Winter Has Passed: What To Watch In Crypto, Part 2

According to the CEOs of CoinDCX, Juno, Persona, Mudrex, Powerloom, and other leading Indian crypto companies.

Good afternoon and welcome back to Tigerfeathers 🐯✌🏽 An especially warm welcome to the 92 new subscribers who have joined since last Friday’s piece about white gold, AKA ice. Adding them in, our total subscriber count is 10,430, which is the average USD price of a Taylor Swift concert ticket. ✨ ~ Slay ~✨

We’ve got some exciting weekend reading for you today; we have composed it by sourcing the wisdom of the crowd. And not just any old crowd - we’re blessed to feature some of the best thinkers in the entire Indian crypto ecosystem.

These people run billion dollar companies, global startups, groundbreaking protocols, and online communities with millions of users. They have real and unique insights about the world of blockchains and cryptocurrencies. And they’ve honoured us by sharing their views and identifying hot topics that merit attention in crypto today.

So whether you’re new to the space or a seasoned veteran, buckle up and let’s dive in because there is something here for everyone.

This edition of Tigerfeathers is in partnership with… Antler India

Antler is a global early-stage venture capital firm that backs ambitious founders from their earliest days. In Web3, global access and networks matter from day zero, whether in the context of users, advisors, investors, or developers.

This is where Antler comes in. They are a truly international organization with 30 offices around the globe and nearly $1bn under management. For everything from deep idea validation to global connections, expansion support, and funding - Antler has you covered.

Over the past three years, the firm has backed 56 startups (selected from over 45,000 founders) in India, anchored by a new $75m venture fund that is solely devoted to backing teams from the Subcontinent.

They are a particularly good ally for this piece as one of the few Indian funds with long-standing conviction and experience in crypto. The Antler senior leadership were amongst the first VCs in India to invest in crypto (they’ve been backing crypto companies since 2017 - including the likes Juno and Mudrex, two businesses featured featured in this piece!).

More recently, the Antler India fund has backed LogX (DEX for trading perpetuals), Cricinshots (Web3 cricket strategy game), Singularity (on-ramp for Web3), PYOR (High-fidelity crypto data and insights for institutions), and Chainrisk (Cyber risk management for dApps), amongst others.

So if you or your friends are starting up and looking for a solid, knowledgeable partner to help supercharge your journey in Web3, check out the fine work being done by the good folks over at Antler in India. Applications are open for early teams and individuals.

Let’s Get Up To Speed

Alright, let’s get into it. As you must have figured out by now, this is the second salvo in a two-part series about cryptocurrencies and blockchains.

In the first edition, we asked eight of India’s top Web3 builders to identify an interesting project or trend that gets them excited. We sent them the following instructions:

Answer the question: ‘what excites you in crypto right now?’

You can write about anything you like, but we encourage you not to write about your own company because we will cover your business when we present your quote.

Other than that, no restrictions on content, length, style, or anything else!

Much to our delight, these awesome founders all came back with illuminating and varied responses. Here is a summary of who they were and the topics they wrote about:

Krishna Hegde, BrownRice Capital: Real world asset tokenization

Prithvir Jhaveri, Loch: Stablecoins

Joel John, Decentralised.co: Web3 social networks

Aniket Jindal, Biconomy: Telegram bots

Rohan Agarwal, Cypherock: EigenLayer

JD Kanani, formerly of Polygon: Some thoughts on blockchain scaling and architecture

Mads Malolan, Reclaim Protocol: Zero-knowledge cryptography

Shaaran Lakshminarayan, TanX: Gearbox Protocol

For the second part of the series, we have used the same format and instruction set.

Now - for some of you, the terms used above might sound like Ancient Greek. That’s completely normal - crypto is a complex, often daunting subject, and it certainly isn’t everyone’s cup of tea. But we’re here to help you in case you’d like to dig deeper and build up your knowledge of this important and frequently misunderstood industry.

As a first step in crypto, we highly recommend reading this detailed breakdown we wrote about how Bitcoin actually works. Unlike most of the literature about Bitcoin that you can find, we like to think that our piece actually gives you all the history and technical understanding you need in an easily digestible format. If you read this piece, I believe that you will understand 80% of everything you ever need to know about crypto.

For another 19.9%, you can check out this piece we wrote about Ethereum and Polygon. Together with the Bitcoin article, this piece can bring you fully up to speed on how blockchains started out and what they are today.

If you have those concepts clear, you will be completely comfortable with all the content in this piece. But even if you haven’t read those articles, don’t worry - I will provide a little editor’s note beneath each of our contributor’s submissions in which I will translate any technical concepts into a more general vocabulary.

So with that said, let’s jump in and learn from our seven amazing contributors!

1. Sumit Gupta, CoinDCX: Web3 gaming

Sumit is building CoinDCX, India’s largest cryptocurrency exchange. They offer both spot and margin trading for hundreds of cryptoassets, as well as futures trading, OTC broking, and enterprise crypto custody solutions.

When CoinDCX was first launched in 2018, there were already a number of successful exchanges ruling the nascent Indian cryptocurrency landscape. Nonetheless, CoinDCX quickly raced away to become the dominant player due to their rapid innovation and customer-centricity.

Today, CoinDCX is the #1 Indian exchange both by volume and by user count (in excess of 15 million). In addition to onboarding and educating customers, they have also played an important role in formulating and implementing industry best practices and regulations. Lastly, through their eponymous venture arm, CoinDCX also supports Indian Web3 startups.

Speaking of venture funding, CoinDCX is backed by BainCapital, Coinbase Ventures, Polychain Capital, and BitMex. As of their last round, they are valued at over $2 billion.

There are 400 million global crypto users right now, but only a few million users are really on-chain and using blockchain technology. In India too, while there are 1.4 billion people, only about 35 million are investing in crypto currently.

While crypto has been around for a decade, we are still early. As they say, ‘slowly and then suddenly’! We have gone through the slow phases already and are close to seeing the sudden growth phase now. But the next phase of adoption will not come from investing or memecoin trading. We need to extend the power of web3 and blockchain and bring it to the masses.

I believe that Web3 gaming can be one of the core drivers to bring users on-chain to fully utilize the power of blockchain and crypto.

