggests the potential for Telegram bots to evolve into comprehensive professional trading front-ends, complete with embedded social layers.

The collective trading volume facilitated by the top five trading bots on EVM chains has surpassed the remarkable milestone of US$18 billion, resulting in fees exceeding US$200 million, denominated predominantly in Ethereum (75k ETH).

However, despite this significant growth, the total value locked (TVL) and trading volumes of these bots remains constrained due to prevalent security risks and a lack of trust in key management. Consequently, users are currently only depositing limited amounts of capital. To mitigate these concerns, smart accounts present a promising solution, potentially attracting a broader demographic of crypto-native traders and enabling larger trading volumes.

We believe smart accounts can address the risk of these platforms and can bring in a larger set of crypto native users to trade in larger volumes. We are also working with teams like Perpie, side bot and many others that are enabling more DeFi products (starting with perps) to be accessed via Telegram bots. We believe it is very likely that trading volumes originated by bots and other intent-centric applications can grow 100x from current levels in 2024.

(Editor’s note: Smart accounts are new kinds of accounts enabled on Ethereum and EVM-based chains that come with a huge amount of flexibility. They can be programmed to offer various kinds of security features, guard rails, and UX improvements. This makes them a great candidate for building safer Telegram bots.)

5. Rohan Agarwal, Cypherock: Eigenlayer

Rohan is building Cypherock X1, the world’s highest-rated hardware wallet (according to CoinBureau).

Making money in crypto is one thing, but keeping those funds safe is another beast altogether. Every day, thousands of investors and crypto users fall prey to scams and exploits that drain their funds. Lots more people simply lose access to their funds because they misplace or damage their devices.

Cypherock’s X1 hardware wallet helps crypto users avoid this painful fate. Just like Ledger or Trezor, Cypherock gives you a hardware device to pair with your computer for safe signing and storage of crypto assets. However, unlike those companies, Cypherock goes to great lengths to create decentralized failsafes and backup plans.

They do this by breaking up the user’s private key across 4 sleek, metallic cards. Along with the X1 hardware device, these cards constitute 5 equal components of the user’s private keys. Transactions can only be made if someone possesses 2 or more of these components.

In this way, Cypherock helps users build access controls and failsafes against unintended consequences. Did you lose your Ledger without noting down your seedphrase? Too bad, all your assets are gone :( With Cypherock, you can misplace your device and two of your cards and the system will still work. What’s more, there is no need to enter a pin to finalize transactions on Cypherock’s hardware wallet. Just tap one of the cards onto the reader device instead 👍🏽 Who said crypto security can’t be fun 🙂

Cypherock is funded by Consensys Mesh, Gnosis, Sandeep Nailwal, and other investors.

Restaking as a concept was introduced by EigenLayer. Restaking in the simplest form offers a way to leverage staked assets in proof-of-stake blockchains like Ethereum for additional rewards by enabling them to be staked again to provide security to Ethereum-based middleware and infrastructure services like side chains, bridges etc. generally categorized as actively validated services (AVS). It's great for AVS since they can access Ethereum’s validators to provide security to their consensus which they will probably never be able to replicate on their own. It's also great for Ethereum validators since they can earn additional yield on their staked Ethereum.

