Crypto in India

Takeaways from the Union Budget '22 and where India's crypto story goes from here

Depending on your penchant for taxation, the 1st of February '22 was either a really good day or a really bad day for crypto investors in India. After months years of confusion, uncertainty, feet-dragging and flip-flopping, the Indian government made its first real statement of intent with regards to its position on crypto assets (and crypto investors) during a presentation of the Union Budget for FY22.

“There has been a phenomenal increase in transactions in virtual digital assets. The magnitude and frequency of these transactions have made it imperative to provide for a specific tax regime.”

- Nirmala Sitharaman (Finance Minister)

If not a ringing endorsement, it was at the very least an acknowledgement that crypto in India had become too big to ignore. Particularly over the last couple of years, crypto has managed to suck in considerable mindshare amongst a largely millennial (21-35) user base and continues to mark itself out as an alternate asset class for risk-seeking investors. Depending on which source you choose to believe, India currently has between 20 million and 100 million crypto investors with an estimated 7.3% of the population holding crypto, earning India second place on the Chainalysis Global Crypto Adoption Index for 2021. We now boast multiple crypto unicorns amongst a broader pool of over 230 startups focused on crypto and blockchain technology that collectively attracted $638 million of investment across 48 funding rounds in 2021. There were over 10000 openings for crypto/blockchain jobs in September which accounted for nearly 5% of all white collar job openings in India. In 2021, India was even 5th in global traffic to OpenSea, the world’s leading marketplace for NFTs.

But I didn’t really need to tell you any of that. If you watched any football or cricket in India at any point in the last year, you would be fully aware of how assertively crypto has bludgeoned its way to the forefront of public consciousness in the subcontinent.

It would be fair to say that crypto has moved from the shadows into the mainstream spotlight. What’s remarkable is that we’ve gotten to this point without the assurance of a regulatory regime or any kind of legislative guidance.

India’s crypto timeline

There have really only ever been two significant instances of regulatory intervention in India’s crypto saga. The first, in April 2018, saw the Reserve Bank of India passing a directive that prohibited regulated financial institutions from working with the crypto sector. In practice, it meant that crypto investors were prevented from transferring their funds directly from their bank accounts into their crypto trading accounts held with local crypto exchanges. The RBI directive effectively suffocated the operations of Indian crypto exchanges, forcing them to scramble for alternate methods to help users withdraw and deposit INR into their trading accounts.

Despite a banner year in 2017 that coincided with the first retail crypto boom, from mid-2018 till early-2020 India’s crypto sector experienced a tough reversal in fortunes. For the vast majority of people, local crypto exchanges represent the access point to the wider crypto ecosystem i.e. the primary way to swap your Indian rupees into bitcoin, ether, dogecoin etc. Cutting the exchanges off from the wider financial bloodstream meant that they became, in essence, economic pariahs. An uncertain legal status coupled with an obstructive banking and payments apparatus meant that Indian exchanges weren’t able to undertake large-scale marketing efforts or raise funds from local investors. With a large section of users spooked by the regulatory flux, this period saw the shuttering of several major crypto exchanges in India (including Koinex, at one point India’s largest crypto exchange, where I served as Head of Business and Strategy), with most either pivoting to greener pastures (like us) or shifting base to friendlier jurisdictions, and many others struggling for survival.

Crypto has never been illegal in India. But its never been ‘legal’ either. A regulatory limbo isn’t good for business. The sidewalks of Indian startup hell are lined with the corpses of crypto companies that died waiting for regulatory clarity on their chosen sector. Despite the economic winter for crypto exchanges, India(ns) continued to make seismic contributions to the global crypto ecosystem courtesy of the enterprise and technical nous of Indian founders. The next major regulatory update wouldn’t come for another two years, till March 2020, when the Supreme Court of India would overturn the RBI directive, declaring it ‘disproportionate’, and remarking that there was no record of any regulated entity suffering any loss or adverse effect as a result of the activity of crypto exchanges. The ruling was rightly hailed as a win for the crypto sector in India. It catalysed a tsunami of interest in India’s crypto sector from investors, traders, and entrepreneurs who could now hire talent and raise funding without immediate fear of the lights being turned off.

