Vision 20/25: Charting India

25 of India's most thoughtful investors provide evidence on the shape of the future

Hey folks 👋

Welcome to the 221 new Tigerfeathers subscribers who’ve joined since our last piece.

Incidentally, 221 is also the number of times we’ve rewatched the video of 18-year old Gukesh D winning the 2024 World Chess Championship last week. Wholesome, humble, and easy to root for - that young man has fully earned his spot on the pantheon of Indian sporting legends👑

While our chess skills at Tigerfeathers are…dubious, at best, we try to keep our readers one move ahead when it comes to all things India. Pawn to D4 (or whatever) here👇

This edition of Tigerfeathers is presented by…Finarkein Analytics

At Tigerfeathers, we’ve written extensively about how India marshalled Digital Public Infrastructure (DPI) to remodel itself as the flag-bearer for 21st century development. This makes Finarkein an ideal partner for this publication.

Finarkein is a data analytics company that helps enterprises to publish, consume, and analyse data on India's open protocols and networks. It is rapidly emerging as the most accomplished DPI technology provider in the market, already powering a huge proportion of the country’s total Account Aggregator flows, while also developing a suite of formidable solutions for ONDC, OCEN, and the National Health Stack.

Companies serious about leveraging DPI for use cases such as lending, insurance, wealth, health, and commerce should reach out to Finarkein. They recently raised USD ~$5 million from Nexus Venture Partners, IIFL Fintech Fund, Eximius Ventures, and Capital 2B (Info Edge) to supercharge their proprietary data analytics and connectors stack, so make sure to give them a shout at hello@finarkein.com to understand how they can support your business today.

“Without a shadow of doubt, humanity’s three greatest inventions are the wheel, calculus, and the year-end list.”

- Galileo

Friends, we’ll never be able to prove it, but 2024 was, at minimum, two months short of a full calendar year.

In any case, we’re in the dying embers now. And with that, comes the second edition of our Tigerfeathers Annual Review. Or, what we’re provisionally calling the Tigerfeathers Annual Crystal-ball & Oracle Survey (TACOS, for short 🌮).

Like last year, for this edition we asked some of the most thoughtful investors in India to weigh in on the same question. For everyone who missed it, last December we asked our participants:

1. What trend excites you most about India going into 2024?

2. If you were starting a company in India today, what would you start?

This year, the question was:

“What is one chart, statistic, or piece of evidence that more people should pay attention to?”

And we’ve had some fantastic responses…

…but, before we get there, a few updates and bits of housekeeping (den keeping?) from behind the scenes at Tigerfeathers.

This Year In Long Reads

In 2024, we’ve written about some of the most compelling ideas, companies, and technologies from the Indian startup ecosystem.

We started the year with a ‘marathon’ through the Open Network for Digital Commerce (ONDC), the disruptive new addition to India’s roster of digital public infrastructure. We did a two-part series on ‘what to watch in crypto’, several months before bitcoin crossed $100K, before DOGE was in the news, and before it was cool to talk about crypto at parties again.

We did our first sit-down interview with Anupam Gupta, to talk about his fantastic new book on the history of Asian Paints. We dove into two incredible chapters of Indian history - about the 19th century ‘frozen water’ trade between Boston and colonial India, and ‘the bold bet on Moore’s Law that changed India’s destiny’. We published two lighter pieces on the NarraTV and The Infinite Almanac of Writing Wisdom.

(Rahul also managed to squeeze in a thesis on the dissolving of language barriers in the age of AI. This one was written for the

newsletter, part of the extended universe at O’Shaughnessy Ventures, which has been his home away from Tigerfeathers for all of 2024).Finally, over the past few weeks we’ve covered the epic tales of two of the most ambitious Indian startups around - the spacetech pioneers at Pixxel, and Jar - ‘Indian fintech’s golden child’.

We’ve been incredibly fortunate to also partner with some of our favourite start ups and investors as sponsors this year. A huge shoutout to Antler India, Rocket Health, Finarkein, TEAM, Navana.AI, and Lightspeed India for supporting our work. If you’re interested in partnering with us next year, feel free to hit us up on Twitter/LinkedIn, or just reply to this email.

With each calendar year our mandate becomes clearer. We want Tigerfeathers to be the single highest source of signal on India in the 21st century. Nothing less. Needless to say there’s a lot more work to do before we can make that claim with a clear conscience.

How It Started / How It’s Going

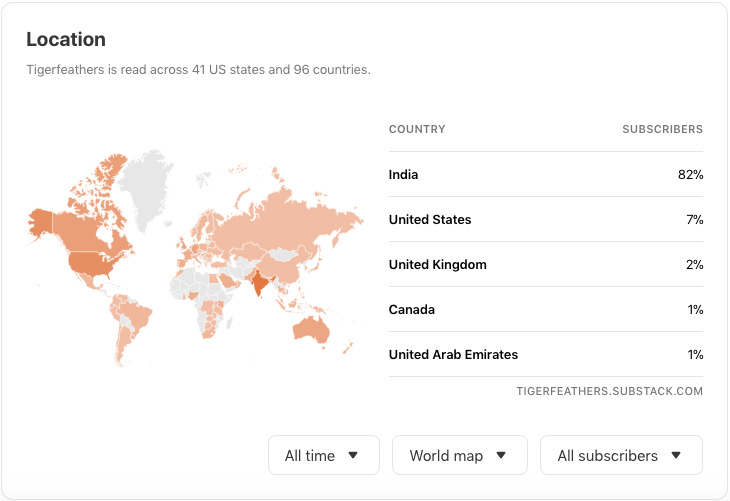

Anyway, we started the year, on 1st January 2024, with 6,990 subscribers (nice, yes). As of this time of writing, on 20th December 2024, there are currently 14,966 of us here. Here’s what the global heat map looks like:

Whether you’ve been with us the whole time or only for a few weeks, all that is appropriate for us to say here is - thank you.

Thank you for sharing our curiosities and for indulging our work. And for proving that in the age of short-form-everything, video-or-nothing media, there is still an appetite for deeply researched, painstakingly crafted, hilarious (some would say), long-form writing.

We know that there are a million better ways you could spend your time, so if you’ve been kind enough to carve out a few minutes of your day(s) to read our stuff this year, you should know that we don’t take that for granted.

Next year is shaping up nicely, with our first three essays already in the oven. We’ve also got our first new media project to be incubated under the Tigerfeathers umbrella 👀, but more on that in a few weeks.

Before we get to today’s piece, one last announcement:

Introducing…The Tigerfeathers ‘Spotlight’ Series

In our quest to turn this newsletter into the home of the most thoughtful writing, storytelling, and analysis from India, we think it’s time to open up this space to the Tigerfeathers community, to share the microphone with voices that are not our own.

So if you’ve ever:

wanted to flex your writing and your insights (but you’ve never had the opportunity or the time)

wondered why a topic you’re passionate about hasn’t gotten the kind of mainstream coverage it deserves

had an opinion that’s too spicy for corporate thought leadership or academia

been in possession of secret knowledge that you couldn’t share before (but you can now)

thought about writing a piece that you know only you can write…

…now’s your chance.

The Tigerfeathers Spotlight Series is our programme to feature the sharpest guest writers (and guest writing) from India. We are looking for stories that are smartly written, rich with insights, and designed to illuminate some aspect of Indian tech, business, history or culture that our readers would find especially interesting, entertaining, or surprising (bonus points for hitting all three).

These could be about the geopolitical history of the vada pav, the economic costs of the Battle of Buxar, the use of CRISPR to breed protein-rich poultry in South India, the branding strategies behind the success of Lays Magic Masala, the founding story of Bajaj Finance, how to make a career in Indian VC, or literally anything else *you* think everyone *needs* to know more about.

Why are we doing this?

Because there aren’t a lot of forums that celebrate the written word in India. The best writing doesn't reside in the same places it used to, and the 'creator' economy has really become a euphemism for the Youtuber and Reel-maker economy. It doesn't do justice to the amazing work being done on blogs, newsletters, personal websites and independent publications by Indian writers. So instead of waiting for this to change, we want to provide a platform for the country's best writers and thinkers to do their thing.

Things we don’t care about:

your professional writing credentials (we don’t have any)

your educational qualifications, work experience, or any of the stuff that typically comprises the first half of a CV (you could be still in college, fresh into your first job, currently surfing the C-suite, or enjoying retirement - if you’re in possession of a great story and you have the talent to tell it, we’re all ears)

Things we do care about:

the quality and personality of your writing

the depth and originality of your analysis

your enthusiasm and curiosity for your topic

We’re envisioning this series to feature original essays between 2500-7500 words (but we’re not too fussed if you break that limit in either direction). We’ll be in your corner, helping you flesh out your idea, giving you feedback, editing your stuff, sending you snacks if you’re working late etc. In short, we’ll take a blood oath to do whatever it takes to help you produce your best work, and give your essay the best chance of success. You will also be entitled to half of any sponsorship revenue (if any) that’s attached to your piece.

Fair warning - our intention is to maintain a very, very high bar for this. We will be as annoying about making sure your final output is fit to publish as we are about our own work. Case in point, our Substack dashboard is littered with the corpses of unfinished drafts (and at least three finished drafts) of essays that we ultimately deemed unworthy of anyone’s attention. We owe that to our readers.

This means no room for low-effort AI slop, no plagiarism, nothing dishonest, nothing too LinkedIn-y, and nothing boring. We’ll start off this programme with just one guest feature, and then re-evaluate things based on how the experiment goes, for you and for us.

If you’re interested in getting involved fill in this Google Form to get things started. Every single person that applies will get a response from us with feedback on your idea/application. And if you know someone that would be a great fit for this, do us both a favour and help spread the word.

Right, enough blathering. Back to our regular scheduled programming.

🌮 TACOS #2

Like we said up top, for the last piece of 2024, we presented 25 of the most insightful investors in India with the following brief:

“What is one chart, statistic, or piece of evidence that more people should pay attention to?

The idea is to have each respondent identify one thing that more people should be aware of - it could be extremely niche, very broad, aimed at founders, other investors, or just curious people at large. It could even be something that is being embodied or tackled by a company in your portfolio (feel free to shout them out).

In short, the mandate is very flexible. The only ask is that it should be something that can be represented as a piece of visual evidence - a chart, number, graph, photo etc.”

The inspiration for the prompt came from three places - 1. Balaji Srinivasan mentioning on a podcast a few years ago to ‘find a chart to bet on’; 2. Shaan Puri and Sam Parr talking about ‘one chart businesses’ on the My First Million podcast; and 3. The Evidence series by Damir Becirovic and Dino Becirovic (which we used as inspiration for a fun Tigerfeathers piece last year).

What we set out to create this time was a compilation of sketches on where India is today, and where it's heading. Plus, it’s always cool to get a glimpse of which signals are top of mind for some of the country’s most active capital allocators. (Also, we ended up getting 28 total submissions, but that sounded a little clunkier in the title, so we left it as is).

Anyway, we owe a massive thank you to all our contributors for making the time and effort to send in a submission, and for making this piece what it is. While putting together this list, we wanted to make sure we had a mix of voices across different domains, funds, investment stages, and vantage points in India’s emerging economy. Ultimately each of these individuals is someone we enjoy hearing from and learning from. We’re confident our readers will come away with the same sentiment.

Let us know what you think in the comments, and if you have any feedback for us for next year.

With that, let’s get to it.

Pranav Pai - 3One4 Capital

Three Stories in Three Images

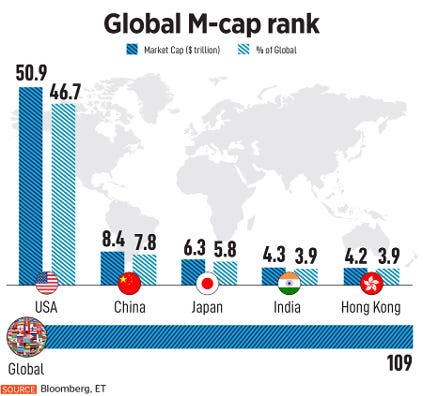

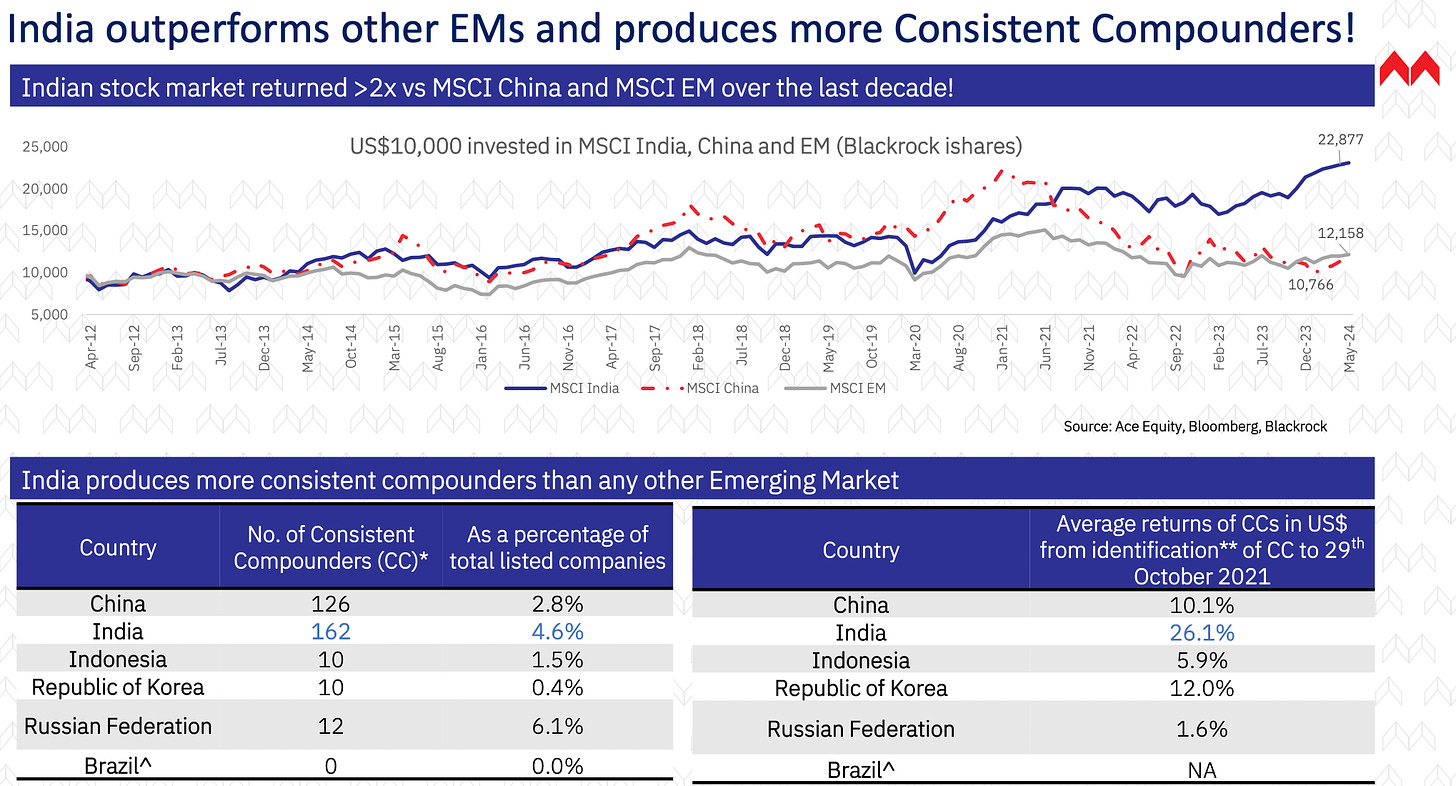

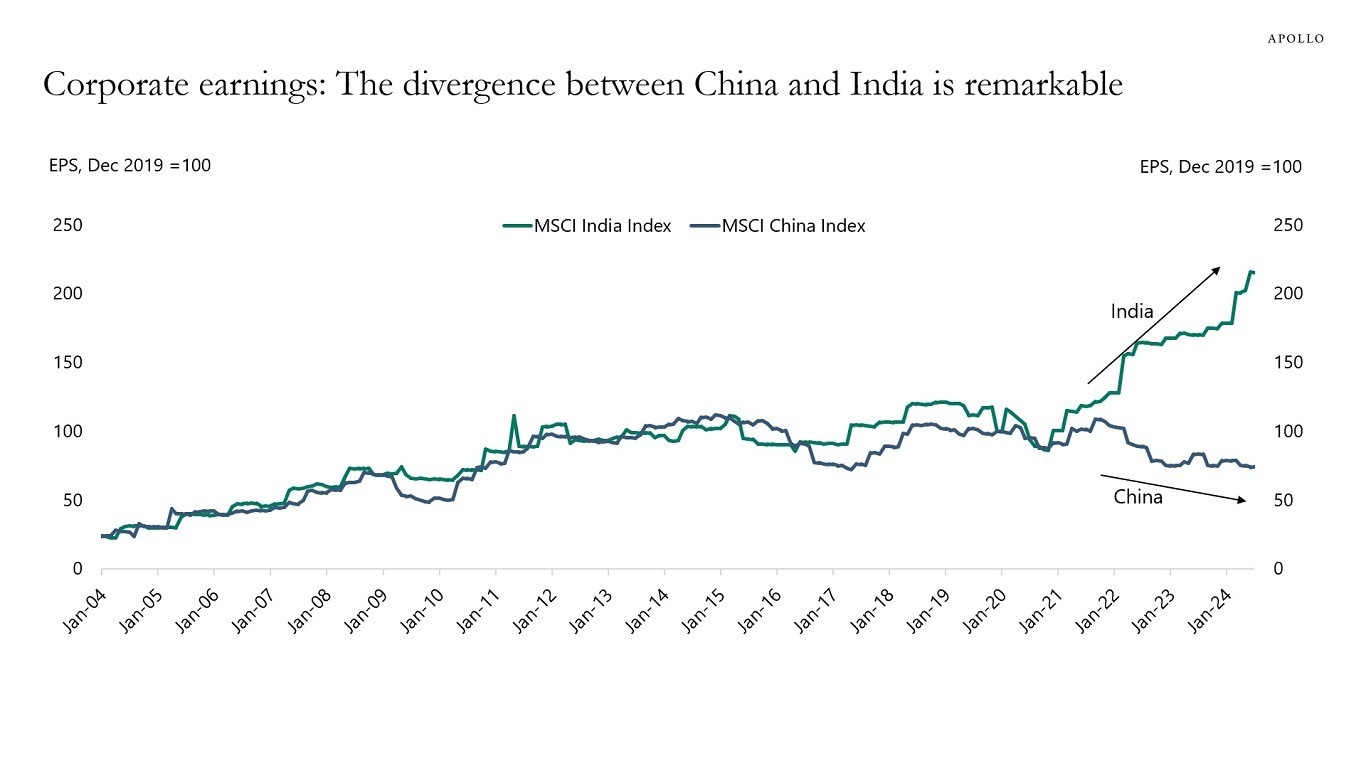

1. India is now the fourth-largest equity market in the world (latest is $4.9 trillion)

2. India has been the best-performing emerging market for equities, better than China

3. Indian corporate earnings are far outpacing China's

India's strengths as a free and large democracy, an open and well-regulated market, and the theatre for translating aspirations into tangible market capitalisation are now clearly evident across these graphs. We are the fifth largest in global GDP and should end up as the third largest at $5.5 trillion by 2027-28.