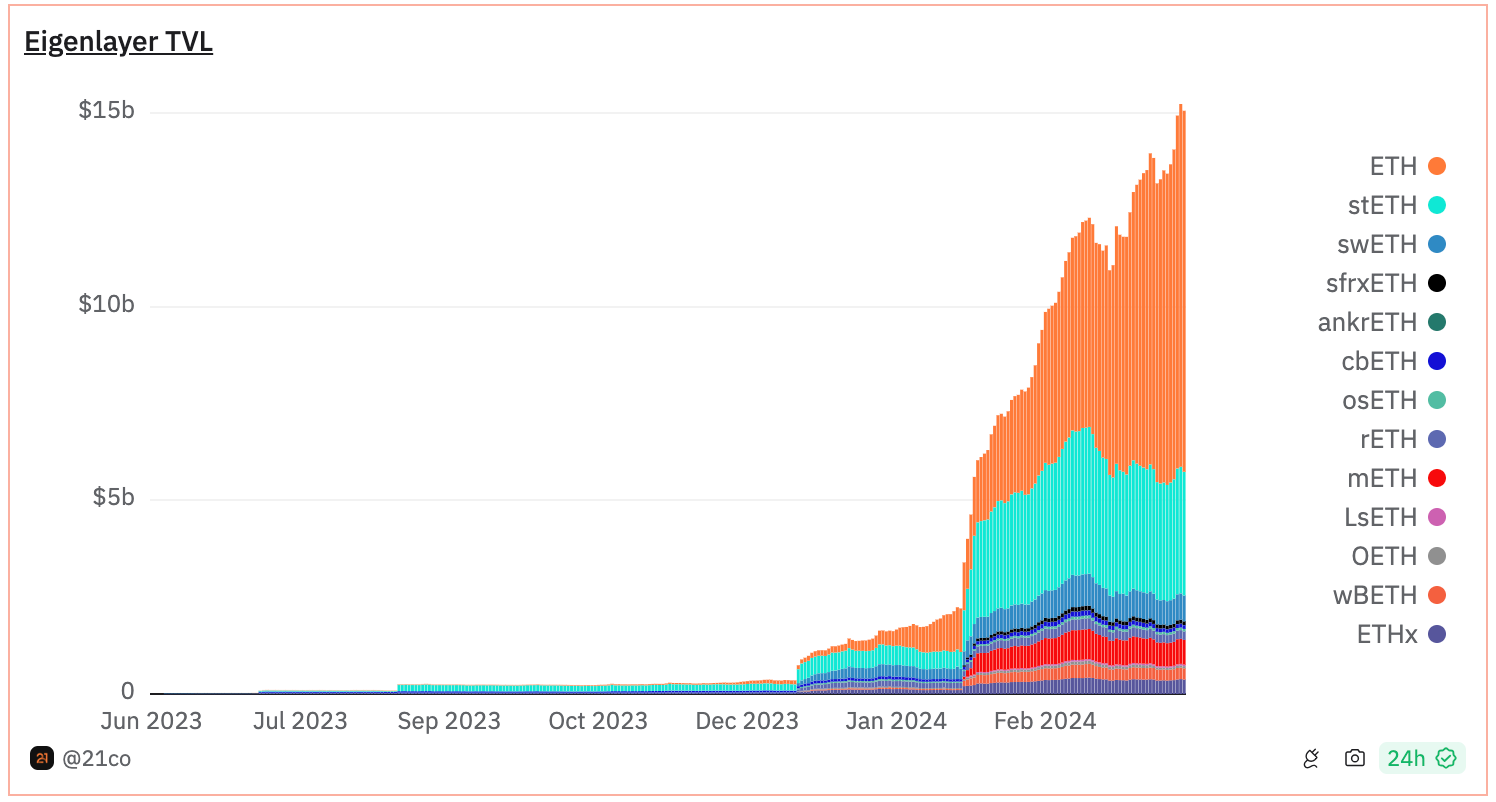

At the time of writing, EigenLayer already has over $15 Billion worth of ETH locked.

(Editor’s note: EigenLayer is the current belle of the crypto ball. As the graph above shows, the protocol has been hoovering up liquidity at a rapid clip. Everyone and their dog is talking about EigenLayer and trying to participate in their rewards campaign.

The big innovation that EigenLayer introduced was to figure out a way to leverage Ethereum’s economic incentives to secure other systems. A feature of Ethereum’s security design is that their blockchain and all the data in it is safe from attack or manipulation so long as the total holdings of all attackers are less than 34% of all staked ETH.

Considering that there is 32 million ETH staked at present, the bare minimum amount required to attack Ethereum at current prices would be around $35-51 billion. That makes it economically unfeasible to target this blockchain.

However, new systems that adopt the same security mechanisms don’t have that kind of economic heft behind them. EigenLayer solves this by allowing Ethereum stakers to ‘restake’ their existing staked ETH into securing the new projects. This allows up and coming blockchains to quickly bootstrap security while also giving Ethereum stakers additional sources of income in the form of rewards from the new projects.

There are two things I’d like to highlight here. Firstly, EigenLayer is an Indian-led protocol. The founder and chief architect, Sreeram Kannan, completed his undergrad and masters in Chennai (Guindy and IISc). So you can add his name to the list of high powered Indians making a mark in global tech.

Secondly, the jury is out on the long term safety and repercussions of EigenLayer. Although their idea is both innovative and highly popular, the security risks posed by its rapid rise are not well understood. Time will tell, I suppose.)

6. JD Kanani, 0xmozak: musings on scaling and architecture

JD is currently in a self-described experimentation phase. So while he builds and experiments, we will afford him the privacy he deserves. As for his past work, it speaks for itself.