In the web 2 world, there are about 3 billion global gamers and a vast majority of the daily active users are playing on mobile devices leveraging the free-to-play model where companies keep the games free to install and play. This helps to democratize gaming as the barrier to entry is low and everyone can play. The companies then monetize through in-app purchases for customisations and level ups and given the endless nature of gameplay, this provides almost infinite scalability and growth. Power users can end up spending thousands of dollars per month as they get more invested in the games.

But the inherent problems with Web2 games are that:

1. Players don’t truly own their in-game assets. Purchases like skins, characters, and other digital goods are often locked to a specific game and can't be transferred or sold outside the game’s ecosystem.

2. Centrally controlled: Games are controlled by their developers and centralized platforms, which can lead to issues like censorship, sudden changes in game rules, or even sudden discontinuation of service.

3. No formal secondary markets: A gamer that has leveled up their character may want to cash out and another player may be willing to pay to get a headstart into the game. There is no formal way to transfer in-game assets in Web2.

Web3 solves many of the above challenges. It utilizes blockchain technology to provide players with actual ownership of their digital assets through non-fungible tokens (NFTs). This allows players to trade, sell, or use their assets in other compatible games, potentially adding real-world value to their gaming achievements. Web3 games operate on decentralized networks, reducing the potential for centralized control and censorship, and increasing transparency in game operations.

One challenge for mass adoption that still exists for Web3 gamers is facilitating smooth transactions. Web2 gamers are used to simple payment flows. Comparatively, Web3 in its current form has multiple friction points such as seed phrases and crypto wallets which involve a steep learning curve. There is an inherent need to develop Web3 payment flows that are much more user friendly and straightforward.

On the builder side too, Web3 gaming involves a lot of complexities. It can take some developers weeks or months to integrate Web3 and blockchain flows to make their games work. We have been witnessing many of these challenges in close quarters. Through CoinDCX Ventures, we have invested in multiple Web3 gaming companies such as Stan Gaming, Meta Engine, Taki Games that are building for the web3 world. So, my team and I truly relate to the challenges developers and gamers face.

As an industry, our first step has to be providing developers the tools and resources needed to develop Web3 games in a scalable manner. Identifying this need, Okto, a Web3 Wallet App, developed an SDK that empowers partners to integrate Web3 functionalities natively, setting a precedent for seamless Web3 adoption across platforms. This reduces development time for developers from weeks and months to a few days. Gamers can also now take their assets across ecosystems using a single wallet that is in use across ecosystems.

From a pure growth perspective as well I am bullish about Web3 gaming given the immense potential it has shown in the past and the future projections. According to a recent BCG report, while the broader global gaming market (Web2) is still growing robustly at about 9.32% CAGR from 2024 to 2029, it is expanding at a rate less than half of that projected for Web3 technologies. Web3 gaming on the other hand is expected to expand at a compound annual growth rate (CAGR) of 18.7% from 2023 to 2033, potentially reaching a market value of around $133 billion by 2033.

Disclosure: Okto is a Web3 super app that was developed by the DeFi team of CoinDCX

Editor’s Note: I don’t think this submission requires much translation - everything is straightforward. Gaming is a larger industry worldwide than music, cinema, and all other forms of entertainment put together. Yet crypto and gaming have seldom worked in tandem; no wonder there is so much interest and investment in Web3 gaming.

2. Varun Deshpande, Juno: Stablecoins

Varun is building Juno, a bank account replacement for crypto natives.

Juno gives users an FDIC-insured checking account in the USA. The difference with Juno is that their account can be easily funded using a variety of fiat and crypto rails. The deposited funds can then be easily swapped for a variety of cryptocurrencies, withdrawn to a self-custody wallet, and used on-chain.

Juno customers can spend their funds (whether stored in fiat or crypto) using popular methods such as Google/Apple Pay, ACH, and via Juno-issued credit cards.

Juno is funded by Sequoia Capital, Consensys Ventures, Polychain Capital, Dragonfly, Jump Crypto, Uncorrelated Ventures, Hashed, Parafi Capital, and a slew of leading angel investors. Read our write-up about Juno’s origin story and ambitious plans here.

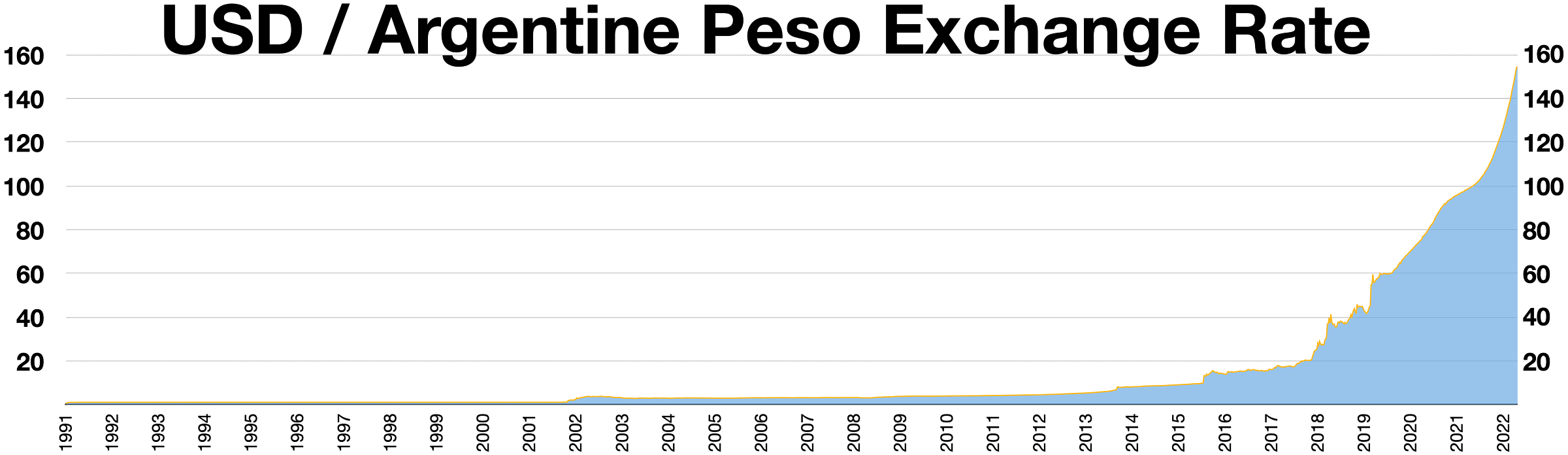

The excitement around stablecoins is really taking off, especially in regions like Latin America and other parts of the Global South.

