Globetrotters #1: Bank On Juno

From fintech to crypto, from India to the United States - Juno is a bridge between worlds

Hey folks👋

Welcome to the 276 new Tigerfeathers subscribers who’ve joined since our last piece. If you enjoy sunshine, soft jazz, long walks on the beach, and reading about the coolest things happening in Indian tech, Web3 and the creator economy, you’ve come to the right place👇

“Moderately bullish on India, extremely bullish on Indians” - Balaji Srinivasan

At some point in the last decade, India’s startup story became impossible to ignore. A country that had a tenuous relationship with capitalism only a couple of generations ago now stands as the third largest startup hub in the world. A palpable culture of entrepreneurship has seeped into the pores of 21st century India. This current vintage of founders has been emboldened by the glut of venture capital from foreign and local investors, inspired by ubiquitous tales of startup success, and informed by accessible playbooks on scaling businesses of every kind.

As India has embarked on its own digital metamorphosis in recent years, the evolving subcontinent has presented aspiring founders with fertile terrain for experimentation. Look across the board - from healthcare to e-commerce, fintech to SaaS, logistics to consumer goods, Web3 and the creator economy - and you’ll find a wave of homegrown upstarts looking to upset the establish order.

We’ve come a long way from the 1990s, when policy changes introduced under the aegis of economic liberalisation shifted India’s capitalist engine out of first gear. In the ensuing years Indian startups have moved from the back pages to the front pages, while India is upgrading from the global back office to the front office.

Our startup journey so far has mostly featured entrepreneurs that were looking inward, catering to the needs of a local market that was coming online for the first time. This included areas like online payments, vernacular social media platforms, millennial-friendly consumer goods, software tools for small businesses, food delivery apps and education platforms, among others. For an economy built on the back of services, we’ve gotten the hang of building digital products rather quickly.

At Tigerfeathers, we’re excited about the next epoch of India’s startup story, which is set up for Indian founders to take their talents, skills and learnings to create products for a global audience. Its why we’re kickstarting a new series called ‘Globetrotters’ that will feature deep dives on companies that are “building from India for the world”. These are teams that sit at the intersection of several broader trends. They are typically attempting to strike gold on pristine ground, blazing new trails for others to follow. Their journeys give us a colourful prism through which to examine compelling sectors, challenges and problems. Simply put, they have stories that are worth telling.

First up is a company I’ve long admired named Juno (formerly Bank OnJuno). Started by a triumvirate of seasoned founders, they are two years into a bold endeavour to build a successful consumer finance product for an American audience (while based in India). It is a mission for which an existing blueprint just doesn’t exist. Juno calls itself a ‘crypto-friendly bank’. Their story represents a case study on how the future of money will be built around a happy marriage of traditional and decentralised finance.

Perhaps serendipitously, after a number of conversations with the team over the last few months, I’m excited to publish this piece on the heels of Juno’s $18 million Series A fundraise announcement that was confirmed just this past Friday.

Today’s piece will cover:

- the Juno origin story

- the entrepreneurial journey of Juno’s founding team

- their tryst with fintech, open banking, and decentralised finance (DeFi)

- the past, present and future of Juno’s flagship neobanking product

Read on, enjoy, and if you think there’s an Indian startup that should be part of this series, let us know in the comments or by replying to this email. Without further ado…

Standing atop the citadel on the Capitoline Hill overlooking the ancient city of Rome was the temple of Juno Moneta. It was named after the Roman goddess Juno, daughter of Saturn and wife of Jupiter. She was referred to as Queen of the Gods and guardian of the Roman people. Among her many titles in ancient mythology, she was hailed as the protector of funds, responsible for the security and issuance of new currency. Thus the temple of Juno Moneta served as both the mint and treasury of the Roman empire. It had the authority to issue freshly minted Roman coins (that bared an image of the goddess and her name). It would retain this incumbency for over four centuries.

The Latin word ‘moneta’ is actually the root of several English words we use today including ‘money’, ‘monetary’, and ‘mint’. The Spanish word for coin (i.e. moneda) also shares the same etymology. Perhaps in more recent parlance, however, the temple of Juno Moneta serves as the fitting inspiration for the name of one of India’s most ambitious and compelling startup ventures.

Juno (the company, not the deity) is building the bank of the future. It is the second entrepreneurial voyage from the trio of Varun Deshpande, Ratnesh Ray, and Siddharth Verma. Away from the cantankerous din of the crypto markets, they’ve iterated their way across multiple industry cycles to create a financial product for US customers that straddles the past, present and future of banking. Their goal is to become the first port of call for people that want to live with one foot in the world of decentralised finance. In the process, they hope to demonstrate the full spectrum of benefits that accompanies this new paradigm, and how it expands the utility of money in the Internet age.

As their journey will demonstrate, Juno may well prove to be the special case of right team, right problem, right product and right timing.

Juno: Origins

The lively campus of India’s Birla Institute of Technology and Science (BITS-Pilani), set in the coastal state of Goa, serves as a neat starting point for the Juno story.

Two of the company’s eventual co-founders, Varun and Siddharth, were childhood friends, and found themselves in the same graduating batch at BITS from 2008-2012. Varun would major in mechanical engineering while Siddharth pursued a degree in computer science. Like many of their peers, they had been seduced by the siren song of the high growth tech world. BITS Pilani has gained considerable notoriety in the Indian startup ecosystem over the last decade for producing a seemingly endless conveyor belt of battle-ready founders and engineers. The Juno pair were no different. Siddharth recounts how he and Varun took alternative routes to kickstarting their individual careers:

“I did a six month internship at Cisco in my last year at BITS. The biggest thing I learnt was that I never wanted to work at a big company again! I ended up joining a smaller competitor of Cisco - Arista Networks - just after graduation. The startup landscape still seemed a little abstract to me. I wanted some real world experience before making a commitment to entrepreneurship. Varun was different. By our fourth year at BITS, he had already started up”.

Varun had founded a company named TopTalent, which sought to build ‘an online job portal for top tier professionals and top notch jobs’. In what would become a recurring trend in their journey, he wanted to solve a problem experienced firsthand by him and those around him. In this case, it was graduates looking for employment opportunities at leading companies in India.

By the time he exited his venture, the portal had been used by over 150K jobseekers to find vacancies at more than 2000 Indian enterprises. Varun would then go on to become the AVP of Marketing at another emerging Indian startup named Toppr that was making waves in the country’s fledging private education (i.e. ed-tech) sector. It was at Toppr where he would meet his future co-founder and CTO of Juno, Ratnesh Ray, who had joined the company as a software developer in 2015. Toppr was Ratnesh’s first professional gig since graduating with a degree in computer science from the Indian Institute of Technology (Allahabad). He would move on to another stint leading the data science team at TinyOwl (a leading food-delivery startup at the time), before finally joining the duo from BITS to set up their first venture together.

While Varun and Ratnesh were striking up a friendship at Toppr, Siddharth was getting firsthand experience as a software engineer at an established company. Arista Networks was undergoing a crucial period of consolidation in preparation for an IPO. He had joined the company in 2012 as part of a 20-member tech team in India, while its headquarters remained in Palo Alto, California. He had a front row seat to a colourful chapter for the company as it rose to become a market leader in ‘data-driven client-to-cloud networking’, culminating in a public share offering on the New York Stock Exchange in the summer of 2014. He admitted to me that:

“The Arista experience was really important because I realised what it takes to build a public company - things like scaling a team or managing employee stock options. More than learning about coding or software, I was learning how to build a tech business”.

After three years at the company he decided it was time to move on. Now at a crossroads, he found himself reckoning with the second-most common question faced by young Indians in their 20s right after “when are you getting married?”, which is “should I get a job or do an MBA?”. Fortunately, one of his future co-founders had stumbled onto a new problem worth solving. And he would need some back up in order to tackle it.

A First Crack At Bat

By the time he exited TopTalent in late 2014, Varun was “emotionally and financially exhausted”. He had spent two and a half years building his startup without taking a salary, learning to live on a frugal lifestyle. His new role at Toppr required him to move to Mumbai, where the concept of a monthly paycheque took some getting used to. Writing in his personal blog at the time, he remarked on how:

“Mumbai’s higher standard of living meant I was spending a lot more on rent, food, travel and daily expenses. Add some EMIs, mutual fund investments and fixed deposits, and I had no idea where I was spending my salary. At the end of every month, I used to wonder ‘Where did my salary go?’”

He envisioned a solution to his dilemma - a smartphone application that could function as an expense tracker, giving him a real time view of his spending patterns so he could have greater control over his monthly outlays. Conventional expense trackers were constrained by a deceptively simple drawback - you had to rely on people to manually input the transaction details into an app every time they bought something or made a payment. If they forgot to add a transaction, then the ‘analysis’ reflected ceased to be useful, and it was only a matter of time till users abandoned the habit of checking the app and lost interest entirely.

Varun shared his conundrum with his buddies Siddharth and Ratnesh, who could help look at the problem through a product-oriented filter. They came up with a hack to get around the ‘data input’ puzzle. Varun recalled how:

“Back in 2016 the Reserve Bank of India mandated that all commercial banks had to notify users with an SMS alert every time they made an online transaction, card payment or ATM withdrawal. If we could automatically pull spending data from the messages folder on a user’s phone, we wouldn’t have to worry about them missing a transaction or logging an incorrect amount”.

By this point, the discussions had evolved beyond finding a solution to Varun’s personal predicament. Monthly budgeting and saving was a genuine problem faced by millions of working professionals in India. If they managed to figure it out, there was a real business to be built here. Through the process of brainstorming, Varun, Siddharth and Ratnesh had also validated an ancient bit of entrepreneurial calculus - three heads are indeed better than one. They realised that they each complemented the other in temperament, and their skills meshed together perfectly. They took the plunge, deciding to leave their individual jobs and set up a company together to address the personal finance challenges of working professionals in India.

