Vision 20/24: Watching India

20 of India's most thoughtful investors peer into 2024, spotlighting the trends and ideas that will shape India over the coming year

Hey folks👋

Welcome to the 314 new Tigerfeathers subscribers who’ve joined since our last piece. To our 54 subscribers in Australia, it’s been a month…we’re not over it.

To everyone outside Australia, feel free to click here to join the crew👇

“Everyone loves end-of-year lists.”

- Aristotle

Friends, we’re rounding off 2023 with a fun one.

This year we’ve written about some of the most compelling ideas, companies, and technologies from the Indian startup ecosystem.

We’ve covered the incredible stories of Pepper Content, SriMandir, KukuFM and NextBillion.ai. We’ve published lighter pieces on the history of Maggi Noodles, and the 10(ish) products that capture how India has changed. We’ve done deep dives on India’s landmark new geospatial policy and revolutionary Account Aggregator framework.

For our last piece of the year, we reached out to some of the most thoughtful (and active) investors from the Indian venture capital landscape, and asked them to look ahead to 2024. We presented each of them with the same two questions:

1. What trends excite you most about India going into 2024?

2. If you were starting a company in India today, what would you start?

They’ve been kind enough and candid enough to share their wisdom with us. We hope that this kind of piece can turn into an enduring annual tradition, as a way to tie a ribbon in the year that was, and to help prophesy the year to come.

Before we jump in, we owe each of our contributors a big thank you for taking the time and making the effort to do this. While putting together this list, we wanted to make sure we had a mix of voices across different domains and vantage points in India’s emerging economy. Ultimately each of these individuals is someone we enjoy hearing from and learning from. We’re confident our readers will come away with the same sentiment.

In A Snapshot

While the responses we received contained a litany of useful ideas and concepts, they also tended to congregate around a few common themes. For those who prefer the trailer to the movie, here’s what you need to know:

Financial Services: The most common theme that excited investors was the expansion and innovation within the financial services industry. This makes a lot of sense given that India has only recently become a well-banked country with effective fintech rails. But while 90% of Indian adults now have bank accounts, relatively few people participate in the capital markets. There is a lot of headroom for credit, investments, and insurance products to all grow (not to mention profit pools too!).

AI Transformation: The second most cited trend was AI-enabled transformation. Our respondents predict that there will be a wave of AI adoption across corporations that mirrors the tech wave of the 90s and 2000s in the US. Except this time, AI startups will be the ones to build products that help customers optimise their workflows and improve productivity.

Deepening Talent Pool: A number of our respondents are buoyed by the fact that the talent pool in India is going from strength to strength. Indian teams are building at the bleeding edge of innovation, and are increasingly choosing to do so based out of India.

Healthcare Revolution - There is a palpable sense that we are moving towards a new era of health-tech in India. Policy initiatives like the Ayushman Bharat Digital Health Mission and the performance-linked incentive scheme for medical devices are boosting the supply side and laying the foundation for an explosion of medical goods and services. Simultaneously, the demand side is also growing thanks to increasing consumer awareness of wellness practices and chronic disease mitigation.

More Public Digital Infrastructure: A number of our key digital infrastructure initiatives are expected to either launch or attain scale in 2024. Some commonly cited examples include credit on UPI, the ABDM health stack, account aggregators, and ONDC (on which you can expect a Tigerfeathers deep dive soon👀). Aside from providing a foundation for entrepreneurship and a widening of access to public services for Indian citizens, these programmes also nudge the Indian economy towards broad-based formalisation and digitisation, thereby bringing more commercial activity into the formal fold.

Alluring Consumer Demographics: India is a very young country, with over 66% of the population under the age of 40. This cohort of consumers has rising discretionary incomes and enhanced proclivities to spend on aspirational products versus their predecessors. This creates an excellent breeding ground for homegrown consumer product companies.

…and there’s a lot more where that came from. If you’re looking to understand which way the wind is blowing in India, or you’re searching for inspiration on your next startup idea, here’s a good place to start.

Pranav Pai - 3One4 Capital

1. What trends excite you most about India going into 2024?

From 2024 to 2029, India will make the generational orbital shift to +$5 trillion in GDP and become the third-largest economy in the world. This is being driven by mass formalisation across daily life for citizens and businesses. We're big believers in Enterprise & SMB Digitalisation in India, and this is a dedicated theme for us at 3one4. From agri and manufacturing to logistics and distribution, we are seeing Indian software being used to evolve efficiencies and expand market share rapidly.

This is also the year of an inflection point in India's public market indices. The Indian ecosystem has already delivered over 20 startup IPOs, with at least 25 more in the pipeline. Tech companies will lead the refactoring of the midcap/growth index, and this will lead to a significant shift in how capital is allocated locally. We are preparing for this shift already, and strongly believe in leading the development of local capital across the capital chain, leading to IPOs.

2. If you were starting a company in India today, what would you start?

At 3one4, we're holding on to several theses we have kept open for nearly a decade! While we've already had a translation of some of our more interesting theses into live companies (Licious, Darwinbox, KukuFm, Betterplace, and more), we've got a few more that we hope to deploy with Fund IV.

A large theme for us is export enablement. The whole stack of Indian manufacturing and production going global - from SMB logistics to demand linkage to payments and compliance is waiting to be built across sectors. We've already backed a couple of companies here, and we look forward to working with more specialist teams that can build software+fulfilment businesses that can dominate this important pillar of the growing economy.

Akshay Mehra - Hummingbird VC

1. What trends excite you most about India going into 2024?

NRI Banking is an area I foresee more interest in 2024. The India narrative is rightfully driven by our young, growing population, coupled with rapid technology adoption. But we often forget that a portion of India's ambitious cohort do leave to live abroad.