People are looking for stable and reliable ways to save, send, and spend money, and stablecoins offer just that, without the wild price swings seen in other cryptocurrencies.

What's making them even more appealing is how much easier it's becoming to use them. Thanks to improvements in how people can get their money in and out of stablecoins (the on and off-ramps) and a smoother experience in managing them (like not having to worry about gas fees and seed phrases), they're becoming a go-to choice.

This is especially true in areas where traditional banking has fallen short. It's not just about offering another digital payment option; it's about creating a financial lifeline for millions with the promise of stablecoins, making them a front-runner in the race to global crypto adoption.

Editor’s Note: Another highly understandable submission that requires no real translation. But for the benefit of crypto newcomers, it might be worth clarifying that stablecoins are crypto tokens that are pegged to the value of real-world fiat currencies like dollars or pounds. Some stablecoins - such as the USDC coin operated by the company Circle - maintain their peg thanks to a reserve of hard assets like dollars and US Treasury bills. Other stablecoins maintain their intended values thanks to algorithmic and technological innovations - many of these stablecoins have gone bust in the past, including the infamous Terra UST coin.

A major reason for the popularity of stablecoins is that they maintain their value when the crypto markets get into choppy and volatile territory. Furthermore, stablecoins have the major benefit of being totally programmable. Since they live on crypto rails, they live by crypto rules. Which means that you can use them in tandem with other digital assets and give them whatever functionality you want. Sort of like regular money with superpowers.

3. Yash Agarwal, Superteam: High-Velocity Capital Markets ft. Memecoins

Yash is a researcher at Superteam, a community dedicated to growing and evangelizing the Solana ecosystem.

While Yash is not presently working a crypto CEO like the other contributors to this piece, we are just as excited to feature him. That’s because over the last 12 months, Yash has marked himself out as one of the most incisive and prescient thinkers in India’s crypto scene.

A quick glance at his Medium page or Twitter account will throw up some of the excellent articles he has written about topics like real-world assets or decentralized physical infrastructure on Solana.

We often find ourselves learning about important new developments in the crypto world through his writing, so we’re glad to have him on Tigerfeathers.

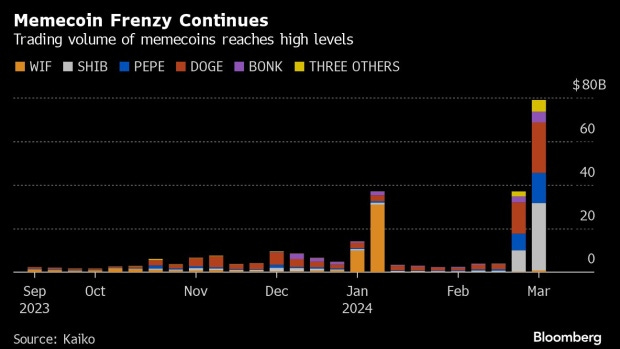

Memecoins are all the rage again. Many are calling for a Memecoin Supercycle.

Everyone remembers DOGE, one of the first memecoins and Elon’s favorite token in 2021. Since then, the markets have evolved to include millions of memecoins, with a few thousand being launched each day. A few memecoins, like BOME, have gone from a $0 to a $1 billion market cap in just 48 hours, a feat only possible in crypto. Solana is at the forefront of this memecoin cycle, where almost all memecoins are being launched and where all the action is happening.

What type of memecoins, you ask? Inspired by Li Jin, memecoins can be broadly categorized as:

Pure Meme-driven – Born out of a popular internet meme, e.g., SHIB, DOGE, WIF.

Community-first – For communities with shared values and missions, e.g., BONK as a Solana community coin or BTC as an internet community coin.

Token-first memecoins – Random tokens launching without a community or meme, but which may later gain some meaningful association. Eg. Random coins like POPCAT.

Product-first memecoins – Memecoin associated with a project, e.g., WEN (Jupiter), Unisocks (Uniswap).

Event-based memecoins – Catalyzed by current real-world events (also considered a proxy for prediction markets), e.g., JEO BODEN as a proxy memecoin for Joe Biden’s election prediction.

Why are memecoins so special? While some might say memecoins are speculating on the attention economy or tokenized culture, others might say it’s financial nihilism i.e. TradFi is broken; retail needs something different.

I feel memecoins are special because, for the first time, memes - the lifeblood of the internet - can be tokenized and speculated upon. Go to any corner of the internet, and you will find memes, so why not speculate on them?

But why did financializing memes find the Product-Market Fit only on the blockchain? Apart from crypto culture, I believe they are the result of the convergence of two technologies uniquely enabled by blockchains:

Financial Asset Creation: For the first time in human history, anyone can create a financial asset in less than 2 minutes and for under $2 — all thanks to platforms like Pump.fun on Solana. Not just the creation of assets, but markets for these assets can also be created (via DEXs like Raydium) with community bootstrapping the liquidity to enable trading of these assets. Traditionally, any asset would need to involve over 100 institutions (market makers, regulators, exchanges, brokers, platforms, etc.) to enable trading of their asset — take the hassle of an IPO, for example.

24/7 Global Trading: Unlike traditional financial markets, blockchains are inherently global and operate 24/7. For the first time in history, anyone from any corner of the world can trade any asset in a single shared financial market without any restrictions or limits. Once you have a non-custodial wallet, you have full control over your funds. You can transact as low as $0.01 or as high as $1 billion in one transaction and in under $0.01 as fees and in under 1 second.

Of all the chains, Solana has truly become the #1 chain for memecoins, accounting for over 90% of new memecoin activity, all thanks to:

Ecosystem: Trading frontends like Jupiter, which aggregates from all DEXs, and token launchers like Pump.fun.

Cult and Community: Strong influencers like Ansem, along with a strong community of traders as well as builders.

Tech: One of the most performant blockchains at scale, with high TPS, low fees, and fast finality.

This combination is truly only possible on Solana at the moment.