For those who don’t know, JD is the former co-founder and inventor of Polygon, one of the largest and most influential organizations in the Ethereum universe. Polygon’s proof-of-stake based sidechain was amongst the very first L2 solutions to achieve widespread user adoption, and their relentless drive to innovate led to numerous advancements in zero knowledge rollups, data availability, and Ethereum scaling more generally. Furthermore, Polygon was the company responsible for onboarding brands like Nike, Reddit, and Starbucks onto web3 for the first time.

Closer to home, Polygon was the first Indian web3 project to go global and capture the imagination of the whole country. India wasn’t even on the global crypto map until JD and Polygon showed up, turbo-charged Ethereum, created nearly $20 billion worth of market cap, and proved that anybody with guts and a good idea can make it in crypto.

In other words, don’t sleep on JD! Check out our piece on his founder story with Polygon here and read what he is watching out for in crypto below.

Blockchain scaling infrastructure is becoming bloated with complexity, multiple layers, and a different token at every step. To solve this, people have started adding more layers instead of removing them or deeply integrating them with each other.

We might see new systems or structures that break this cycle:

More integrated and highly opinionated systems

Lower user acquisition costs by providing cost-free user transactions with ZK systems

App-focused infrastructure

(Editor’s note: This one will probably require some deconstruction. If it wasn’t already evident, JD is a deep thinker who spends a lot of time pondering over the technical and philosophical ramifications of crypto’s various design choices. In a conversation I had with JD, I was able to unpack some of these musings.

First of all, blockchains are becoming increasingly ‘plug-and-play’. This means that projects are launching with shorter and shorter development windows by outsourcing key technical considerations to third parties.

Today it is possible to build a blockchain by cobbling together modular components from different vendors. Things like bridging, data availability, security, and sequencing are all available as a service.

While this may reduce the barriers to entry and accelerate the pace of innovation, it also introduces lots of additional complexity and technical risk. End users may find themselves exposed if something goes wrong because we don’t really have a roadmap for handling crises in the event of failures. As apps and blockchains spread out their dependencies and technical liabilities, we increase the chance of cascading failures and wide-scale fallout. As an alternative to this, JD is of the opinion that developers should seek to cut deep in their work and keep core technical functions within their own ambit as far as possible.

Coming to the user side of things, JD believes that cost-effective customer acquisition is still an unsolved problem. If a new user wishes to come and use any blockchain-based app today, they need to pay transaction fees to power their transactions (however small that amount may be).

For first-time users, this will necessitate funding their account somehow. Most apps today either subsidize the user’s fees themselves - which is an unsustainable practice - or they ask users to pay an onboarding fee. This is not ideal, as most users will drop off if you ask them to pay before they have even done anything.

If we are to bring crypto to population-scale adoption, JD thinks we need to figure out a cost-effective way to bring them on-chain. Ideally, the solution should prevent spammers and sybil attackers without pricing out everyday users. Perhaps some form of zero-knowledge proof generated at the user’s end could do the trick.

Lastly, JD is enthusiastic about app-focused infrastructure. In other words, he would like to see more crypto developers place user experience and functionality at the center of their roadmap. He highlights the Farcaster model wherein the application requirements were prioritized first, with all architectural and infrastructural choices flowing downstream from there.)

7. Madhavan Malolan, Reclaim Protocol: Zero-knowledge cryptography

Madhavan is building the Reclaim Protocol, a mechanism for proving the authenticity of data obtained from third parties on the Internet.

If I wanted to prove to someone today that I had a certain driver rating on the Uber app, I would have two choices: either share a screenshot or use something like OAuth to sign in to my Uber account.

The first option is easily forgeable and the second option relies on Uber to implement OAuth or some other authentication on their side. They may or may not have any incentive to do this. Furthermore, if I use something like OAuth to import my data into a third-party app, I also run the risk of revealing all my data to said third-party.

What if it were possible to cryptographically prove my Uber driver rating to a third-party without revealing any further information or relying on Uber’s APIs? Reclaim Protocol is building the tools to enable exactly this.

Built on top of TLS and zero-knowledge cryptography, Reclaim lets users prove some data about themselves in a verifiably accurate and secure manner, all without relying on any external parties or servers. They also have a cryptoeconomic mechanism to provide their data with a decentralized layer of trust.

Notably. this data can be used on-chain to establish certain truths or facts about a user’s bank balance, frequent flier miles, proof-of-personhood, or pretty much anything else. This opens up lots of interesting possibilities for next-generation dApps.