In the last five years, where it pertains to official word on the status of crypto in India, we haven’t had much else to cheer about. Many of the largest banks and payment networks in the country have stayed clear of crypto despite the Supreme Court ruling as the RBI continues to advocate a complete ban on cryptocurrencies behind the scenes. Various official bodies have continued to relay fears about crypto enabling money laundering and a weakening of our sovereign monetary system. For the most part, we’ve moved through countless cycles of regulatory gossip where the threat of a crypto ban has always loomed large. However, our entrepreneurs have continued to build, with India now boasting a vibrant crypto ecosystem that features accomplished players tackling everything from NFTs, Decentralised Finance (DeFi), Play-to-Earn (P2E) and everything in between. The global tech and crypto communities are taking notice. And Indian VC funds are finally ready to bet big on crypto entrepreneurs.

That’s why crypto’s inclusion in the Union Budget is such a big deal. There is a very real chance that crypto will come to represent the beating heart of the next iteration of the Internet. Indian users, founders and developers deserve the chance to have a say in how it is built and to take part in the economic opportunities it presents. It is important that we have a regulatory regime that supports these efforts.

So what’s in the actual Budget?

The Finance Minister chose to focus largely on the tax implications of crypto in the Budget, revealing clues about the government’s position and thought process with regards to regulating this space:

1. Defining virtual currencies

2. Income tax payable at 30% [effective 1 April 2023]

3. Tax Deducted at Source (TDS) on crypto transactions at 1% [effective 1 July 2022]

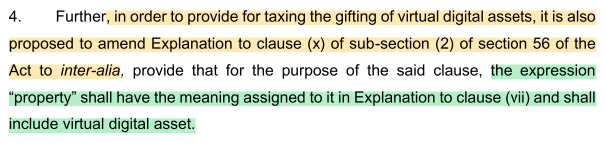

4. Gifting at 30% for ‘non-blood’ relatives [effective 1 April 2023]

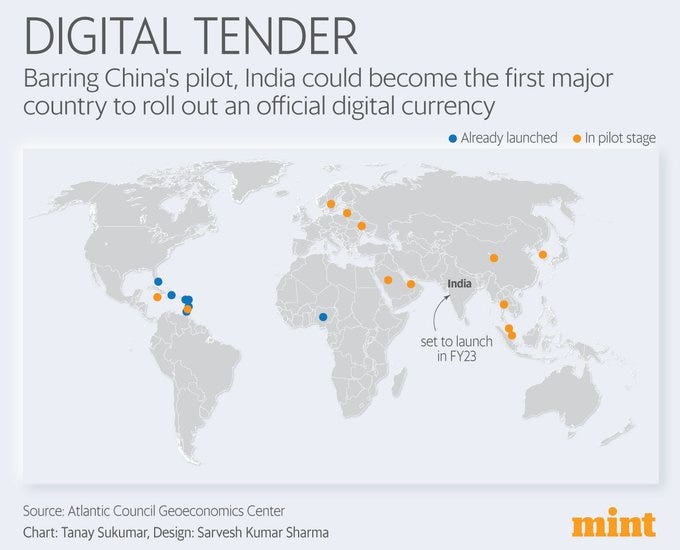

5. Introducing a Digital Rupee (included in the Budget speech)

The Good, The Bad, and The TBD(C)

There are many ways to splice these new provisions from the vantage point of industry, individuals and institutions (and the government, of course). I’ve tried to unpack these in the paragraphs below along with my own beliefs about how things could potentially play out (and because this is a serious, mature publication, I’ve classified each of these points using an appropriate emoji). I’m not an expert on taxation but I’ve also collated as much information and guidance as I can from professionals and veterans working on the (crypto) accounting implications of the budget, and cited their analysis below.