All this has led to the emergence of memecoins as an asset class with more than $50 billion in market cap (excluding Bitcoin). But memecoins are just one native asset class; there can be many more crypto-native asset classes that will be created. Who knows, we might even see NGOs launch their tokens and raise funds for a flood or a war.

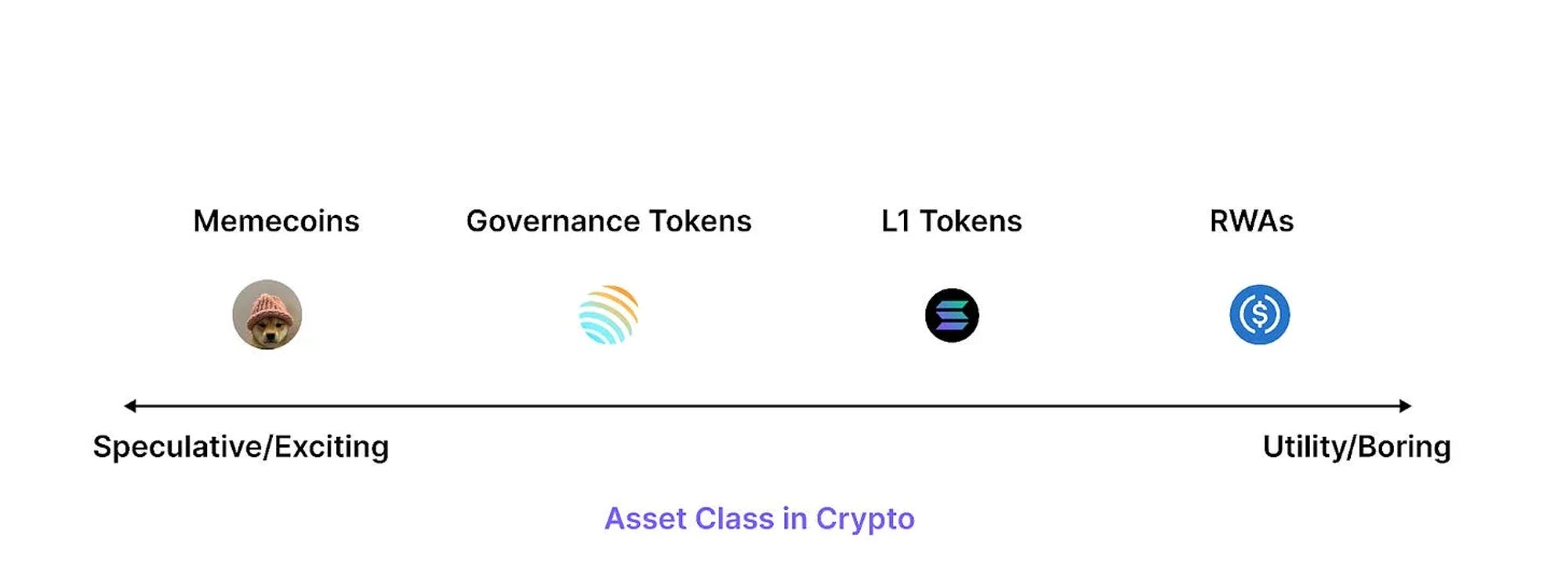

On one end of the spectrum, we will have speculative asset classes like memecoins, and on the other, we will have asset classes like RWAs (tokenized dollars or even whisky or luxury watches).

Memecoins aren’t just a great tool for crypto onboarding but also an excellent way to battle-test infrastructure. For serious RWAs to trade on-chain, we need infrastructure with enough liquidity (look at top memecoins; they have the deepest liquidity aside from L1 tokens/stables), stress-tested DEXs, and a broader DeFi ecosystem.

Study Memecoins.

Study Culture.

Study Solana.

Study High Velocity Capital Markets.

Editor’s Note: Yep, no translation needed here either. All we’ll leave you with is this incredible thesis that successfully argues the case for all government money to be replaced by canine-themed assets. Woof woof, Klaus Schwab.

4. Ankita Verma, Persona: Decentralized physical infrastructure (DePIN)

Ankita is building Persona, a platform that is reimagining advertising for the Web3 generation.

Crypto has hundreds of millions of users generating on-chain footprints today. However, most advertisers are not savvy enough to leverage this goldmine. Persona solves this problem.

Using their powerful engine which has analyzed 200M+ wallets and tens of thousands of Dapps and contracts, Persona knows how to swiftly and accurately segment a particular user base. They then use this data to help advertisers reach their ideal audience with intelligent, impactful, and measurable campaigns.

On the other side of the equation, Persona helps popular Web3 apps and games to better understand their user bases and partner with the best advertisers. It also allows the publishers to then share this advertising revenue with users, all while protecting their privacy and data.

The Persona platform is used by partners such as MetaMask, Moonpay, Immutable, and Paypal, amongst others. The company has been funded by Cadenza VC, Hashed, Ace Company, Untamed Ventures, dash, and iSeed.