Reclaim Protol is backed by Lemnis Capital, Dragonfly Capital, Hashed, YCombinator, Spartan Group, Coinbase Ventures, and several leading angel investors.

Zero-knowledge cryptography is supremely misunderstood, which is limiting the tech’s potential.

Properties

A zero knowledge proof (ZKP) is structurally like a function with parameters, a business logic, and a return object.

Before ZKPs, if you were to share a proof that you executed a computation correctly, you would share with me all the parameters to the function, the source code of the function, and the output.

I would take that and run the source code myself with the provided parameters and compare the output against what you provided.

This protocol has a few drawbacks that zkps help overcome.

Zero knowledge proofs have 3 properties:

Privacy

Scalability

Interoperability

Privacy

If one or more of the parameters is sensitive, I can’t share the parameters with you. That breaks down our protocol we defined earlier.

With ZKPs, you can share private params. Basically, letting the counterparty verify the correctness of the computation even though they don’t know all the params in plain text.

You can think of it as follows. The private parameters are in some sense encrypted in such a way that the encrypted parameter behaves exactly the way the plain text parameter would have in the computation. That way, you know that the computation was executed correctly, without having to know all the parameters in plain text.

This is where ZKPs get their name. You get zero additional knowledge about the private parameters. You don’t learn about its value, its size, its range etc.

The ZK rollups that we know in crypto don’t use this property at all. All the parameters are public. So, they are not strictly speaking ‘ZK’ as per the definition.

Scalability

In a traditional computation verification, if the parameters are large, you need to send all that data over the wire to the counterparty. Sometimes that is enormous. However, if it is a zero knowledge proof of the correct computation, you don’t need the parameters in the plain. No matter what the size of the plain text value of the parameters, the proof of correct execution is always exactly the same size - 200B (bytes) for a Groth16 proof. That’s tiny.

What that means is that it is super efficient to prove that you correctly executed certain computation. Previously it wasn’t. Because previously you had to transfer the large inputs too to verify the execution. Now you just share a 200B proof.

This is the property of ZK proofs that ZK rollups use. No matter how large the block, it is easy to verify that the block was constructed correctly without having to download the entire block. (Editor’s note: yes, feel that education seeping deep into your brains 🧠 )

Interoperability

The parameters, source code, and return values are independent of the chain. In fact, they’re independent of the underlying platform. A ZKP can be created and/or verified by software that runs on chain, off-chain, on the client, or on the backend… it doesn’t matter. A zkp once created can be verified anywhere. Again, because it’s only 200B of proof, its cheap enough to verify even on chain.

That means you can create a zkproof in a certain context (on a chain, on some app etc) and that proof can be correctly verified even outside the said context. Just like having the parameters, source code and return values of a function is enough to verify correctness independent of the underlying tech, a ZKP is tech agnostic.

What we get wrong

ZKPs are for ZK Rollups

ZK Rollups are not even ZK! They just use the succinctness of the ZKPs to make it easy to verify correctness of block creation.

ZKPs are for Blockchains

ZKPs have nothing to do with a blockchain. There is no relation between the two technologies. Neither is a zkp dependent on blockchains, nor is a blockchain dependent on zkps. (They just often go together and share an overlapping community. Silvio Micali, one of the inventors of ZK crypto, is also the founder of the Algorand blockchain).

8. Shaaran Lakshminarayan, TanX: Gearbox Protocol

Shaaran is building TanX, the world’s leading institutional decentralized exchange.

There are lots of large financial institutions today that wish to trade cryptoassets - hedge funds, venture funds, family offices, and trusts. These investors place a very high premium on security - they don’t want to relinquish custody of their cryptoassets lest they suffer through another FTX-type scenario.

But at the same time, they also want access to the largest liquidity pools, whether they be on centralized exchanges or DEXs. TanX helps them solve this conundrum.

Using the TanX infrastructure (powered by zero-knowledge cryptography), institutions (and also retail investors) are able to keep custody of their coins while trading across large and diverse cryptocurrency markets. At the time of writing, over 1.5B has been traded using the TanX platform.

TanX is funded by Elevation Capital, Pantera Capital, Spartan Group, StarkWare, Goodwater Capital, Protofund, and Upsparks.

Gearbox Protocol is an exciting new project.

Overcollateralization and its Limitations:

DeFi lending often requires users to deposit collateral exceeding the loan value (e.g., 2x), ensuring repayment through liquidation. While mitigating risk for lenders, this practice limits capital efficiency. A user seeking a $10,000 loan might need $20,000 in collateral, locking up significant capital. This can disadvantage smaller investors.