And so, in August 2015, BeeWise was born.

Right from the jump, the group was aligned on the importance of nurturing a product DNA built around user-friendliness that would percolate through all their future ventures. The BeeWise Expense Manager was designed to be slick, simple, and easy to use. “Our strength has always been in abstracting away the complexities that underly financial services for our users,” says Siddharth. As word spread and they began to see some traction with consumers, the team began thinking about how the BeeWise application could become a platform to drive further commercial and financial activity. In other words, could they connect consumers and businesses in a novel way that was mutually beneficial to both parties.

The team understood that there were tremendous benefits around customer loyalty and retention that could be unlocked by merchants and consumer brands by using the spending data captured on the BeeWise app. At best, these companies only had a fuzzy picture of their own customers. They didn’t know much about the behavioural patterns or buying preferences of consumers. That’s mainly because the data around customer spends was held captive by banks and other financial intermediaries that facilitated online and offline transactions. But if these merchants could partner with BeeWise directly, they could get a richer picture of who their customers were and how often they bought a certain product. They could also design bespoke rewards and incentive programmes for their most loyal fans.

The first step to enabling this functionality was building out a BeeWise SDK (Software Development Kit) - a set of software tools that third party developers could use to build integrations with the BeeWise platform.

In practice, this meant that when a customer walked into a store (eg: Starbucks) and bought something, they would get a notification on their BeeWise app letting them know if they had qualified for a discount or earned a voucher or some cashback on their purchase. The customer could then claim these ‘Merchant Funded Rewards’ using their BeeWise app. They could even withdraw these benefits to a third party wallet or payment app. This feature - called the BeeWise ‘Savings’ Wallet - was made available to over 8000 online and offline merchants across India for any transaction made via a debit or credit card. Thus, they built a “frictionless way for merchants to acquire and incentivise users based on their financial data”.

In less than a year, the BeeWise app had been downloaded over 100k times, having processed more than five million transactions worth ~$500 million. The team recognised that they were sitting on transaction data that could be packaged in a way that was incredibly valuable to providers of financial services via their SDK. To capitalise on this, the team also built a backend engine that generated a credit score for users based on their financial activity.

This would mark the start of a multi-year mission across different products, companies and continents to apply digital ingenuity in the hopes of helping everyday users gain access to financial products that would have been otherwise out of reach for “conventionally ineligible” customers.

Fintech Inside

India is a notoriously credit starved market. More than 160 million Indians are underserved today, with only 22% of India’s population considered ‘credit served’. Those numbers were worse off by several magnitudes even just five years ago. One of the main reasons for the credit gap is the fact that a large chunk of India’s population lacks a credit history, or any ability to pledge personal collateral towards a loan. This makes it economically unviable for traditional lenders to acquire and service small-ticket customers. This is also why we witnessed an explosion of fintech lenders enter the Indian market in the 2010s seeking to tap into alternate data sources and digital channels to underwrite new-to-credit customers.

Back in 2016, the BeeWise team realised that traditional financial services players could use the raw transaction data captured on their platform along with their proprietary underwriting engine to source new leads for financial products like loans, stock trading, insurance etc. They developed this underwriting engine as an independent software product, and marketed it to financial services companies. “We were able to charge a subscription fee to fintech startups and financial institutions to basically use our credit scoring mechanism as a preliminary filter to create a pool of potential new customers,” recalls Siddharth.

A free expense tracker proved to be a great hook as a lead generator to upselling high-margin financial services. A similar playbook is being used today by a number of Indian fintech startups, including the likes of Khatabook, Vyapar, Dukaan, Flobiz, and others. In late 2016, the BeeWise app was acquired by one of the largest FS companies in India - Aditya Birla Money - which had already been using the platform as a source of user acquisition.

And so, a first crack at bat drew to a close with a successful exit.

From the outside looking in, it would have been hard to describe the BeeWise journey as anything other than a success. The team had built a much loved consumer product. On the back of that they’d created two clever enterprise solutions. At its peak the BeeWise platform had processed more than 100 million transactions. But by the time they exited the company, they knew they’d hit a ceiling. Siddharth admitted that:

“We felt by the end that we had taken BeeWise as far as we could. On the enterprise side there were some natural bottlenecks. We realised that banks and fintechs were hesitant to pay a subscription fee to an external provider for a service that was so crucial to their operations (i.e. credit scoring). We also found at the time that some merchants didn’t want to have a third party governing their relationship with their customers. Even generally speaking, expense management tools like ours (or like Walnut, Moneyview and others) eventually run into a retention problem. Once users understand their spending patterns they tend to lose interest.

The real challenge is inserting yourself into the lifestyle of consumers and continuing to provide value in different ways. The only way to become churn-proof is by embedding yourself into the money flow. Either you need to be able to offer financial products and services yourself. Or you need to be a regulated entity that sits at the source of user funds. Or you need to become part of the payments value chain, with complete visibility and influence over transactional spends.”

In an ideal world, they would have just started their own bank. But in India it is virtually impossible for new players to get a banking license. It takes a significant capital outlay, a credible track record of business, and a ton of time spent manoeuvring the regulatory maze that represents the Indian banking system. The next best option was to build a digital product that mimicked all the functionalities of a bank - without a bank license - and to do it in a digital setting. This type of offering has since become colloquially known as a ‘neo’ bank or a challenger bank.

A Nuo Adventure

“Banking is necessary, banks are not” - Bill Gates (1994)

For those of you who aren’t fintech nerds that live and breathe this stuff, a neobank is just a fancy name for a company that offers a suite of banking and financial services in a digital setting. They are unregulated entities in most cases, and can operate in a more efficient manner without the ponderous compliance costs and responsibilities faced by regulated institutions. They take advantage of the operational cost savings resulting from an absence of physical branches, passing on those benefits to customers in the form of products like zero-fee credit cards, zero-commission stock trading, zero-commission forex transactions, current accounts without minimum balance requirements, saving accounts with a higher annual return, etc.

Neobanks also promise a slick digital interface and user experience that is seen as an upgrade to the oft clunky digital offerings from traditional banks. Their branding is colourful and modern, designed keeping in mind the need to appeal to a younger customer base. They often position themselves as a cross between a financial product and a lifestyle product - like digital assistants that give you recommendations on how to spend, save and invest your money. They are tailor-made for users that are looking for a digitally native way to manage their finances (and those for whom waiting in line at a bank would represent a tepid form of modern torture).

Neobanks mushroomed all around the world in the 2010s as consumers increasingly began using their smartphones as the primary tool to manage their money. The global neobanking industry grew to a market size of USD 45 billion in 2021 and it is estimated to continue growing at a CAGR of over 45% from 2022 to 2028. Many of these startups have grown to become heavyweights in their local economies. Companies like Nubank (Brazil), Monzo (UK), Revolut (EU) and Chime (US) have attained multi-billion dollar valuations in recent years and eaten into the market share of traditional financial institutions. Some banks, like Goldman Sachs (Marcus) or Kotak Mahindra (811) have even launched their own independent neobank offerings to appeal to younger, digitally native customers. Some, like Monzo (UK), Varo (US) N26 (EU), and Nubank (Brazil), have gone on to become fully licensed commercial banks.

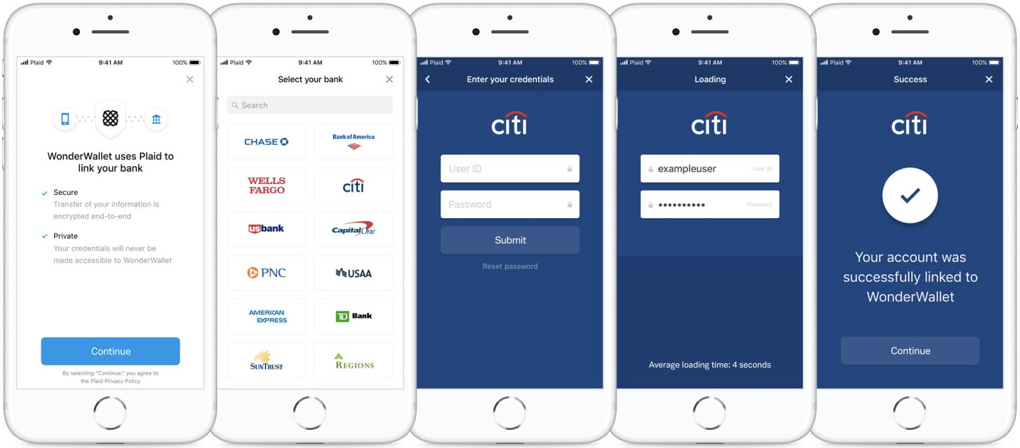

In early 2018 neobanks were still a novel concept outside of the US, UK, and EU. There certainly weren’t any trailblazers that had made a significant dent in the India market yet. For Juno, going the neobank route was also the fastest route to building a fintech offering for Indian consumers. Thats because, in most cases, a neobank is just a digital wrapper placed around a traditional bank. It is a way for new teams to offer digital banking experiences without needing a banking license or regulatory approval. These arrangements typically take the form of partnerships between regulated entities and young startups. The startup will build the mobile application, design the offerings, and craft the user interface. The bank will sit underneath, effectively ‘lending’ its regulatory status to the application behind the scenes.