A few quick stats on the segment: 30M NRIs, primarily concentrated in North America, Middle East, and the UK; we're estimated to see $114B of inward remittance volume in FY 2024 (3.6% of India's GDP); less than 35% of NRIs have NRE/NRO accounts, and NRIs as a segment - <2% of our population - account for more than 40% of all customer deposits in India. The current UX for NRIs is riddled with inefficiencies: onboarding for a bank account can take up to 2 months, and still remains offline and manual. It surprises me that this segment is overlooked and at times, TAM is a question mark.

One of our portfolio companies, Vance, is building a solution for this segment and they've seen an extremely clear need for their product, with remittances - their inaugural offering - surpassing $380M on an annualised basis in 9 months.

2. If you were starting a company in India today, what would you start?

With India's rising GDP and the growing penetration across asset classes, I believe the family office segment is currently being overlooked. As we've seen over the past decade, and forecast into the next, the number of family offices managing capital - specifically in the $50-100M net worth range - is poised to grow. Yet, through my conversations with family office managers, there is a clear lack of technology and tooling built for this segment. Although often dealing with a spectrum of asset classes - from public equities to real estate - managers manually mark their investments via Excel.

I would build a highly-targeted set of tools for the segment, automating mark-to-market calculations for assets, a team to assist with tax / estate planning, and for offices that wants to be a bit more 'hands on', a set of RIAs for investment advice, among other services. Within this segment, there is not only a clear need, but a willingness to pay for a product at a high ACV (relative to assets being managed). And lastly, the business model will be agnostic across regions; a product that can be sold globally.

Salone Sehgal - Lumikai

1. What trends excite you most about India going into 2024?

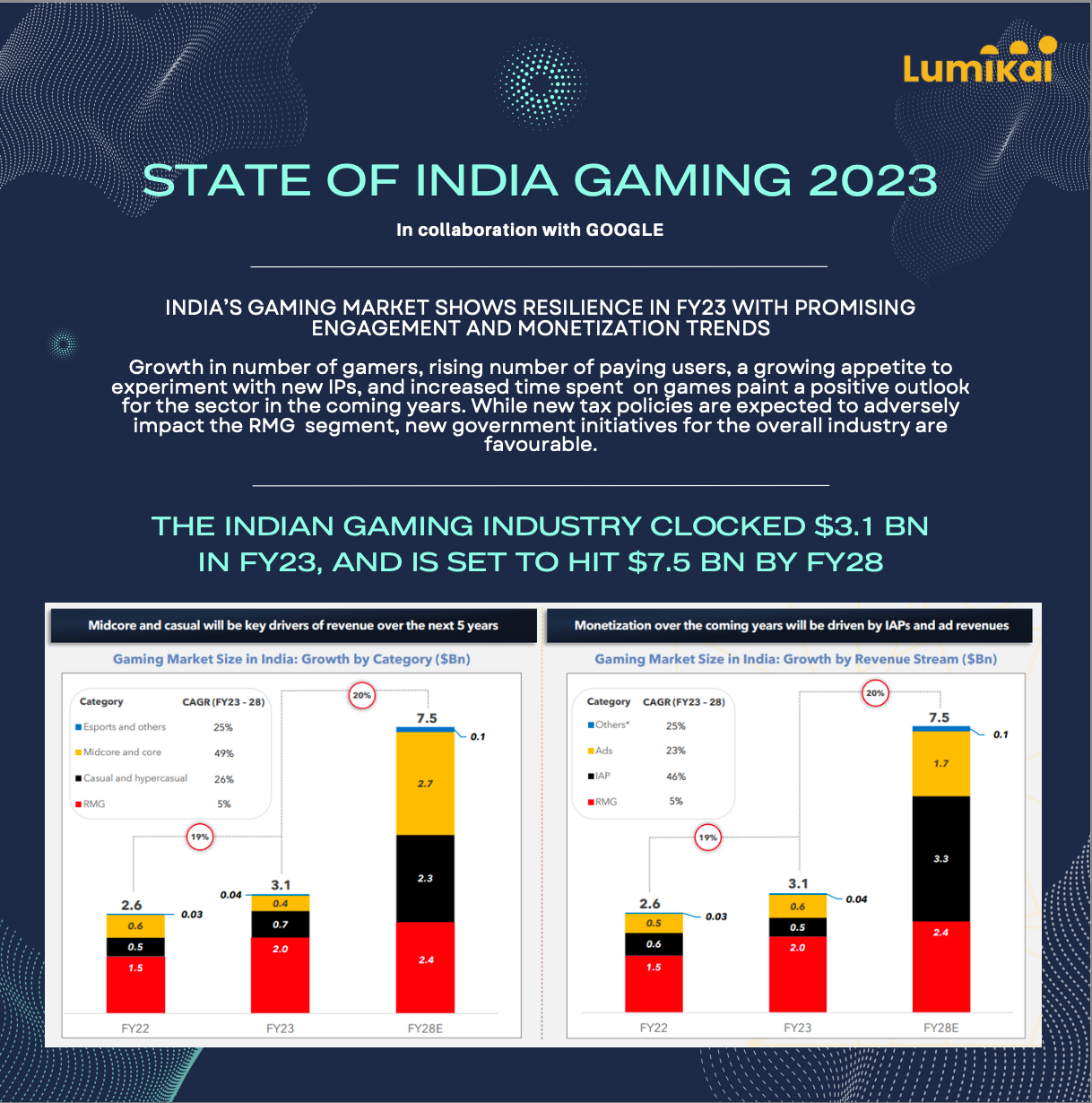

In India, we have crossed an inflection point when it comes to gaming and entertainment consumption. With over 700M+ smartphone users and an average Indian consuming 20GB/month, the biggest beneficiaries of that digital consumption have been video content and gaming. India is now one of the largest gaming markets in the world, with Indians consuming more than 15Bn gaming apps last year.

With rising adoption and increasing monetisation especially with UPI enabling micro-transactions, over $1Bn was spent on games directly via in-app purchases and ad based revenue in 2023 and our research shows there is $3Bn+ of pure revenue upside still to be achieved in the next 2-3 years. Thus, the narrative that Indians don't pay has been turned on its head.