The country’s large and compounding internal demand, more efficient market practices, rapid formalisation, intense capex expansion, growth in local manufacturing, and intentional shift towards renewable energy are multiplexing to support a national fabric of resilience against global uncertainty. India is in a compelling position to leverage these strengths and entrench itself in the global financial order. This is the decade where we will see a surge of Indian value creators that will realign the economy towards a tech-first future and support the country's ascent towards becoming the third largest economy globally. We have plenty left to build, and we must not miss this window.

Karthik Reddy - Blume Ventures

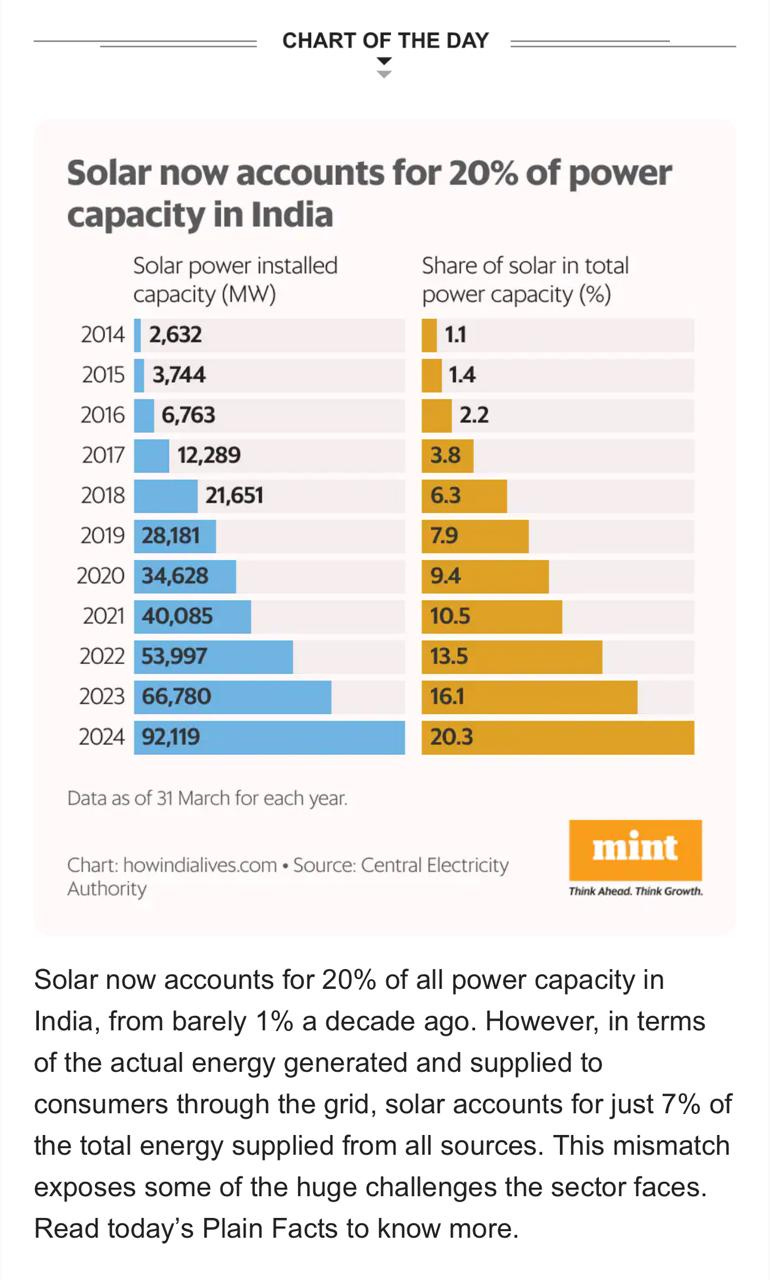

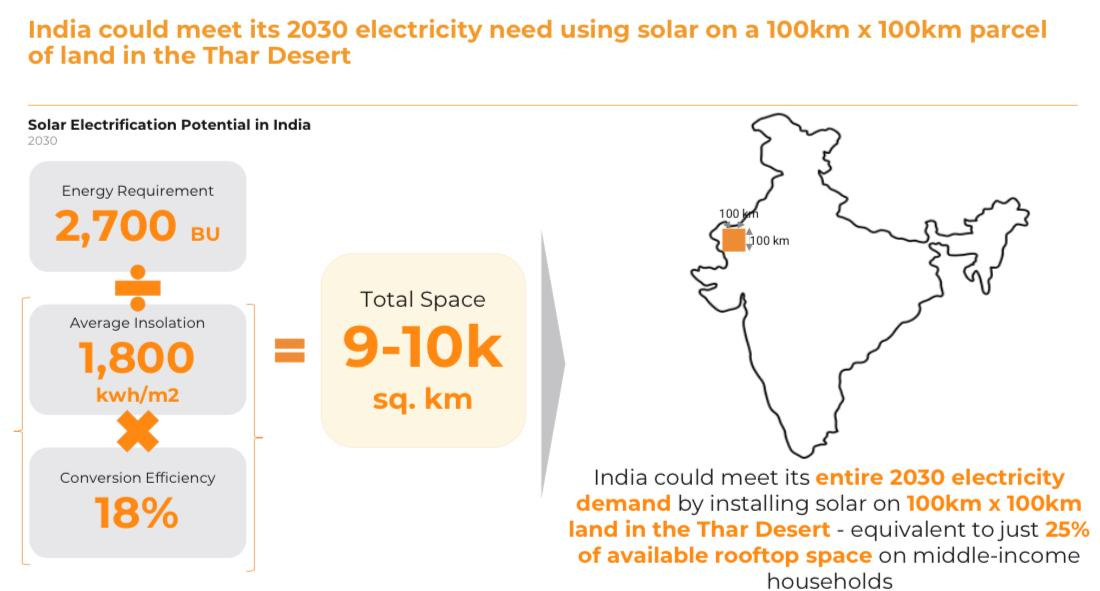

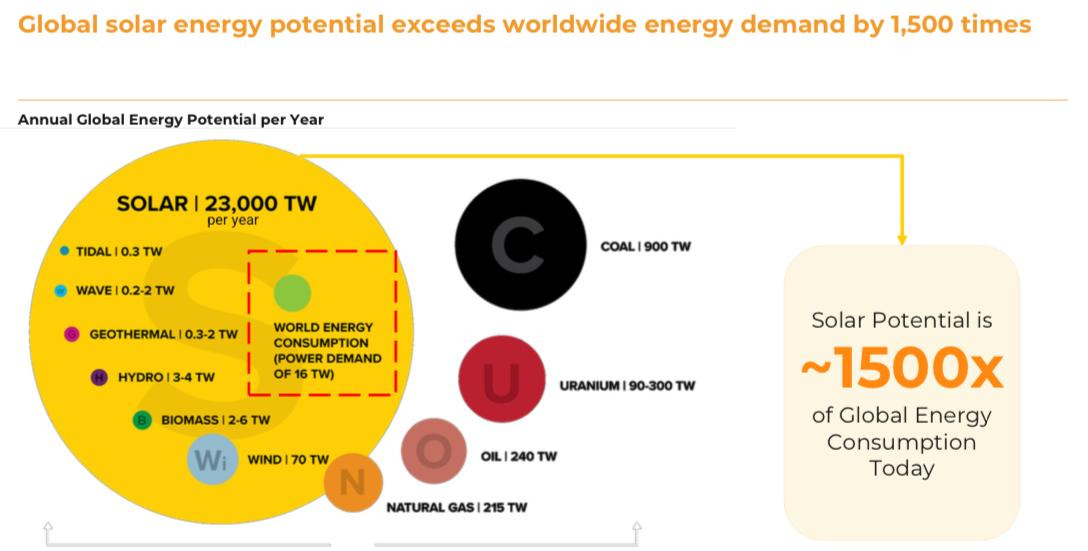

India’s energy independence can be architected entirely through solar. To be able to build capacity in the desert 🌵 🐪 is one thing, but to be able to amplify rooftop capacity in industrial areas shrinks transmission losses and in classic Indian style, decentralizes capture, production and distribution of energy, possibly creating a global template of renewable energy at a scale never seen before.

The electrification of large scale mobility, the lack of pollution in the cities or at fossil fuel burners across the country is too compelling to not move to this future in the next 6-10 years.

We’ve created PLIs for solar panel and component manufacturers and increased import tariffs only to see prices be shored up and exports surging whereas the multi-fold benefits of accelerating local scale has been lost on the country’s collective imagination.

Billions of panels doing surya namaskar all day long is the yogic future of India 2047.

Dev Khare - Lightspeed India Partners

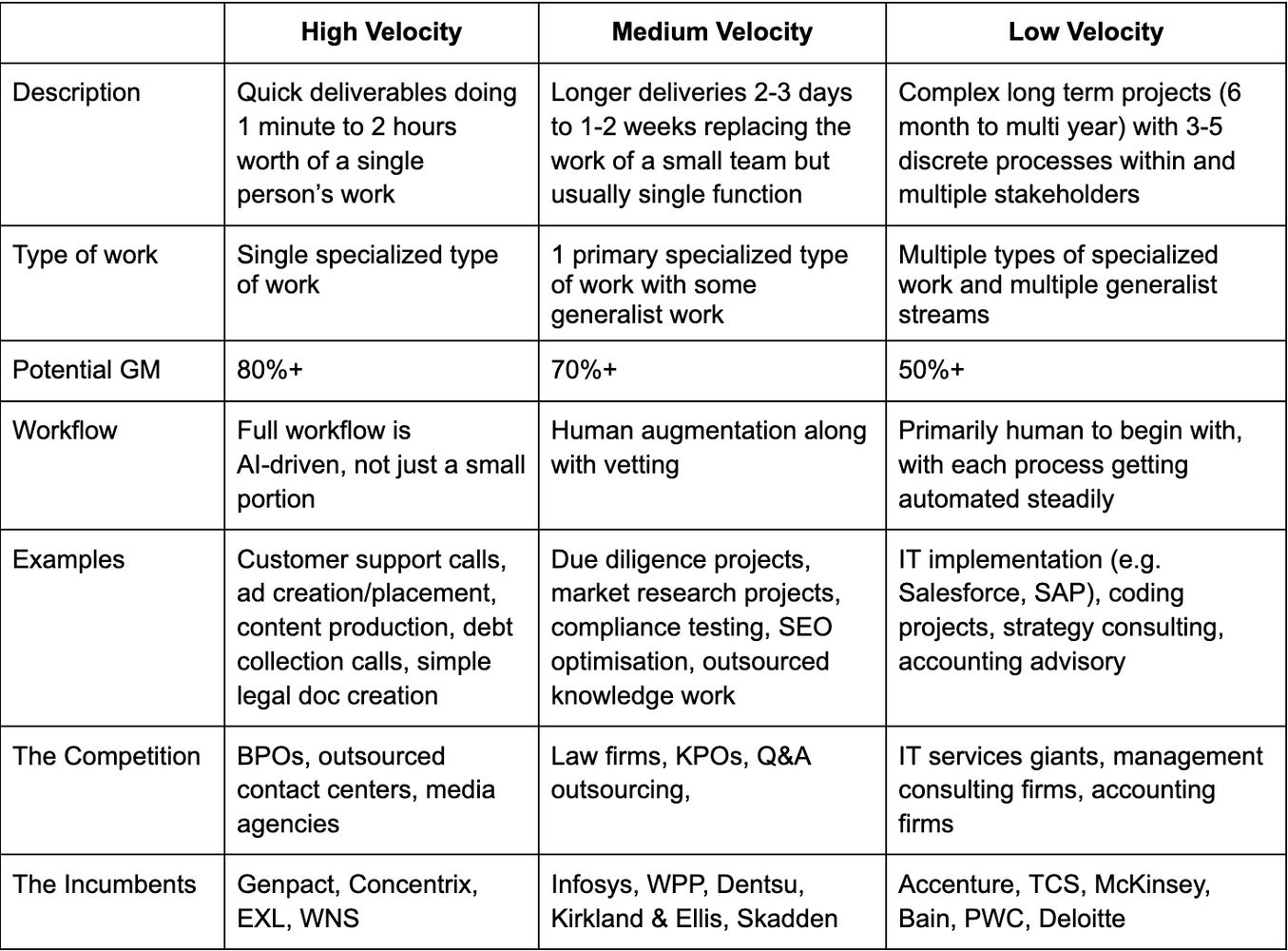

The one big wave these days in technology is the intersection of large language models and work. We see a multitude of startups emerging over the next decade to recreate work. We've written about this here

High-velocity work and low-velocity work is being recreated through technology, broken down to its base elements and then re-assembled to create full-stack solutions. This graph compares these types of work - we'd love to chat with founders starting up in this area!

Avnish Bajaj - Z47

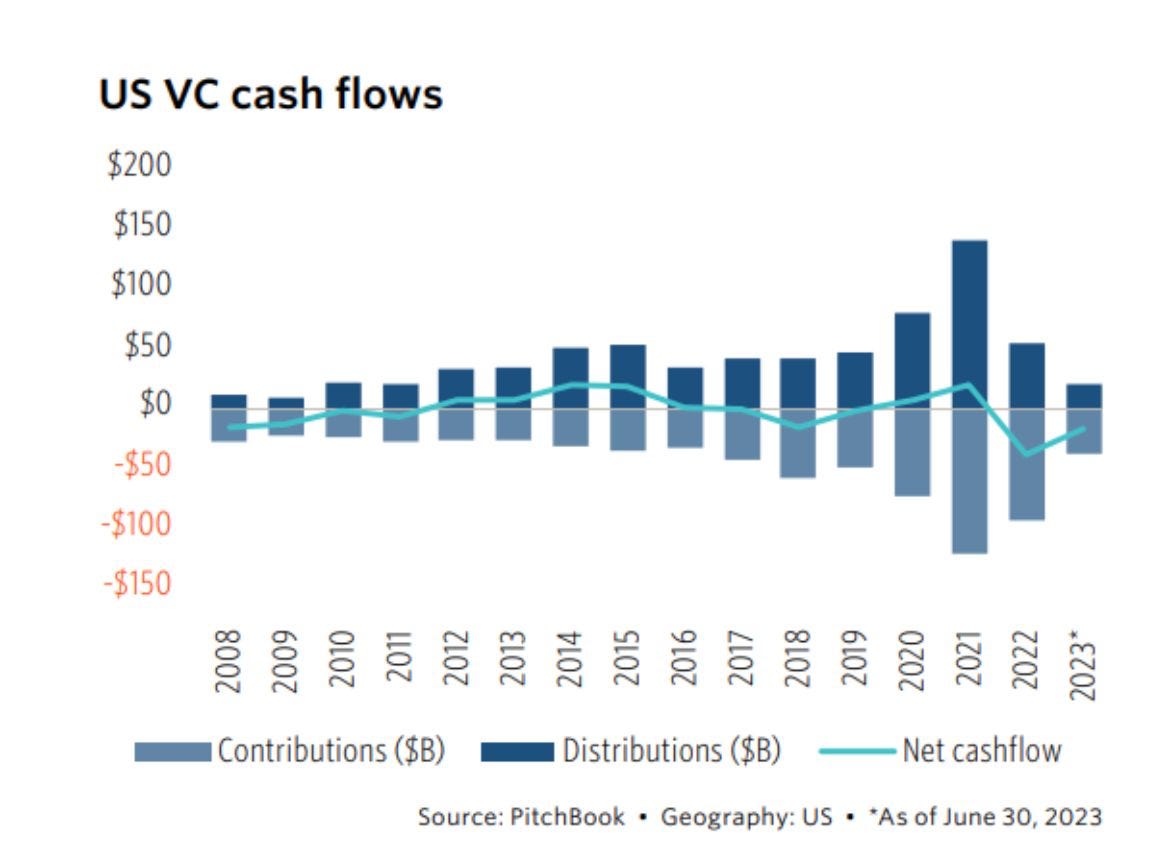

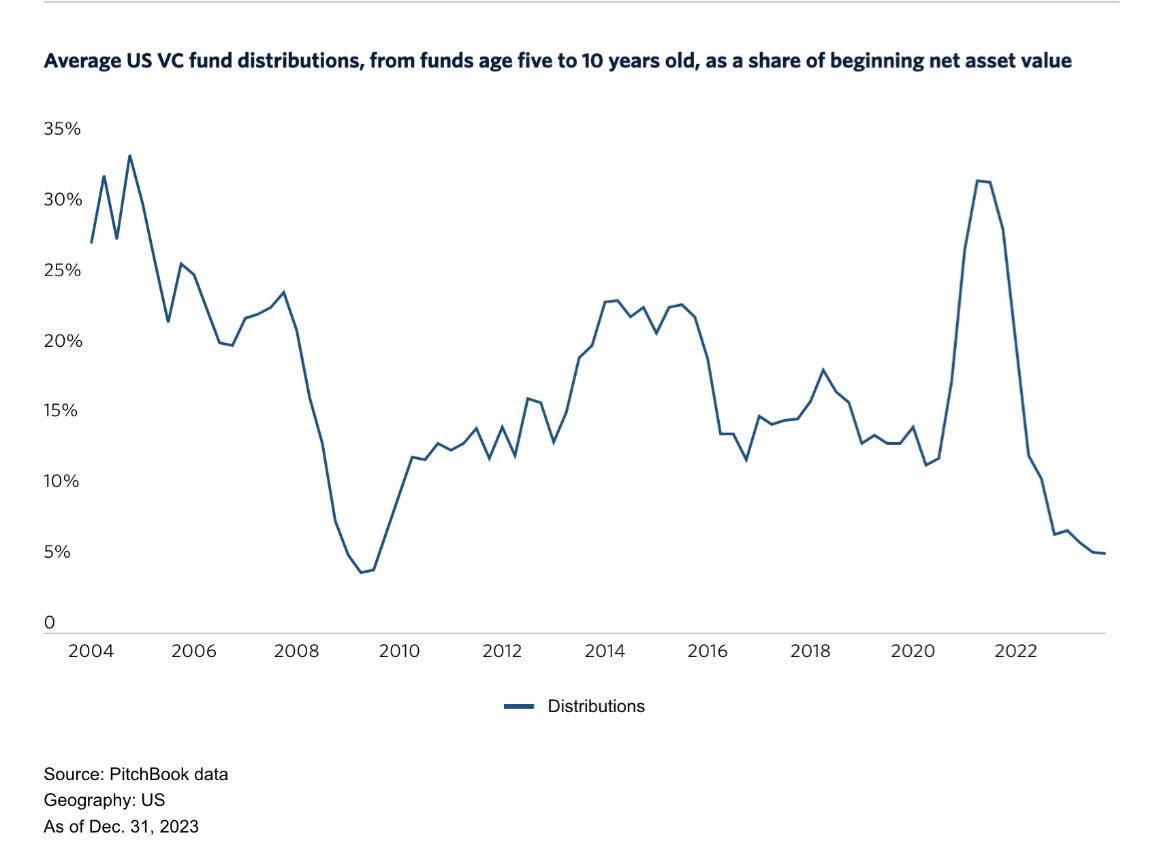

Here are two charts which show how the VC industry is liquidity-starved and at close to all time lows. Despite all the hype people see in our industry, this is what LPs care about the most!

The data paints a concerning picture: distribution rates from VC funds aged 5-10 years have plummeted to around 5% of net asset value, down from peaks of over 30% in previous years. Meanwhile, the overall cash flows in the US VC industry show contributions significantly outpacing distributions in recent years, creating a negative net cashflow environment.