For instance, Jupiter, a leading Indian neobank, has a partnership with Federal Bank, a publicly traded commercial bank in India. When users create a new account with Jupiter, they’re really creating a bank account with Federal. Jupiter builds the application and provides the user interface. They offer neat features like spending analytics, wealth management, gamified savings, 1% cashback on card spends, among others. The relationship with Federal also allows Jupiter to issue Visa debit cards to its customers (with Jupiter’s branding). As far as users are concerned, they are customers of Jupiter. Federal is happy to use the startup as a marketing channel to increase their account openings and customer deposits. Jupiter gets to cultivate a long term financial relationship with younger customers and leverage different products to generate revenue (eg: taking a percentage of the fees on card spends).

In late 2017, the former BeeWise team decided that a neobank would be their next move. Siddharth recalled that:

“Starting a neobank would give us a birds eye view of a customer’s financial activity. We could analyse this data and provide sophisticated services on the back of that. To start off, we wanted to use this data to help users get access to loans against the future value of their monthly salary payments”.

So they picked out a name - NuoFox - and began searching for the right banking partner to fuel their neobank adventure. Here, its worth understanding how these partnerships work to help contextualise Juno’s future strategy and product rationale.

So bear with me through a little detour.

The Open Era

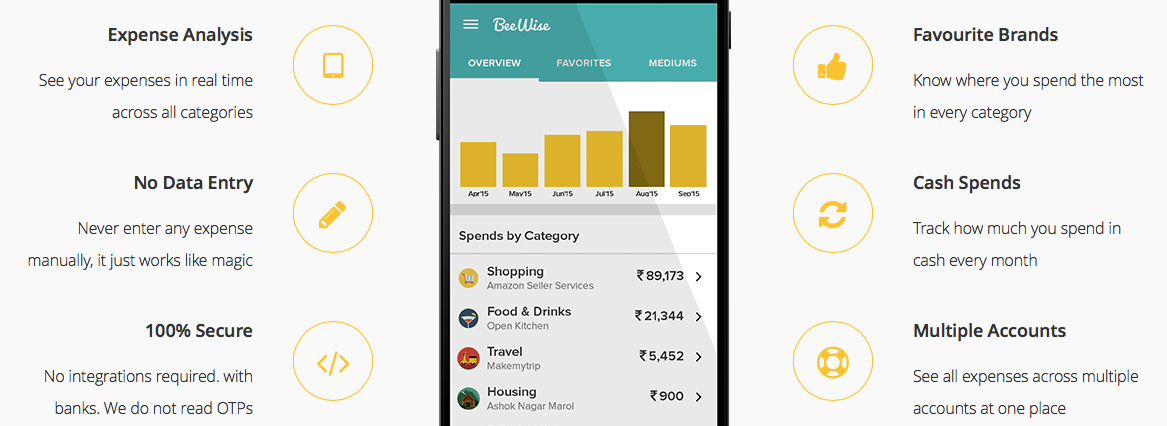

Starting in the mid-2010s, the neobanking era of fintech has been catalysed by a trend known as Open Banking or API Banking.

For the uninitiated, an API (Application Programming Interface) is a piece of software that allows two applications to communicate with one another. APIs are like connective tissue that glue together different software components, allowing them to seamlessly exchange data between each other. They are important building blocks in modern software development because they allow developers to easily build integrations with third party software and hardware providers. By using APIs to connect with existing tools and platforms, engineers can also save the time and effort involved in developing certain functionalities from scratch.

For example, Uber doesn’t need to undertake the mammoth task of building out their own mapping capabilities because they can just connect to Google Maps’ public API instead, giving them access to Google’s best-in-class mapping services. Google already did the hard work required to create a digital map of the Earth. Now they let companies like Uber tap into this capability via an API that lets them support a variety of commercial use cases. The likes of Uber can use this API (via a few lines of code) to integrate Google Maps directly within the Uber app. This allows them to provide the best possible location data for their drivers and riders (and helps Google generate a sizeable recurring fee in turn).

Another prominent examples of APIs we use on a regular basis is when you get the option to log into a new website using Facebook/Twitter/Google. Websites use the APIs from major social media platforms as a convenient way to authenticate the identity of users. APIs are how travel booking websites get up to date flight timings and prices from airlines. Anytime you see a ‘Pay with PayPal’ option on a website it means that website has integrated the PayPal API. Today, merchants and enterprises can use APIs from specialised API companies like Stripe (payments), Twilio (messaging), Onfido (identity verification), and others to easily embed sophisticated features within their websites and applications.

APIs are the digital capillaries that orchestrate the fluid movement of data within the software applications we use today. Perhaps unbeknownst to the average consumer, they’ve also become central to the digitisation of our financial lives. Modern fintech applications (savings and budgeting tools, payment apps etc) use APIs to connect with your bank account. This means they can access real-time information on your account details, bank balances, transactions, and other financial data. These apps use this data to offer consumers new products like account aggregation, personal finance management, instant credit underwriting, bespoke rewards etc, that are typically outside the technical wheelhouse of old-school financial institutions.

Since 2015, various regulatory regimes around the world have advocated for the ‘opening up’ of banking systems via APIs in order to spur competition and innovation within their local markets. These programmes may have different names - Open Banking in the UK, Open Finance in Brazil, DEPA in India, FDPS in Singapore, PSD2 in Europe - but their mandates are roughly the same. They compel regulated financial entities to create an API layer on top of their core banking systems that lets third parties easily access the financial data of their customers. This data sharing is typically predicated on obtaining customer consent. At their core, these measures are designed to enable data portability, restoring the control and ownership of financial data back to individual consumers.

Most of these initiatives were introduced in the US and EU in the wake of the 2008 financial crisis as a way to shake up the banking status quo in the West. Regulators sought to induce competition for incumbent banks who had abused their privileged position as licensed financial service providers. In some ways this was a crude alternative to just doling out a slew of fresh bank licenses to new market entrants. Instead, third parties and startups could now access the same consumer data as banks, theoretically placing them on even footing. They could leverage their nimbleness and technical nous to offer customers a higher standard (and range) of services. Consumers could choose from a near infinite buffet of financial providers instead of a limited menu of chartered banks. Banks in turn faced the prospect of receding into the background as commoditised data providers if they didn’t up their game.

Open banking was responsible for a tidal wave of fintech innovation in the 2010s. Not only were startups launching to build new consumer products, but multiple companies emerged that sought to sit in the middle of the open banking highways, helping to build the bridges between banks and fintechs. These companies are commonly referred to as ‘fintech infrastructure providers’. They help banks and other traditional financial institutions develop their API capabilities.

Because banks still use a mish-mash of archaic legacy systems with clunky architectures, they need technical assistance from companies like Plaid (US), Tink (EU), and Setu (India) to build a usable API layer that third parties can connect with. These companies abstract away the complexity of dealing with ancient banking infrastructure and provide developers with off-the-shelf APIs to build new products. A prospective fintech startup today doesn’t even need to approach individual banks to form partnerships for account linking. They can just go to one of these infrastructure providers that maintain ready API libraries for use cases like neobanking, credit card programmes, account opening, payment initiation etc.

The modularisation of finance via APIs has been a line in the sand as far as global fintech innovation is concerned. This new paradigm was punctuated by Visa’s offer to buy Plaid for $5.3 billion in January 2020 (a deal that was eventually blocked by the US Department of Justice on anti-competitive grounds). It demonstrated how essential it was to own prime real estate on the new boulevards of modern finance.

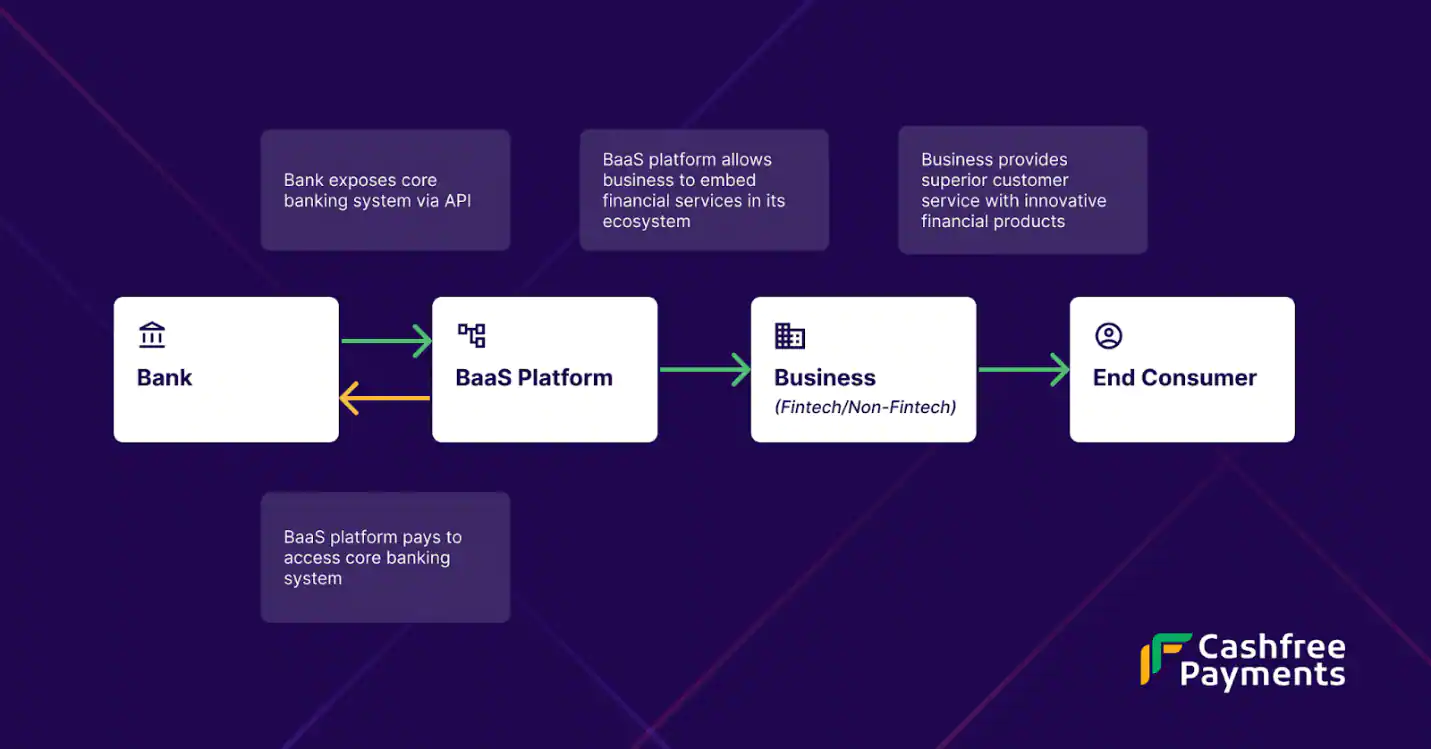

We’ve transitioned from an era of banking to one of Banking-as-a-Service (BaaS), where any app/platform/marketplace can become a financial services company by embedding the right APIs into their product or platform. The global BaaS market was valued at $2.5 billion in 2020, projecting to reach a market size of $12.2 billion by 2031.