We are living in new India. 50% of India's population is under 25. They are a mobile- first, digital native population who learnt to swipe before they type, and their tastes/preferences will determine what the next generation of interactivity and immersion for the Indian audience looks like over the next decade. We are excited to see what the future holds.

2. If you were starting a company in India today, what would you start?

It's an incredibly opportune time to build in India, for India. Our growing world class digital infrastructure combined with a massive paradigm shift in technology and AI, rising disposable incomes coupled with a strategic imperative for global investors to seek yield in India, means that this is India's decade.

As a founder, there are several whitespaces possible in interactive media at the intersection of culture, new media and technology. As India's most active seed investor in the interactive media and gaming landscape, we have a diverse portfolio across game studios building India first experiences (e.g Studio Sirah and Gigafun Studios), interactive media platforms disrupting legacy media (e.g. Eloelo), or more frontier facing bets leveraging XR (Autovrse), Generative AI (Supernova) and several others.

Accompanied with the 'digital decolonisation' that is taking place, we see Indians no longer emulating the West and reclaiming culture, identity, community as evidenced by the rise of local language streamers, youtube influencers, micro-creators and new age Indo-centric brands. All of these are mega trends which will drive innovation with the opportunity to create category leading companies.

Abhishek Sethi - Grad Capital

1. What trends excite you most about India going into 2024?

Many talented Indian students are choosing to start a technical company in India instead of going to a top university in the US. Many are no longer saying that "I need an MS in Mechanical Engineering from a foreign university to build quality robots". I think the increased retention in quality science talent is exciting, and this is compounded by companies like Pixxel, Ather, Greyorange that inspire local talent by solving hard technical projects in India.

2. If you were starting a company in India today, what would you start?

Gene-editing. Figuring out if we can engineer superior immune cells to defeat a cancer. It is happening already (clinical trials approved to fight leukemia), and I think there's real progress to be made in exploring more ways to create better immunity in us using gene-editing. Recent discovery & progress of CRIPSR Cas9 (gene-editing tool) makes this way more affordable and precise.

Another idea would be to create a school to make vocational training with better RoI. I think the shortage of talent is not limited to just coders & managerial (CS/ MBA) jobs; it is also important to develop manufacturing and vocational jobs. I think a school that up-skills people while leveraging automation is also an important opportunity for India in the post US-China world. There are hundreds of millions of young Indians, and they all can’t be coders. We should help them become experts of other crafts so that they can export globally competitive products.

Hemant Mohapatra - Lightspeed India Partners

1. What trends excite you most about India going into 2024?

Globally there are two related macro themes playing out:

(1) we are seeing a version of Hotelling's Law ('success breeds more copy-cats') play out, as a result of which most markets have become oversaturated with too many rival products that look a lot like each other - e.g. in SaaS.

And (2) we are exiting an opex-heavy cycle where much of the differentiation between products was around GTM (brand, discounts, service, etc) and re-entering an R&D-focused capex-heavy cycle where differentiation is all about de-novo technical innovation. #1 and #2 are always connected. We see this already in the visibly higher excitement about nuclear fusion, semiconductors, space tech, EV, climate, green hydrogen, exotic materials in the last few years.

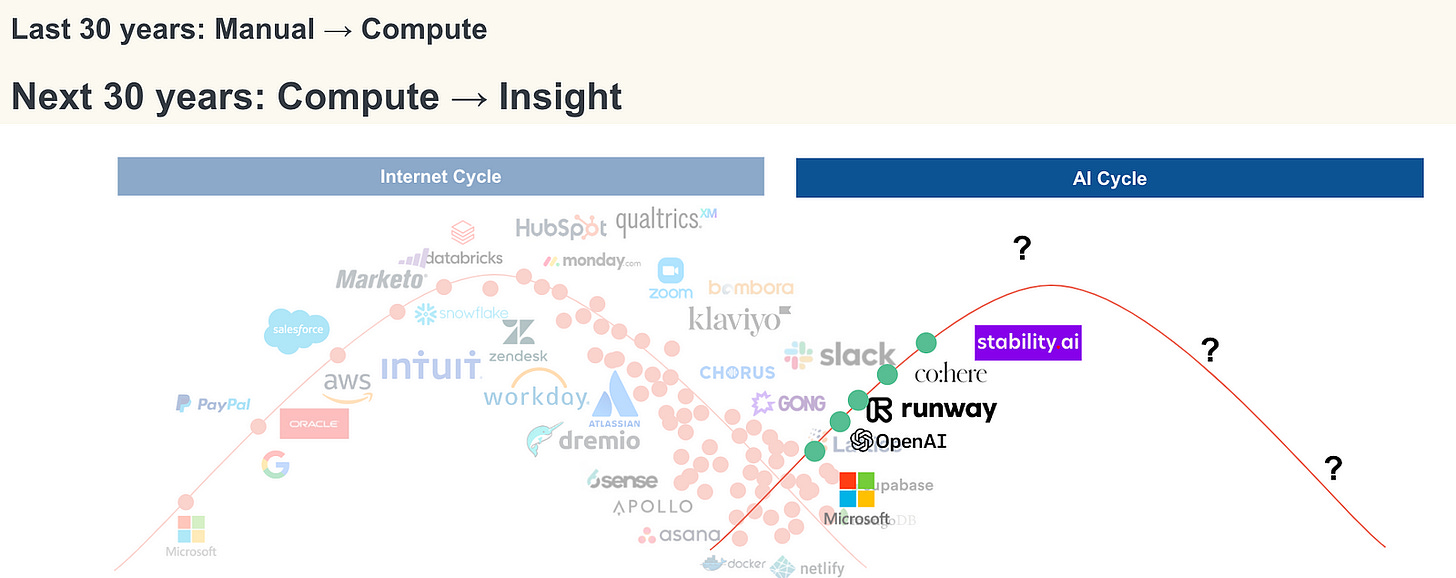

In terms of investments, I believe the first cycle of traditional software -- e.g. enterprise SaaS -- has run its course. Over the last 30+ years, the cost of compute and distribution has come down to zero. In the next 30 years, the cost of "intelligence" is likely to come down to zero. I am excited by what could be built on top of that. We are just about exiting the first wave of "Software enabled Internet" and entering the early years of "AI enabled internet". The sort of behaviours software inculcated in us -- click a button, drag and drop, or find our way through a B2B workflow -- may be totally up for an overhaul with AI.