This liquidity crunch has serious implications for the venture ecosystem. Limited Partners (LPs), who are the backbone of venture capital funding, are seeing diminished returns on their investments, which could lead to more selective fund commitments and potentially smaller fund sizes in upcoming vintages. This challenging environment might force VCs to rethink their exit strategies and portfolio management approaches, potentially leading to more focus on profitability and sustainable growth rather than pure growth at all costs. It could also mean less overall funding for startups going forward!

Vaas Bhaskar - Elevation Capital

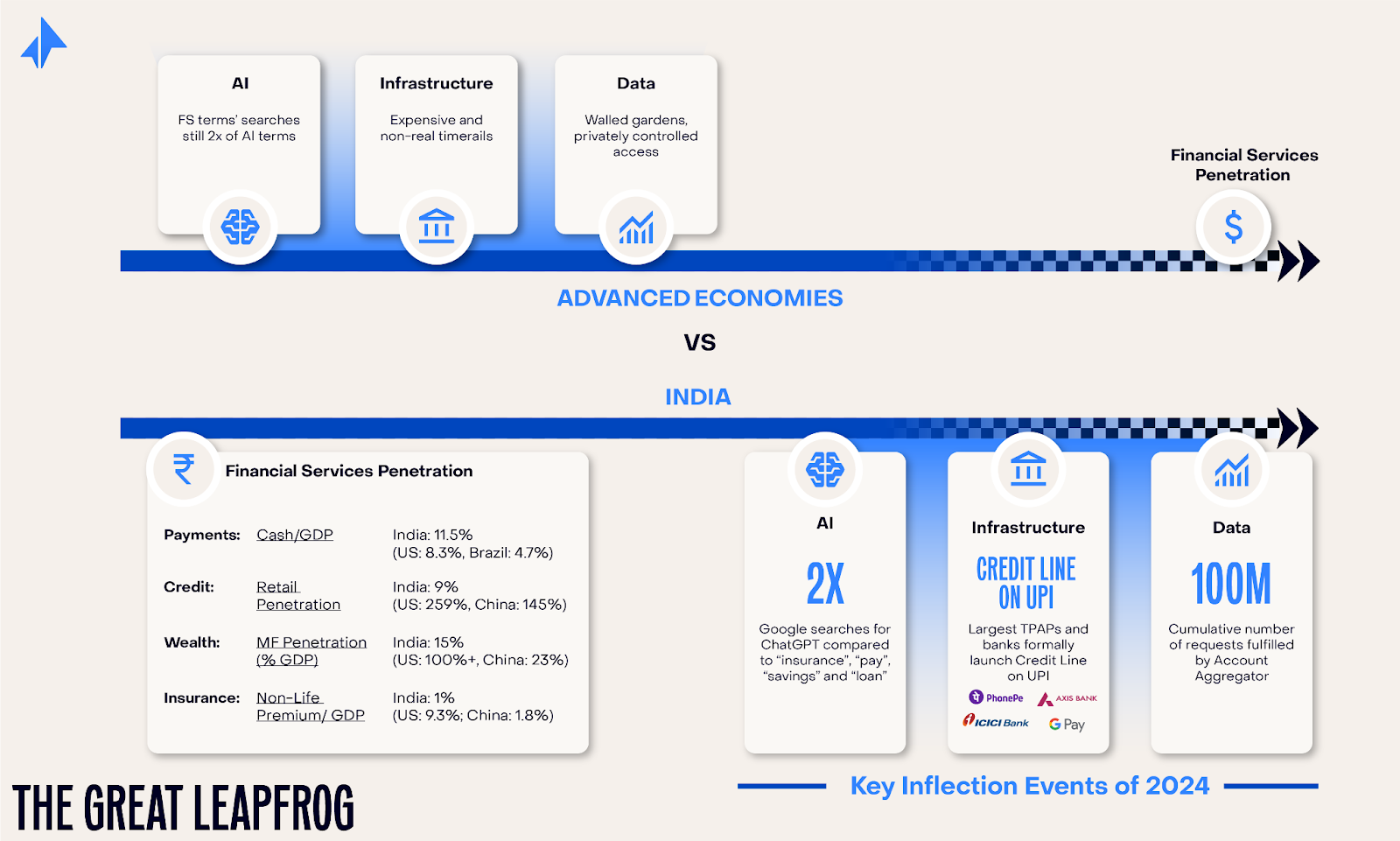

Eight months into 2024, while most fintech-watchers gathered at GFF (or were stuck in a cab in BKC!), I noticed three inflection points in India’s fintech story playing out in a way that defies global precedents. Financial data availability, financial digital infrastructure, and AI adoption in India have outpaced the large-scale penetration of financial products. This is in sharp contrast to most large, advanced economies, like China and the US, where this trinity has followed FS adoption (or is still absent). We’ve flipped the script!

This reversal of the traditional FS evolution pattern, unseen elsewhere, has profound implications for the future of India’s fintech and financial services adoption. It has thus created opportunities for unique India-first fintech businesses to emerge.

Data enables mass personalization and satchetization: As an illustration, Dezerv’s Wealth Monitor provides an aggregated view of performance and advisory across all investments. It has tracked Rs 1 lakh crore worth of assets for 4 lakh+ individuals - a majority of whom are new to wealth services. This highly personalized wealth and investing experience at a scale is truly unique to India and not possible without the strides we have made in consent based data availability!

Digital Infra creates never-seen-before seamless customer experiences: India’s DPI vision has become more audacious. For example, Credit Line on UPI moves away from the universally dominant card form-factor to serve consumer credit — scan a QR and utilize a small spending line for high-frequency transactions. India first businesses will get built on this - for example, Vegapay is building an infra layer to power this globally unique customer experience. The first-time formal credit user will experience credit in a modern form factor, not a card - a relic of the past.

AI re-imagines efficiency and customer UX. Taking FS to billions requires companies to (i) lower customer servicing costs and (ii) simplify user experience to serve products natively. Financial institutions can massively reduce servicing costs through AI agents for collections, recon, customer services, and mid-back office work. Service delivery will get innovated with more personalized and multi-modal offerings (e.g., voice).

I'm spending a lot of time in these spaces, so reach out if you're building something here!

Pratik Poddar - Nexus Venture Partners

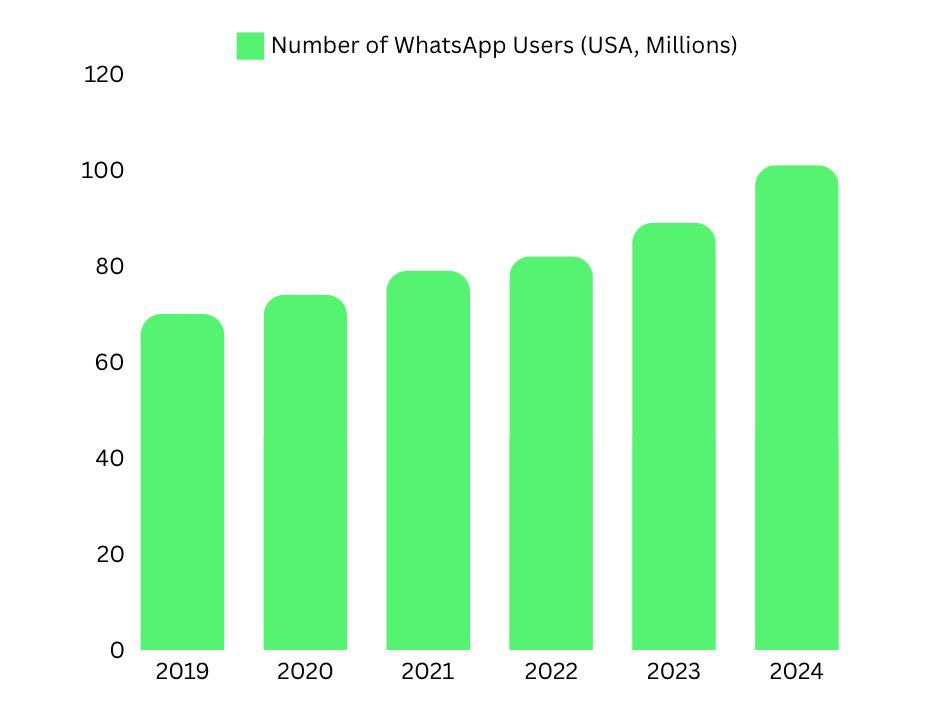

WhatsApp’s growth in the U.S. has historically been slow, but that is changing rapidly for a variety of reasons - better cross-platform compatibility, enhanced privacy features, rich media sharing, and business integrations. The platform recently announced that it surpassed 100 million users in the U.S., marking a significant milestone. Previously considered challenging to build on due to platform risk and limited monetization opportunities—especially given its low penetration among high-ARPU audiences—WhatsApp has now achieved critical mass in the U.S. This milestone significantly mitigates monetization concerns around businesses building on this platform.

Entrepreneurs can now develop robust solutions, including communication infrastructure tools, international commerce platforms, business intelligence services, vertical-specific applications, and community management tools. I’m actively seeking opportunities to capitalize on this timing to reimagine WhatsApp as a foundation for building scalable, impactful businesses.

Rajan Mehra - March Capital

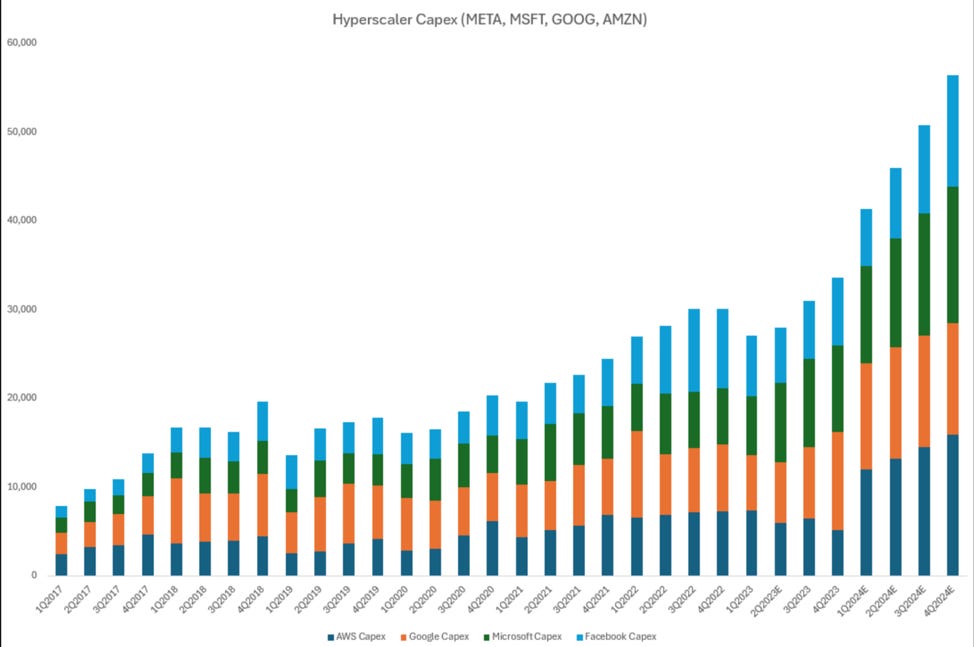

Capex spend at Hyperscalers is run rating at over $200B in Q4 2024, with at least $100B being incremental spend on Generative AI. So far one company has benefited disproportionately from the Gen AI platform shift: Nvidia. In 2024, its market cap grew an astounding $1.8T to $3.2T in 2024, making it one of the largest and most important companies of our generation.

While Nvidia’s revenues and profitability have grown tremendously, their customers and customers customers need to demonstrate ROI on their spend. Open AI, Google and others have recently had a flurry of product launches and monetization initiatives and we expect the pace of this to only accelerate. 2025 will be the year we’ll see companies adapt to the reality that AI targets not only software spend, but also people budgets. This presents a massive TAM opportunity, and we’re excited to find and back companies building agentic software and applications that will leverage the large buildout of capex.

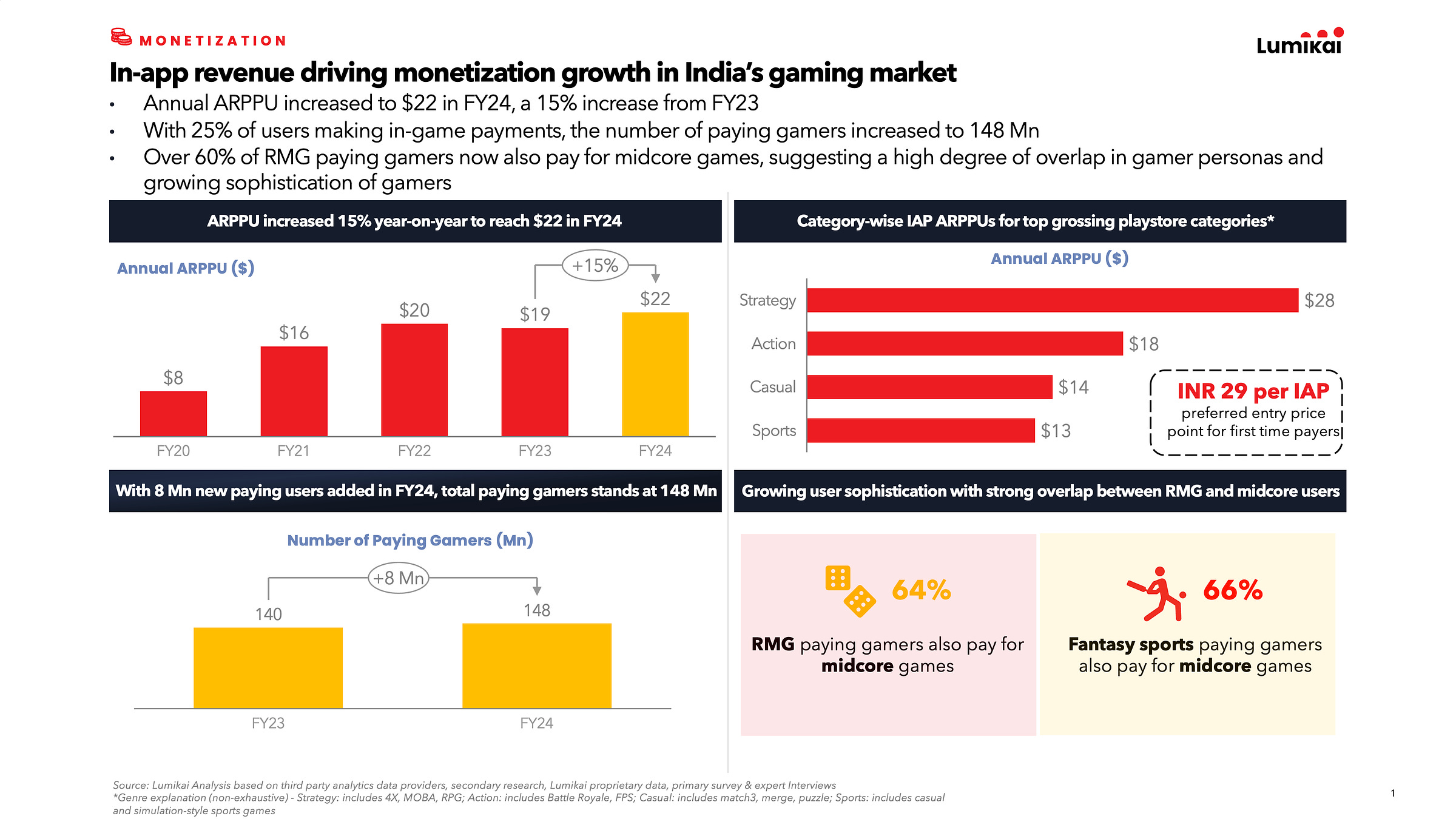

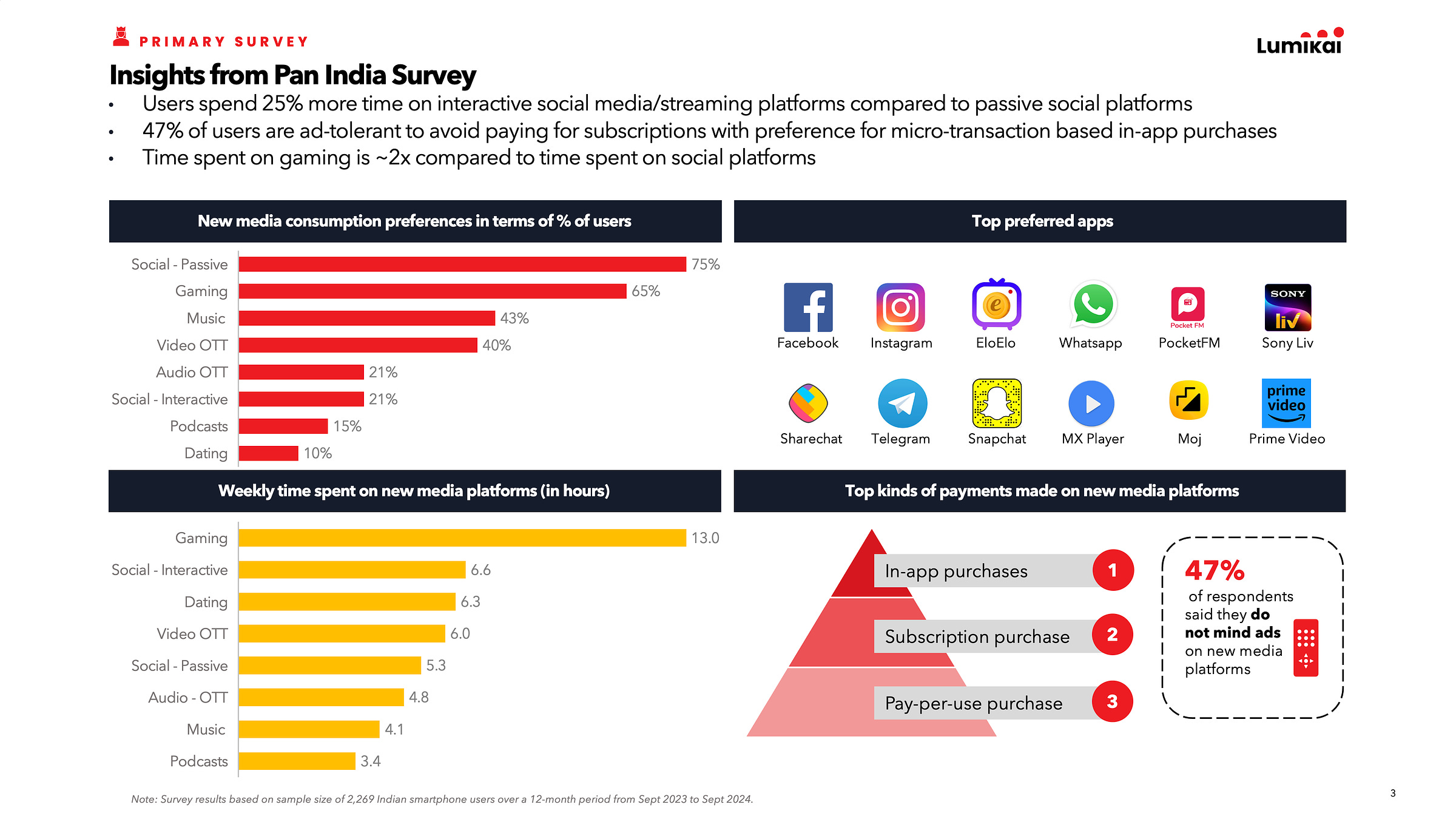

Salone Sehgal - Lumikai Fund

I spoke about the undeniable future of interactive media and gaming in India in the Tigerfeathers annual review '23.