Today there is a bustling BaaS ecosystem across the globe. There are specialist players providing the infrastructure (i.e. APIs) to support every use case from Payments (eg: Stripe, Razorpay), Card Programmes (Marqueta, M2P), Core Banking (Mambu, Zeta), Lending (Rupifi, Klarna), and anything else you can dream up. Big banks (eg: ICICI, RBL, Federal Bank) are now proactive in their outreach to startups and eager to form new partnerships that would expand their account coverage and total deposits. They also see banking infrastructure as a new potential revenue stream, being able to charge third parties for access to their APIs.

In India in early 2018, however, the BaaS party hadn’t really kicked off yet.

From Plan A to Plan B(itcoin)

“We will either find a way, or make one” - General Hannibal of Carthage

Today its become common for most major financial institutions to maintain up-to-date API libraries as a form of digital hygiene. To some extent, this has been prompted by a need to comply with regulatory requirements around data sharing and competition in financial services. However, the savviest banks have also understood that API-readiness can be a source of competitive advantage - it means that you become the first port of call for startups (fintech or otherwise) that want to launch digital banking products.

But in early 2018, when the NuoFox team was shopping around for the right bank partner for their neobank venture, they were confronted by an ecosystem that hadn’t gotten its act together yet. After a round of conversations with all the private banks in India, they found two major banks that were keen to support their product. Siddharth recounted how:

“The application had been built. We were ready to go. The only thing left to do was stitch together the banking APIs. But when it came time to integrate, the banks began to drag their feet. We realised that the infrastructure just wasn’t ready.”

Instead of being derailed by the news, they saw an opportunity.

“We knew that there was a huge plumbing issue when it came to banking infrastructure in India. We realised that we had two options. Either we try and solve this problem ourselves, helping the banks to develop their API capabilities. Or, we reduce our dependence on banks entirely.

At the end of the day, a bank is just a marketplace for borrowers and lenders. We wanted to explore if it was possible to build the same marketplace without banks.

The answer was yes, and the answer was crypto.”

The early days of NuoFox had coincided with the last dregs of the 2017-18 crypto bubble. The price of a single bitcoin had risen from under $1000 at the start of 2017 to almost $20000 by year end. The intervening 12 months had seen crypto enter the mainstream spotlight. News networks began wall to wall coverage of crypto market movements. Corporations began tinkering with distributed ledger technology. Regulators realised they had to devote significant resources to understanding this new frontier. Entrepreneurs were invoking the spectre of decentralisation to raise silly sums of money in support of questionable business ideas. And all your hip friends strangely began using ‘blockchain’ as part of their daily vocabulary.

Like many other curious minds working in tech at the time, the NuoFox team had one eye on the affairs of the crypto world. Siddharth recalled that:

“Crypto seemed like the solution to building a financial product without any dependence on a centralised intermediary. It was also a solution set that was designed for a global market by default.”

Varun added:

“We were still obsessed with solving the problem of credit for retail customers. Crypto allowed us to think of this problem without the restriction of borders. Building a product on a global scale using a blockchain platform like Ethereum meant that we could help match borrowers and lenders from around the world in a mutually beneficial way. For the most part, lending was still a localised activity within individual countries, which meant that credit terms were dictated by the monetary policy of individual central banks. We saw an obvious arbitrage that was waiting to be exploited.

For example, consumers in the US, Japan and Europe were basically getting a zero percent return on the savings in their back accounts. On the other hand you had countries like India and Indonesia where retail loans could cost a borrower 12-40% in interest payments. If you could bring these two segments together you could help one set of people generate a higher yield on their savings while lowering the borrowing costs for the other.

The vision for NuoFox morphed into a new experiment to see if this emerging crypto toolset could be used to build a global marketplace for credit.

And so the idea for Nuo.Network was born.

But first, another little detour.

Going Bankless

Often lost amidst the cacophony of frenetic price movements, brazen scams and feverish hyperbole, is crypto’s original stated purpose - to build global systems of value transfer that can function without the need for traditional intermediaries which can often be inefficient, omnipotent, extractive, and sometimes irrelevant in the digital age. This mandate has been stretched and pulled in various directions over the last decade, which makes it easy to forget how we got here.

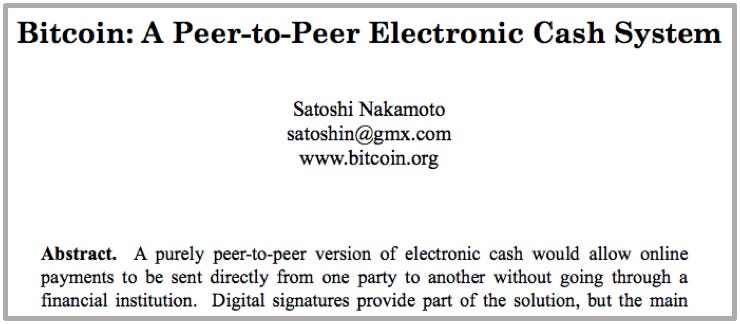

When Satoshi Nakamoto first laid out the blueprint for Bitcoin in late 2008, he envisioned a monetary system for the Internet age that would be outside the control of any central authority. In the digital era, all information is ultimately reduced to 1s and 0s. Communication is represented by bits of data flowing through cyberspace. Satoshi theorised that the process of sending a digital payment over the Internet should be no different than the process of sending a message over the Internet - i.e. instant and virtually free. The notion of a cross-border payment makes as much sense as a cross-border email or a cross-border instagram post.

The issue was that we still relied on arcane bank systems, national clearing houses, and expensive payment networks to transact across physical boundaries. We hadn’t yet harnessed this global system of communication to solve the problem of moving money around the world. The time and costs we associate with traditional payment systems is the price we pay to financial intermediaries like banks and payment networks (eg: Visa and Mastercard) to secure these systems, to make sure that things run smoothly, and to mitigate against the counter-party risk that arises from a lack of trust between transacting entities.

The innovation that Satoshi introduced with Bitcoin was an accounting system (called a blockchain) that could keep an accurate record of account balances and transactions occurring on this network. Each participant on this network could maintain their own synchronous copy of the Bitcoin ledger, removing the need for central record keeping. By cleverly melding the principles of cryptography and game theory, Bitcoin could incentivise network participants to maintain an accurate record of network activity themselves, without the need for additional traffic cops.

The rules of the Bitcoin network would be embedded in its code base, designed to execute automatically as long as participants abided by the prescribed conditions. This digital agreement - known as a ‘smart contract’ - doesn’t need any external accountants, auditors or lawyers to enforce. It substitutes a trust in people with a trust in the underlying code. Satoshi’s payment network also made use of a native currency called bitcoin, whose value fluctuates with the whims of a free market.

In the 13 years since Bitcoin’s launch, an entire ‘crypto’ ecosystem has emerged around blockchain technology. The constituent nuts and bolts that allow Bitcoin to work as a decentralised monetary system have been repurposed to fit a variety of use cases beyond ‘money’. We now have general purpose blockchain platforms like Ethereum and Solana that allow developers to spin up their own smart contracts for various decentralised applications (Dapps). These programs are borderless, transparent, and available for anyone to access without permissions. They make use of cryptographic assets called tokens (similar to Bitcoin) that can be used to represent anything from plots of virtual land, to insurance contracts, to units of computing power, to shares in a company, and so on.

You can think of blockchain platforms as public utilities for citizens of the Internet. They aren’t owned by any single person or institution. They exist outside the traditional jurisdiction of governments and regulators, theoretically free from the influence and censorship of central authorities. They allow anyone with an Internet connection to design software applications for a global audience. When designed correctly, blockchains open up new commercial possibilities for entrepreneurs because they obviate the administrative time and costs involved in central mediation. They allow us to reimagine conventional value chains.

Siddharth, Varun and Ratnesh identified this potential too. They said that:

“In 2017, most people were just using blockchain platforms to raise money for speculative ideas via Initial Coin Offerings. But we saw the potential of smart contracts to create a platform that could facilitate borrowing and lending for retail customers. It was an alternate route to building a global bank without relying on legacy fintech infrastructure.”

So in early 2018, against the backdrop of a collapsing crypto market, the team commenced building.