2. If you were starting a company in India today, what would you start?

A technology as new and exciting as AI can also be scary. What's happening in Europe with AI regulation is nothing short of disastrous. What excites me about India is that we don't have a lot of the baggage that other entrepreneurial ecosystems have. We seem to want to build, our regulators are thoughtful, our founders are humble yet hungry. But we need bolder founders and investors or we'll be left behind. AI is as powerful a resource as Oil but what use would oil be if people just fed it to horses asking them to run faster?

A new resource needs new thinking. Founders who can take big swings and be at the cutting edge. Capital is available - take our portfolio Sarvam.ai, for example, that just raised a $41M series A with a thesis around building India-centric population-scale solutions using AI. I am actually quite inspired by their mission -- if AI is going to be part of the Maslow's hierarchy of needs in the next 10 years, why should only the few benefit? We need to find ways for AI to reach every human on the planet in ways that are cheap and accessible.

Rajan Mehra - March Capital

1. What trends excite you most about India going into 2024?

2024 will be the year of AI, AI and more AI.

The launch of ChatGPT in late 2022 was a seminal moment for the mainstreaming of Generative AI. The energy that we now see around Artificial Intelligence is reminiscent of the accelerated growth of the internet in the late 1990's. The emerging AI opportunity represents a platform shift in which incumbents, with their data and distribution moats, will have to contend with challengers who will attack with new business architectures and business models. Platform shifts represent a once-in-a-generation opportunity to recreate the business landscape with new horizontal platforms that create tremendous value for customers, significant wealth for founders and capabilities for countries.

2. If you were starting a company in India today, what would you start?

While a few large companies will develop the most dominant Foundation Models for AI, these models will need to be culture-specific, language-specific and domain-specific to be truly useful. If I were an Indian founder, some areas I'd consider founding a company in would be:

building vertical business applications while using established Foundation models e.g. drug development, disease diagnostics in healthcare, contract lifecycle management in legal tech and beyond e.g. secondary/tertiary care in tier 3 cities, augment teaching capacity in education etc.

building co-pilots for India specific use cases

building tools for ML Ops, governance, risk e.g. fraud detection, risk management in financial services.

March portfolio companies Uniphore, Generate Biomedicines and Spark Cognition are excellent examples of AI native companies that are leveraging the benefits of AI across diverse industries, ranging from contact centres to biosciences to industrial automation. We hope to see many such companies built by Indian founders in 2024.

Vaibhav Domkundwar - Better Capital

1. What trends excite you most about India going into 2024?

The bear market of the past 18 months has been a blessing in disguise for the Indian startup ecosystem. It forced every founder from pre-seed to growth stage to re-think and re-plan and go back to the fundamentals of their businesses and build a sustainable foundation at the core. As a result, we are a higher-quality startup ecosystem with a stronger focus on fundamentals than ever before.

This trend of ensuring strong fundamentals is what I am most excited about as we step into 2024 as it will help us see the fuller visions behind so many companies come to life. Fingers crossed!

2. If you were starting a company in India today, what would you start?

I would start an AI-powered enterprise solutions company because I believe we are going to see a fundamental shift from “digital transformation” to “AI transformation” of the enterprise, and its 20 year timeline is starting now. An enterprise solutions company of the AI-enabled world will look quite different than the enterprise software or enterprise consulting company of today and it is better to be early as it gets defined than wait to learn from others who will lead the wave and have an unfair advantage.

Rohit Ganapathy - Accel

1. What trends excite you most about India going into 2024?

As far as exciting developments go, especially in the Indian context, I have to point out how amazed I am with the AI talent pool. ChatGPT wrappers aside, we are seeing a new crop of research led companies that are attacking really hard problems. Startups like AI4Bharat and Dashtoon being some fine examples.

While the past year has been a humbling one, defined by a lull in investment activity and an incredibly austere buying environment, I see this as a massive blessing to founders who are just starting up. Building in such an environment, devoid of delusion, will push you to build a business that is fundamentally strong.

2. If you were starting a company in India today, what would you start?

LLMs have proven to be very potent as reasoning engines, especially in a setup where there are several of them talking to each other. With GPT Vision, multimodal LLMs can now think AND see. I find this toolchain to be mind-bogglingly powerful. Every single white collar job out there has elements that are repetitive are boring. Some more than others. If I had to start something today, I’d figure how i can employ this toolchain to make people 10x more efficient at their jobs. I would however, steer clear of saturated domains like Software engineering and Content Writing where competition is stiff. Picking something boring and unglamorous might turn out to be your edge.

Rajeev Mantri - Navam Capital

1. What trends excite you most about India going into 2024?

- Financialisation of savings and formalisation of businesses: There is domestic risk capital available for technology companies at every stage now, from angel and seed funding to growth stage equity, as well as in public markets. This phenomenon is a direct outcome of the formalisation of businesses and financialisation of savings, a mega trend that has been underway for some years, but one that is now acquiring scale. I think it will have a hugely positive impact on the business landscape. The cumulative effect will be so profoundly transformative, we lack the imagination to estimate it correctly.

- Rise of deep technology entrepreneurship: India’s entrepreneurs are now building ventures in a range of sectors with science and technology as the foundational differentiator. The rise of deep tech will dramatically raise productivity, and people are going to be surprised at the products and services that emerge from our tech ecosystem. A lot of what is happening is still under the radar.

- Entrepreneurship gaining social acceptance: There was a time when India’s technical talent aspired to build a career at global tech companies. Starting a startup was not viewed as mainstream. Not anymore - our talent now wants to start up at home, and build the next Paytm and Flipkart. Entrepreneurship as a path is getting acceptance in society, across the country. This has arguably never happened before.