Predictably, whenever such statements are made, the "argumentative" Indian often chimes in with the classic "Show Me The Money" retort. So this year, it's about both show and tell.

With $3.8 billion in pure revenue from Indian consumers, micro-transactions have emerged as the fastest-growing slice of the revenue pie in India's gaming industry, expanding at an impressive 44%. Contrary to the stereotype that all Indian gamers are solely "RMG" (real-money gaming) players, there's a significant overlap between RMG players and mid-core gamers, reflecting an increasing appetite for genre experimentation. Let's not forget, even King—makers of the global phenomenon Candy Crush—began as a skill-based real-money gaming company!

Breaking down even more entrenched stereotypes, the average Indian gamer is not exclusively rich, urban, or male. A nationwide survey highlights the growing prominence of non-metro gamers (66%) and female players (44%), signaling greater inclusivity.

Among first-time earners aged 18-30, 43% show a high willingness to pay for interactive media and entertainment, driven by what we internally call the 3 "A"s - access (digital), aspiration (global), and affluence. Moreover, interactive entertainment has overtaken passive consumption; time spent on games is now double that on social platforms, shattering the myth of "doom-scrolling" dominance.

The medium of entertainment has fundamentally shifted. Families no longer gather around a single television screen for linear programming. The future of media is interactive, immersive, personalized, and ever-present—accessible anytime, anywhere, directly in the palm of your hand, 24/7.

Kushal Bhagia - All-In Capital

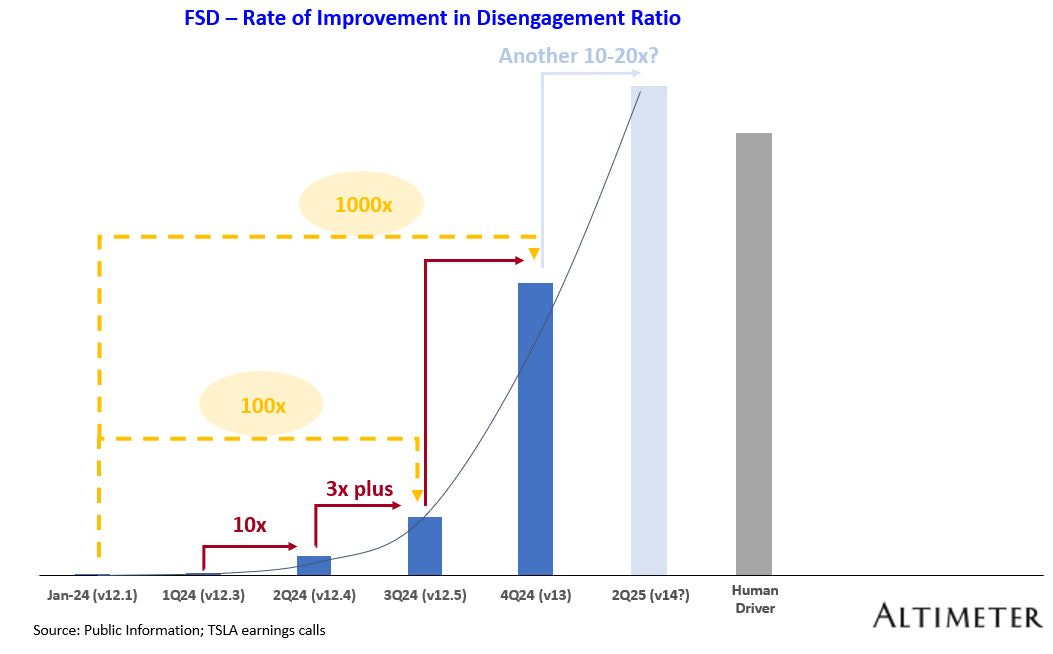

My submission is this chart by Altimeter capital:

Self Driving without LiDAR is here and is on an exponential improvement curve. We have all known this was coming for many years but it’s finally here and I feel everyone is underestimating how dramatically robo-cars are going to change our cities and the world.

Sheetal Bahl - Merak Ventures

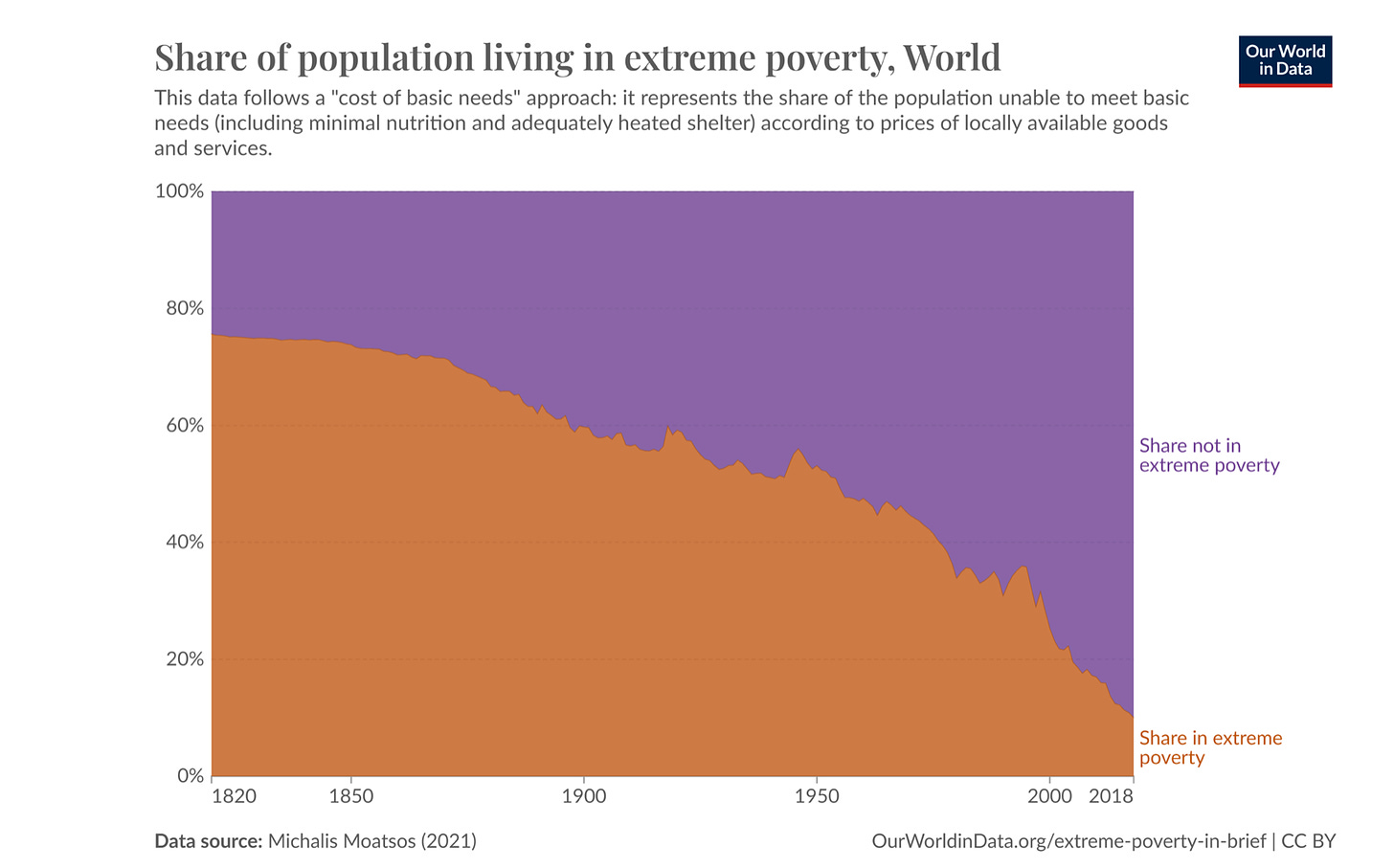

Economist-historian Deirdre McCloskey once said, “For reasons I have never understood, people like to hear that the world is going to hell”. I’m not one of those, and I keep looking for data to back my belief. Here is one such chart which shows how dramatically extreme poverty has fallen in the last couple of centuries.

The importance of this cannot be overstated, for poverty leads to malnourishment, homelessness, disease, AND death. And with every passing year, we are getting closer to “global zero” poverty.

Rahul Mathur - DeVC

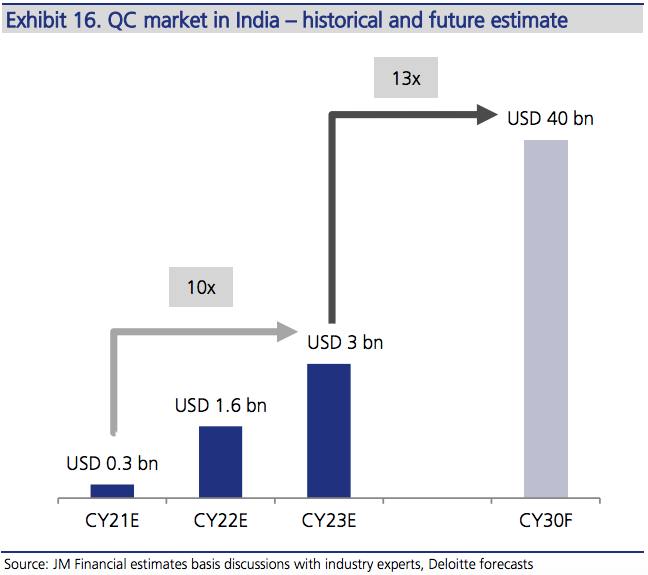

The graph that I want to share is the India quick commerce (QC) market size from JM Financial (Feb ‘24 report):

Why?

(1) In 2020 — Very few believed that QC was ever going to take off. It was dismissed as the “elite Indian’s new one-trick pony”

(2) In 2 years from launch, QC has become the “default” channel / mode of commerce for thousands of Indian households. The market size has increased by x10 from $300M in GOV (gross order value) to $3bn. In the same period, quick commerce companies have also added ~$20bn of market cap to private & public markets.

(3) Quick commerce in India is the perfect example of “the best founders create markets”. The Zepto founders were in my cohort at Y Combinator (W21); it’s been thrilling to see their unbelievable progress with regards to category creation. They’ve attracted new demand and also captured market share from both traditional ecommerce channels as well as traditional retail players like kiranas and modern trade stores.

(4) It is also a story of “legendary founders continue to tap into adjacent markets”. Quick commerce is no longer grocery — it is also consumer electronics, fashion & apparel, beauty & personal care (BPC), and even complete meals now.

The reason for sharing this creative is to remind any founder or investor reading this passage that sometimes, the irrational ideas win. Markets don’t always have to be entered, they can also be created. And often, it just takes one believer (Deepinder Goyal for Blinkit, Suvir Sujan for Zepto) for the founder’s dreams to take off and category to explode into life.

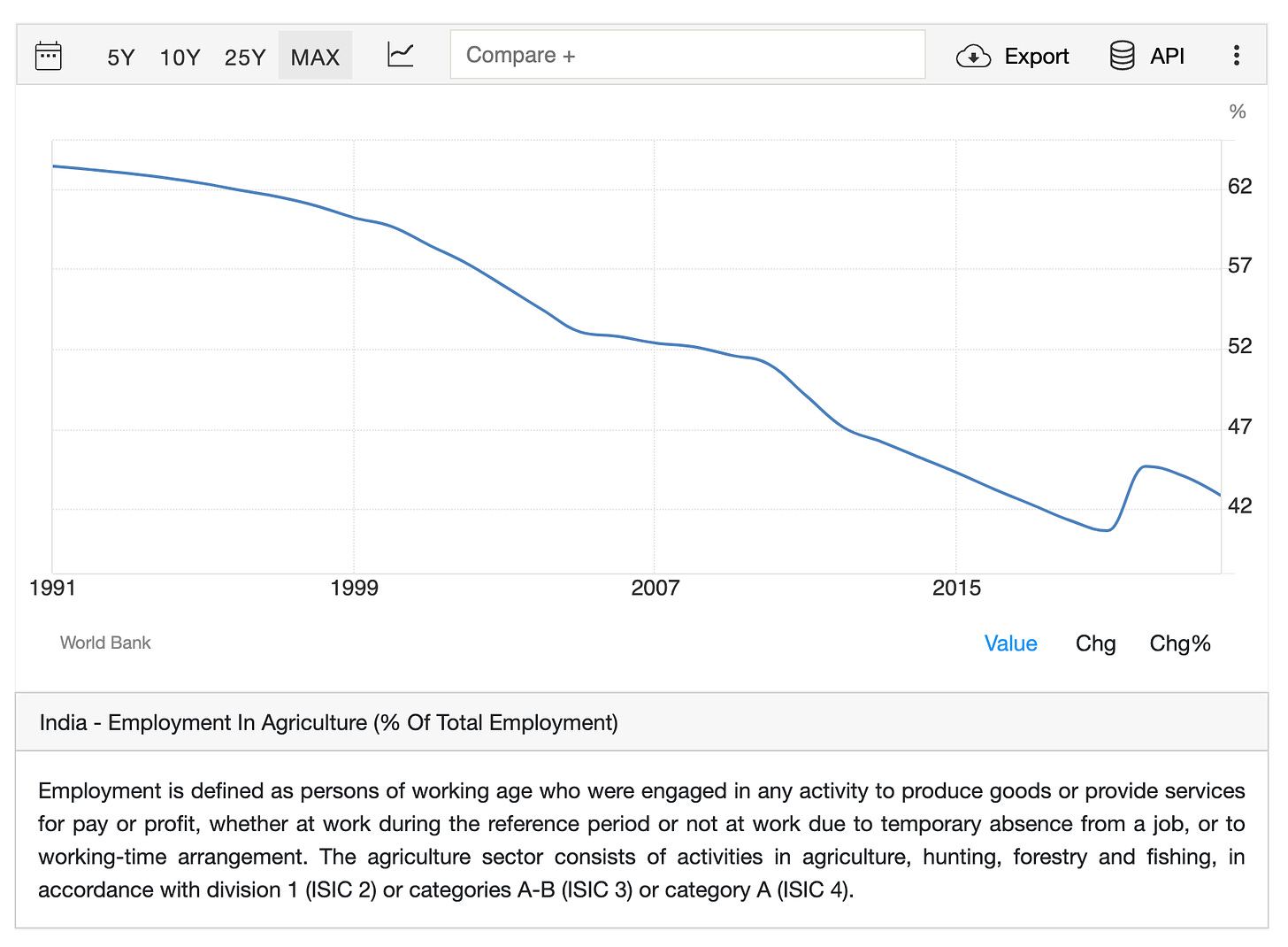

Gautam Shewakramani and Raj Sheth - Inuka Capital

At Inuka Capital, we believe that an overlooked second order effect of labor moving to urban areas and service industries in India is the workforce shortage emerging in important, nation building skillsets. The chart above shows the % of employment in agriculture; similar shortages can be seen in manufacturing and healthcare.

We believe that valuable companies can be built by solving labor bottlenecks for Indian industry - either by automating these short-supply jobs or equipping potential workers with the right technology & economic incentives.

We’ve led investments into 2 companies that play into this theme — Terafac has built a robotics solution using AI and computer vision to automate manufacturing functions starting with welding, and Leher Farms has made agricultural spraying orders of magnitude more effective through drones.

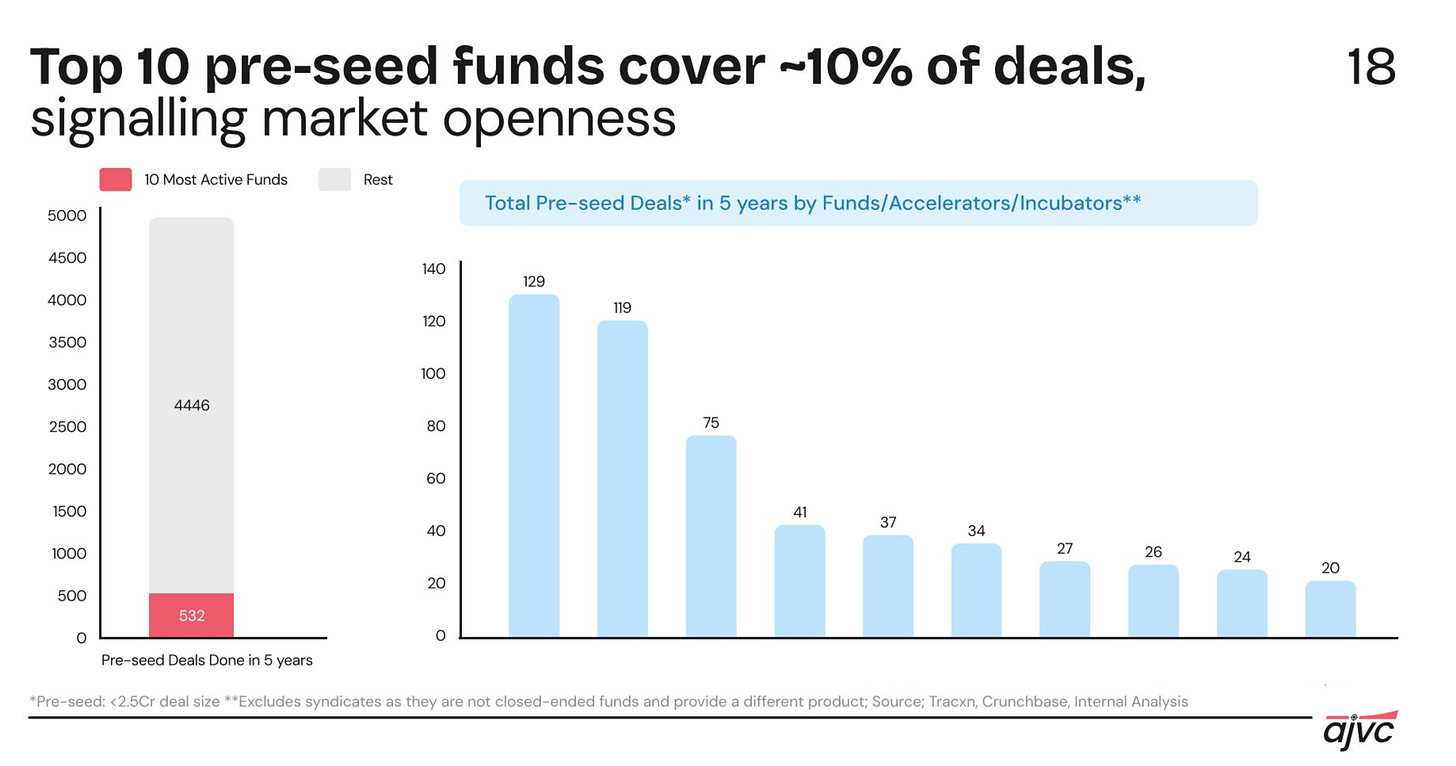

Aviral Bhatnagar - ajvc

Contrary to popular wisdom, the pre-seed market in India is highly disorganized, very open, and drives the highest returns. There is an evident lack of institutional capital in the earliest stages for the first cheques. If you look at the same data cut for seed or Series A, the top 10 funds are an exponentially increasing proportion of funded rounds. We also believe the pre-seed rounds that materialize are ~20% of the true market. There is latent entrepreneurial demand that is not fulfilled because there aren't enough funds to give founders their first backing. It was shocking, but not surprising, that 42% of AJVC's applications do not even have an incorporated company. India is a country that is both overcapitalized (on few companies that get a lot of money), and undercapitalized (on a lot of companies that get no capital). Pre-seed data is the biggest indicator of the same.