New Lipstick, New Pig

In order to build their bank of the future, the team had to reconfigure the plumbing that underpins conventional capital markets. Ethereum allowed them to bypass the antiquated machinery (the rules, regulations and rates) used by

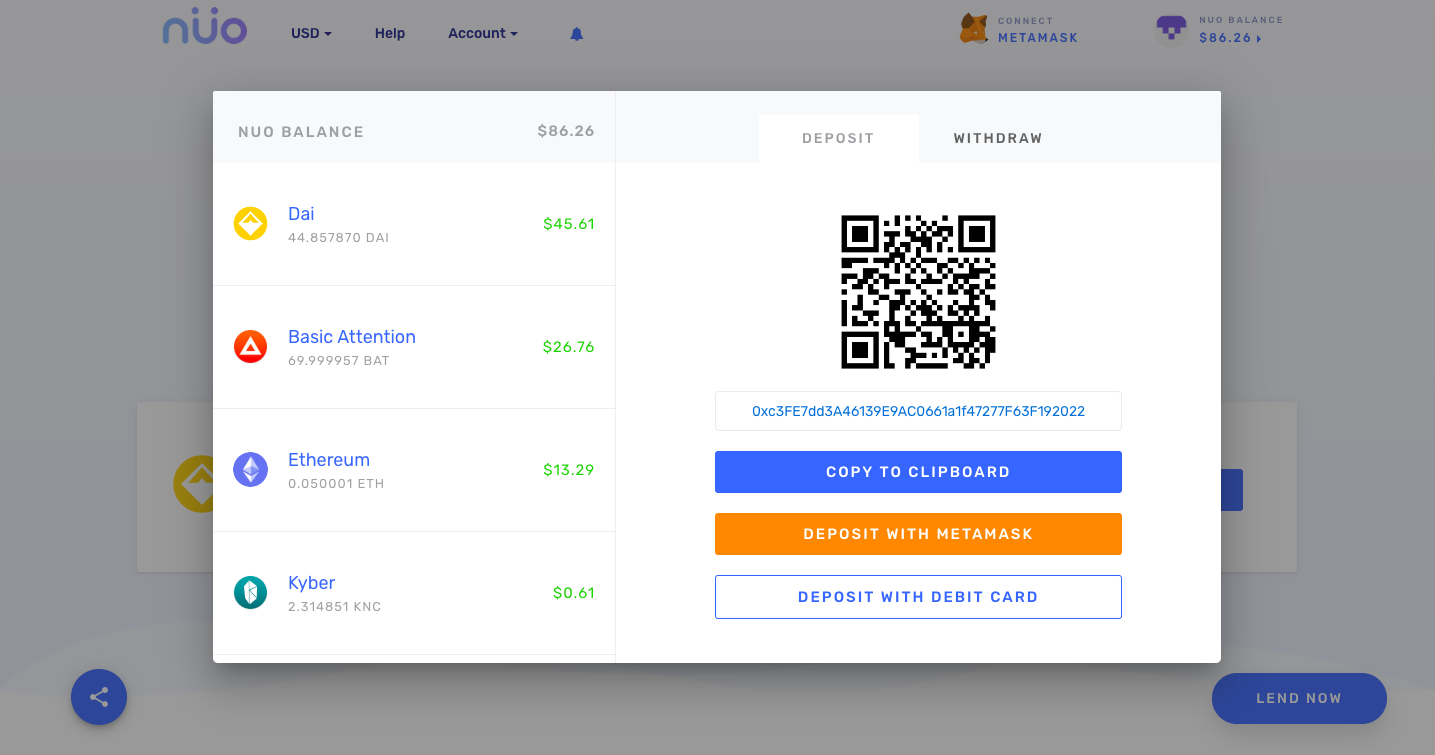

First, they launched a smartphone app called Nuo in March 2018 which offered a wallet where users could manage their cryptocurrency portfolios. The app was intended to be the slick front end for all the complex crypto services they facilitated behind the scenes. The real magic, however, happened back stage. The north star for the team was in crafting a protocol on the Ethereum blockchain (called Nuo.Network) that could orchestrate the borrowing and lending of crypto assets. Here’s the English translation of that sentence:

The team essentially prescribed the rules that should govern a lending marketplace; embedded those rules into code; and executed this programme as a ‘smart contract’ on the Ethereum blockchain. It meant that anyone in the world with an Internet connection could use Nuo.Network to borrow and lend their crypto assets. They didn’t need the permission of a central authority to do so. They didn’t even need to personally know who they were transacting with. A user could create an application for a crypto loan and the programme would match that with a user who wanted to lend out their crypto with the same specifications (amount, time period, collateral required etc). The protocol could even ‘lock up’ the collateral for safekeeping and liquidate it if the value fell below the amount of the loan (similar to how banks today carry out margin calls). The smart contract would see to it that the conditions were carried out as specified, without the need for any human involvement in the process.

In a fully realised end state, the Nuo app would be the pretty wrapper on top of Nuo.Network, allowing users to earn yield on their crypto holdings by algorithmically lending out these assets to crypto borrowers around the world. So while innovation in fintech was limited to using open banking to connect with the old rails of finance, the crypto world was innovating by building new rails entirely.

This is the promise of Decentralised Finance (DeFi). It opens up the possibility of building an entirely new financial system without any human dependencies that is unconstrained by legacy rules, legacy costs, and legacy rails. This system is global, transparent, and autonomous by design. Robert Leshner (the founder of Compound, one of the leading decentralised lending protocols) articulated this on a recent podcast, remarking that:

“At the heart of it the human processes [that you described] are liabilities to the bank and to you. There’s so much room for human error, there’s so much room for fraud. There’s so much room for mistakes to occur when there’s that many people and steps along the way.

The advantages of a financial market being built using smart contracts instead of all of the processes that exist at Wells Fargo means that it’s autonomous and it operates 24/7 and if its built correctly it can run forever without flaws. And this is like the super power of smart contracts in general.

When it gets applied to finance you start to see that a protocol like Compound, it can scale to a hundred times the assets without anything changing. It can process a hundred times as much assets without anything changing. Not a single additional person is needed. In fact no people are needed, at all, for the daily operation of it. And thats really magical. Because it means that you’re able to, over time, have complete confidence in a blockchain-based financial system to not mess up. If it works today on Tuesday it’ll work on Wednesday if nothing has changed. It puts more of the burden on getting things correct up front.”

The chart below from the IMF’s Global Financial Stability Report sums it up nicely:

On the back of their DeFi ambitions, the Nuo team won acceptance into a startup accelerator run by a prominent venture studio named Consensys in San Francisco. Consensys supports projects being built on the Ethereum blockchain. It identifies talented crypto teams and backs them with funding and technical expertise.

The team managed to raise additional funding from a handful of angel investors in India. With a total headcount of 5 people and around $100k of capital to play with, they moved to the West Coast of the United states for the second half of the year.

Direction DeFined

"What the smartest people do on the weekend is what everyone else will do during the week in ten years" - Chris Dixon (a16z) in 2013

San Francisco was a breath of fresh air for the Nuo team. It brought some much needed perspective. While in India the country’s central bank was ramping up its hostility towards crypto entrepreneurs, the denizens of Silicon Valley, on the other hand, provided the encouragement they needed to push on with their mission. Siddharth recounted how:

“In the summer of 2018, everybody in Silicon Valley seemed to be playing around with blockchains. We were exposed to so many different viewpoints that we wouldn’t have had access to in India. There were other major DeFi lending platforms like Compound and MakerDAO that launched around the same time, so we felt like we were on the right track”.

Consensys helped them refine the vision for the product. The biggest change they made was switching their focus from building a mobile-based lending app to building a decentralised web-based platform for enabling crypto credit. They also pivoted from a peer-to-peer model to one based on creating a community-funded pool of reserves from which various crypto assets could be lent out.

Essentially, users that wanted to lend their crypto would deposit their assets into a common liquidity pool from which borrowers could avail of instant loans. They would get paid an interest fee based on their proportionate contribution to the assets in the pool (eg: if I contribute 10 Ether to a pool that has 100 Ether, I’m entitled to 10% of the total interest paid out on Ether-based loans). This is a quicker way of disbursing loans as opposed to a prospective borrower having to wait to be matched with a willing lender, which was a major drawback of the original peer-to-peer construct. This type of model has become par-for-the-course in the world of DeFi. It is used by some of the most prominent DeFi platforms, exchanges and market makers in the crypto ecosystem today (like Compound, Uniswap, AAVE, Curve, and others).

Nuo.Network went live on the Ethereum blockchain in January 2019. Within four weeks of launching, they had facilitated over $100K worth of crypto loans (a figure that would rise to $15 million in just six months along with $20 million in user deposits). When measured by total assets under management (or ‘total value locked’ in the Nuo smart contract) they were the #6 ranked DeFi app in the world just one month after launching (eventually making it to the top #3 at their peak). The team didn’t spend a single dime on marketing the product. Their traction was purely organic, and gave them a clear sign that they were encircling the hallowed ground of product-market fit.

True to form, one of the main reasons for their immediate traction was the sheer amount of thought they put in to making the product easy to digest for the average crypto user. Right from the start they wanted to appeal to a mainstream audience. For example, users could sign up to the platform with just an email address or by linking their PayPal account, as opposed to needing to know how to use a ‘self-custodied’ crypto wallet like Metamask. They also introduced several innovations to reduce the ‘gas fees’ that a user would have to pay when interacting with the network. Gas fees are essentially the transaction fees you pay when using blockchain platforms like Ethereum. For new-to-crypto users, these fees can often be prohibitive and confusing, so the Nuo team sought to make their UX a little less esoteric for crypto newbies.

Nuo were also able to integrate with ‘crypto-as-a-service’ providers like Wyre, a startup that aimed to build bridges between traditional and decentralised finance. Wyre is one of the pioneers in an emerging class of companies that want to help enterprises plug-in crypto capabilities into their existing commercial offerings. Their objective is to remove the technical and regulatory barriers between the worlds of fiat currencies and crypto currencies. For blockchain startups like Nuo, Wyre allowed them to offer their users the ability to link their debit cards to the platform. It was an easy way to ‘on-ramp’ new users into DeFi. This arrangement allowed users to seamlessly convert the USD in their bank account into a crypto token called USDC, which could then be lent out as a way to generate a higher return on their savings than they would get from their banks.