1. Clarity 👏

Crypto has often been seen as the black sheep of our tech and finance ecosystem because of the historical uncertainty around regulations. Indian crypto enterprises had been left out of most venture capital agendas for the longest time. Institutional investors had avoided holding crypto on their balance sheets or using it to diversify their treasuries. Brokerages haven’t been able to offer crypto trading to their existing clients. Retail investors have had to play a guessing game when it comes to tax compliance, trying their best to map their trading activity to existing norms around accounting for long term capital gains. As a founder or trader you were always at risk of flouting some existing rule that you didn’t know existed.

That’s why installing a tax framework is an important step to clearing up some of the confusion around the status of digital assets in the country. Leaving aside the actual rate in question, just the fact that there is clarity around how to account for the gains from crypto investing mean that potential investors (both retail and institutional) that have stayed on the sidelines now have one less barrier to dip their toes into this new asset class. Contrary to popular belief most crypto exchange operators and traders would much prefer the assurance of a fixed tax regime rather than the confusion that accompanies a regulatory vacuum. We still need a comprehensive crypto policy framework, but taxation is a good first step.

2. Impact on retail traders 🙁

In more ways than one, retail traders have borne the brunt of the new provisions. A flat 30% tax on crypto means that regardless of your income bracket (or your respective tax slab) everyone is regarded at the same level when it comes to taxable returns on crypto trading. This would place crypto within the same financial universe as gambling or skill-based gaming (poker, rummy) in India, where the returns from these activities are similarly taxed irrespective of the income status of the individual in question. To an extent, for me, this is more telling of the government’s mindset than any of the other measures that have been introduced.

Crypto is being seen and treated largely as speculative activity. That is understandable. To outside observers this world can often appear to be a cross between a casino and a theme park. But that is partly a feature, not a bug. One of the central promises of blockchain-based crypto assets is that anyone in the world can come up with the next great tech idea, execute it as a decentralised application using a public blockchain platform, and solicit funding for their idea from anyone in the world with an internet connection. It is borderless, permission-less innovation supported by borderless, permission-less finance. Every idea is not a slam dunk. However, a 24/7 liquid market means that there will be always action for these ideas on the trading front, regardless of whether the underlying asset has any real utility or future prospects (re: Shiba Inu). But the point is, that contrary to the world of equities or venture capital, ordinary investors and citizens of the internet have an equal chance to take part in the upside of the next big tech innovation.

There is certainly a lot of speculative activity masquerading as investment activity, which is why Indian authorities have imposed a ‘gambling’ tax on crypto income. The problem now is that ordinary investors, for whom crypto has represented an alternate way to protect and grow their wealth, are now being penalised by a prohibitive tax rate that severely impedes their ability to take part in the upside of this new technology.

As a relatively new asset class, crypto is volatile enough to begin with. When you couple that with a 30% tax on any gains, you’re effectively killing ‘middle class’ crypto investors or, at best, ushering them away from viewing crypto as a viable investment option. They might as well buy a lottery ticket. This is compounded by the fact that retail investors won’t even be able to cary forward their losses, or set-off their losses against the gains from any other type of asset (equities, bonds, property). These investors typically fall within a younger age bracket, and increasingly come from outside India’s major cities. The goal should not be to restrict average Indian citizens from participating in the future or learning about new technological opportunities at their disposal. If the objective of the government is to protect smaller investors from volatility or scams, they should prioritise consumer education either at a federal level or via stronger community efforts from crypto exchanges.

3. Inconsistency with actual crypto usage 🙈

For the uninitiated, Tax Deducted at Source (TDS) is tax that the government imposes at the time/source of making a payment. It was introduced so the government could collect tax from the source of income. It requires the payer/buyer (‘the deductor’) to deduct tax before paying the balance to a payee. The deductor then has to record and deposit the TDS in the government’s online TDS portal. The deductee is entitled to get credit on that amount at the end of the specific tax period. It is typically applied at the time of making payments like salaries, commission, rent, interest, professional fees etc.