Harnidh Kaur - WTFund

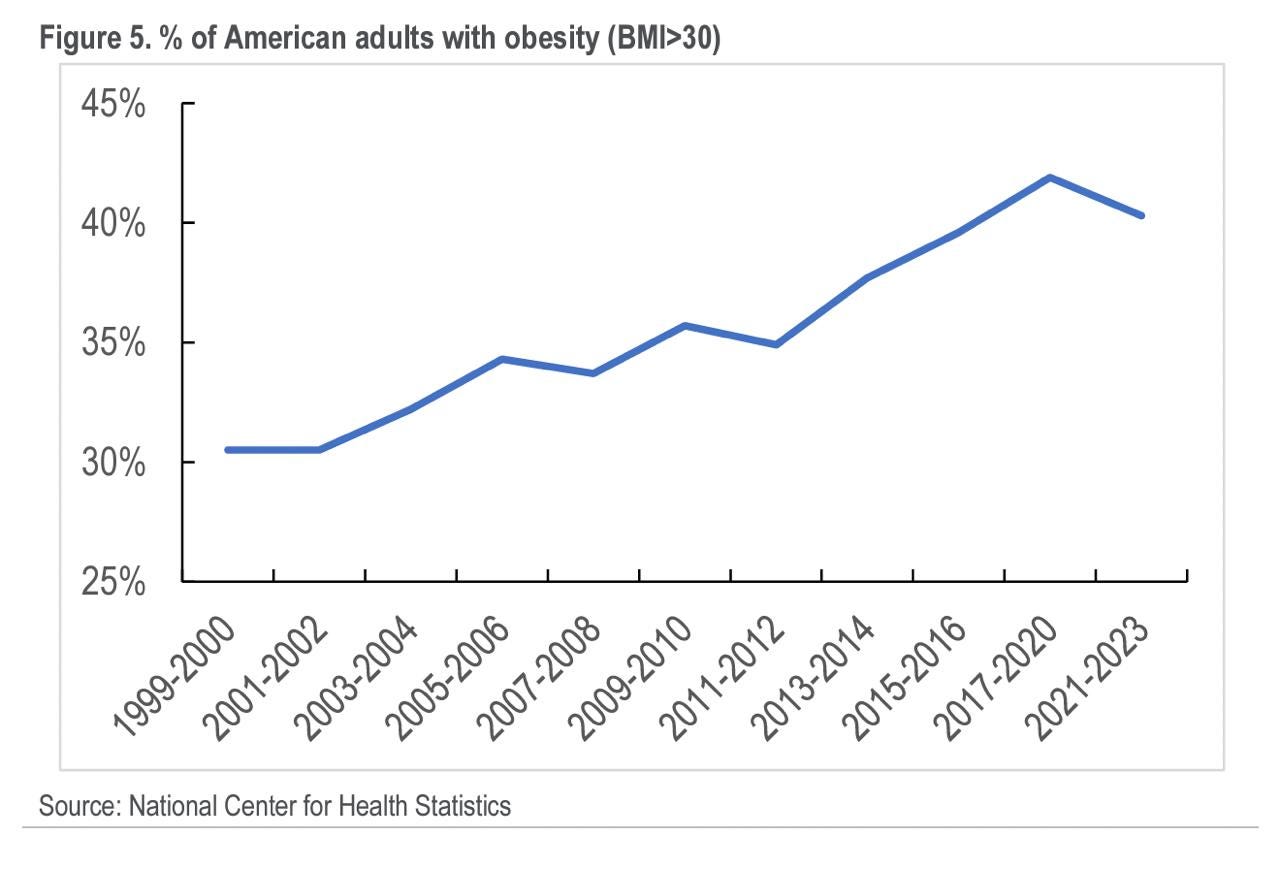

This chart, showing the relentless rise of obesity among American adults, feels like a warning—but also a turning point. After decades of climbing numbers, we may be on the brink of peak obesity, thanks to GLP-1 medications. These drugs aren’t just reshaping how we treat chronic illnesses; they’re primed to create ripple effects that could redefine industries and behaviours globally. For India, though, this story is uniquely layered.

India has a history of flooding global markets with affordable generics, and GLP-1s will be no exception. The potential for widespread availability could democratize access, making these life-changing drugs affordable for millions who currently suffer from obesity-related illnesses like diabetes and hypertension. This is huge for a country where public health infrastructure is overstretched and personal healthcare costs are crushingly high. But with opportunity comes risk. India’s notoriously patchy medical regulation means that an influx of generics could lead to misuse, overprescription, or unsafe knockoffs, especially in a healthcare ecosystem already struggling to track outcomes and ensure proper follow-up.

Still, the possibilities are staggering. A healthier workforce could drive productivity gains across sectors, especially in the gig economy where better health might mean more stability and earning potential for millions. Urban planners could finally start building active, pedestrian-friendly cities instead of the car-centric sprawl we’re used to. Even industries like food and fashion would have to adapt to shifting consumer demands—smaller portion sizes, new health-focused product categories, or more inclusive and diverse approaches to clothing design.

GLP-1s might seem like just another medical intervention, but in India, they’re a signal of something bigger: a chance to rethink how we approach health, equity, and opportunity. The challenge isn’t just making these drugs available—it’s doing so responsibly while leveraging their ripple effects to create meaningful, measurable change. This chart isn’t just a statistic; it’s a call to action for a healthier, more intentional future. But only if we’re brave enough to handle both the promise and the risks.

Akshay Mehra - Hummingbird Ventures

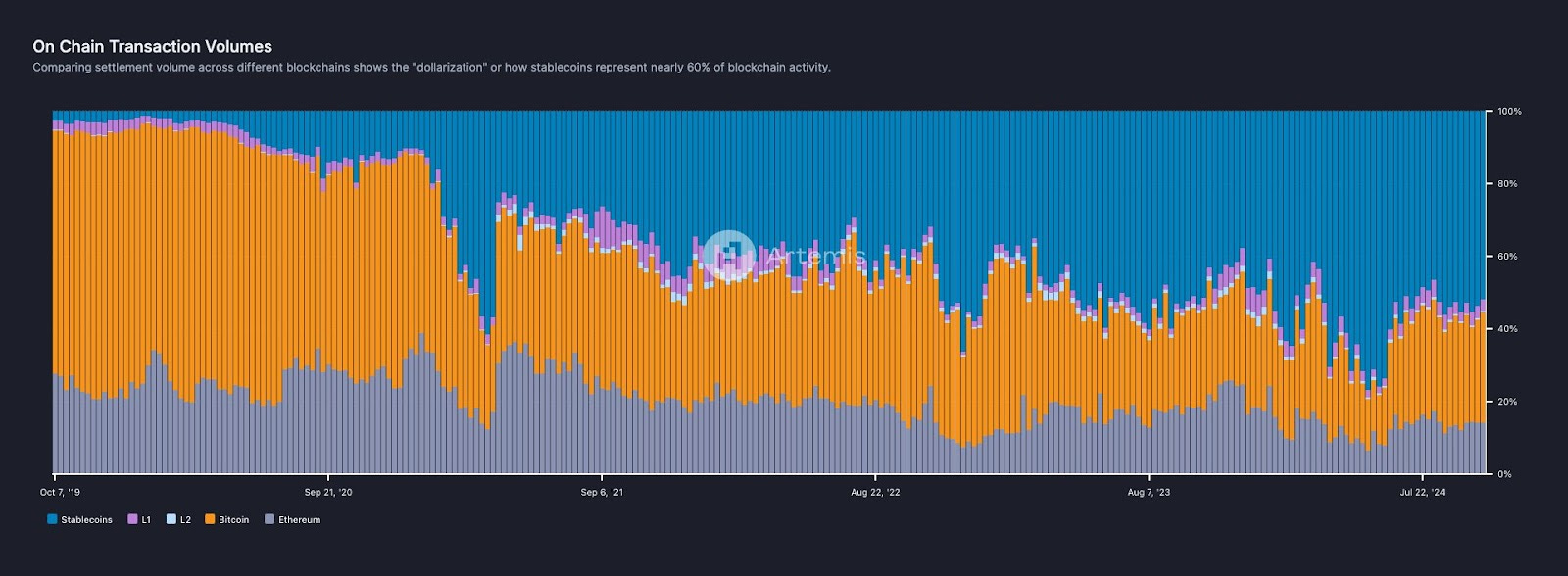

Bitcoin's narrative—from 'digital gold' to a hedge against the ever-growing supply of the US dollar and other fiat currencies—has clearly taken off this year, with new highs almost daily. At the same time, another on-chain instrument that has been flying under the radar is stablecoins.

Stablecoins represented close to 3% of all on-chain transactions in 2020, and the asset class has ballooned to 50% of all transactions in recent years. The narrative is strong and the technology superior to what people have to experience today. For one, stablecoins offer the trifecta of being better, faster, and cheaper than any other form of cross-border payment: better because they operate 24/7 globally; cheaper because transactions can cost less than 1 cent on L2s; and faster because they’re instant, reducing working capital requirements and counterparty risk associated with batch-processed traditional payments. For those of us in emerging markets, stablecoins are even more relevant. They provide access to a relatively stable US dollar—critical in economies with volatile local currencies. While us Indians face a manageable 3–5% annual depreciation against the USD, countries like Venezuela are far worse off.

Beyond payments, I'm excited to work with teams building across the 'stack', from orchestration and enabling stablecoin acceptance, to platforms for issuance (Stripe's $1.1B acquisition of Bridge underscores this theme). The technology will dislocate - and rightfully so - many parts of traditional finance services and lead to a much better UX for consumers and businesses.

Sandeep Murthy - Lightbox Ventures

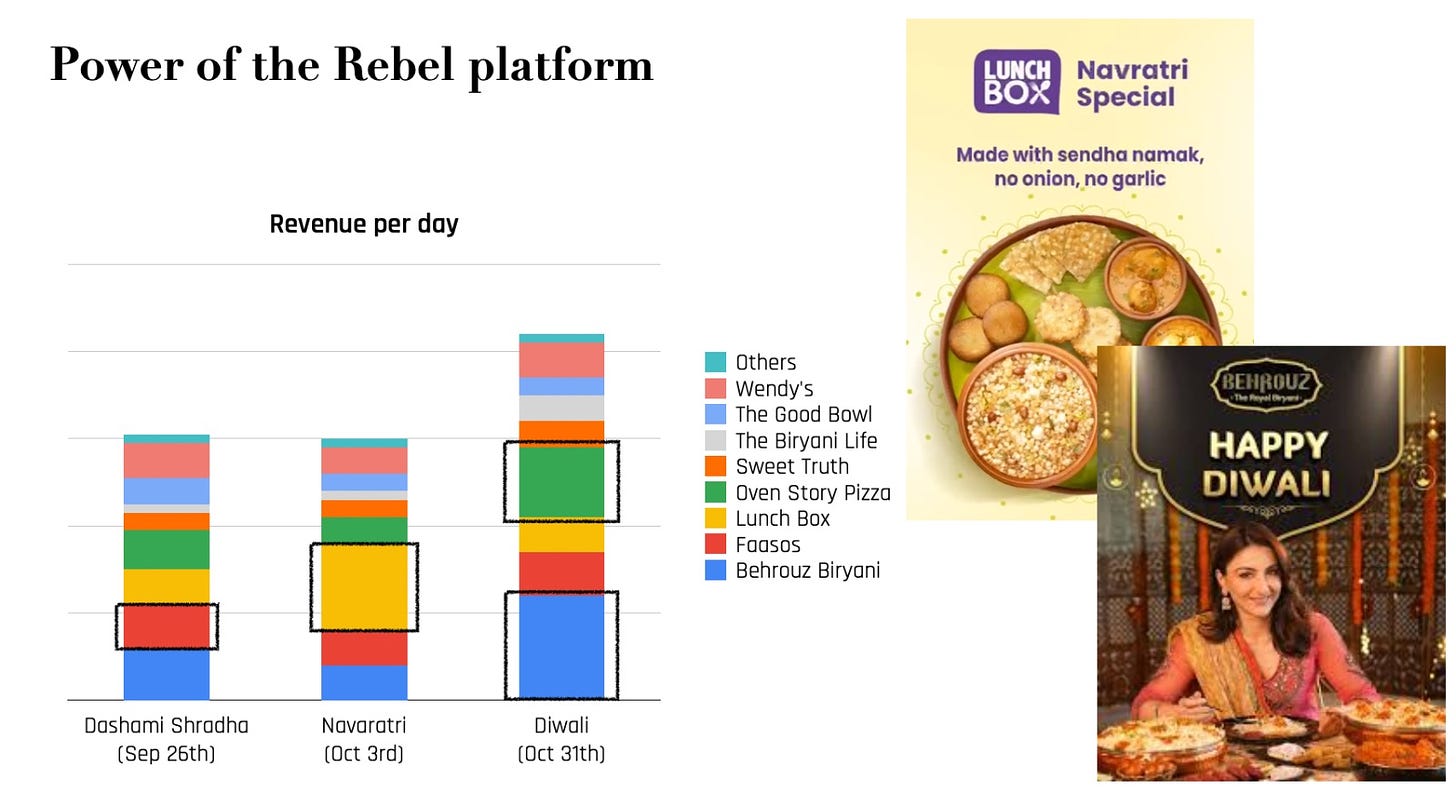

India is a complex market with multiple dimensions that run across demographics, culture, geography, and spending behavior. A differentiated offering with first-principles thinking is paramount. When Lightbox first invested in Rebel Foods, cloud kitchens as a concept were relatively untested within the broader foodtech space. Our big learning from the Rebel Foods journey is that a multi-brand, multi-cuisine strategy that leverages the same (kitchen) infrastructure has served to insulate the company from the seasonal variability in demand that's typical to the restaurant business and delivered revenue stability.

Over the years, Rebel Foods has built a broad portfolio of internet restaurant brands that address every demand segment through all 365 days of the year. Take for example the September-October festival season. Between Navratri and Diwali, consumer preferences shift toward pure vegetarian food (with specific ingredients like Sabudana) and away from indulgences such as pizza and biryani. If Rebel Foods had chosen to focus on a single brand or a specific cuisine category, it would have seen high volatility in sales on a daily basis.

We believe that this customised, differentiated approach could work across categories such as wellness, apparel, beauty, and personal care. Just taking apparel as an illustration, what if a house of brands leveraged a store to change their offering across seasons - beachwear and informal wear in summer, wedding wear/Indian attire during the festive season (September-December), winter clothes in (December-February), and much more. Can an entrepreneur reimagine this idea of using one infrastructure with multiple brands to cater to the apparel needs of the Indian consumer across seasons?"

Dinesh Pai - Zerodha / Rainmatter

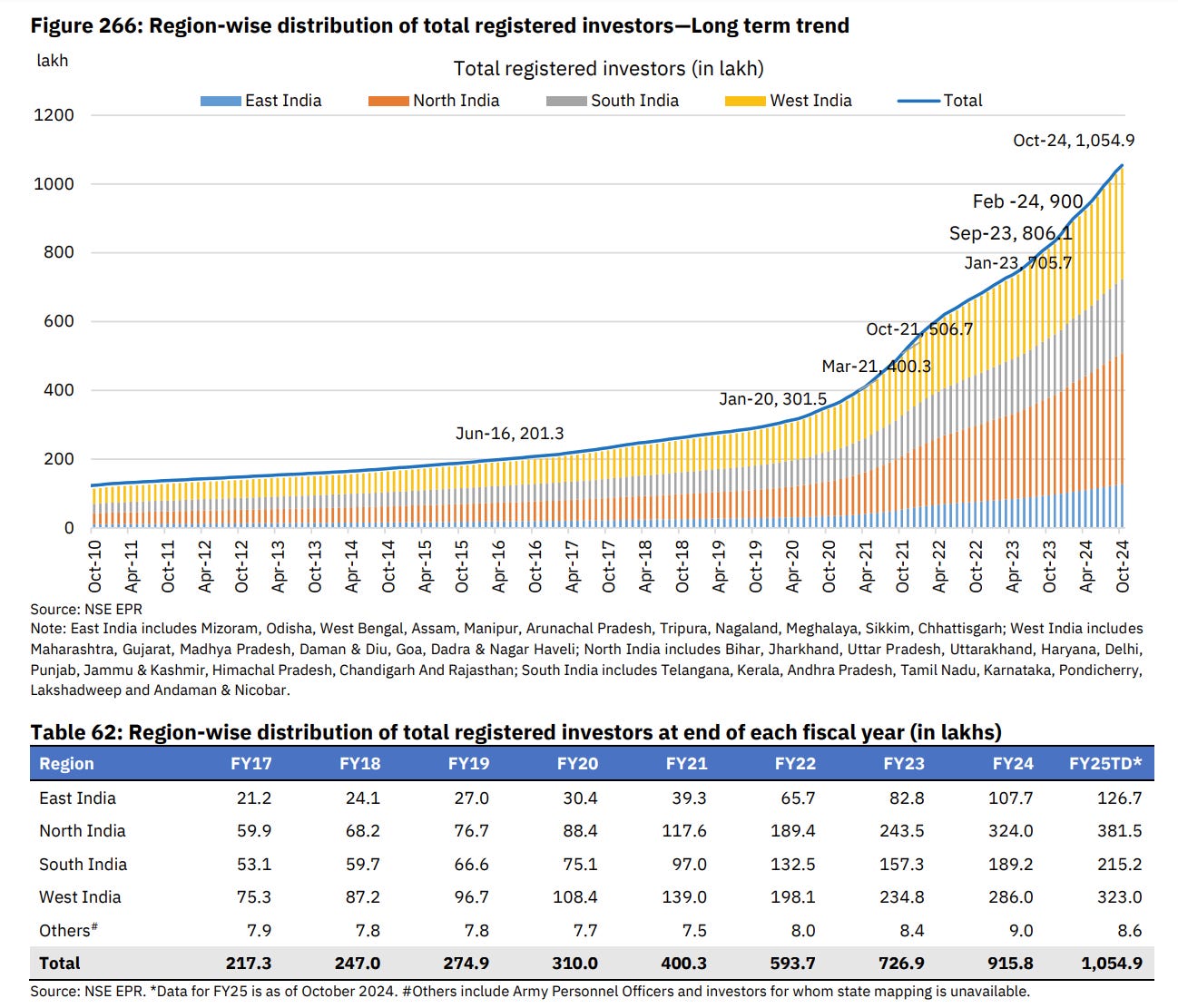

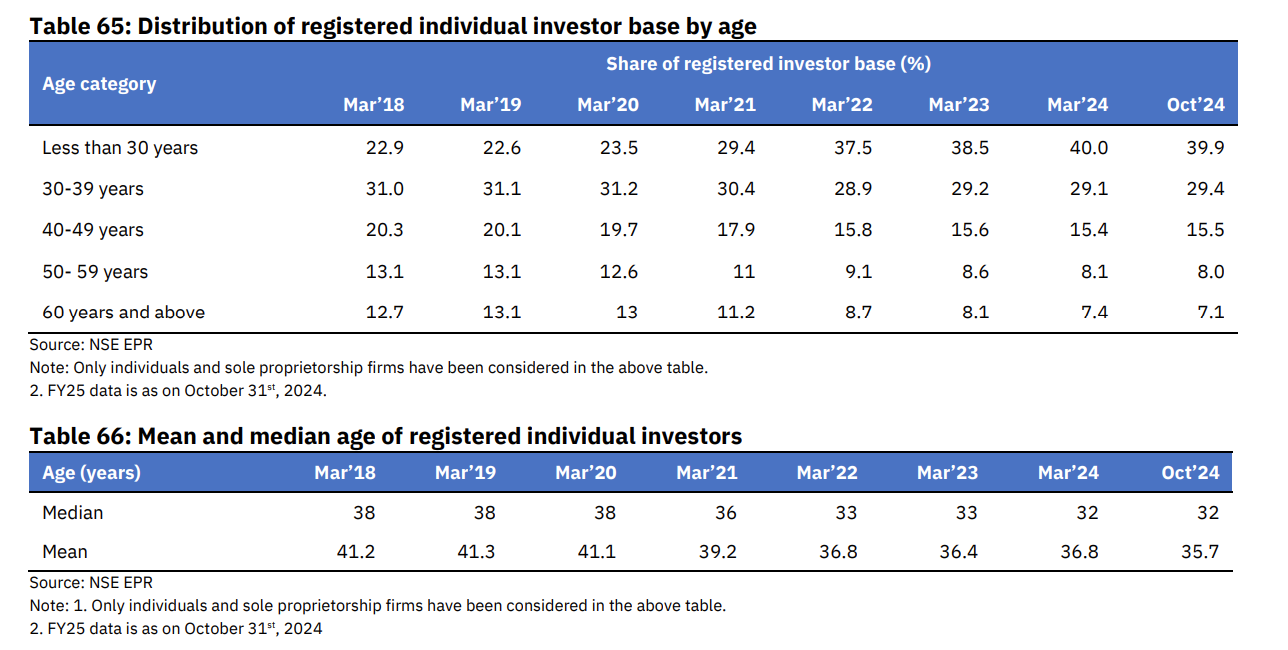

Theme #1 - Growth in India’s capital markets

There has been phenomenal growth in domestic investor participation in India's capital markets over the past 4 years. Currently, we have approximately 10.5 crore unique investors with demat accounts - up from just 3 crore investors in FY20. When compared to 60 crore PAN cards linked to Aadhaar, demat accounts represent around 17.5% of this more accurate proxy for the addressable market (rather than total population).