USDC is a leading example of a stablecoin, a class of cryptocurrencies whose value is pegged to the price of prevailing fiat currencies (typically the US Dollar). Every unit of USDC is backed by an actual dollar sitting in a bank account managed by a regulated entity named Circle. Each USDC token can be redeemed for an equivalent amount of US dollars at any time, per Circle’s guarantee. USDC, then, is just a different flavour of a US dollar. Its like a dollar that lives on a blockchain, which allows it to embody the features of other crypto assets (borderless rails, programmable, applicability in DeFi etc) without any of the volatility. Stablecoins help to mitigate against the problem of using crypto assets to make payments. In many ways they’re the gateway drug for individuals and institutions that want to dip their toes into the crypto world.

Nuo.Network had been successful in carving out a share of the global DeFi market. They had proven that traditionally complex banking operations could be both decentralised and automated, and that users were ambivalent towards the choice of infrastructure they were using as long as it helped them achieve their objectives.

As an Indian company attempting to build a consumer tech solution for a global audience (before testing the waters domestically), the Nuo team was writing its own playbook. They were helping to install streetlights on a road less travelled.

But operating a complex crypto protocol wasn’t necessarily what they set out to do. They wanted to build beautiful consumer products. Operating a protocol was more about managing processes than solving consumer problems. It was more about identifying the right building blocks, than putting it all together. It was like building the machine than built the machines.

To get back to their original course, they passed through one final pitstop.

Surging to Product-Market Fit

On the back of their progress with Nuo.Network, the team was accepted into the inaugural cohort of Surge, an accelerator for early stage startups in India & Southeast Asia created by Sequoia Capital.

Surge gave them the opportunity to parley with some of the brightest minds in India’s tech ecosystem, including Sequoia’s top brass of startup wizards. Varun recalled how:

“Surge helped us understand how to build a company, and not just how to build a product. Conversations with Rajan, Shailendra, Prateek, Rishen, and others helped to refine our thinking. Before Surge we were obsessed with big problems and complex solutions. After Surge we started thinking about big markets and simple solutions. Its not that we were scared of tackling hard problems. But we realised that the maximum value creation happens when you try to solve problems that have an infinite time horizon and a large Total Addressable Market (TAM).

By this point the team had the luxury of being able to pick between a number of potential future directions. They now had a clear sense of their own strengths and weaknesses. They were also in possession of several valuable insights about their chosen domain that had been gleaned from their experience with Nuo. They knew, for instance, that:

They didn’t want to launch their own proprietary ‘Nuo’ token. It was trendy at the time for Defi platforms to launch their own tokens as a means of incentivising and rewarding their users. In 2017, token sales had emerged as an alternate route for blockchain projects to raise money without having to go through traditional institutional sources of funding. It was an approach taken by several of their peers at the time. Although launching a token was a quick and lucrative way to fill their coffers, it would have shackled them to a path of regulatory nomadism. Token sales have been frequently chastised by regulators as a violation of prevailing securities laws and a means of circumventing capital controls. (“We decided to avoid doing a token if it meant we could sleep peacefully knowing that our operation wouldn’t be banned by governments overnight.”)

They wanted to operate a product, not a protocol. At the time it was expensive and inefficient to use the Ethereum blockchain (today there are several solutions aimed at tackling this issue). They had to rely on a number of hacks to overcome this hindrance, but still ending up footing the gas bill for their users in most cases. They also had to bear the cost of price slippage that resulted from not being able to match borrowers and lenders in a timely manner. (“We were already building a new version of the platform that optimised gas fees, but we realised this was taking us further and further away from our real goal of solving the everyday financial problems faced by people around the world.”)

They wanted to exist in harmony with prevailing regulations (“We thought that our best chance of impacting the lives of people would be by bringing together the best parts of traditional and decentralised finance. It was important to find a middle ground that was on the right side of regulation. A regulated offering would let us appeal to a wider customer base. It was a surer way to build a sustainable company that could survive long term.”)

They had stumbled upon their target market - the United States (“While analysing the IP addresses of users on Nuo.Network, we realised that 70-80% of of our users were from the United States. They were using Nuo to generate yield on their savings. Given that the prevailing savings rate offered by US banks was almost literally 0%, we realised that crypto could solve a problem for US citizens that neither banks nor fintech startups had an answer for.”)

The team exited Surge having raised $3 million in a seed round for their new venture led by Polychain Capital and Sequoia Capital. The round also saw participation from Dragonfly Capital, Consensys Labs, Astarc Ventures, Singapore Angel Network and prominent angel investors including Amrish Rau (CEO, Pine Labs), Jitendra Gupta (CEO, Jupiter), Nitin Sharma (Antler India), Balaji S. Srinivasan (Ex-CTO, Coinbase), Salil Deshpande (ex-MD, Bain Capital Ventures), among others.

The mandate this time was clear - to build a neobank that would give users the ultimate toolset to manage their finances, allowing them to hop between traditional and crypto rails to find the best way to save, spend, and invest their money. Their aim was to roll this out in different jurisdictions by partnering with local banks and infrastructure providers. They would start with the United States.

The original plan when they were first conceptualising the product was to build this neobank on top of the existing Nuo.Network. This would allow them to offer their customers an ability to earn a higher interest (5.5%) on the portion of their savings they held in USDC. However that plan was eventually shelved. The team gradually sunsetted Nuo.Network in December 2020 in order to focus full time on the new product. Instead of building the underlying rails themselves, they would leverage an existing ecosystem of players (public blockchains, DeFi platforms, bank partners, fintech infrastructure providers etc) to assemble the building blocks for their neobank.

Customers in the US would no longer have to rely directly on legacy banks or indirectly on legacy banking infrastructure. They could now #BankOnJuno.

What is Juno?

By their estimation, the team actually cycled through 12 different iterations before settling on their most recent avatar. Each of the founders, along with their Head of Product Swaminathan Jayaraman, conducted more than 200 user interviews to understand the needs of bank customers in the US before crafting the initial product.

They originally went to market in November 2020 with a simple proposition (and a playful launch video that took aim at incumbent banks).

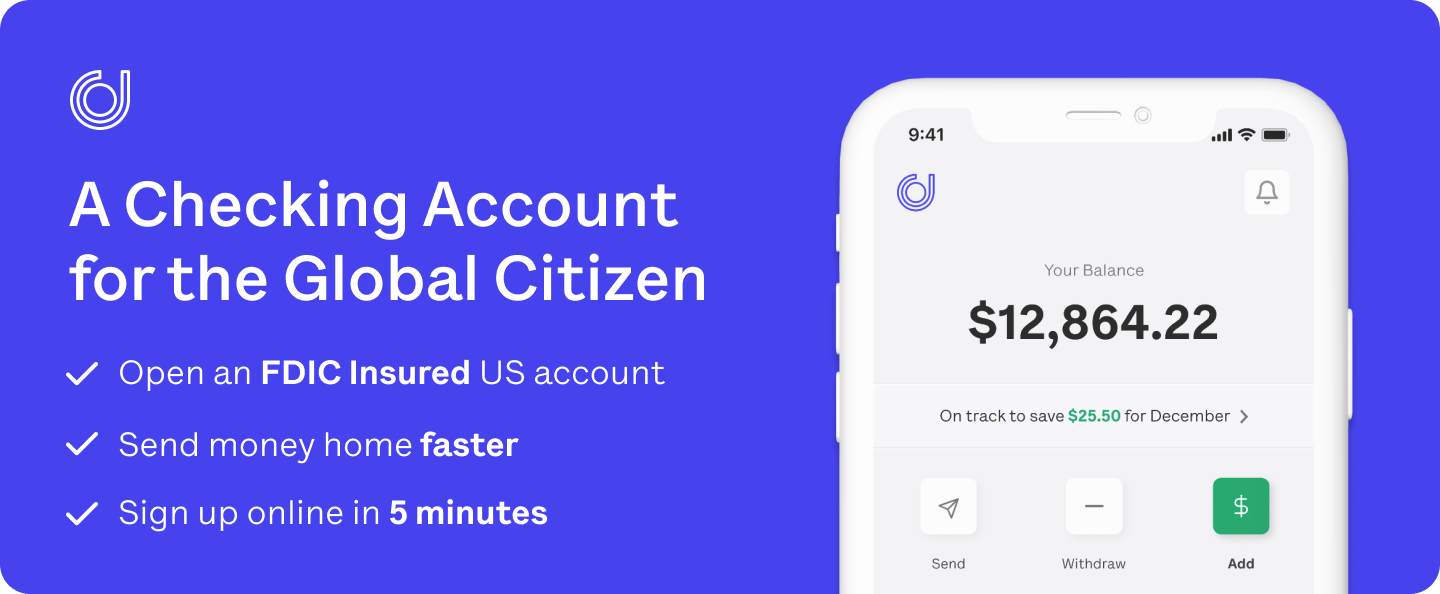

Their initial aim was to offer US customers ‘The Most Powerful Checking Account’ in the market. The Juno app (then named ‘OnJuno’) allowed people to:

- Create an FDIC-insured bank account and get approved in under 5 minutes

- Generate 2.5% interest p.a. on their deposits

- Withdraw their money anytime with no penalties

- Order a metal debit card (or generate a virtual debit card) powered by Mastercard

- Get 5% Cash back on all popular brands like Netflix, Amazon and Uber

- Easily manage their subscriptions

It was essentially a cash account (i.e. a current account) that offered an interest rate that was 200-250X higher than any bank in the US was offering even on a savings account. They had a slick mobile app. Their account didn’t require any minimum balance. They promised no hidden fees. It was neobanking 101.