With regards to the Budget, the government has imposed a TDS of 1% on crypto transactions, meaning that buyers/traders will have to deduct TDS for each trade or transfer they make (subject to certain transaction limits). Theoretically, they have to then deposit this TDS in the online portal, which requires knowledge of the Personal Account Number (PAN) of the counter-party (the seller) to the transaction. If you were imposing TDS at the exchange level, it would be practical to implement. Indian crypto exchanges have records of the PAN details for each of their users, collected as part of the Know Your Customer (KYC) process while signing up a new account. It would be cumbersome (but possible) to deduct and record TDS for their customers at the time of each transaction.

However, there are several reasons why TDS at 1% wouldn’t just be impractical but in many cases impossible to implement in practice. For one, it would take a significant chunk out of the trading corpus’ of retail traders, many of whom typically undertake a high frequency of trades every day to try and make a return on the arbitrage. These traders already have to pay a transaction fee to the crypto exchange, and another 1% TDS for each transaction would seriously cut into their ability to sustainably carry on their trading activity.

Arguably more pernicious than the strain on traders, is the question mark over how to implement TDS for crypto transactions that place place off of Indian crypto exchanges. The main utility of centralised exchanges is to provide people with an easy way to convert their fiat money (i.e. their rupees) into crypto assets. They offer a platform for buying and selling crypto assets, creating a liquid market for Indian users. The vast majority of people access the crypto world for the first time using these central exchange services (‘central’ because they are owned and operated by a single corporate entity). However the second function that crypto exchanges offer, is that they are customarily used as a portal to the wider crypto ecosystem. They are a gateway to the Metaverse.

Typically users first buy their crypto assets on a central exchange using their INR. They can then withdraw these assets into an online (or offline) crypto wallet where they manage the custody of their own crypto tokens (as opposed to the exchange custody-ing these assets on behalf of the users). Individuals can then use their crypto wallets to access services and applications in the wider crypto universe. For example, they can connect their wallets to OpenSea to buy and sell NFTs, or to Uniswap where they can swap their tokens for others, or to AAVE where they can borrow or lend their crypto assets to earn yield. The vast majority of this activity occurs without knowledge of the counter-party to a transaction, instead governed by the terms of a ‘smart contract’, which embeds the rules of the transaction into the underlying code.

For all of this activity, it would be impractical (if not impossible) to fulfil TDS requirements because not only are you dealing with international web services that don’t record the personal (or tax) information of their users, but you often have no idea of the identity of the person you’re transacting with. Your counter-party could be a non-Indian tax resident sitting at a different corner of the world.

With the way things are currently set up, we will likely see a drying up of trading volume on Indian crypto exchanges or worse, we will see traders conducting their crypto activity outside the purview of Indian authorities. I’m hopeful that the Indian crypto community (both users and operators), can facilitate a softer and perhaps more pragmatic stance with regards to both income tax and TDS so that ordinary citizens aren’t prohibited from participating in the crypto ecosystem.

4. Web3 in India 🚀

If you’ve managed to stay clear of the crypto madness so far, you might be asking yourself what the fuss is all about. Its all just a speculative bubble isn’t it? Its all just influencers shilling memes and dreams right?

Well, not exactly. We’re on the cusp of moving into a new digital era, one where decentralised blockchain-based protocols and crypto assets will likely play an important role in reimagining the future of the Internet. ‘Web3’ is a vision of the Internet where users and builders are empowered to control their own identities and manage their own data. It aims to shift the balance of power from rent-seeking central intermediaries to individual users who can utilise these new crypto tools to have a bigger say (and ownership) in the Internet products and platforms they use on a regular basis. Virtual currencies, virtual goods, and virtual reality will represent major pillars of our digital lives going forward.