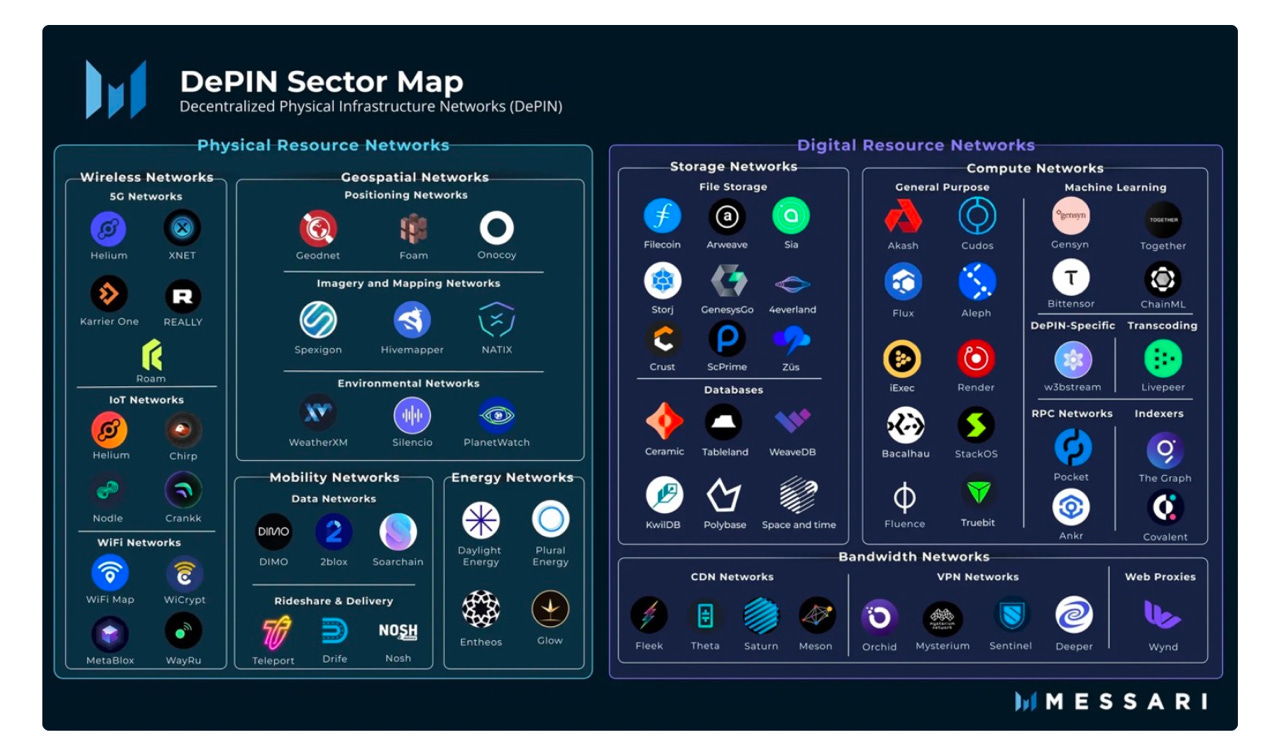

Decentralized physical infrastructure networks (DePIN) have garnered significant interest in the crypto community since 2023, with over 650 projects and a total market capitalization exceeding 20 billion USD. This interest is expected to continue growing throughout the latter half of 2024 and into the future, especially due to DePIN’s alignment with the AI industry.

So, what are DePINs? In essence, they're decentralized applications that incentivize individuals build and share real-world physical infrastructure in return for blockchain tokens. From hotspot routers for wireless connectivity, to GPU chips for computing and data centers for file storage, DePINs cover a broad spectrum of infrastructure needs.

Early projects like Power Ledger and OpenBazaar laid the groundwork in showcasing how blockchain could decentralize energy distribution and e-commerce respectively. Helium's decentralized wireless network incentivizes individuals to provide Internet connectivity, while Render's decentralized cloud computing platform offers scalable infrastructure to developers and businesses.

Filecoin decentralizes storage, rewarding participants with FIL tokens for renting out their storage space.

Other notable DePIN projects include Theta Network and Akash, which incentivize users to share graphic processing unit (GPU) computing power, and Livepeer which decentralizes video streaming allowing developers to integrate live video into their applications.

The beauty of DePIN networks lies in their provision of an open and permissionless marketplace for infrastructure across various industries, including media, gaming, AI, information services, and life sciences, each corresponding to an industry worth over 1,000 billion USD. So the potential is huge!

Core benefits over the traditional model include:

Decentralization: Removing the reliance on centralized entities for infrastructure establishment and maintenance.

Shared Economy Model: Distributing infrastructure costs and responsibilities among service providers.

Cost Efficiency: Offering lower costs compared to traditional models, with opportunities for users to earn tokens.

Innovation Catalyst: Democratizing infrastructure and fostering innovation by leveling the playing field for new players.

Overall, I am excited about what the future holds for DePIN. Challenges such as regulatory hurdles, scalability issues, and the need for improved interoperability and privacy remain. These challenges will require regulatory support and technological innovation, particularly in regulated industries like telecoms and energy.