There was no mention of crypto in their early messaging because they didn’t want to alienate users that weren’t already familiar with the space. In fact, for a short period they were mainly targeting Indian and Asian immigrants living in the US that weren’t getting what they needed from existing banking providers. Juno catered to this segment by partnering with fintech company Wise (formerly TransferWise) to enable cheaper and faster remittances from directly within the OnJuno app so these individuals could send money back to their loved in their home countries. (“In hindsight, trying to build an immigrant-focused bank was ultimately a distraction,” admitted Siddharth).

That positioning would soon change. In August 2021, the team finally showed their hand with regards to their crypto ambitions. They introduced a new proposition.

While it has become fashionable for neobanks and fintech apps to offer crypto trading to their users as a way to increase revenues and user engagement, the Juno team wanted to be more thoughtful in how they presented this new domain to their customers. Varun explained to me that:

“If you want to create a massive company in crypto, you have to either create a new financial primitive or vastly improve on an existing primitive. These primitives are specialised domains that give people different entry points to the crypto ecosystem. From 2009-2020 we cycled through three major primitives - Mining, Trading, and Borrowing of crypto assets. We believe that the fourth major primitive will be ‘Earning’. It will be the most important period of widespread crypto adoption because we will move beyond the era of speculation to one of utility. People will earn from crypto in various ways - by generating yield on their savings, by selling NFTs, by playing blockchain games, by contributing to DAOs - and it will expose them to the vast potential of Web3 and decentralised finance.

To carve out a niche for themselves in this new era, Juno introduced a first-of-its-kind mechanism that allowed people to receive a portion of their paychecks in crypto. With this feature, customers can split their monthly salaries into Bitcoin, Ether, USDC, or plain old vanilla USD. They can toggle between how much of their paycheck they want to allocate to each asset, and can change this allocation anytime. They have the option of receiving/storing their crypto assets in their own Juno wallet (integrated within the Juno app) or in an external wallet of their choosing. Juno also lets users buy, sell and swap between select crypto assets at minimal fees. Customers can also freely transfer the crypto from their Juno wallet to an external wallet (and vice versa).

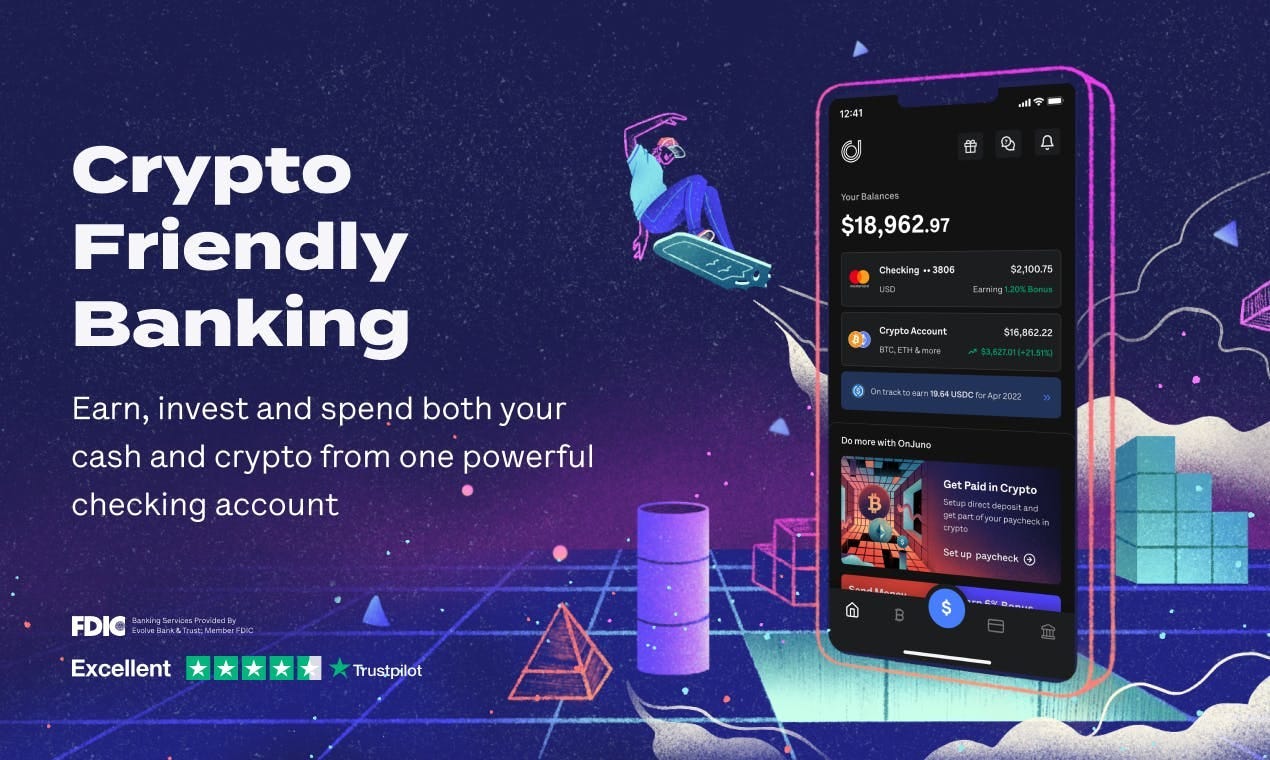

Simple right? Where this gets interesting is in how Juno have blurred the lines between people’s fiat assets and their crypto assets. Juno customers have the option of choosing between USD and USDC when making payments or ATM withdrawals with their Juno Debit Card (powered by Mastercard). It means people can actually use their crypto holdings to meet their day-today expenses as opposed to hoarding them away in a wallet that is disconnected from the ‘real’ world. By holding their deposits in crypto, they can avail of the benefits that come with DeFi. For example, Juno offered a 6% APY on the USDC holdings of their users via the crypto capital markets (vs 1.2% APY on USD that was constrained by prevailing central bank monetary policy). This feature has been recently paused as a precautionary measure to protect user funds from the delinquency risks of Defi lending (more on this in a bit).

How does Juno work? The cleverness of their offering is in how they’ve stitched together different money legos to create a crypto-infused neobank. Under the hood Juno have partnered with a local bank named Evolve Bank & Trust to provide checking accounts to their users. Evolve has an existing arrangement with Mastercard to enable the settlement of card transactions in USDC. This means that in the eyes of Evolve and Mastercard there isn’t a real difference between USD and USDC when it comes to customer funds, a view that has been blessed by the Office of the Comptroller of the Currency (OCC) which regulates national banks in the US. Juno can offer seamless financial services at the intersection of crypto and fiat (card payments, withdrawals, crypto cashbacks, paycheck conversions, buying/selling crypto without fees, instant settlement etc) because both the USD and USDC balances of customers are held on the books of Evolve. There’s no settlement involved because all the money is just moving in-house within the same bank. The USDC is custodied by leading crypto custodian Bitgo, but it ultimately exists within the canopy of Evolve.

Juno also uses a Payroll API provider named Argyle which lets users to set up direct deposits of their monthly paychecks into their Juno checking accounts. They use a BaaS provider called Synapse that gives users the ability to split their paychecks into different currencies. And they work with crypto-as-a-service companies like Wyre (and others) to build bridges with the blockchain world, for buying and selling of crypto as well as interacting with Defi lending platforms and liquidity pools like Compound (a functionality that has been recently paused, as mentioned earlier).

Over the last 12 months, Juno has transitioned from being a superior general-purpose checking account into a bank for people that want to live crypto-native lives. It is the first company to connect banking and crypto within the same interface. They’ve doubled down on this mission, introducing features that allow users to connect their checking account with ‘Layer-2’ blockchains like Artbitrum, Optimism and Polygon for quicker and cheaper transactions. They’ve also introduced ‘Juno Pay’ that lets third party wallets use Juno’s platform to facilitate buying and selling of crypto using traditional payment channels like debit/credit cards, ACH and bank wires. Most recently they’ve also launched a first-of-its-kind tokenised loyalty programme that is intended to be an upgrade on traditional credit card points.

Varun shared his thoughts on the current Juno positioning, saying that:

“We took the decision to go after people that are super crypto-native. We decided we didn’t want to pitch to new-to-crypto users. It is a much harder sell to convince these people to switch their bank account completely. We are catering to individuals that want to ‘live crypto’ on a day to day basis. They are individuals who might have a material portion of their net worth in crypto. Or they interact with the crypto ecosystem on a day-to-day basis. We want to help them navigate their lifestyles without any hindrance, to transact freely without any friction. This cohort of people might be small today, but one day it won’t be.

We want Juno to be the default on-ramp and off-ramp solution between the fiat and crypto ecosystems. Individual users are already using Juno to instantly spend and ‘cash out’ their crypto assets. They shouldn’t have to wait 3-5 days for settlement or pay 3-5% in fees to move their crypto from their wallets to their bank accounts, which is what typically happens. At the other end of the spectrum, we’re building tools so crypto applications and wallet providers can also use Juno’s infrastructure to facilitate fiat payments on their platforms. We want to be the fastest and cheapest funding mechanism in the market. And we want to operate in a way that is compliant with and beholden to existing regulations”

With any crypto venture there are important trade-offs to consider when designing your product or picking your jurisdiction. The crypto ecosystem exists in a perpetual nautical flux, buffeted by tailwinds and headwinds alike. Juno is well positioned to go the distance, but the journey ahead won’t necessarily be smooth sailing.