The number of investors below age 30 has doubled compared to FY18.

Several factors contributed to this growth: the COVID-19 pandemic gave people additional time to explore investment options, SEBI implemented regulatory changes that increased market trust, widespread access to affordable phones and data emerged, digital KYC became easier through Aadhaar infrastructure, and market intermediaries launched various educational initiatives. However, while this growth has exceeded expectations, we must focus on increasing education and awareness about cyber frauds and scams targeting investors.

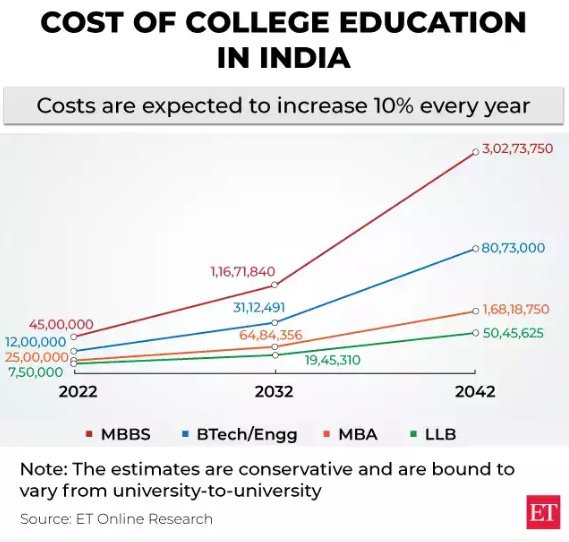

Theme #2 - Education costs are outpacing wage growth

India's young demographic profile (65% of the population below 35) presents an advantage that will last for approximately 30 more years. This advantage necessitates a focus on upskilling and education to improve economic conditions for the majority of our population. However, the data on education costs raises concerns. Costs have risen dramatically - the average expenditure for a four-year degree is currently around ₹10 lakhs and is projected to increase further. The All India Survey on Higher Education 2020-21 reported that engineering courses in private institutions have increased by over 50 percent in the last decade. Education inflation stands at approximately 10%. Between 2014 and 2018, primary education costs rose by 30.7%, while graduate and postgraduate fees increased by 5.8% and 13.19% respectively.

These rising education costs in India are particularly concerning as they outpace wage growth - leading to higher dropout rates, limited access to quality education, and a widening skills gap. Most critically, this trend hinders upward mobility for middle-class and low-income families.

Sanil Sachar - Huddle Ventures

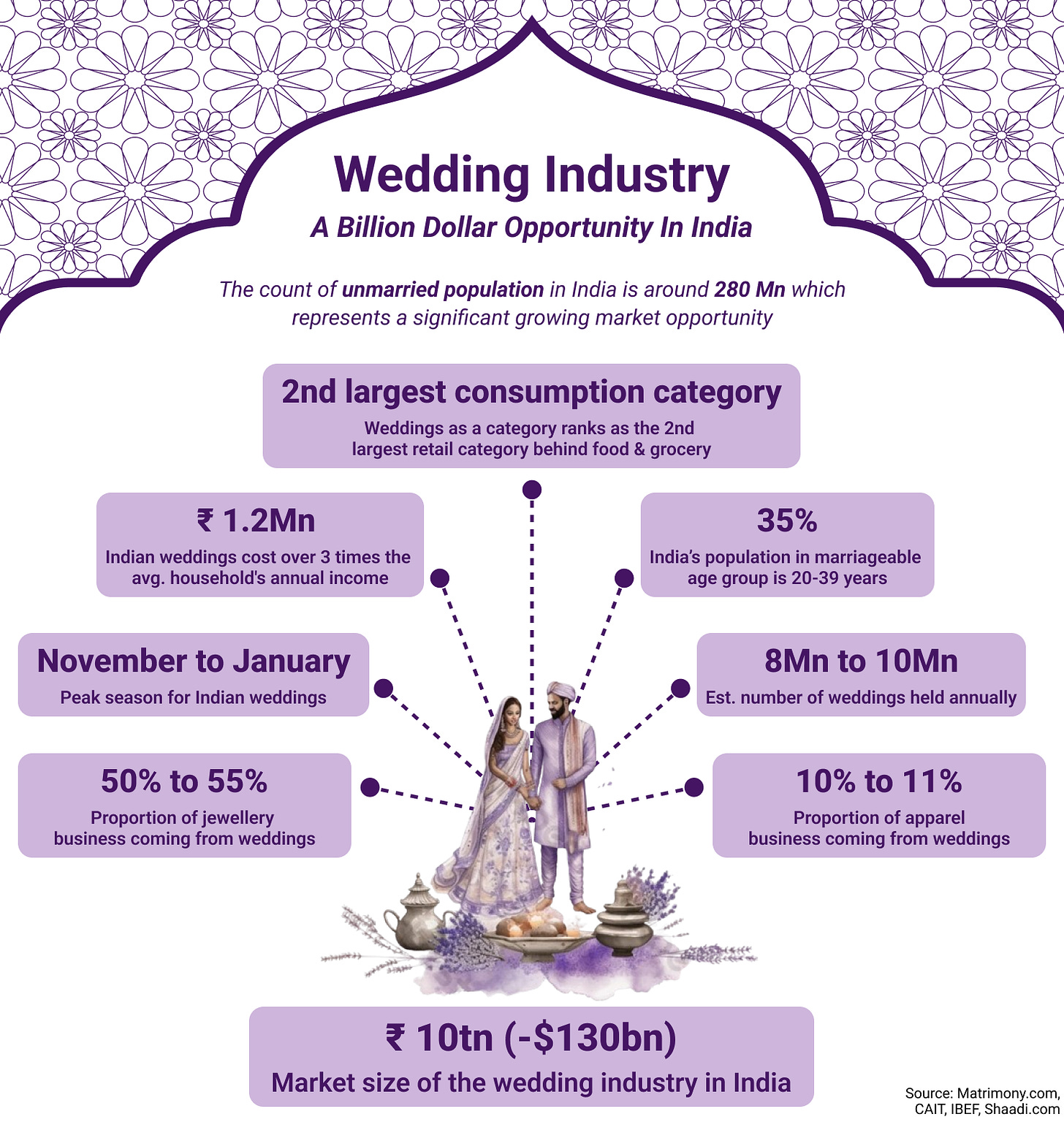

We should all be watching for brands (products and services) targeting new-age parents. This market is ripe and growing steadily, with opportunities across verticals catering to children from birth through their early teens. The best part for these emerging brands is that multiple market indicators are working in their favor simultaneously.

Three key factors stand out:

First, new-age parents are themselves consumers of non-legacy brands, making them more receptive to trying newer brands than previous generations. Combined with their significant online presence, self-awareness, and research-driven approach, this gives digital-first brands an easier path to building awareness and encouraging product trials.

Second, improvements in supply chain infrastructure are leveling the playing field for brand accessibility. While this transformation isn't complete, it's progressing steadily. Distribution methods like quick commerce are giving brands easier access to distribution points, enabling faster doorstep delivery and supporting more frequent purchase cycles.

Third, a simple Google search reveals growing numbers of newlyweds, recently married couples, and soon-to-be-wed pairs in India, indicating an expanding Total Addressable Market (though we should carefully consider the growing DINK - Double Income No Kids - lifestyle trend). With 2024 showing significantly more weddings than 2023, we can anticipate a potential rise in birth rates, expanding the market for new-age parent-focused brands to a scale where multiple players can succeed - it won't be a winner-takes-all market.

In this space, brands that build trust, maintain strong quality standards, and ensure easy distribution will find success. The market is ready for multiple new players to emerge and thrive.

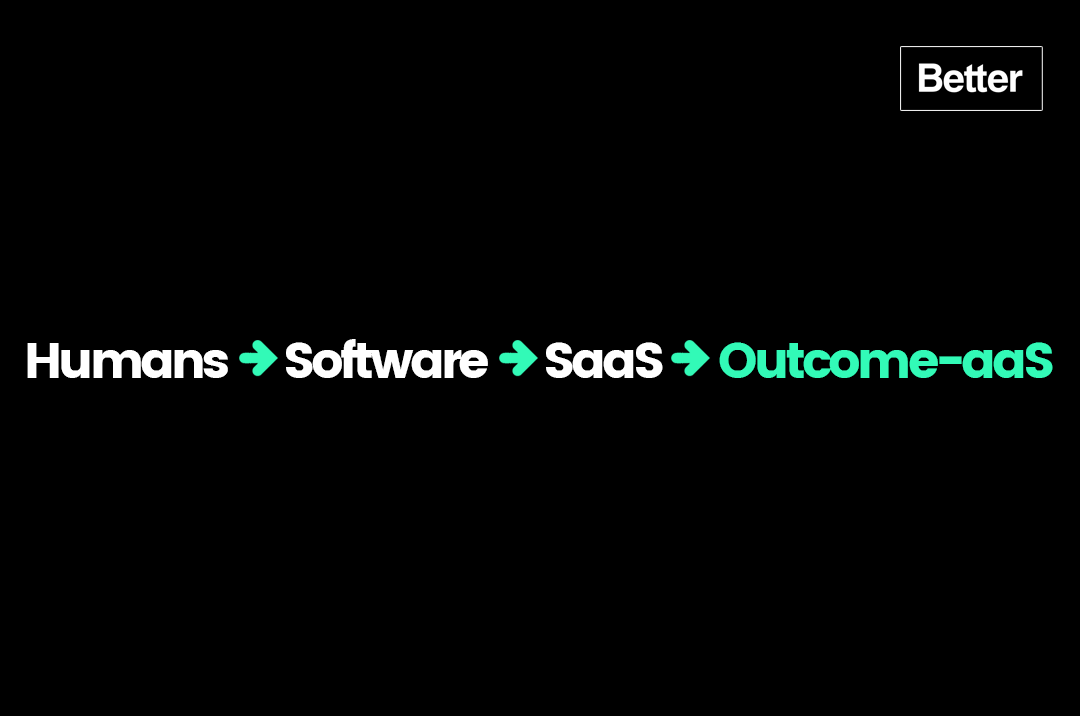

Vaibhav Domkundwar - Better Capital

AI-powered Outcome-as-a-Service will replace software and services as we know it today as enterprises choose tangible outcomes over yet another piece of software.

Outcome-as-a-Service (OaaS) is a business model that leverages AI to deliver specific, tangible outcomes directly to customers, bypassing the need for traditional software and service management. Instead of providing tools or platforms that require user intervention and management, OaaS delivers the end result that the user desires, either fully automated by AI or AI-led and assisted by humans, where necessary.

Traditional software requires users to manage installations, configurations, and updates, while SaaS simplifies this by offering software on a subscription basis, eliminating the need for on-premises management. OaaS goes a step further by removing the need for users to interact with software at all, instead providing the desired outcomes directly through AI automation.

Traditional software and SaaS providers might struggle to compete with OaaS because OaaS eliminates the need for software management and interaction. It delivers results directly, making many of the features and benefits of traditional software and SaaS redundant. This fundamental shift challenges existing business models and value propositions.

Examples:

DPDZero is delivering collections outcome to lenders, harnessing advanced data models to prevent delinquencies by using hyper-personalized workflows to elevate borrower experience.

Mezink is delivering guaranteed influencer marketing outcomes to brands, leveraging AI across steps - discovery, evaluation, activation and reporting - leading to 3x-10x better ROAS.

Aakrit Vaish - Peercheque

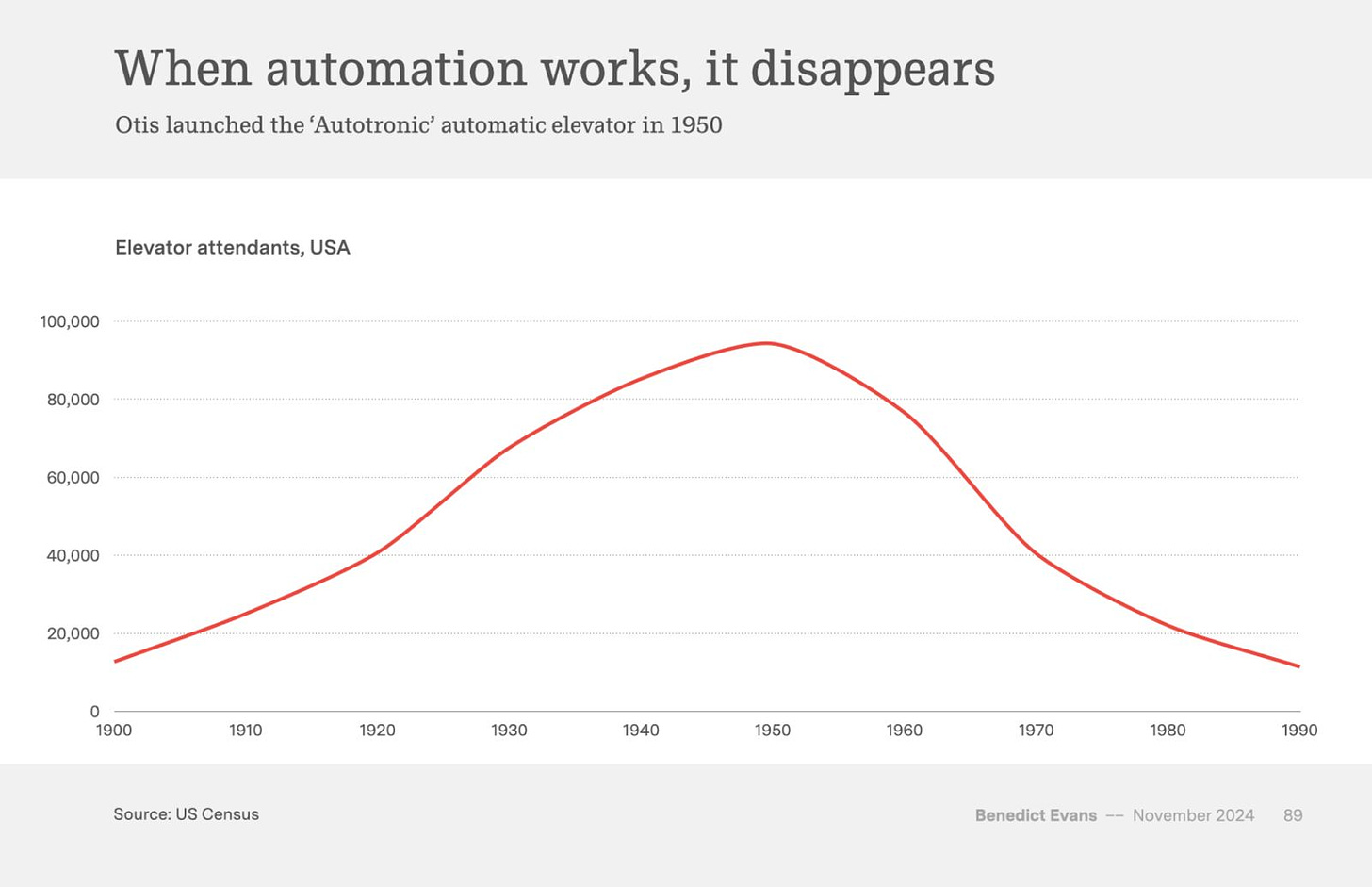

There are many analogies used to describe AI today. Some compare it to the advent of electricity, while Sam Altman recently likened AI to the transistor. However, this chart is my personal favorite: AI will become so deeply ingrained in every aspect of our lives that we won’t even notice it.

AI won’t be a disruptive spectacle but a quiet revolution that will evolve into an invisible force driving progress—powering systems, enhancing experiences, and solving problems behind the scenes. Over time, AI’s pervasive presence will feel as natural as electricity or the microchip: vital and ubiquitous, yet so seamless that we take its extraordinary capabilities for granted.

Natasha Malpani Oswal - Kae Capital

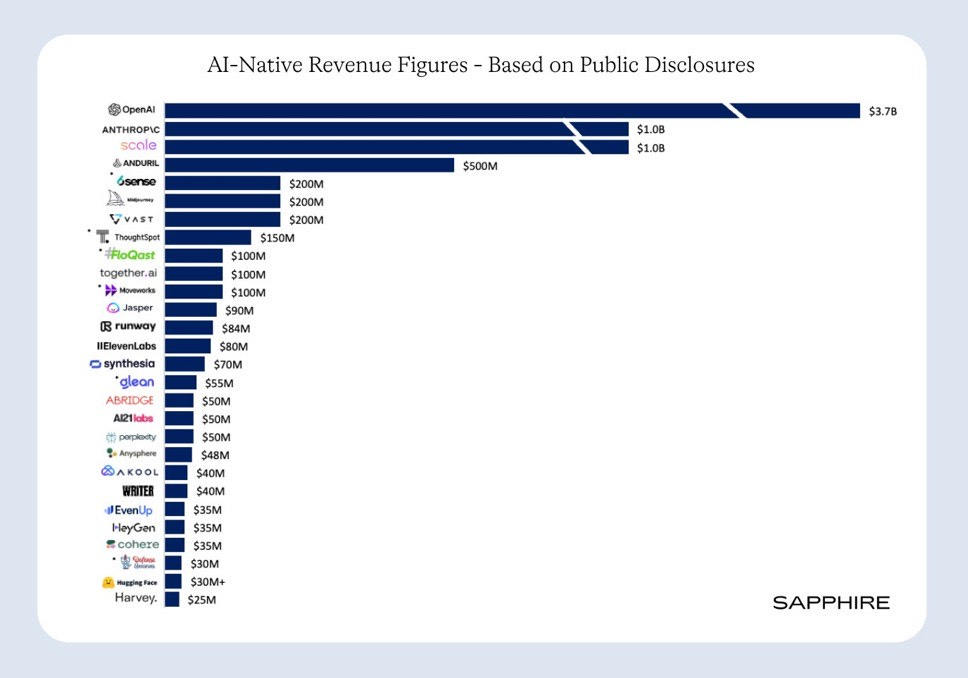

The Rise of AI-Native Revenue Machines

AI is often framed through two extremes: the flashy promise of foundation models reshaping industries or dystopian fears of replacing human jobs. But this chart tells a different, more grounded story.