That being said, with the immediate threat of a crypto ban having now been quelled (🤞 ), entrepreneurs and institutions that have stayed clear of this space can start to conceptualise their own Web3 strategies. Assuming that the stringent measures currently imposed don’t drive away retail users (and hopeful that they will be eased in some respects), I expect to see a flowering of Web3 economic activity being led out of India. This includes:

Indian artists using NFTs as a way to monetise their work and extend their Intellectual Property

Indian creators developing new brands and telling new stories (via NFTs) that tap into the rich tapestry of Indian mythology, folklore and tradition that allows us to continue to shape global culture while exporting Indian soft power

Indian brands, artists and corporations creating Web3 campaigns as a means of engagement and enrichment for their most ardent fans

Indian designers, writers, animators and producers helping to fill in the technical and creative requirements of an immersive digital future

Indian social media companies and gaming platforms utilising crypto tools as a way to reorient themselves in service of their customers, rewarding individuals for their time, attention and contributions while giving them a way to participate in the growth and upside of the platforms/brands they use.

Professional services companies (old and new) helping to fill in the knowledge and brokerage gap for Indian crypto users (including accounting, tax, legal and possibly real estate requirements)

Indian founders and developers continuing to build from India for the world, giving India the strongest possible voice in dictating what our digital future will look like

Another tailwind for our vibrant fintech sector, which can now experiment with the challenge (and opportunity) of embedding Web3 tools into our existing financial routines

And an opportunity for Big Tech and Big Finance to experiment with the versatile commercial canvas that NFTs represent.

Indian corporations, institutions and other traditional investors exploring the merits of diversifying their treasuries into crypto assets (echoing a similar trend in the US public markets over the last 18 months)

Indian traders, investors and users being able to participate freely in the future digital economy, owning and controlling their digital identities, investing in digital assets and monetising their digital output

I’m aware that I’m probably getting ahead of myself here. I think most institutions will continue to wait and watch. We still need a comprehensive regulatory framework for crypto in India that extends beyond just a specified tax regime. The government says a Crypto Bill is on the way. My own experience tells me that timelines on this stuff are usually a bit hazy. There will no doubt be some back and forth between the regulators and industry representatives. But I would hope that the economic potential of Web3 for India nudges legislators towards a more progressive policy framework that will allow Indian dreamers to build and participate in the future without running afoul of the law.

5. Central Bank Digital Currency (CBDC) i.e. a Digital Rupee 🤔

An Indian CBDC has been rumoured to be in the works for a number of years now. Like the T20 World Cup, the news and activity intensifies every two years till eventually the idea is returned to the lab for further modifications. It is the White Whale of India’s crypto story.

Simply put, a CBDC is a cryptocurrency issued by a central government. It is an attempt to extract the technical potential of blockchain-based crypto assets (programmability, transparency, digital issuance and control) while discarding some of the more adventurous utilities of these assets (global, borderless, permission-less finance, decentralised issuance, no central governing authority, censorship-resistance, inflation-resistance, pseudonymous identification). A CBDC is like a PG-13 cryptocurrency. But that doesn’t mean it can’t be useful.

Central bankers have been enamoured by the prospect of CBDCs to upgrade international clearing and settlement between global banks (that currently take place over a messaging system called SWIFT). SWIFT is a creaky way of transferring value across borders that is due for an upgrade. This ‘wholesale’ use case for CBDCs retains promise for cross border payments, making them faster, cheaper and easier to track, and has been an area of focus for many of the world’s most prominent banking and payments players.

On the ‘retail’ side, CBDCs are intended to be a way for governments to introduce digitisation into their economies and phase out the use of cash. As a ‘crypto’currency issued by the central bank, they would theoretically provide citizens with the benefits of using digital money (like bitcoin or ether) while also retaining the assurance of a central bank guarantee. Programmable money means that digital currencies could be bestowed with certain parameters that executed on the satisfaction of pre-defined conditions. For example, the agriculture ministry could distribute subsidies to farmers in the form of Digital Rupees that were programmed so they could only be spent at government licensed equipment distributers. This would save the time and costs in involved in the evaluation and arbitration of similar large scale initiatives. The government would also be able to enact and execute monetary and fiscal policy interventions in a purely digital manner. Programmable money also means that existing costs of servicing financial products (loans, insurance, remittances) could also be obviated as transactions become governed by contracts embedded in code.