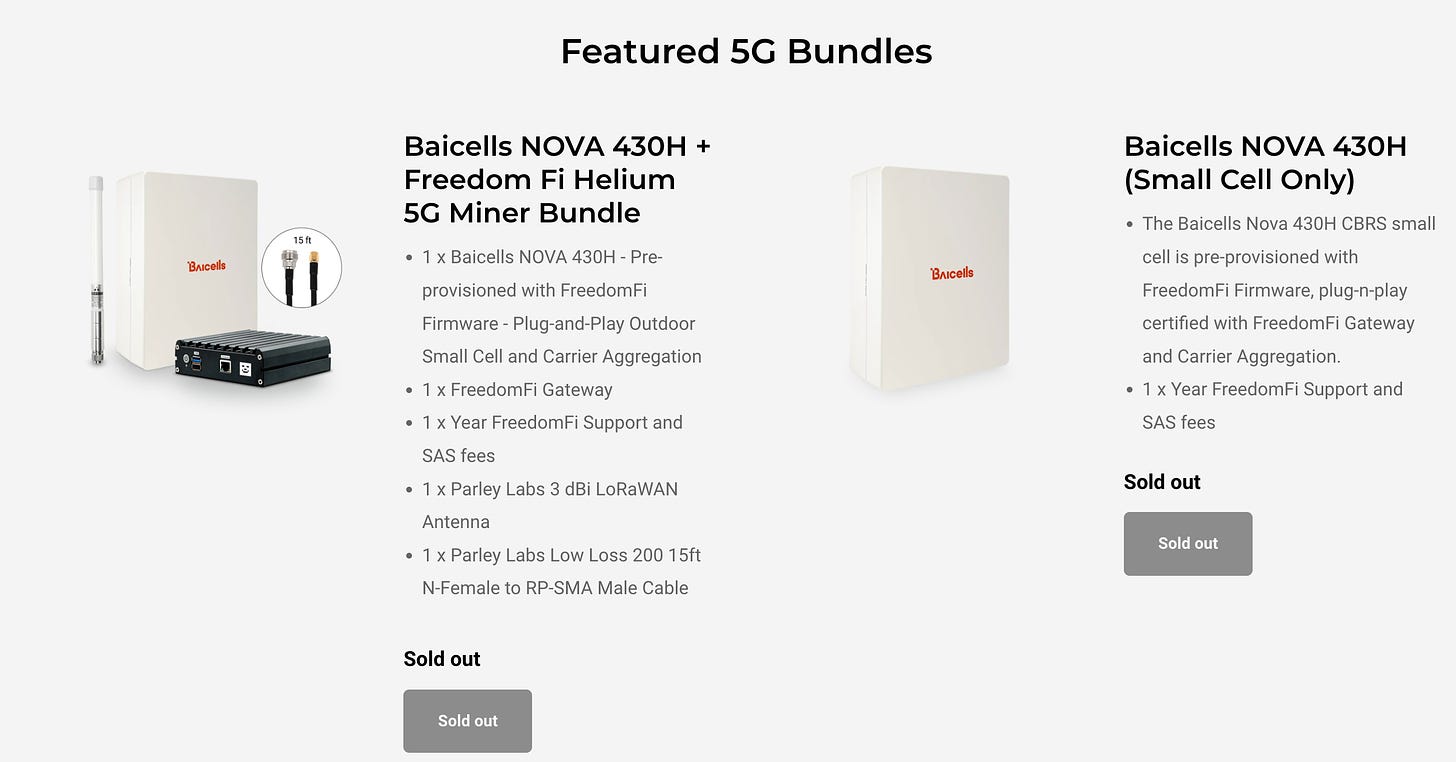

Editor’s Note: As Ankita so eloquently points out, blockchains can even be used to bootstrap the creation of physical infrastructure. The case of the Helium project is quite fascinating.

Helium is a protocol that allows individuals to wire up their own mobile hotspots and internet routers around the world. The resources provided by these ‘operators’ then get pooled into a common network by Helium, allowing end users to gain low-cost Internet connectivity.

The protocol measures the uptime, utilization, and performance of each operator, and then coordinates a payment of token rewards accordingly. In this way, Helium attempts to basically crowdsource the creation of a mobile network - something that would otherwise be a hugely expensive undertaking that could only be done by a mammoth single entity like Reliance Jio.

5. Ishaan Negi, Stealth: Pendle Protocol

Ishaan is building a stealth startup-within-a-startup from inside Juno. While we won’t give away what exactly they are building, we have seen it and can tell you that it’s a gorgeous consumer-facing app with very smooth customer on-boarding flows.

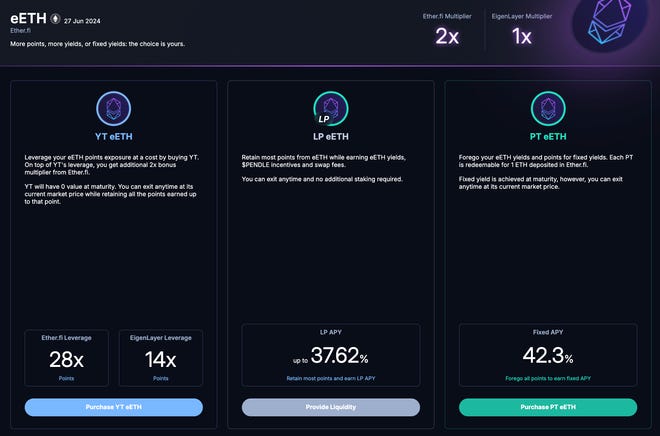

Pendle is a permission-less yield trading protocol and might just be a new DeFi primitive to come out of this cycle. Through their yield tokenisation, they allow users to deposit a token, which is split into a principal component (PT) and a fixed rate yield component (YT) with maturity. Now trading yield is something retail participants don’t do in traditional markets, so what is behind the recent hockey-stick growth of Pendle? → Enter points.

This yield tokenisation allows users to give away their points for a fixed yield right now (the user may not want to speculate on the future value of points or find arbitrage in yield pricing) or leverage their YT to get multipliers on points. This supercharges any points campaign for a team launching with the points farming mechanism. The team has been relentless in the bear market finding PMF and it seems like points might just be the lightbulb moment for retail to understand yield trading.

Editor’s Note: OK, let’s translate this one. Imagine there is a crypto token called TigerCoin. One of the mechanisms of TigerCoin allows you to basically lock it up or ‘stake’ it in return for some new issuance of TigerCoin.

Now, if you’re wondering why such a mechanism makes sense to include in a token, that is a good question. The best reason to enable staking is to incentivize good behaviour. For example, many coins like Solana and Ether can be staked. If you stake SOL in the Solana protocol and behave well by performing some useful work such as cross-checking all Solana transactions for accuracy and correctness, you can get rewarded in freshly issued SOL. However, if you mistakenly or sneakily approve an incorrect transaction, your staked SOL can be confiscated.

In addition to this, another common (and somewhat ponzitastic) reason why protocol developers build staking mechanisms into their coins is to ensure that the circulating supply low stays low and people don’t sell the price downwards.

Anyway, lets come back to TigerCoin. Imagine that in return for staking TigerCoin, you also receive periodic staking rewards in the form of new TigerCoin. Let’s say that presently, 100 Tigercoins of principal earns you an annual yield of 5 TigerCoins, although the yield changes based on certain factors that are hard to predict.

Now imagine that you are a very risk-averse investor. You don’t want to risk the TigerCoin yield dropping from out under your feet. You are happy to lock in a fixed yield immediately. To do this, you would go to Pendle and deposit your 100 TigerCoin into their protocol.

From there, the protocol would allow to sell your future yield of 5 TigerCoins for a fixed amount of say 4.75 TigerCoins over the same time period. On the other side of this trade, some other investor would put in the 4.75 TigerCoin required to give you this fixed yield.

From that investor’s perspective, he is paying an amount slightly below par to receive 5 TigerCoins in the future. He also gets any potential upside in case your initial principal of 100 TigerCoin yields MORE than 5%. On the other hand, if the TigerCoin yield goes down, he has already stumped up the 4.75 coins required, so your yield is guaranteed.

In this way, Pendle basically recreates a well known financial concept known as interest rate swaps. Every month, capital markets process trillions of dollars worth of interest rate swaps. Pendle is exciting because it brings this product to the world of crypto.

6. Edul Patel, Mudrex: Starknet

Edul is building Mudrex, a new kind of crypto investment platform. Mudrex’ flagship product is called Coin Sets; it allows investors to gain exposure to a curated set of cryptocurrencies. You can think of this sort of like an index fund - in fact, with names such as ‘Crypto Blue Chip - 5’, and ‘Crypto Mid Caps - 10’, the nomenclature of Coin Sets would be very familiar for many traditional stock market investors.