Companies like OpenAI, Anthropic, Scale, and Anduril are already hitting significant revenue milestones, proving that AI-native businesses are solving billion-dollar problems at scale.

Why This Matters:

AI has moved beyond moonshots. These aren’t just experiments or developer tools—they’re businesses with sustainable models tackling real-world challenges. From defense to automation to specialized vertical AI solutions, AI-native companies are creating entirely new markets, roles, and opportunities.

The hype around AI often misses this critical shift: AI isn’t just replacing jobs—it’s fundamentally reshaping industries like consumer tech, healthcare, and gaming. And this is only the beginning.

For Indian founders and investors, this chart is a wake-up call. The question isn’t, “Can AI work in India?” The question is, “What billion-dollar problem can your AI-native business solve?” The time to rethink intelligence economics isn’t tomorrow—it’s now.

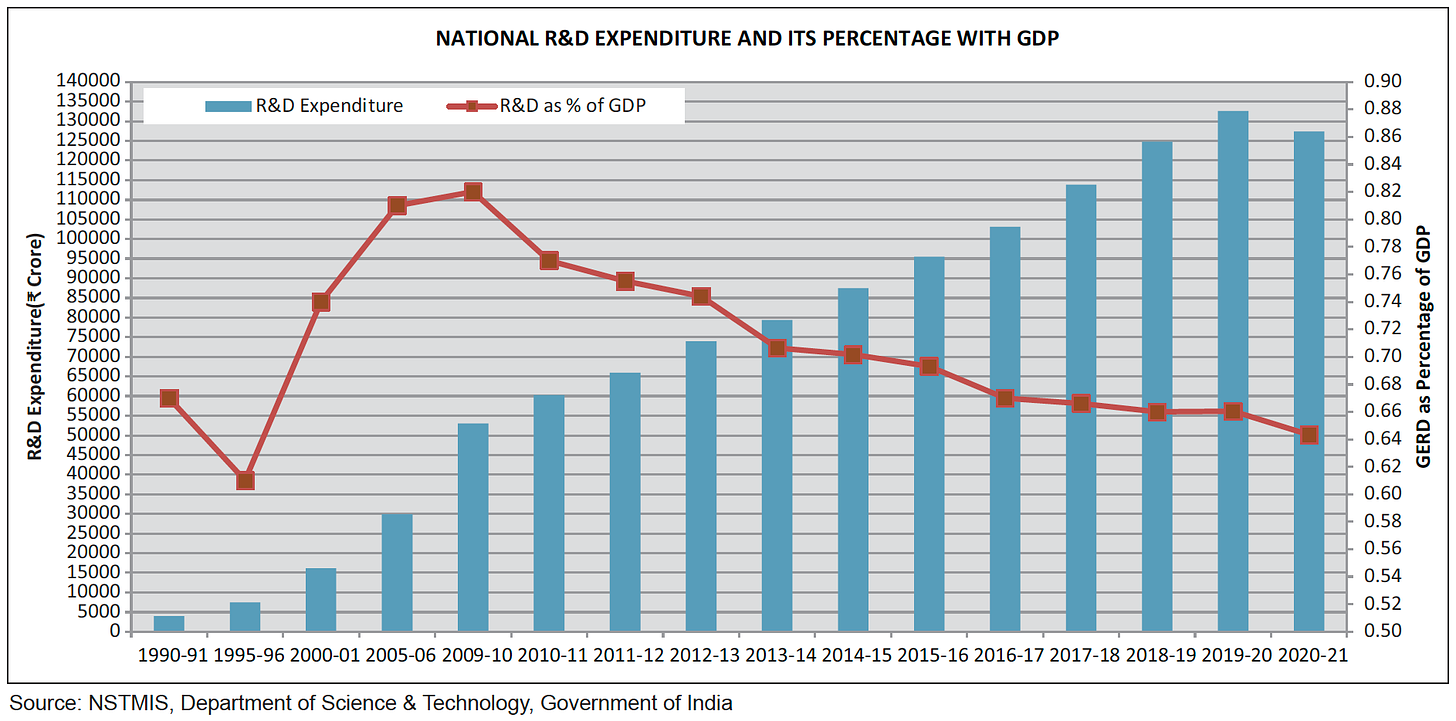

Rahul Seth - Industrial 47

The discussion around India’s R&D spending often begins with the stark realization that we invest only 0.7% of our GDP in R&D. This is considered abysmal compared to say South Korea, which allocates 4% of its GDP to R&D.

Although we bemoan our political will and the government’s seriousness about this, the details reveal a very interesting picture. Of the .7% GDP spend on R&D, 65-70% of it is from the government, translating to approximately 0.5% of GDP, while the private sector contributes the remaining 0.2%.

In contrast, South Korea’s government spends only 25-30% (1%) of the 4% GDP on R&D, with a significant 70-75% (3%) coming from private corporations.

This 15-16x disparity in private sector investment underscores the true fundamental challenge in India’s industrialisation journey.

Pearl Agarwal - Eximius Ventures

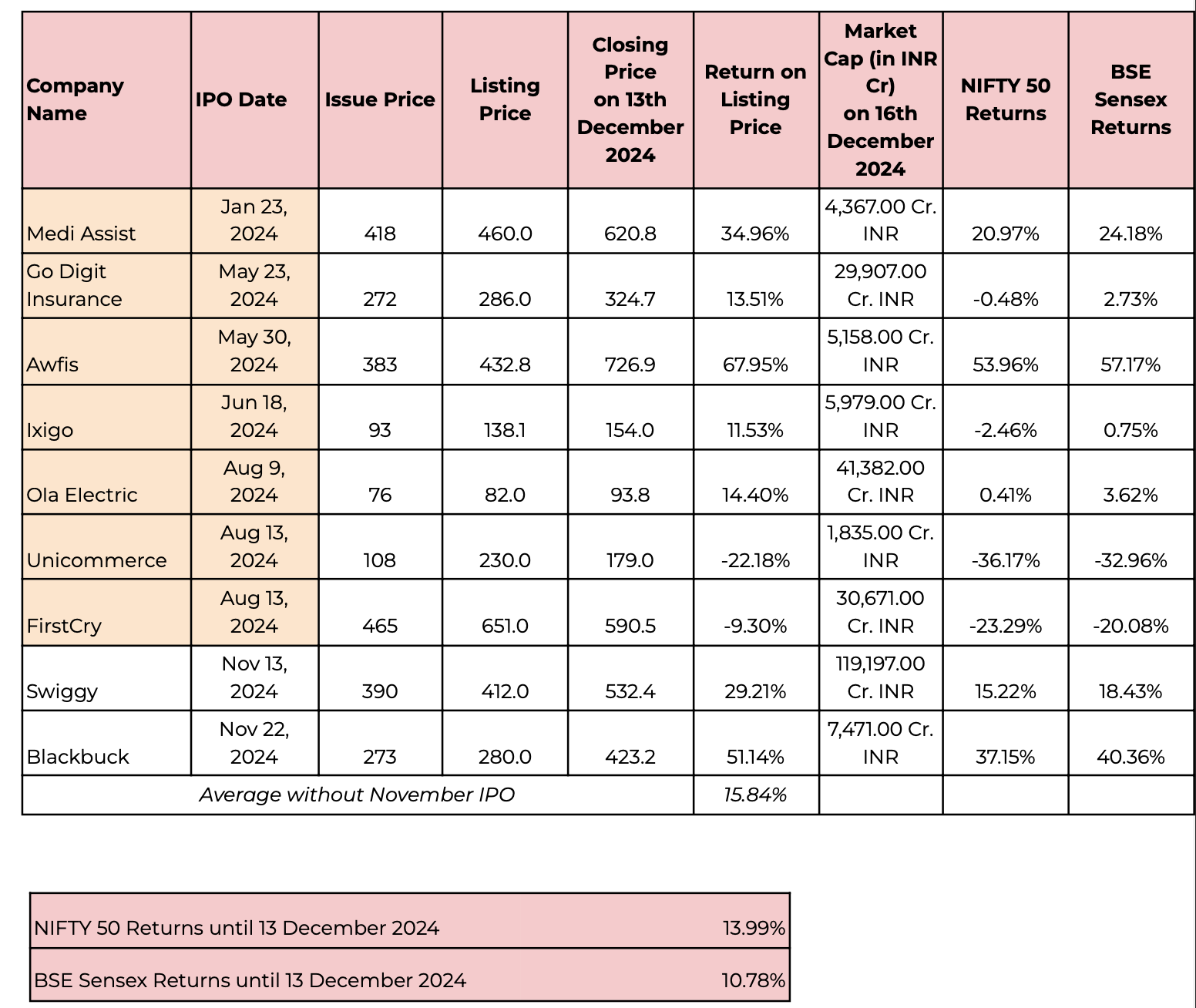

The 2024 IPO wave for Indian startups, especially in tech, saw significant pre-IPO buzz, but long-term performance has been underwhelming. While strong brands like Swiggy (+29.21%, INR 119,197 Cr market cap) and Awfis (+67.95%, INR 5,158 Cr market cap) delivered good returns, smaller players like Unicommerce (-22.18%, INR 1,835 Cr market cap) struggled.

Pre-IPO markets are prioritizing profitability, scalability, and execution over growth narratives like brand and impact. Ola Electric and Ixigo showed moderate success, but startups without strong consumer brands or financial metrics failed to sustain momentum.

With IPO returns averaging 15.84%, they barely outperform broader indices like Nifty 50 (7.02%) and BSE Sensex (10.23%). There is significant volatility in performance with 6-month lock-in. For VCs, this provides a robust exit mechanism but merit for retail investors is yet to completely play out.

Abhishek Sethi - Grad Capital

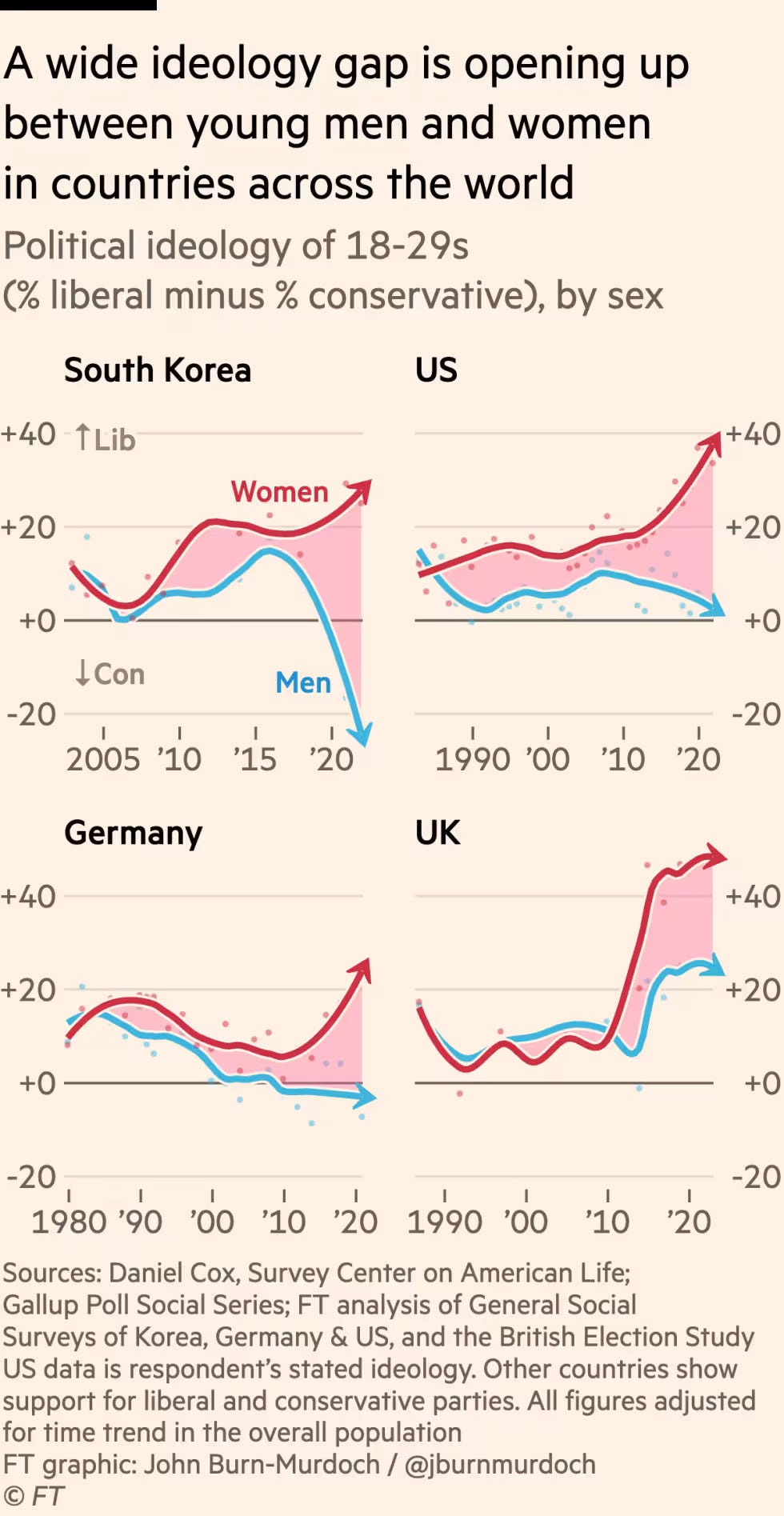

Our recent visits to colleges reveal an interesting shift: mixed-gender friendship groups seem less common than they were in the 2010-2020 period. This social separation appears to mirror the widening political ideology gap between young men and women, as shown in recent data from multiple countries.

The divide is particularly stark in South Korea, where movements like 4B (which advocates for women to reject marriage, dating, childbirth, and heterosexual relationships) have gained traction, and in the United States, where issues like reproductive rights have increasingly polarized gender-based political views. Content creators and social media have amplified these divisions - figures like Andrew Tate have amassed huge followings among young men while promoting traditionalist viewpoints, while algorithm-driven echo chambers further reinforce gender-specific worldviews.

Paradoxically, this ideological chasm is widening during an era of supposed progress in gender equality. While some see business opportunities in this trend (like the rise of AI-powered dating apps), historical patterns suggest we might be approaching an inflection point. Social movements often move in cycles, and this current period of gender-based ideological separation might eventually trigger a counter-movement toward reconnection and understanding.

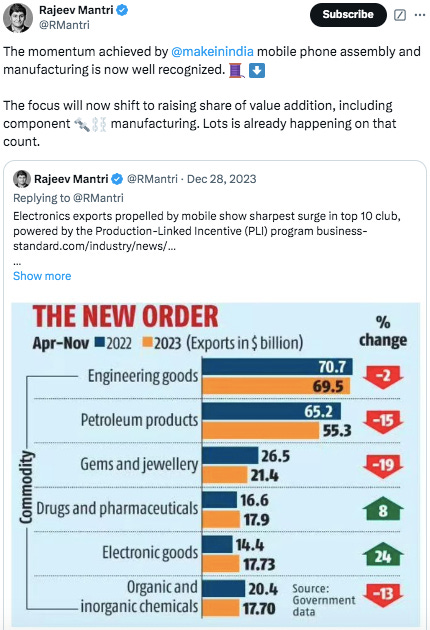

Rajeev Mantri - Navam Capital

Led by the rapid expansion of Apple's manufacturing footprint, India has scaled up smartphone exports to the US by more than 1000x over the last 5 years. From a standing start, within the next 2 years, India's share of global iPhone production is on track to exceed 25% with the value addition share approaching 40%.

This exponential rise in volume and value share has been made possible by the growth of the component and sub-assembly ecosystem in the country. Backward integration by marquee manufacturers at this scale will have highly positive second order effects for all deep technology and hardware-oriented startups in India, as the supply chain expansion will also see a range of allied capabilities being built up across India's electronics manufacturing clusters. Intelligent industrial policy, deft manoeuvring through the geopolitical and geo-economic currents by the Government of India and intense efforts by private industry have come together to get us to this stage, but there is much more to come.

Watch this space - manufacturing in the Indian economy is taking a turn which most people have not even imagined.

Nitin Sharma - Antler India

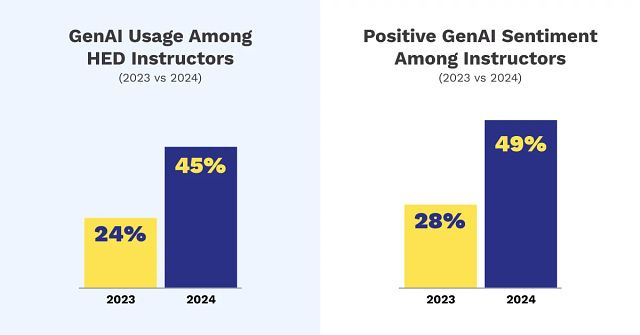

How GenAI will disrupt education is something I have been recently thinking a lot about, and I am convinced we're grossly underestimating this moment - partly because the sentiment around edtech (which for the most part was neither ed nor tech :) turned too sour in the last couple of years. But if you look closely - a sector which has historically been a Luddite-ish laggard is seeing doubling of a new tech adoption in one year! My slightly contrarian view is that this is the time to build completely new products, experiences and business models around learning. Every space will obviously get changed by AI, but perhaps education will change the most?

If you think about it, all previous platform shifts (PC, Internet, mobile, cloud) weren't fundamentally around learning or education, but GenAI inherently is. If all knowledge is essentially language, and if we can generate context and content to teach anything, then education is transformed. As someone who has been deeply invested in edtech since 2008, I've heard the buzzwords - Bloom's Law, personalized learning, adaptive pathways, flipped classroom, microschools - but only now do I feel that with GenAI, we can make all of this possible.

With the ability to speed learning to synthesis, the ability to generate multi-modal content to teach anything in any avatar or style of a teacher, we can bring the right teacher (subject-specific LLMs) to any student. We can make toys interactive vs. just responsive. We can make teachers focus far more on developing competencies vs. delivering content. We can cut down 50-60% of administrative time that is spent by teachers and principals in very manual, repetitive tasks. We can completely change the cost structure of universities (where non-teaching costs have gone up 7x even when students are 2x in the last 30-40 yrs). And for countries like India, we can augment teachers in local languages, and actually improve employability vs. just give out degrees. It's a whole new future possible...