Gearbox: Undercollateralized Loans and Composability

Gearbox offers a different approach: undercollateralized loans through isolated credit accounts. Users can borrow a portion of their collateral's value, improving capital efficiency. Leveraging existing DeFi positions further maximizes asset utility.

Gearbox's strength lies in composability. Unlike existing leverage options, Gearbox leverages isolated smart contracts, allowing users to apply leverage to specific DeFi activities. This enables targeted position manipulation. For instance, users could leverage their farming position to increase potential yields without exposing their entire portfolio.

Supported Activities and Features:

Gearbox caters to various DeFi strategies, including:

Leverage Farming: Users can amplify returns by borrowing additional assets to increase their liquidity pool deposits.

Leverage Repaints (Reaping): This allows users to temporarily "improve" their DeFi portfolio APY, but requires careful management to avoid impermanent loss.

Margin Trading: Experienced users can leverage Gearbox for margin trading to capitalize on price movements.

Safety Measures and Risk Management:

Gearbox prioritizes user safety by using isolated credit accounts that prevent contagion if one position faces liquidation. Additionally, a whitelist of approved applications and tokens reduces potential exploits. The focus on real assets and DEX trading mitigates risks associated with illiquid perpetual contracts.

The Gearbox Token (GEAR): Governance and Utility:

The GEAR token plays a central role. It grants voting rights on crucial protocol parameters, such as whitelisted applications, fee structures, and collateralization ratios. GEAR holders can participate in "Gear Wars," where they vote on issuing new leverage tokens ("Gears") for specific assets. This allows the community to shape the protocol's future. Furthermore, GEAR can be staked for participation in governance and to earn rewards from user activity.

Investment Thesis and Future Potential:

Gearbox offers a compelling proposition. Its undercollateralized lending and composable leverage features address limitations within DeFi borrowing. Growing demand for leverage farming and reaping highlights Gearbox's potential. The protocol is well-positioned for significant Total Value Locked (TVL) growth as more users embrace its functionalities.

Moreover, Gearbox isn't confined to a single niche. It provides exposure to multiple DeFi narratives, including derivatives, yield farming, and initial DEX offerings (IDOs). With a lower market cap compared to established competitors, Gearbox presents a potentially attractive opportunity for investors seeking exposure to the growing DeFi lending space.

Concluding Remarks:

Gearbox Protocol presents a novel approach to DeFi borrowing and leverage. Its features empower users with greater capital efficiency and targeted position management. The Gearbox ecosystem prioritizes user safety and fosters a strong community through its governance model. As the DeFi space continues to evolve, Gearbox has the potential to become a cornerstone for strategic and efficient leverage strategies, shaping a more inclusive and dynamic financial landscape.

(Editor’s note: Gearbox has added a new financial primitive to the cryptocurrency toolkit: the concept of a credit account. Using this construct, users can deposit collateral (say 10 ETH) and then withdraw a higher amount (say 15 ETH) into a credit account. They can also use their existing DeFi positions on-chain as collateral for their credit accounts.

The magic of these credit accounts is that they come with preset rules that prevent the user from running away with the money. However, they still allow the user to deploy their borrowings into a variety of whitelisted DeFi protocols and strategies.

If the strategies begin to show risk or the financial position starts becoming untenable, the Gearbox protocol can liquid the position and make the lender whole, including by handing over collateral if necessary.

This is a huge breakthrough for DeFi, which is currently limited largely to inefficient overcollateralized loans.)

Phew, that was certainly a lot to take in and to digest.

What do you mean, is it over?

It is, but just for now. Because next week, we will be back with part two of this series, featuring additional eye-opening insights from eight more of India’s finest web3 mavens.

What… what is a maven?

Sers, the search bar is literally on your screen.

Speaking of your screen, we hope you enjoyed what we showed you in this edition of Tigerfeathers. We certainly learned a lot while compiling this article, and we hope you found it informative too.

We’d like to end with a huge thank you to our amazing contributors - Krishna, PJ, Aniket, Joel, Rohan, JD, Madhavan, and Shaaran. And of course, thank you to to you - the reader! If you enjoyed this article and felt like you learned something, subscribe below to receive part 2 next week!

This looks like promotion of few protocols and hardware.

Also you missed the big player in Interoperability "Polkadot". Overall this lacks in-depth research. Could have been better.