At the time of writing, Coin Sets has >$20M in AUM from over one million investors. And that’s not all - Mudrex also has a crypto lending and direct investment product, through which investors can take exposure to individual coins either on an ad hoc basis or through systematic investment plans. All of this is enabled by Mudrex’ financial rails, which offer global fiat on/off ramps in 75 currencies and multiple payment modes including cards, bank transfers, crypto deposits, and UPI.

Mudrex has raised two rounds of venture capital from funds such as Nexus, Arkam, and Better Capital. You can read our Tigerfeathers breakdown of Mudrex and the rise of social investing here.

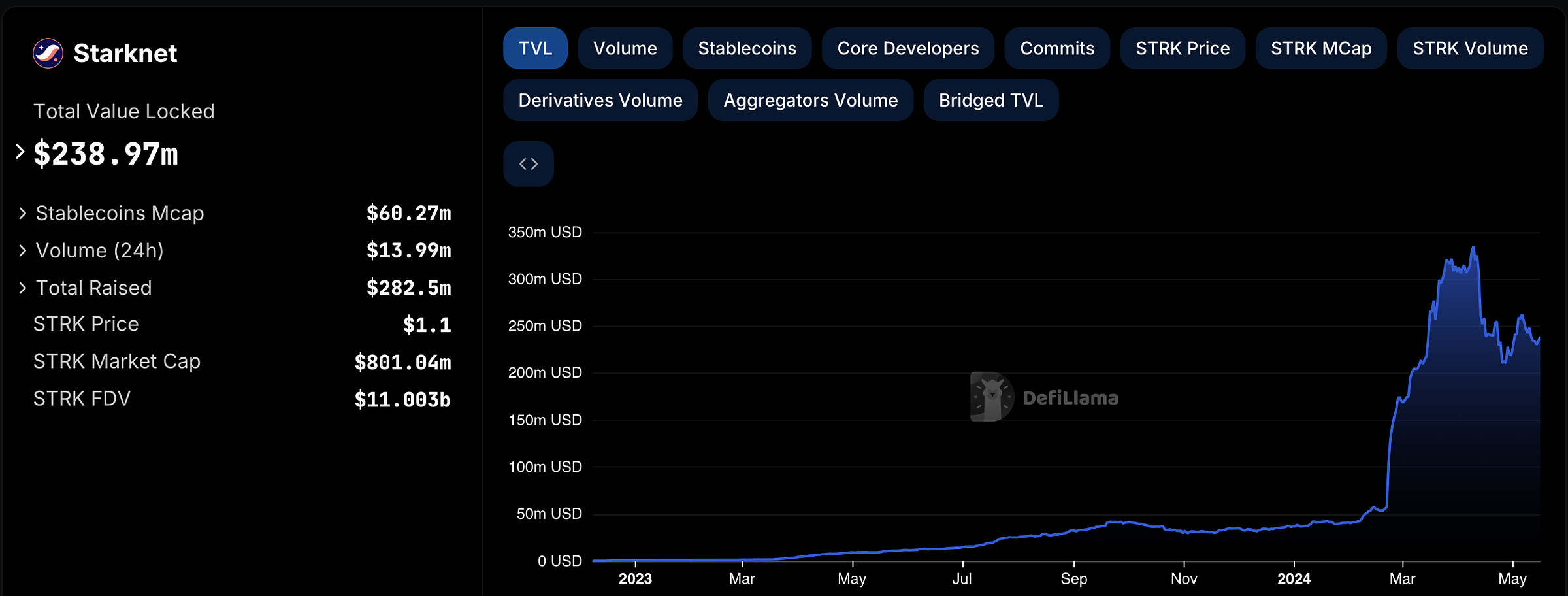

Starknet and zkStarks will move ETH from the dialup era to broadband

The early version of the Internet was slow, clunky, and broken. When broadband replaced dial-up connections, the Internet exploded with new activity and products. The massive upgrade in bandwidth unlocked the full potential of a global information network. Today, that same upgrade is occurring on blockchain networks.

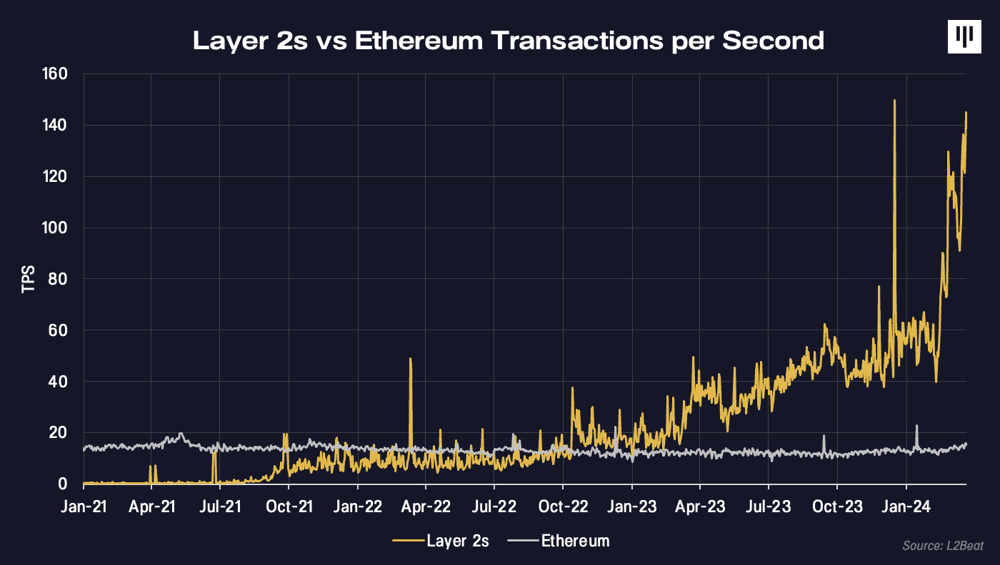

The Ethereum ecosystem has scaled by ~10X over the past two years, powered by Layer 2 blockchains. Layer 2 chains achieve greater speeds and lower costs by batch processing transactions to be settled on an independent blockchain, the Layer 1. This scaling approach is known as a “rollup chain.”