The Good, the Bad, and the Mullet

It is incredibly difficult to build a crypto company that is entirely compliant with existing regulations. Its like trying to build a streaming service that plays by all the rules of the VHS era. These two things weren’t intended to live side by side. Sure, it makes sense to borrow from the lessons of the old world. But the more you try to retrofit your proposition to a bygone era, the more you cap the potency of invention, particularly in the Internet age. Its important then to find the sweet spot between innovation and regulation that leaves room for experimentation.

DeFi in particular emerged as a free market answer to banking policies introduced in the Western world in the aftermath of the 2008 Financial Crisis. Regulators stopped issuing new bank licenses in order to maintain a tighter grip over the banking industry, to prevent another financial collapse at the hands of cavalier operators. Their compromise was to encourage a policy of open banking and third party access to customer data. However this regime insulated incumbent banks from genuine competition, given that they didn’t have to reckon with the muscle of fully licensed competitors. Thats why open banking has also been described as a “coronation disguised as regulation”. Its why fintech is sometimes critiqued as a stop-gap solution.

“All fintech is just updating numbers in somebody else’s database.”

- Sergej Kotliar (CEO, Bitrefill)

DeFi seeks to provoke changes from the ground up, reimagining banking from first principles. It is based on the idea of how money should (or could) move in the Internet age - borderless, permission-less and programmatic. Banks obscure the peer-to-peer nature of finance. They represent an administrative layer on top of financial activity. DeFi (and crypto more broadly) seeks to replace some of this administrative layer with autonomous code. Juno is building a portal to this new domain, exploiting the potential a new design space that’s been playfully labelled as ‘The DeFi Mullet’.

Juno is hardly alone in the Mulletsphere. Their competitors include traditional fintech players (eg: CashApp, Robinhood) as well as crypto companies like Eco, BlockFi and Coinbase, that are giving people an easy way to either earn crypto rewards, spend their crypto easily, or earn yield on their stablecoin holdings by tapping into DeFi markets. In fact, any platform in the US that’s bridging the divide between DeFi and traditional finance by providing ‘on-ramping’ and ‘off-ramping services’ is effectively playing in the same domain as Juno.

“Twenty years ago, “is it an internet company?” was a common question. Today, (almost) every company is an internet company. Ten years ago, “is it a mobile company” was a common but now obsolete question. Similarly, we will soon stop asking “Is it a crypto company?” because most companies – starting with the broader financial services industry – will have a crypto component.”

- Angela Strange (a16z)

The last six months have seen a procession of deep-pocketed names enter the Web3 ring, offering some combination of wallet services and crypto trading as a way to test the market. You could make a reasonable claim that any fintech app or neobank that isn’t taking a serious look at Web3 is running the risk of being left behind. Juno has a headstart, having already done the grunt work to build integrations with the traditional banking world as well as the crypto version. But the beauty of public blockchains means that it doesn’t take much time for someone to catch up. There are no API permissions required in DeFi. Crypto finance is open by default. Competition isn’t so much a technical challenge as much as it’s an act of regulatory endurance…

…which is easier said than done. Today it is especially difficult to build a crypto company in the United States, where an alphabet soup of federal and state agencies is still competing for turf when it comes to crypto regulations. The SEC, OFAC, CFTC, OCC, IRS, and various state bodies each have a legitimate claim (and independent mandates) for overseeing the crypto industry. This is partly due to the difficulty in classifying crypto assets as either securities, commodities, currencies or property.

The Securities and Exchange Commission (SEC) in particular has been quick to the draw, dangling the threat of enforcement over any crypto feature or token that smells like a security. Even industry giants like Coinbase and Blockfi have had to either shut down their yield-generating products or pay massive fines in recent months to avoid collapsing under the hammer of the US justice system. Coinbase employees have also been charged with ‘insider trading’ of crypto tokens in recent weeks, which is indicative of the SEC’s suspicion that a large swarth of crypto assets are just securities in disguise. Its why almost all crypto yield, derivative and margin products have been shuttered in the US. Juno, too, made the decision to de-list certain DeFi tokens on their platform to avoid falling afoul of securities regulations.

To be fair to the SEC, the crypto sector doesn’t always cover itself in glory. For much of 2022, this space has been reeling from the implosion of several major companies like BlockFi, Celsius, Voyager, Stablegains and others who played fast and loose with customer funds. These companies have been endowed with the moniker of ‘CeFi’ - centralised lending companies that tapped into DeFi under the hood. They advertised lucrative returns to US customers that were starving for a way to protect and grow their savings beyond the paltry rates offered by commercial banks. These CeFi companies donned the mask of stability, purporting to safely lend out customer deposits on transparent DeFi platforms, while instead manually redirecting those funds towards disastrous projects or lending them out to disastrous counter-parties. When the market turned for the worse, these CeFi platforms had massive holes in their balance sheets, resulting in huge losses for customers and a loss of faith in DeFi.

‘Yield’ in crypto currently has a bad name (arguably for good reason). The 2022 CeFi crash has provoked an inquiry into the nature of DeFi yields and where they come from. It is this same cautionary ethos that prompted Juno to halt their own yield offering on USDC. If you want access to higher DeFi yield that is market-determined vs negligible yield that is central bank determined, it is reasonable to assume you will be taking on a higher risk. In an ideal world, the robustness of DeFi platforms should ensure that these decentralised credit systems are resistant to traditional collapses. However things start to get hairy when humans get too clever for their own good.

Here its worth pointing out the difference between CeFi and DeFi. The former is made up of companies staffed by humans that made several errors of judgement in how they deployed customer deposits. These people were susceptible to the same cocktail of flaws that has sparked every financial crisis ever - greed, FOMO, short-sightedness and hubris. DeFi, on the other hand, worked as intended through the 2022 CeFi crash. It was transparent and predictable. Liquidations were carried out as per the terms of the underlying smart contracts. Collateral was held captive till loans were repaid. These protocols had no time for funny business, and left no wiggle room for bad actors to exploit. You couldn’t call up developers on the Compound protocol to ask for a few more days to pay back your loan. In fact, loans on the vast majority of DeFi platforms are overcollateralised (at 150% of the loaned amount) for this reason. If the value of the collateral falls below a certain limit, the contract is liquidated and money returned to the lender. All of this is carried out without the need for human intervention. That’s the promise of DeFi.

High yields in crypto naturally comes with a higher risk. People are comfortable paying higher yields because they typically use these funds to amplify their crypto bets in a bull market. When the market turns, the demand for crypto loans typically reduces, which also reduces the yields available on DeFi platforms. There is no FDIC insurance for crypto funds, nor will their be a bailout if these systems go belly up. But DeFi has demonstrated that you can have global capital markets that are 24/7, sophisticated, transparent, and autonomous. It has proven that you can have an entire financial system that will reliably keep humming along even if crypto prices collapse. There are even some major institutions that now trust these DeFi markets enough to use them as a way to protect and grow their treasury reserves.

The tragedy is that most crypto is borrowed today for the sole purpose of further speculating on crypto. We can only begin to really test the merits of decentralised finance once crypto funding can be redirected towards productive economic activity (as is the case in the traditional banking world). Crypto companies like Goldfinch and MoHash are attempting to do just that, but its still early days. Generally speaking, the ‘circularity’ of the crypto economy is one of the most frequent (and valid) criticisms of crypto. Thats why companies like Juno are important infrastructure pieces that are essential to unlocking the usefulness of crypto assets in the real world (and vice versa). As a bridge between crypto and fiat, Juno are already helping their users make productive use of their ‘crypto wealth’ to support their daily expenditure. But they could eventually also help direct customer’s crypto deposits towards genuine economic use cases (beyond helping someone else margin trade), making them an important cog in the global economic machine.

It remains to be seen how regulators in the US eventually choose to build a policy framework around this sector. To some extent, this is the elephant in the room when it comes to Juno’s future success (but in this case the elephant also has a machine gun). Regulators can kill the party whenever they like. They can impose censorship on centralised access points like Juno if they see fit to do so. They can ring-fence certain transactions or products or platforms as illegal. There’s no guarantees with crypto, which is why Juno will always have to be on their toes when it comes to designing certain features and services or offering certain assets and tokens.

The inability of various regulatory bodies to arrive on a consensus definition of crypto is not surprising. ‘Crypto’ is not a monolithic phenomenon. It means many things to many people (just like money means many things to many people). In the last 14 years, this space has become welcome pasture for technologists, capitalists, ideologues, opportunists, and speculators alike. Each of these cohorts has their own reasons and motivations for entering this domain.

Cryptographers and cypherpunks see these systems as essential to safeguarding user privacy in an age of techno-surveillance. Libertarians see bitcoin as an expression of monetary sovereignty, embodying the idea of money that is untethered from state control. Entrepreneurs hope to use blockchain technology to reduce the friction of global value transfer and exploit the resulting opportunities this unleashes (similar to how Internet founders could innovate on the back of a reduced cost of global information transfer). Individuals have turned to crypto in search of an alternate way to protect and grow their wealth. Some people are using stablecoins as a cheaper, faster way to make payments. Retail investors just want to see the number go up.

Each of these groups has its own idea for what crypto ‘should’ be. These visions are sometimes incompatible with one another, with some factions happy to invite progressive regulation and others that think it imperative to keep this world outside the scrupulous hands of traditional authorities. Regardless of someone’s reasons for arriving at the door of Web3, Juno is attempting to be their digital sherpa into the decentralised promised land. It will not be easy to be everything for everyone. The team will have to make tough decisions at every step of the way (that won’t always be well received). They are under no illusions about the scale of this challenge:

“As a team our DNA is to go after problem statements which look so ambitious from the outside that we’re almost called foolish. For example, you could say it was foolish to:

1. Build a neobank in India in 2017

2. Build a DeFi platform from India for a global market in 2018 when DeFi wasn’t even a thing yet