2. If you were starting a company in India today, what would you start?

My skill set and experience is in investing, so I would stick to my knitting! I am setting up an investment and asset management platform at Navam Capital that will be focused on backing and building engineering-driven, intellectual property-rich frontier tech ventures. We at Navam are very excited to work with India’s deep tech founders pioneering tomorrow’s great enterprises.

Rohit MA - Peer Capital

1. What trends excite you most about India going into 2024?

Data was crude oil; Annotated clean data is rocket fuel: I am increasingly bullish on finding ‘profit pools’ in clear annotated data. Clean annotated data by its very nature is hard to come by. Consumer interactions for the longest time were not anchored by data, because there was no mode to capture it. The slow erosion of ‘physical instruments’ and the penetration of digital modes of interacting has led to the possibility of capturing metadata. India has been able to capture this by making the mobile the core ‘tensor’ of our society. The ability to capture, along with the ability to analyse data, is critical for the country’s growth.

Techno-optimism and the shrinking of the bureaucracy: Tech used to be an enabler. Now technology has become front-and-center in how Indians interact with each other today. Technology has become a core-part of governance too. A techno-optimist places technology front-and-centre in most problems involving redistribution. This thought process is a lot more pronounced today. Engineering + product teams are taking on tougher challengers. One can see this in a top-down sense as well. When looking at it top down as well - The number of openings for the annual UPSC CSE is continuously decreasing. I expect governance to become tech-first in the future and the relevance of non-technical fading away with generalists taking the space.

2. If you were starting a company in India today, what would you start?

Health is wealth: With the post-COVID era tailwinds of digital adoption across stakeholders in the healthcare ecosystem, there is a looming opportunity to enable healthcare access across geographies of our country and riding on the ABDM stack, which (albeit still very early) represents a tremendous opportunity for early movers here. Preventive Healthcare with a tech wrapper and early engagement can positively affect overall healthcare costs across insurers and service providers while improving coverage.

Osborne Saldanha - EMVC

1. What trends excite you most about India going into 2024?

Indians are increasingly becoming ambitious and aspirational. At the grassroots level, Indians are coming out of the “middle class” mindset that ruled our parents’ generations, and taking entrepreneurial risks - and not just in the tech ecosystem.

Women are taking up farming in a big way. Truck drivers are now becoming fleet owners. Students are educating themselves about entrepreneurship. We now have role models we can look up to and learn from. This is a monumental and fundamental shift that is changing the average Indian household’s income and asset profile. There will be large portions of India’s population that will rise up in the income pyramid, potentially leading to India’s perception changing from a DAU farm to an ARPU farm. It’s exciting!

2. If you were starting a company in India today, what would you start?

Given the shift in the Indian household asset profile, I would consider starting a company that manufactures investing or savings products. Except, I’d go very niche and narrow in my product strategy or target customer profile.

Building for the next decade, I’d want to create better experiences for Indians to invest and save in their future. Better experiences are not just an outcome of having great mobile apps. I’d consider having offline “experience centres” to build trust and acquire users. Indian financial firms are more competitive than ever and large fintech startups continue to grow and thrive. Building a financial startup today for the next decade will initially require doing hard things that don’t scale. This will help provide the user with a step change in user experience while building competitive moats for the business.

Pearl Agarwal - Eximius Ventures

1. What trends excite you most about India going into 2024?

India is undergoing a massive demographic transformation, and this is creating exciting opportunities across Fintech, Healthtech, and Entertainment, which are the primary needs of any individual regardless of their age and socio-economic status. Further innovation across generative AI is deepening use cases that can be built across these three segments.

Some of the trends below:

Fintech: We foresee greater collaboration between fintechs and large legacy players. Plays that leverage developments across open data ecosystems will create accessible credit solutions for diverse user groups. Further, empowered by generative AI, credit providers will be able to underwrite asset classes previously inaccessible. To be able to cater to the evolving needs of a modern consumer, banks will need to partner with new-age technology providers, such as Vegapay that offers an omni-stack lending solution, to offer customised products.

Healthtech: While healthcare solutions in the past have primarily focused on delivery of care and products, there is a greater need for preventive solutions that not only help patients manage diseases but also reverse early signs. To facilitate this, we see a growing need for data-driven solutions that are able to leverage longitudinal health data of patients. With rapid adoption of ABDM, the ability of data to play a crucial role will be further enhanced. Moreover, care providers will now also be able to leverage generative AI to support care-givers.

Gaming: We believe a notable segment of customers will move from Real Money Gaming (RMG) to traditional gaming platforms. To meet this new demand, we will see more domestic studios launch locally relatable gaming experiences. These will be empowered by two trends; the emergence of publishing platforms that empower distribution (such as Simple Viral Games that enable studios to enhance discoverability), and gen AI powered infrastructure solutions that make designing game worlds and content easier.

2. If you were starting a company in India today, what would you start?

Given the scope of the credit gap in India ($530 billion for MSMEs), I would start-up in the secured lending segment, particularly underwriting of physical assets. New-to-credit consumers and businesses can utilise physical assets to secure loans, which has been difficult to underwrite digitally in the past due to lack of comprehensive data associated with it. With generative AI allowing for greater comprehension for unstructured data, there is significant scope for penetrating these newer markets.

Rahul Chowdhury - RevX Capital

1. What trends excite you most about India going into 2024?

Considerable appetite for credit growth, especially around income-generating credit.

In the mid-stage startup world, business models are being revamped very quickly towards sustainability and profitability. It lays a solid foundation of investments picking up a lot more in 2024.

The fintech revolution continues in India. Next frontier - Credit on UPI, and this will be a complete game changer.

A very stable government and consistent policies across the board and spectrum, especially local manufacturing.

2. If you were starting a company in India today, what would you start?

In the area of non-traditional finance access or in the area of marketing and distribution. These are the two biggest challenges that MSMEs face today and where there is tremendous growth opportunity.