Jivraj Singh Sachar - Indian Silicon Valley Capital

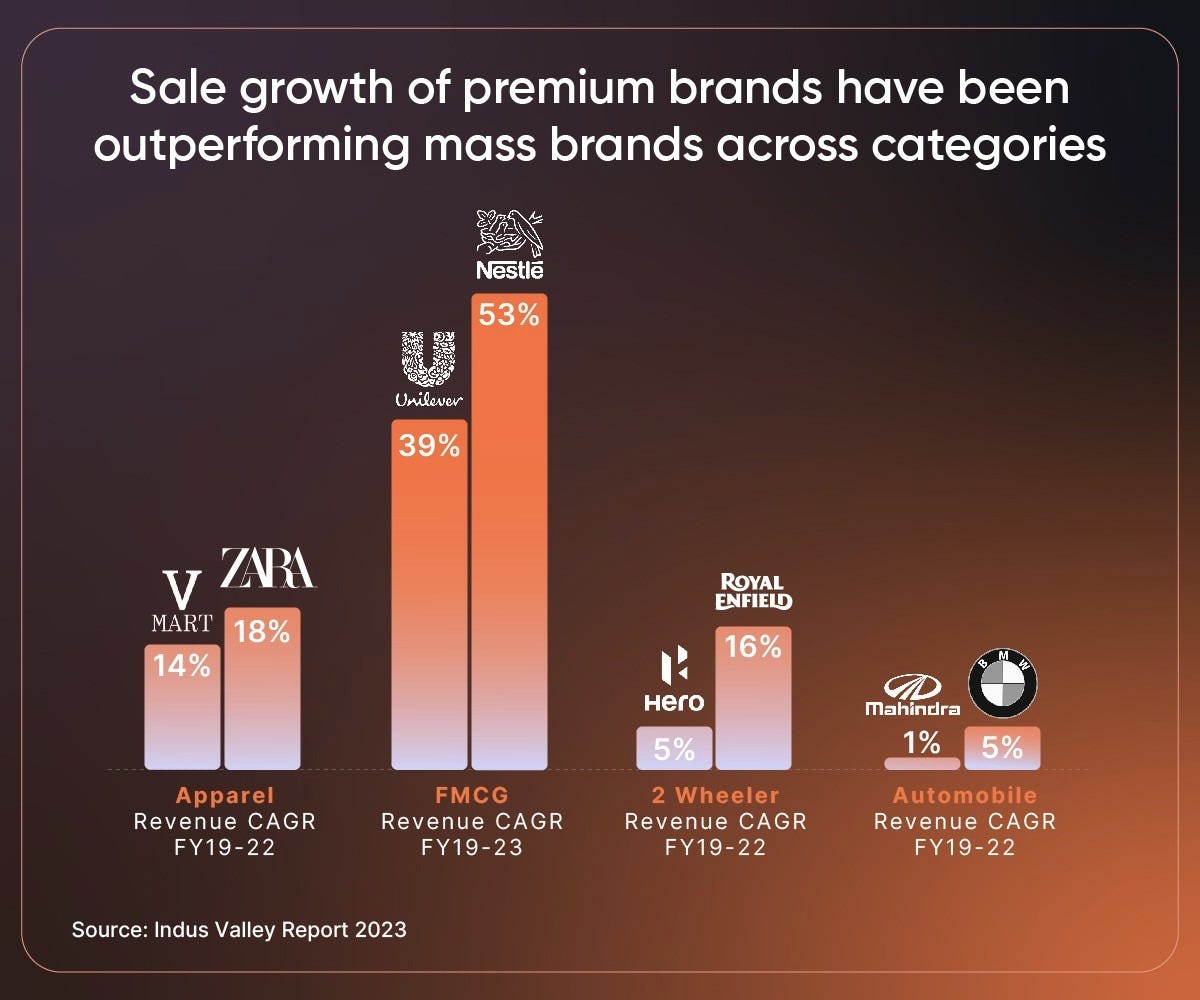

I’m excited to see the trend of ‘Premiumisation in Consumer’ start to hit inward consumption categories (like - spices, cookware, flour, kitchen appliances, healthy consumption). Currently most of the premiumisation of products has happened in categories that are social (and by extension - braggable) but that shall change going forward and will open up many opportunities for would-be entrepreneurs.

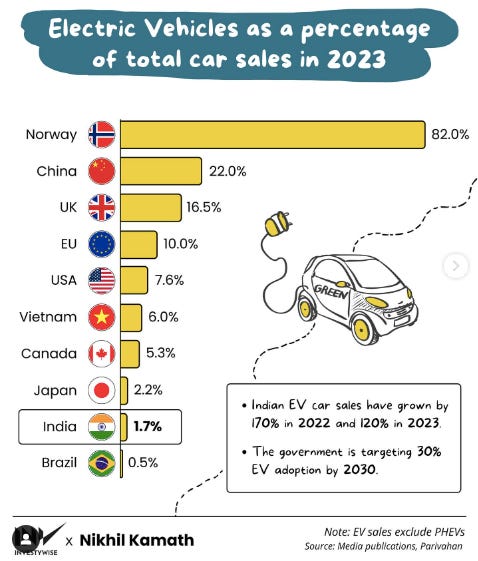

Furthermore, I am very excited for the EV penetration to go up in the country. I forsee this in turn opening up opportunities across the value chain of EV infrastructure. Bound to happen.

Arjun Vaidya - V3 Ventures

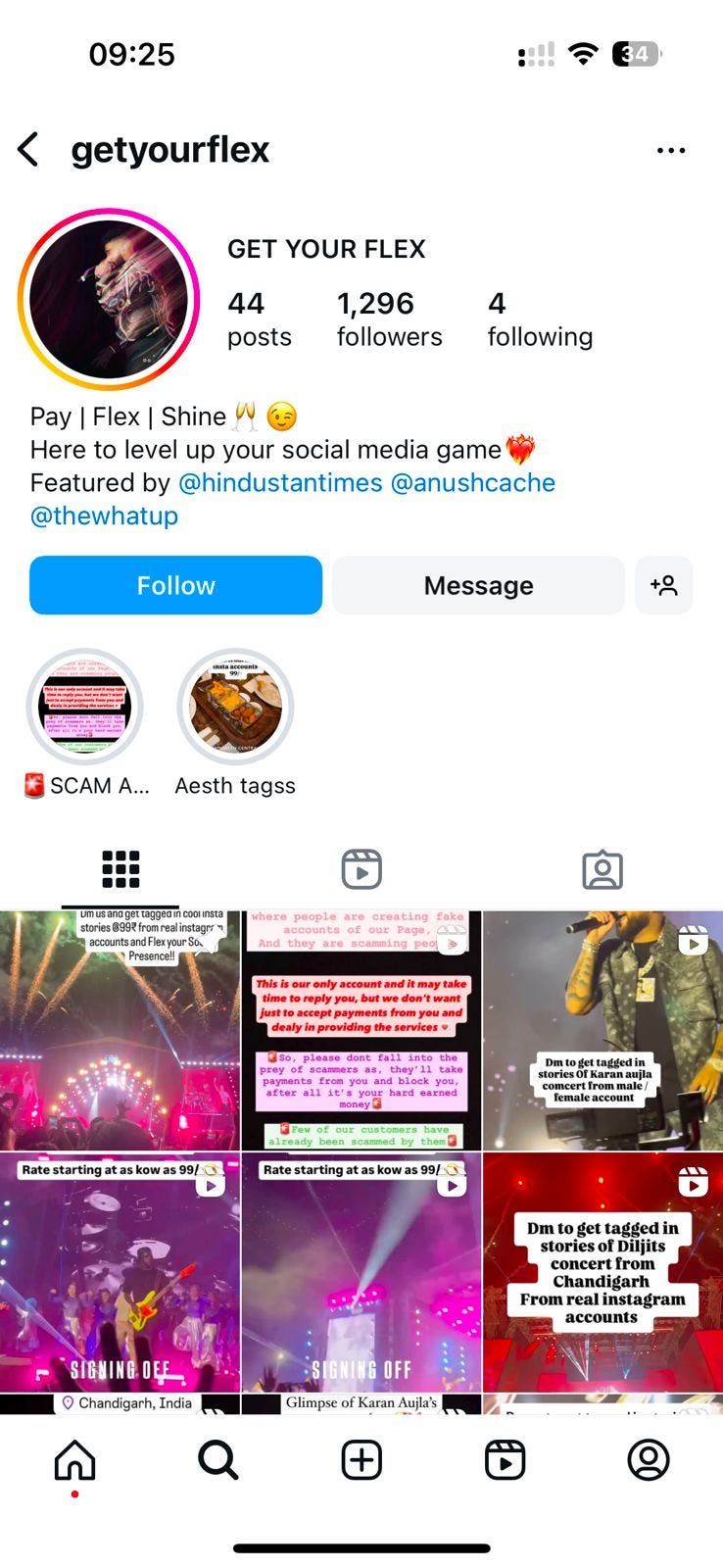

This seems like an inane picture of a random insta page but it blew my mind.

There’s a page that’s selling videos from concerts for people to flex on social media. It says a lot about where Indian consumption and society is heading.

I’ve said this many times before. We’re living in a different age. When I was growing up, large global artists weren’t coming to india. There were so few, you could count them on your fingers.

Now everyone’s coming. And they're all coming back to back - so, users have the option to choose. With this, what’s baffles me is that your regular consumer is willing to drop INR 10-20k on tickets for a 3 hour experience without thinking.

This was definitely not the case in the generation before.

Yes, it’s the experience economy but, it’s also a social media flex. To say, “I was there”.

Think about this. You’re at an event. You see the biggest artists in the world through your phone screen because you want the best video to put in your WhatsApp groups or on your social media. So, you miss the actual moment. I’m guilty as well.

So, these pages thought cleverly. If the video is all that you want - let’s sell you the best ones 😂

While I respect the ingenuity of the idea - it says something about what matters to new age consumers. While I consume differently from my parents- the difference between Aisha (my daughter) and me will be much starker.

Understanding and navigating through this is the challenge that all of us will have to grapple with. The one that understands it best will win 😃

Aaryaman & Rahul - Tigerfeathers

Aaryaman Vir 🐅

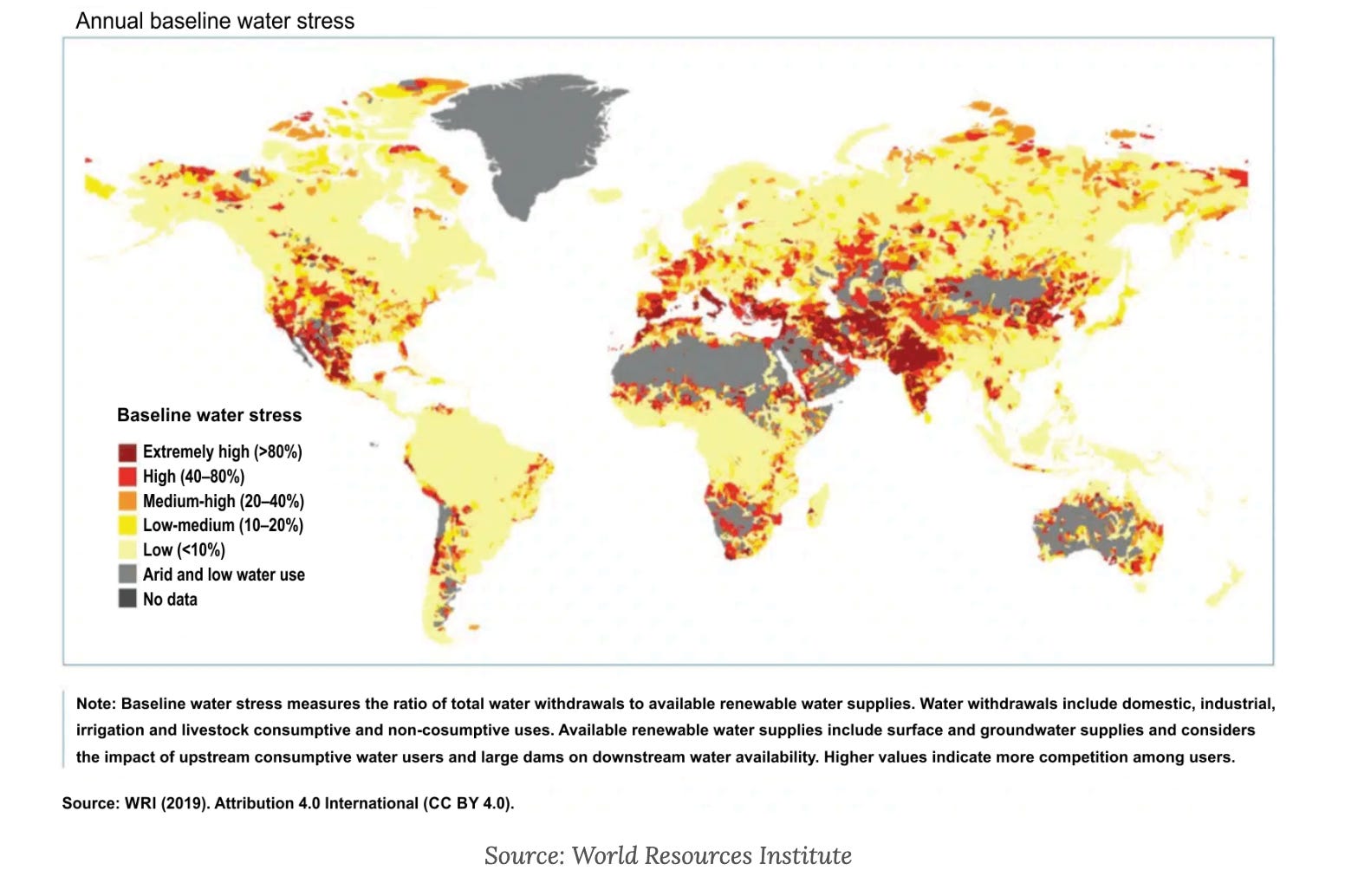

Human beings are extremely complex creatures, but our physiological needs are laughably simple. We just need two things to survive: food and water.

Unfortunately, it seems like we’re kind of running out of one of those things - water. And when I say ‘we’, I mean humanity, but also India in particular. You see, India is the most water-stressed nation in the world. We have 18% of the world’s population, but only 4% of its water resources. And we’re depleting those resources fast.

Due to unsustainable pumping to feed our agriculture industry, we are running down our groundwater supplies. To make things worse, the water cycle - responsible for recirculating water in our ecosystems - is being destabilized by climate change and human activities like deforestation and urbanization. To top it all off, we have to grapple with the uncomfortable reality that many of our freshwater sources like the Indus and Brahmaputra rivers originate in Chinese-controlled Tibet.

So the bottom line is that we need water solutions, and we need them fast. Not only is water essential for agriculture, energy, and you know… LIFE, it is also required for the liquid cooling systems that keep our data centers and GPUs running. And we all know that use case isn’t going away anytime soon.

Thankfully, the government of India also knows this and is taking serious action. Over the past decade, India is estimated to have spent $250 billion on water transformation initiatives including river purification, desalination, irrigation efficiency, and groundwater recharge. But we need the private sector to wake up and join the party too.

Otherwise shocking scenes like this one from May 2024 in Delhi will become all too common.

Rahul Sanghi 🐅

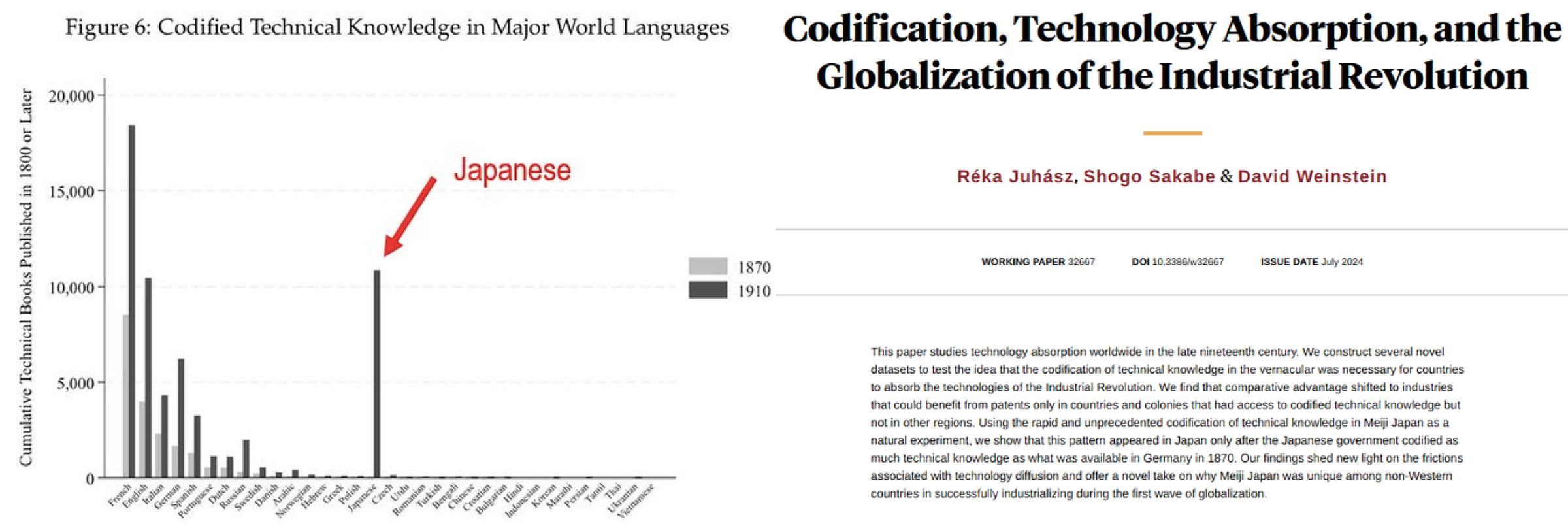

In the 19th century, Japan's Meiji government made what might be history's smartest industrial policy bet. Their strategy? Translate knowledge. They systematically converted over 10,000 European technical books into Japanese - everything from engineering and manufacturing to medicine and astronomy.

This wasn't just an academic exercise; it was the deliberate transfer of centuries of Western scientific progress into Japanese hands. Within a generation, Japan transformed from a feudal society into an industrial powerhouse that could compete with Europe's greatest nations.

Fast forward to last week, when India made its own $715 million bet on knowledge access.

Starting January 2025, the 'One Nation One Subscription' deal will give 18 million Indian students and researchers access to over 13,000 scientific journals under a landmark deal announced by the Indian government. It’s the biggest deal of its kind, ever. Like the Meiji government's translation project, it's a bold wager on what happens when you democratise access to the world's best research. The timing is particularly significant.

Why? Because in India, only about 125 million people (roughly 10% of the population) speak English with any fluency, creating a massive knowledge barrier for hundreds of millions of Indians. But just as India opens these digital gates to global knowledge, we're seeing AI models that can translate and make sense of information across languages with unprecedented sophistication. Combine institutional access to cutting-edge research with AI-powered translation tools that can make that research accessible in Tamil, Hindi, Bengali, and dozens of other Indian languages, and Japan's 19th-century transformation might end up looking like a warmup act to what we see in India over the coming decade.

And that’s that🎉

A big thank you once again to all our contributors. And a big thank you to all our subscribers for taking the time to read our stuff this year. That’s it from us for 2024. We’ll be back in January with a piece on Bombay’s groundbreaking hospitality and restaurant company - Hunger Inc. Subscribe to make sure you don’t miss it.

A very happy new year to you all, we’ll see you on the other side ⏩

Must have been a huge amount of work to collate all of these views and research - thanks for sharing.

Excellent article as always, thanks for collating the view points across several VCs. The water shortage statistics really stood out. Thinking out loud if there are any tech enabled solutions that would be worth pursuing to solve the water issue. Where we stand today, we don't even have the ability to track how much water is consumed per flat even in a city like Mumbai. My neighbour who has 8 people and us who are just 2 people are paying the same water bill. It's surprising why we still don't have water meters in place. As they say - you can't improve something that you can't measure.