Total transaction throughput on Ethereum-based Layer 2s is currently over 140 TPS (transactions per second), compared to 14 TPS on Layer 1.

This brings us to Starknet, a Layer 2 rollup on Ethereum that is emerging as a frontrunner due its unique advantages.

At its core, Starknet leverages ZK-STARKs, a cutting-edge cryptographic proof system, to verify transactions. This approach significantly enhances security compared to traditional consensus mechanisms. ZK-STARKs enable the creation of succinct proofs that can be efficiently verified, ensuring the integrity and validity of transactions.

Starknet's general-purpose nature is another key differentiator. Unlike many other Layer 2 solutions that focus on specific applications, Starknet provides a versatile platform for developers to build a wide range of decentralized applications. This flexibility has attracted a diverse and vibrant community of developers, resulting in a rapidly growing ecosystem of innovative projects.

Furthermore, Starknet's composability fosters a highly interconnected Ethereum ecosystem. By enabling applications to seamlessly communicate and interact with one another, Starknet unlocks new possibilities for decentralized finance (DeFi), decentralized autonomous organizations (DAOs), and other blockchain applications.

Editor’s Note: As we explained in our article about Polygon, Ethereum has a scaling problem. It is relatively expensive to use Ethereum, and there is a limit on the number of transactions that can be executed per second.

To get around this limit, Ethereum pioneered a new concept known as ‘layer-2’ systems or roll-ups. In essence, the idea behind a roll-up is to take a user’s funds on the main Ethereum system and freeze them in a special vault. Simultaneously, the same funds will get issued into that user’s account on the roll-up system.

On the roll-up, the cost and speed of transacting will be much more favourable versus the Ethereum mainnet. Should the user wish to withdraw their funds to the mainnet, the assets on the roll-up are destroyed and the funds on mainnet are unfrozen.

To prevent the chance of accounting screw-ups or other funny business occurring on the roll-up, layer-2 systems often implement some kind of periodic update on the main Ethereum system. This checkpoint ensures that the accounting on the roll-up can be properly checked and validated.

Starknet’s method of checkpointing using magical math techniques from the world of zero-knowledge cryptography (Mads Malolan explained this concept brilliantly in part one of this series). Edul predicts that Starknet will continue growing quickly and take up an increasing amount of activity off Ethereum mainnet onto its own roll-up.

7. Swaroop Hegde, Powerloom: Decentralized Data Networks

Swaroop is building Powerloom, a composable data network designed to serve the Web3 industry’s voracious appetite for accurate and reliable data.

Building things in crypto is hard for many reasons, but a key reason is that blockchains make for unusual and unwieldy data stores. This is a problem because every single crypto application needs data to function.

Through its decentralized network, Powerloom incentivizes the creation of reliable and customizable data markets. Do you want to build a dashboard that keeps track of in-depth statistics from a Web3 game, NFT collection, or DeFi protocol? Powerloom can help you get real-time data about all these apps in a decentralized and trustless way.

Powerloom is backed by Blockchain Capital, Fenbushi Capital, and Protocol Labs, to name a few. They help develop and run the Powerloom network. With token incentives, the Powerloom mainnet is scheduled to go live by the end of Q2.

From Powerloom’s perspective, we’re excited about expanding Powerloom onto Base, partnering with projects like BNS in the Base ecosystem, and announcing data markets soon becoming available on this platform, which is a noteworthy development in the crypto ecosystem for several reasons.

This move signifies the growth of composable data infrastructure and a new era of collaboration and accessibility.

Base, being a blockchain designed for interoperability and dev-friendliness, becoming a home for Powerloom’s data markets drastically lowers the barrier for developers and projects aiming to integrate or leverage onchain data. This accessibility is crucial for fostering innovation and broadening the range of applications and services that can be built within the DeFi ecosystem.

Powerloom’s mention of having multiple partners in the pipeline as it expands on Base underscores the collaborative nature of blockchain development. These partnerships can lead to cross-pollination of ideas, technologies, and user bases, further strengthening the blockchain ecosystem. Collaboration is a crucial driver of innovation, and by fostering a network of partners, Powerloom and Base are setting the stage for more integrated and comprehensive DeFi solutions.

Editor’s note: Every day, millions of users interact with their blockchain of choice. As they do so, they generate data. Sometimes, this data is stored as a ‘variable’ in the blockchain database itself. Other times, the data is emitted as a kind of notification that is sent out to all parties watching the blockchain.

In either case, fetching or organizing the data is a real pain in the ass. It requires a lot of legwork to keep all this data in a form that allows quick and easy access for developers. Today, companies like Moralis and Alchemy do this gruntwork and offer access to the data via APIs.

This is great a lot of the time, but it can also be disastrous when these services fail or get something wrong. These services are also rigid and seldom customisable. This is where onchain data protocols come in. They incentivize the creation of data markets that are decentralized and tailor-made - so developers can get easy access to the data they need from a variety of providers instead of a central actor that has a higher failure risk.

Powerloom is excited about launching this service for the Base blockchain, which is an Ethereum roll-up launched by the American cryptocurrency exchange Coinbase. Base is rapidly becoming very popular because of its low fees and easy integrations with the Coinbase exchange which has millions of users. Every day, Base generates hundreds of thousands of dollars worth of revenue for Coinbase - as shown by the yellow line in the graph above. This might set a precedent for other major tech companies to launch their own roll-up.

So there you have it, folks.

Fifteen topical insights about what to watch in the world of crypto, brought to you by fifteen of the most talented and relevant entrepreneurs from the Indian crypto milieu - seven of them in this post, and eight of them in part 1 of this series.

This is the second time we’ve published an article that crowdsources learnings and insights from industry leaders - the first one was this piece, in which we collated the views of 24 of the country’s top venture capitalists about what to keep an eye on in the wider world of Indian tech.

As we keep growing and evolving, we would love to get your feedback. Does this format work and add value for you? Or do you prefer our long-form solo articles?

Regardless of which option you prefer, we’re really grateful for your continued encouragement, attention, and support. We would also like to thank the contributors to this piece for their generosity and acumen. So a huge shout out to Sumit, Varun, Yash, Ankita, Ishaan, Edul, and Swaroop!

That’s all for this time, people. See you soon.

And while you’re at it, subscribe so that you never miss an edition of Tigerfeathers