Healthcare + Insurance experience for the masses. The unique health IDs (ABHA) seems to be a great opportunity for start-ups to build in a PPP model.

EV Space – clean energy adoption in India is gaining momentum with increasing government support, infrastructure development and growing awareness. So, any company either trying to build infrastructure, or lower consumer prices through use of clean energy solutions, would be great areas.

Any company trying to ride the ONDC wave for commerce. We see ONDC as a great public infrastructure and over the coming years, we expect it to reach scales in line with what we have seen in UPI.

The entire packaging industry is going through a revolutionary change and all the goods we use or consume will completely transform in look and feel over the next few decades (materials especially). The innovation here is very exciting and something I personally spend a lot of time learning about.

As a Fund Manager in the DEBT space, we see mid to late-stage companies come to us for working capital needs. We are overall just excited about the local BHARAT manufacturing and consumption story. Between both the funds, we have already invested over 900+ Crores across 75 + entrepreneurs which are largely MSME’s, and that’s where our concentration will be. Overall extremely excited about the next two decades.

Priya Shah - Theia Ventures

1. What trends excite you most about India going into 2024?

I’m excited about several trends in India today, notably the following:

(i) The growing talent pool of accomplished, energetic and dynamic entrepreneurs setting up early stage companies today in India

(ii) The excitement to build innovative product businesses, with real tangible value, with science-based technology and hardware IP. Shout out to some of our awesome founders who are doing this, such as MetaStable Materials, Canvaloop Fibre, AltM Bio and Varaha Ag.

(iii) The regulatory tailwinds creating strong incentives for corporations and start-ups to integrate sustainability into their operations and address the biggest issue that we’re facing today globally, which is climate change.

2. If you were starting a company in India today, what would you start?

If I had to start a company today, I would team up with experienced scientists and build a climate tech, artificial intelligence platform, which uses hyper-spectral satellite data to generate insights on agriculture, built environment and other nature bodies. The technology would integrate advanced machine learning and geospatial imagery to generate actionable insights, targeted towards companies in the following sectors: insurance, finance, food and beverage, real estate, energy generation, manufacturing businesses, as well as governments. The purpose would be to offer these companies intelligence and help them adapt their operations to climate-resilient alternatives and green their supply chains, as well as to identify opportunities, and make both short and long-term expansion decisions with confidence.

Ashish Fafadia - Blume Ventures

1. What trends excite you most about India going into 2024?

There are too many things to name, but four in particular that stand out as areas of potentially massive transformation - Telecom & Networks, Gadgets and Deeptech, AI & Software, and Capital Markets & Financial Services.

For instance, I imagine that over the next few years, our communication dynamics will go through a significant change. While on telecommunications we have 5G, I also envisage that the form factor of every screen that we use (TV, phone, laptop etc) will also go through a change. We’ll see much of this play out next year as new gadgets come to market. So while 5G increases the scope of audiovisual tools at our disposal, newer gadgets could alter the face of our entertainment landscape.

I’m also paying attention to the trend of more and more countries gravitating towards CBDC. I anticipate this will trickle into retail usage of these products in India too. From a Blume perspective it was encouraging to see Slice gain approval from RBI to merge with North East Small Finance Bank (NESFB), and at least a handful of companies like Purplle, Turtlemint, Servify, Intrcity heading towards profitability. With public markets holding up incredibly well, I anticipate a dozen internet and digital company IPOs, and at least $ 3-5 Bn worth of exits, and an equal quantum of capital raised on stock markets.

2. If you were starting a company in India today, what would you start?

Currently private markets in India and globally are performing as they should - in terms of a rightful correction in valuations coupled with a complete dry out of liquidity (due to basic lack of conviction of investors). It feels like there’s a great opportunity to create an exchange for facilitating the buying and selling of secondary investments (that will help fund managers and shareholders of holders successful companies get an early exit). It would be a massive game changer for the private markets ecosystem. I’m convinced that an opportunity like that would eventually lead to liquidity being injected back into the market. Once investors manage to get their exits, they will start hitting the markets again.

On another note, ‘personalisation’ as a theme excites me. Personalised healthcare, personalised pharmaceuticals and medication, personalised entertainment et al. My favourite area within this theme is personalisation of Financial Services. It’s the hardest to get right and very difficult to challenge pre-existing regulatory moats. Investors are naturally apprehensive and founders are wary of running afoul of Indian regulators. But India is growing at a healthy rate and the mid-market and affluent investible corpus will continue to set the pace. My grand vision would be to have a business with extremely strong privacy fundamentals and AI-linked personalisation of financial services - ideally a a full stack model that doesn’t eliminate the advisor but makes it possible for the user to decide their preferred form of engagement (i.e. whether they want to engage with a digital-only interface or a hybrid platform powered by tools but guided by humans).

Sarvesh Kanodia - Omidyar Network India

1. What trends excite you most about India going into 2024?

India is at an interesting juncture in its growth journey. A key challenge for India in the past and even today is low productivity of the workforce. As we look at expansion in manufacturing capabilities, AI, climate change and all the other key macro drivers, the underlying factor driving that is the quality of human capital. Businesses are looking for quality talent. As a result, skilling our youth is going to be critical for the country to achieve its growth aspirations.

Founders are seeing this opportunity and looking to build skilling solutions that can deliver at scale. In 2024, we should see some of these companies becoming more mainstream, start showing meaningful traction and generating meaningful investor interest. For e.g. Entri is an upskilling platform focused on government and private jobs. They are currently at 130cr ARR, cash flow profitable and poised to raised a growth round in early 2024.

2. If you were starting a company in India today, what would you start?

While we are aiming to create new jobs, given the large supply i.e. population, it is going to be tricky to create enough jobs. Moreover, as AI advancements make existing workforce more productive, job intensity across sectors could also come down. As a result, the only way to solve for the demand-supply problem in the Indian workforce is to train individuals to become self dependent. This could mean entrepreneurship, freelancing etc.