CBDCs have been a popular topic in Davos crowds for a number of years. Many governments around the world see it as a mid-point between fiat and cryptocurrencies. The Chinese government has been conducting retail experimenting with a Digital Yuan for much of the last year. While the RBI itself has left clues about its own CBDC ambitions over the past few months, there are many questions still to be answered like:

Would the Digital Rupee be a fresh issuance of fiat money? Or would citizens redeem Digital Rupees in exchange for physical cash? Will there be a fixed supply? Will CBDCs eventually be a supplement, complement or replacement for our existing currency system?

Will this be a mandatory rollout for Indian citizens or an opt-in? Would this require separate KYC and AML checks? Would foreign visitors be able to access these facilities?

Would an Indian CBDC be freely tradable on Indian crypto exchanges? Could we issue Digital Rupees to our international trade partners? Could it become a viable alternative to traditional reserve currencies?

Will this initiative be controlled entirely by the Central Bank? Or would commercial banks act as a conduit for distributing, redeeming and managing the retail side of the equation? Does a CBDC wallet become a quasi-bank account? Do we need another ‘tech-first’ regulator governing this effort?

What will be the status of our existing payments infrastructure in a post-CBDC world? If its just one central authority managing the whole system, do you really need a blockchain for that? Will we choose the potential programmability of CBDCs over the programmability of UPI? Will cryptocurrencies, CBDCs and digital cash all be able to co-exist? How will it effect our existing fintechs, payment companies and digital wallet providers?

Will the government have complete surveillance over the movement of Digital Rupees in the economy? Will the government be able to unilaterally censor private transactions? Is that something that Indian citizens should get to vote on? On the other hand, could it help ensure transparency of government income and spending?

India is at the absolute forefront of global innovation when it comes to digitising an economy using a first principles approach via the implementation of public digital infrastructure. It remains to be seen how India’s CBDC efforts will fit into our existing digitisation efforts. A Digital Rupee would definitely reduce the time and costs involved in the physical issuance and transfer of new currency notes. Programmable money is a revolutionary concept, but I’m wary of efforts that aim to strip away all the features that make crypto interesting. Let’s see how this plays out.

Closing Thoughts

Indian tech has arrived. Indian founders and startups have rightfully earned their moment in the global spotlight. The last decade has proved that we are capable of writing software and building products that can stand shoulder to shoulder with our global counterparts. That same entrepreneurial zeal should be nourished in support of our Web3 goals. We have the ambition and the talent. India should be leading this charge.

While I applaud the Indian government for coming forward with an idea for a prospective crypto tax regime, there is certainly some distance to make up to ensure that our crypto story includes everyday users and investors, and not just HNIs and large ticket investors. That philosophy should extend beyond just tax implications into the final Crypto Bill as well. It will require a good faith effort from all stakeholders to define a progressive middle ground. We will need answers to questions like:

Who is the ultimate crypto regulator in India? Is it the RBI, SEBI or CBDT? Who regulates the exchanges? Do we need specific regulation for DAOs, DeFi, NFTs? Where do dollar-backed stablecoins fit into the equation?

What is the framework for consumer protection? What are the rules around crypto exchanges advertising on TV and in the newspapers?

Can corporations hold crypto on their balance sheets? Are there regulations around around self-custody of institutional assets? Do we need an insurance framework around theft/loss of crypto assets?

Can Web3 companies accept payments in crypto? [Probably Not]

Is the Indian government committed to letting our Web3 ecosystem flourish or will draconian policymaking suffocate the enthusiasm for this technology? Will it lead to a brain drain of crypto talent? Will investment dollars move elsewehere?