I would look at building something that is supporting new and existing entrepreneurs to help Indians become more self dependent. There are several companies trying to address this problem / bigger theme in different ways. A couple of examples from our portfolio are Buyume and Project Hero, who are working with beauty professionals and small and medium construction companies respectively to help them grow their business.

Arjun Vaidya - V3 Ventures

1. What trends excite you most about India going into 2024?

The trend I am most excited about for 2024 (or the near future) is the creation of 10s of new startup hubs in our country. As part of my role as a VC - I’ve travelled across India to meet companies. While I do spend a lot of time in Bombay, Delhi and Bangalore - work has also taken me to Surat, Jhansi, Guwahati and Kochi among others.

We’ve had the good fortune of investing in companies like Entri (Kochi) and Lahori Zeera (Chandigarh) and this changed my view on building from a metro. My mind told me that building from outside a metro would cause issues in attracting talent, and the lack of an ecosystem would disadvantage startups. On going and visiting, I saw quite the contrary.

Founders in these cities have:

more time on their hands: they save commute time, have lesser distractions and in some ways a better quality of life

build more sustainably: the notion of bottom line and traditional business runs deep in their blood

have lower cost bases: everything from rent to salary is at a much lower base

much less attrition: teams are usually happier, have lesser options to jump ship and stay closer together leading to much lower team turnover

As you can see - only seeing is believing. And, my preconceived notions on the challenges proved wrong. I predict that the next leg of India’s large outcomes from the startup world will be built from these cities. And, it’s our job to nurture them.

2. If you were starting a company in India today, what would you start?

Answering the other question, if I were to build again - of course I’d build in D2C/consumer. It’s a space I understand but also we’re a brand starved nation. As incomes rise, the middle class has become much more aspirational. Premiumisation is here, but at a mass premium price point. That’s where the real TAM is sitting.

I’d build in consumer electronics, health & wellness or sports & fitness or lifestyle. These are the categories where I see massive headroom.

Aditya Singh - All In Capital

1. What trends excite you most about India going into 2024?

Hottest trends in 2024 - The Indian Consumption Story; GenZ-Millennial Children of India-1 Parents

India-1, known for its high spending capacity, lacks a spending habit, as a result of their upbringing being rooted in an era of Indian scarcity. However, the children of India-1, raised in an era of abundance, do not share their parents' frugal habits. Currently, as they mature into the 18-25 age group, they enjoy more freedom to explore, they have individual banking privacy, and a broader exposure to new products and experiences through social media, leading to spending habits that starkly contrast with their parents'.

In 2024, this trend is hot. Social media has succeeded in enticing GenZ towards experiential activities, and spending on products and services subsequently becoming integral to these experiences. All In Capital, recognising this shift, has invested in consumer brands catering to this young demographic. NewMe targets GenZ girls with hyperfast fashion, and Salty offers accessories for all genders. Got a houseparty this weekend and or a new Bumble date? Cool, buy two new dresses from NewMe. Your first month-iversary with your situation-ship? Sure, buy her a gift-box of accessories from Salty. This generation raised by India-1 households spends far more generously than previous generations.

2. If you were starting a company in India today, what would you start?

Credit Recovery Enablement - Driven by booming consumption and growth in SMEs, credit activity in India is at an inflection point, which will further get accelerated by the account aggregator framework. As lending explodes, credit recovery will become an even bigger problem to solve than today. This gets worse with small ticket loans on specific purchases such as smart-electronics or automobiles. Present day solutions to these are trying to improve the underwriting engines, however much remains to be done to solve the problem of credit recovery.

This presents an opportunity to build tech-driven products around the recovery of credit. All In Capital, anticipating this challenge, has invested in solutions such as RocketPay, which enables retailers to create UPI mandates for EMIs on smartphone purchases on credit and shutdown those smartphones in case of defaults; or FuturElectra, which enables lending for EV two-wheelers with live geo-tagging and lender-enabled vehicle shutdown in case of EMI defaults. These technology-led approaches to recovery influence borrowers' behaviour and ensure EMI obedience. Another solution we have invested in is Volt Money, which enables collateralisation of the borrower's mutual fund holdings, allowing small loans to be issued in a secured manner.

Mandeep Julka - Chiratae Ventures

1. What trends excite you most about India going into 2024?

In general, looking ahead the following trends could be very promising:

Leveraging Digital Public Infrastructure: India has the opportunity to experience a step-function growth curve by leveraging the unique Digital Public Infrastructure that has been built to drive digital adoption at a population scale. Start-ups leveraging these rails, either directly or tangentially, could create massive value for themselves and the society at large.

Realism: While India does present a massive opportunity, one still will need to sweat the small stuff in order to capture a meaningful share of that pie. And this healthy dose of realism from 2022 and 2023 is likely to continue being effective in 2024 as well.

Building Together vs Zero-sum-game: Once the dust settles down, it is quite clear that in certain sectors, a collaborative approach will create more value than an attitude to disrupt the status-quo. This learning could incentivise building strong partnerships, and increasing the proverbial pie. In fact, Chiratae’s portfolio Fibe and Vayana have been consistently following this approach since their beginnings, and we appreciate the Founders’ vision and maturity for having done so from the start.

2. If you were starting a company in India today, what would you start?

Elder care: While India’s current demographic profile is young, it is expected to start evolving eventually. With no official social security net, and evolving family dynamics, effective elderly care is a growing need.

Authentication SaaS: The flip side of AI is a likely increase in digital media/assets of questionable authenticity. Anticipating and solving for this is another area of interest.

Manu Chandra - Sauce.vc

1. What trends excite you most about India going into 2024?

There is a perfect confluence of improving consumerism, increasing disposable incomes in the upper segments, higher awareness due to social media, penetration of digital commerce and payment systems - expect this to help a new generation of brands and associated investment opportunities emerge in India.

2. If you were starting a company in India today, what would you start?

A good VMS (vitamins, minerals & supplements) brand or a premium Kaya clinic chain. Both have a high-repeat, irrational-spend nature which lends to scale and profit. Neither space has enough competition yet so can be considered blue-ish ocean opportunities.

Nitin Sharma - Antler India

1. What trends excite you most about India going into 2024?

There is a very palpable sense of “India’s time has come”, “this is the tech-ade” and “this time, it’s different”. It’s a confluence of a number of factors - stable domestic growth, geopolitics and capital flows, maturing of the tech ecosystem (including value realisation), and building ‘from India for the world’ (from services to products and platforms).

Compared to when I moved back to India 10 yrs back (when most ideas were “X for India”), founders are more original and first principles in their approach. From our Antler vantage point at the Day Zero stage, they are also younger, more diverse, and far more global in their ambition. We still haven’t produced a large platform company but it finally feels like the seeds are sown for such a $100bn or trillion $ platform to emerge in the next 10 yrs - perhaps in AI, digital public infra, climate or Web3.

2. If you were starting a company in India today, what would you start?

There are whitespaces of opportunity everywhere - from new models in edtech (contrarian to say this today) to AI-reimagined SaaS and IT services. To emerging massive spaces like female health, senior care to petcare. To building products with a very deep understanding of vernacular users, for example what Kutumb (one of my earlier investments) is doing on deepening their Internet experience with communities.

But thinking from the lens of completely reimagining a value chain, I’d zoom in on digital public infra (DPI), a uniquely Indian catalyst for some moonshots, ONDC being one. If ONDC takes off in a big way in 2024-25, there is the potential to bring crores of new sellers into the online ecosystems. Only 5-7% of Indian SMBs sell something online; beyond demand generation, they are also daunted by everything from creation of catalogs, content and listings, managing advertising, pricing and updates across multiple fragmented channels, etc. I am intrigued by the possibility of a new Shopify-like platform which could leverage GenAI to make a lot of this feel seamless and magical, while giving them instant national reach via ONDC. And in general, we are bullish on our investments in Plotch, Bitsila and others building infrastructure for ONDC to scale adoption faster.

Aaryaman & Rahul - Tigerfeathers 🐅

Aaryaman

1. What trend(s) excite you most about India going into 2024?

One trend that really excites me is the fact that Indian teams are increasingly solving very hard technical problems working out of India. Whereas the Indian tech industry has often been associated with IT services firms and ops-heavy copycat companies, we are flipping the script and actually contributing breakthrough technology to the global commons. Companies like Pixxel, log9 Materials, Airbound, and Popvax are just a few notable illustrations of this trend. Long may it continue!

2. If you were starting a company in India today, what would you start?

If I had to start a company today, I would look towards the life sciences industry. Breakthroughs in genomics and AI promise to herald incredible new treatments and therapies for all manner of ailments and illnesses. The recent landmark FDA approval for gene therapies to treat sickle cell disease is a timely example of what’s to come.

In order to capitalise on these trends, I would look to identify and plug any gaps in the supply chains of key pharmaceutical ingredients. For example, many gene therapies rely on specialised lipid nanoparticles (LNPs) to deliver a payload into the nucleus of the cell.

Making these LNPs is often outsourced to contract research organisations. India, with its low cost base and long history of exporting speciality chemicals, could be a great place to make not just LNPs but also other products and services required for the life sciences revolution.

Rahul

1. What trend(s) excite you most about India going into 2024?

It’s hard to look past the Indian Consumption Story. When we started Tigerfeathers in mid-2020, one of the first pieces we did was about the looming ‘golden age’ for consumer brands in India. The idea was that the splintering of mass media into ‘micro’-media (via the Internet) would create the conditions for the flourishing of countless ‘micro’ brands in the country aimed at specific market niches instead of the general population.

I think that thesis has largely held up, validated for me by the kinds of products that regularly make their way to my Twitter and Instagram feeds. We now apparently have a first ever energy drink for gamers in India, a homegrown buffalo jerky brand, a company making a line of bougie oral care products, and even a brand of high-heeled designer sneakers for the comfort of the Indian bride.

When you start with a base of 1.5 billion, it shouldn’t be surprising that even the tiniest of niches can represent a viable market segment (and that’s before you take into account the potential to take a homegrown product to global shores). Indian founders can experiment today because the Indian consumer is ready - ready to be surprised and delighted by products that can help them ‘level up’ their aspirations. It means there’s a much richer palette of products (and services) that is being produced and consumed in India than at anytime before in our history. ‘Niche’ market and customer segments like pet care, sexual health and wellness, e-sports, fitness & recovery etc should see plenty of entrepreneurial action. I’m looking forward to seeing Indian brands stretch the imagination of Indian consumers over the coming decade.

2. If you were starting a company in India today, what would you start?

If you look at the last decade and a half in India, each time our DPI roster has been extended, it has typically catalysed a cycle of innovation and entrepreneurship in the country. Eg: the introduction of recurring payments on UPI led to the increasing viability of digital subscription products like KukuFM. I believe some of the most potent startup ideas in India are buried in the second and third-order effects of our DPI initiatives.

At the moment, I think that most holds true for ONDC. We are still very much in the early days of ONDC adoption but if our e-commerce penetration does eventually rise from 5-6% to 60-70% (as the ‘bull case’ for ONDC would suggest), then I imagine that’ll lead to plenty of room for entrepreneurs to get busy across the e-commerce value chain. If ONDC does achieve its grand ambitions then I think it makes sense to figure out how to surf the trend instead of swimming against it.

A big thank you once again to all our contributors. And a big thank you to all our subscribers for taking the time to read our stuff this year. That’s it from us for 2023. We’ll be back in January with a deep dive on ONDC - subscribe below to make sure you don’t miss it.

A very happy new year to you all, we’ll see you on the other side ⏩

Nice compilation. Are you aware of any teams working on gene editing in India? Would love to learn more about the space

Perfect way to end the year.

Merry Christmas and a Happy New Year !!!