Will traders and users have to submit to complete oversight on their off-exchange crypto activity? Or will the policymakers come up with a pragmatic way of regulating crypto while recognising that it is difficult to retro-fit existing tax and accounting frameworks onto a new technological paradigm?

Will the banking, payments and card networks be allowed to support crypto activity in India? Or will they be spooked into sitting this one out?

In many ways I sympathise with governments and regulators that are grappling with sensible policymaking for crypto. When Satoshi Nakamoto first conceptualised Bitcoin in 2008, he envisioned a native monetary system for the Internet that would function peer-to-peer without the need for central intermediaries like governments, central banks or corporations. His innovation was in designing a system for coordinating resources between strangers over the Internet that replaced our trust in people with a trust in code. This system is now used and trusted by hundreds of millions of people around the world as a legitimate store of value. Their trust is emboldened by the fact that this system has no loyalties to any single individual, government or corporation - Bitcoin (and public blockchains) are global utilities for global citizens, just like the Internet.

Bitcoin as a philosophy suggests an abandonment of state-sponsored paternalism in lieu of upholding the sovereignty of the individual. It is a check and balance against the collapse of sovereign monetary systems. As Nassim Taleb so eloquently describes, bitcoin is “insurance against an Orwellian future”. In the last 12 years, that same philosophy has extended to the design of other crypto networks with different use cases that similarly aim to decentralise the worlds of finance, art, gaming, social media etc while giving users greater ownership and control over their digital lives.

If you are one of those central intermediaries (like central banks and central governments) whose usefulness, functionality or existence is threatened by the emergence of decentralised protocols and crypto assets, it can be tricky to chart out an appropriate response. Do you enable this technology (and potentially your own obsoletion)? Do you acknowledge that the land of the Web will have its own native currencies, communities and customs, and the physical world should build around these? How much crypto activity do you let slide? How much do you reign in? What is the role of sovereign governments if blockchains can now safeguard property rights and enforce contracts? How much regulation is too much regulation when it comes to crypto i.e. at what point does stringent regulation defeat the entire purpose of having this decentralised toolset?

I don’t know the answers to each of these questions. And I don’t envy those whose job it is to answer them while keeping everyone safe, satisfied and happy. But I don’t think this genie goes back in the bottle either. Crypto is an idea virus that has already infected hundreds of millions of people around the world. It has spawned a macro level game-theoretical experiment where nation states and jurisdictions that want to attract crypto entrepreneurs and enthusiasts have introduced policies like a 0% crypto tax or declaring bitcoin as legal tender. People spending a majority of their time online can now move their physical selves to friendlier jurisdictions that allow them to enjoy the full extent of the digital opportunities at their disposal. That’s why I believe countries that take an antagonistic stance to crypto now will eventually lose out to those that understand the promise of these new technologies.

I’m hopeful that India will fall in the latter camp. I’m hopeful that we can design a policy framework that gives our talent a reason to stay. I’m hopeful that a progressive tax regime leads to a larger tax base for the government and in turn a large power base for India’s crypto constituency. I’m hopeful that crypto will come to represent just another global stage for Indians to shine. WAGMI.

MORE FROM TIGERFEATHERS

On Bitcoin

On Web3

On the Metaverse

On Polygon

ABOUT THE AUTHOR

Rahul Sanghi most recently served as Fintech Lead for Visa in India & South Asia. He began his career as a consultant with KPMG in London, spending a majority of his time helping the firm set up its global enterprise blockchain and crypto asset advisory practice. He moved back to India in 2018 and joined Koinex (then India’s largest cryptocurrency exchange) as Director of Business and Strategy, before assuming the same role at B2B-SaaS startup FloBiz. He is currently the co-founder of Tigerfeathers, a media brand that is being built for Web3.

If you’re based in India and working on anything cool in Web3, crypto, NFTs, Defi - I’d love to hear about it. Feel free to get in touch on Linkedin or Twitter.